| | | | | | | Presented By EQUITYZEN | | | | Axios Pro Rata | | By Dan Primack ·Aug 30, 2021 | | | | | | Top of the Morning |  | | | Illustration: Sarah Grillo/Axios | | | | China's increased scrutiny of capital markets isn't restricted to tech IPOs. It's also taking a harder look at private funds. Driving the news: China's top securities regulator, Yi Huiman, today said in a speech that VC and buyout fund managers must better align their interests with those of limited partners, adding that the government is dedicated to rooting out embezzlement and public equities masquerading as private equities. - Huiman also decried public solicitation for private funds, which he said are at "in a critical period of transformation and development."

By the numbers: Chinese private equity and VC funds manage an estimated $2 trillion, more than tripling over the past four years. A lot of that growth was actively encouraged, and sometimes even directly enabled, by a government that believed its private sector was too reliant on bank lending. The bottom line: This was a shot across the bow; a "clean your room or else" sort of message. If it's not heeded, Chinese regulators might be much more prescriptive, or even punitive, the next time around. |     | | | | | | The BFD |  | | | Illustration: Brendan Lynch/Axios | | | | Centerbridge Partners and Caisse de dépôt et placement du Québec are in talks to buy Omaha-based travel nurse staffing firm Medsol from TPG for around $2.3 billion, per Bloomberg. - Why it's the BFD: Medical temp needs were expected to surge pre-pandemic, due to aging baby boomers, but they're now in hyperdrive as hospitals struggle to keep pace with unvaccinated COVID patients.

- ROI: TPG paid around $500 million to buy Medsol from other private equity firms in 2017.

- The bottom line: "Health systems are seeing higher turnover and attrition, and more vacant positions that take longer to fill in some cases due to worker burnout, which was high among health-care workers even before the pandemic. Demand is highest for nurses, who make up the largest part of the clinical workforce." — Michelle Davis & Kiel Porter, Bloomberg

|     | | | | | | Today in Theranos | | Source: Giphy Elizabeth Holmes plans to claim she suffered a "decade-long campaign of psychological abuse" from her ex-boyfriend and former Theranos president Sunny Balwani, per court papers filed just before the start of her criminal fraud trial. - The filing also alleges that Balwani "controlled what she ate, how she dressed, and how much money she could spend, who she could interact with – essentially dominating her and erasing her capacity to make decisions."

- All of this suggests she'll blame her role in the fraud on Balwani, whose own trial doesn't begin until next year. Prosecutors originally planned to try the pair together, but Balwani objected and a judge agreed to separate the defendants.

- Holmes is likely to take the stand in her own defense.

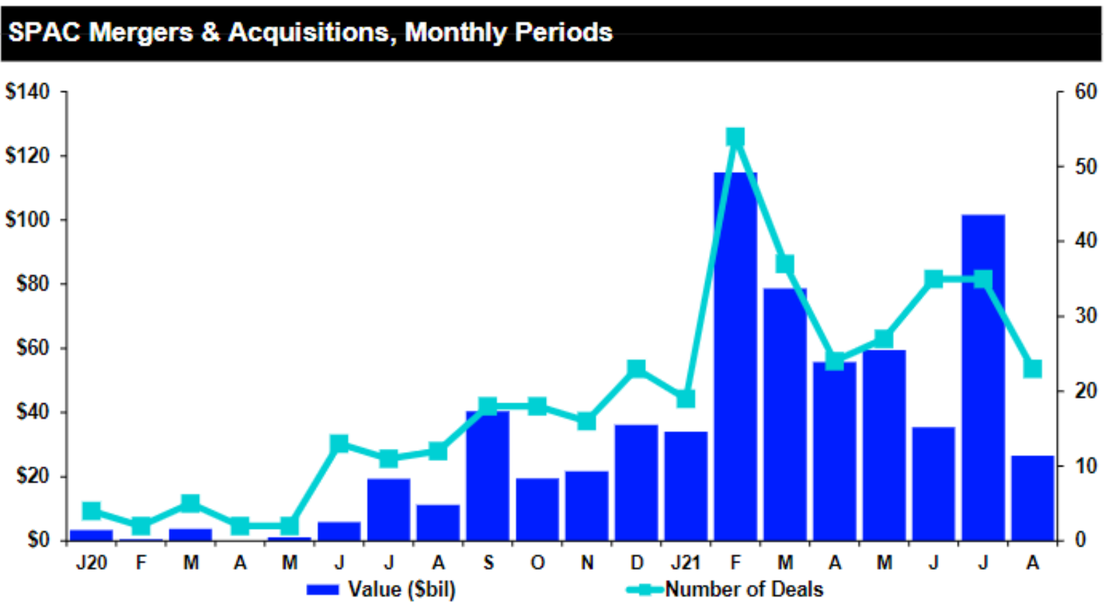

ICYMI: Kia published a pre-trial primer in Saturday's issue of Pro Rata. |     | | | | | | A message from EQUITYZEN | | The marketplace for pre-IPO equity | | |  | | | | The number of unicorns has grown from 12 just eight years ago to more than 750 today, worth a combined $2.4 trillion. Invest in or sell shares of proven pre-IPO tech companies via EquityZen funds. Note that not all pre-IPO companies will go public. Join for free and explore the private markets. | | | | | | Venture Capital Deals | | 🚑 Laronde, a Cambridge, Mass.-based developer of circular RNA solutions, raised $440 million from Fidelity, T. Rowe Price, BlackRock and founding investor Flagship Pioneering. http://axios.link/QKIl • Whoop, a Boston-based maker of fitness wearables, raised $200 million in Series F finding at a $3.6 billion valuation. SoftBank Vision Fund 2 led, and was joined by IVP, Cavu Ventures, Thursday Ventures, GP Bullhound, Accomplice, NextView Ventures and Animal Capital. http://axios.link/uCfn 🐶 Petlove&Co, a Brazilian pet supplies and services network, raised around $150 million. Riverwood Capital led, and was joined by Tarpon, SoftBank, L Catterton, Porto Seguro and Monashees. • Origin, a San Francisco-based employee financial wellness platform, raised $56 million in Series B funding at a $400 million valuation. 01A, General Catalyst and Lachy Groom co-led, and were joined by insiders Founders Fund, Felicis Ventures and Abstract Ventures. www.useorigin.com 🚑 Lynk Pharma, a Chinese biotech focused on myelofibrosis and IBS, raised $50 million in Series B funding. Lilly Asia Ventures led and was joined by New Alliance Capital, Hangzhou HEDA Biological Medicine VC Partnership and insiders Legend Capital and Med-Fine Capital. http://axios.link/J2CQ • Flip, a Los Angeles-based beauty and wellness social commerce startup, raised $28 million in Series A funding led by Streamlined Ventures. http://axios.link/unKO • Urbanbase, a Seoul-based 3D spatial data tool for interior design, raised $11.1 million in new Series B funding led by Hanwha Hotel & Resort. http://axios.link/n2bT • Sastrify, a German SaaS procurement startup, raised $7 million in seed funding led by HV Capital. http://axios.link/eGM6 • Solo, a Seattle-based time and income optimization platform for app-based gig workers, raised $5.3 million in seed funding led by Slow Ventures. www.worksolo.com • HAAS Alert, a Chicago-based provider of real-time auto collision prevention SaaS, raised $5 million in seed funding co-led by R^2 and Blu Ventures. http://axios.link/58qQ • Spinach, an Atlanta-based provider of Zoom App integrations for distributed teams, raised $2.75 million in seed funding. Cardumen Capital led, and was joined by Zoom and Tuesday Capital. www.spinach.io • Vietcetera, a Vietnamese digital media startup, raised $2.7 million. North Base Media led, and was joined by Gojek, East Ventures, Genesia Ventures, Summit Media, Hustle Fund and Z Venture Capital. http://axios.link/kCBk • Ola Electric, an Indian EV maker, is in talks to raise up to $500 million led by Falcon Edge Capital at a valuation between $2.75 billion and $3.5 billion, per TechCrunch. http://axios.link/dPLl |     | | | | | | Private Equity Deals | | • Accel-KKR invested in PropLogix, a Sarasota, Fla.-based provider of real estate title closing software. www.proplogix.com • The Carlyle Group has emerged as the preferred bidder for Hexaware, an Indian IT services firm that's being sold by Baring Private Equity Asia for around $3 billion, per Reuters. http://axios.link/YiCs • Centerbridge Partners is in talks to buy the banking unit of British grocer J Sainsbury (LSE: SBRY) for around £200 million, per Sky News. http://axios.link/G6VW 🚑 Charter, a Colton, Calif.-based post-acute care provider owned by Pharos Capital Group, acquired Genesis HospiceCare (Athens, Texas) and Saints Hospice (Plano, Texas). www.charterhcg.com • Hg agreed to buy a majority stake in Riskalyze, an Auburn, Calif.-based risk analysis platform for financial advisors, from FTV Capital for a reported $300 million-plus. http://axios.link/Hjcs 🚑 ILC Dover, a Newark, Del.-based portfolio company of New Mountain Capital Partners, bought Flexan, a Lincolnshire, Ill.-based medical device contract design and manufacturing firm, from Linden Capital Partners. http://axios.link/N8xG • McGraw Hill, a portfolio company of Platinum Equity, agreed to buy Achieve3000, a Red Bank, N.J.-based preK-12 online learning platform, from Insight Partners. http://axios.link/5T8j • Salt Creek Capital acquired Brave Quest (dba eLogHomes), a Brattleboro, N.C.-based provider of customizable log home design packages. www.eloghomes.com • Tritium Partners invested in Stukent, an Idaho Falls-based provider of digital courseware and simulations. www.stukent.com • Zeekr, a Chinese EV brand of Geely, raised $500 million in its first external funding round from such backers as Intel Capital, CATL and Bilibili. http://axios.link/c8ZD |     | | | | | | Public Offerings | | For the third straight week, there are no IPOs scheduled on U.S. exchanges. http://axios.link/DpA0 • Cadre Holdings, a Jacksonville, Fla.-based provider of safety and survivability equipment for first responders, withdrew registration for an IPO that was slated to raise up to $135 million. http://axios.link/ORcZ • Freshworks, a San Mateo, Calif.-based provider of customer support software, filed for an IPO. It will list on the Nasdaq (FRSH) and reports a $10 million net loss on $169 million in revenue for the first half of 2021. The company raised around $400 million, most recently at a $3.5 billion valuation, from firms like Tiger Global (26.2% pre-IPO stake), Accel (25.8%), CapitalG (8.3%), Sequoia Capital India (12.3%) and Steadview Capital Management. http://axios.link/tHtp • Olaplex, a Santa Barbara, Calif.-based hair products company owned by Advent International, filed for an IPO. It plans to list on the Nasdaq (OLPX) and reports $95 million of net income on $270 million in revenue for the first half of 2021. http://axios.link/7skS • Rivian, an electric truck maker that's raised more than $10 billion, said it filed confidentially for a public offering at what could be an $80 billion valuation. Backers include Amazon, T. Rowe Price, Fidelity, Coatue, Ford Motor Co., Dragoneer, Baron Capital and BlackRock. http://axios.link/iqf6 • SenseTime, a Chinese developer of facial recognition technologies backed by firms like Alibaba and SoftBank, filed for a Hong Kong IPO. http://axios.link/z9vn 🍅 Sovos Brands, a Berkeley, Calif.-based food and beverage company whose brands include Rao's Homemade, filed for an IPO. The company, owned by Advent International, plans to list on the Nasdaq (SOVO) and reports $10 million of net income on $351 million of revenue for the first half of 2021. http://axios.link/fJ66 • Sterling Check, a New York-based provider of background screening and ID verification software, filed for an IPO. It plans to list on the Nasdaq (STER) and reports $4 million of net income on $299 million of revenue for the first half of 2021. Backers include Goldman Sachs. http://axios.link/3u3i |     | | | | | | Liquidity Events | | 🚑 Catalent (NYSE: CTLT) agreed to buy Bettera Holdings, a Plano, Texas-based maker of gummy vitamins, from Highlander Partners for $1 billion in cash. http://axios.link/HL3v • Ideanomics (Nasdaq: IDEX) agreed to buy VIA Motors, an Orem, Utah-based developer of electric commercial vehicles, for up to $630 million in stock. VIA had raised over $57 million from backers like Danaher, Osborn Cos. and Centrecourt Asset Management. http://axios.link/bmTH • Monomoy Capital Partners sold Friedrich Air Conditioning, a San Antonio-based maker of air conditioning, dehumidification and purification products, to Atlanta-based Rheem. www.friedrich.com • SunTx Capital Partners sold NationsBuilders Insurance Services, an Atlanta-based provider of construction and transport insurance and services, to San Diego-based Align Financial Holdings. www.nbis.com • Zebra Technologies (Nasdaq: ZNRA) agreed to buy Antuit.ai, a Frisco, Texas-based provider of analytics SaaS for forecasting and merchandising that raised over $70 million from firms like Goldman Sachs and Zodius Capital. www.antuit.ai |     | | | | | | More M&A | | 🚑 Baxter International (NYSE: BAX) is in advanced talks to buy Chicago-based medical equipment maker Hill-Rom Holdings (NYSE: HRC) for around $10 billion, per the WSJ. Hill-Rom previously rejected a $9.6 billion offer from Baxter. http://axios.link/tffw |     | | | | | | It's Personnel | | • Shreyas Garg and Joanne Shang both left Morgan Stanley's tech investment banking group to join late-stage VC firm IVP. www.ivp.com 🚑 Aamir Malik (ex-McKinsey & Co.) joined Pfizer to lead M&A as chief business officer. http://axios.link/ftT4 • TSG Consumer Partners promoted Alex Gilmore (London) and Kelly Pease (NYC) to vice presidents. www.tsgconsumer.com |     | | | | | | Final Numbers | Source: Refinitiv Deals Intelligence. Data through Aug. 29, 2021. Global SPAC merger activity accounts for 13% of overall deal-making, per Refinitiv. - SPACs also have a powerful group of new defenders, as 49 national law firms last week issued a joint condemnation of anti-SPAC lawsuits being prepped by former SEC commissioner Robert Jackson and Yale Law School professor John Morley.

- Jackson and Morley already have filed three suits, including against Bill Ackman's Pershing Square Tontine Holdings, and said up to 50 SPACs could be in their legal crosshairs.

- Latest SPAC merger: Revelation Biosciences, a Menlo Park-based developer of immunologic therapies, agreed to go public at an implied $128 million valuation via Petra Acquisition (Nasdaq: PAIC). Backers include Global Health Investment Fund.

|     | | | | | | A message from EQUITYZEN | | Where to invest in the pre-IPO unicorn market | | |  | | | | With EquityZen funds, you can invest in or sell shares of proven pre-IPO tech companies. Why it's important: The number of unicorns has exploded in just eight years, from 12 companies to more than 750 today. Note that not all pre-IPO companies will go public. Join EquityZen for free. | | | | 🙏 Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and nurses to sign up. |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment