| | | | | | | Presented By Yieldstreet | | | | Axios Markets | | By Sam Ro ·Aug 04, 2021 | | Today's newsletter is 1,309 words, 5 minutes. 📈 of the day: $14.96 trillion, the total amount of U.S. household debt. | | | | | | 1 big thing: A debt premium on carbon |  | | | Illustration: Sarah Grillo/Axios | | | | Banks are under fire for their role in funding fossil fuel companies, even though most have pledged to pull back over the coming decades, Axios' Kate Marino writes. What's happening: Despite pressure from activists, shareholders and Democratic politicians to finally divest from carbon-spewing businesses as the planet warms, the biggest American banks are still energetically backing dirty energy. The big picture: Withdrawing capital from fossil fuel companies is only half the story in the transition to a sustainable future. The other half is investing in the technology and infrastructure to support the widespread adoption of renewable power. - Banking heavyweights like JPMorgan Chase and Bank of America have committed trillions to sustainable projects. And this year has brought a surge of private capital investment in climate tech, as Axios Generate author Ben Geman reports.

Where it stands: Until that renewable infrastructure is in place at a large scale, there's still a need for some level of fossil fuel power. - Those companies need funding — but simple supply-and-demand dynamics means fossil fuel companies increasingly have to pay up for the privilege of borrowing cash, sources tell Axios.

- "There's a growing number of [credit] investors who have oil and gas on their list of what they don't want to lend to," a capital markets banker tells Axios.

The impact: How much more do dirty energy companies have to pay? The cost compared to non-fossil fuel businesses can range from a half a percent premium to more than 5% for riskier endeavors. State of play: This scenario is most pronounced in coal. - "There's a very small pool of alternative capital providers that are now financing these assets at low to mid-teen interest rates, whereas three or four years ago there was a wide dispersion of capital available at very competitive rates," Chris Post, a senior managing director in FTI Consulting's power & renewables practice, tells Axios.

Meanwhile: In the oil and gas space, the lending calculus is different. - Oil prices are up more than fourfold since the low reached in April 2020 — enabling a lot of producers to make money.

- Cue the debt spigot for companies willing to pay the pricing premium.

The bottom line: Investors are driven by returns. As the universe of buyers of fossil fuel debt shrinks, so too does liquidity in the market and the ability to exit a position if things go south — a risk that helps perpetuate the shrinking universe of buyers. - At the same time, the ability to charge higher than average interest will no doubt keep other investors hooked on lending to fossil fuel companies.

Go deeper |     | | | | | | 2. Catch up quick | | The CDC has extended the eviction moratorium for most through Oct. 3. (Axios) Lyft's quarterly revenue jumped and its adjusted EBIDTA was positive, but the company reported a net loss. (Axios) Treasury Secretary Janet Yellen says President Biden's economic agenda is critical for the U.S. to remain the "world's pre-eminent economic power." (CNBC) |     | | | | | | 3. Americans are charging more than it seems |  Data: New York Fed; Chart: Axios Visuals Credit card balances recently ticked higher, but remain well below pre-pandemic levels. However, consumers are charging much more than those balances might suggest. Why it matters: Higher credit card balances are considered a rough proxy for spending activity and consumer confidence. By the numbers: According to the New York Fed's Household Debt and Credit Report, credit card balances increased by $17 billion in Q2 to $787 billion. - That's still below the $927 billion level before the pandemic in Q4 2019.

Between the lines: Those depressed levels belie the actual amount of spending consumers are doing with their credit cards. - Credit card balances reflect a combination of revolving debt, which are the balances the consumers carry from billing period to billing period, and transactions, which are consumer purchases that get paid off right away.

- Typically, around one-fourth to one-third of outstanding balances represent transactions, New York Fed researchers explained on a call with reporters.

Yes, but: The researchers said there's "no doubt" that most of the decline in the balances right now is due to borrowers reducing how much debt they were carrying, not how much they were purchasing. Zoom out: The fact that spending is elevated while credit card debt is depressed can be explained by the massive savings accumulated during the early part of the pandemic. - These savings have been inflated by stimulus checks, enhanced unemployment benefits, and a lack of opportunities to spend during the early months of the pandemic. New York Fed researchers say consumers redirected these funds toward paying down their debt balances.

What to watch: The researchers added that credit card applications are up and rejection rates are down. Furthermore, an increasing number of borrowers are getting approved for higher credit card limits. - This is all associated with greater spending in the months to come.

The bottom line: Just because credit card balances remain depressed doesn't mean consumers aren't spending. Rather, it's the case that consumers have enough in savings that they can afford to carry smaller levels of debt. |     | | | | | | A message from Yieldstreet | | How to diversify your portfolio like the ultra-wealthy | | |  | | | | You can diversify your investment portfolio while generating passive income with Yieldstreet. Here's how: The platform lets savvy investors go beyond crypto and the stock market, giving them access to alternative investments such as art, real estate and more. Put your money to work. | | | | | | 4. Vax mandates to arrive in small businesses |  | | | Illustration: Aïda Amer/Axios | | | | Half of America's small businesses are likely or certain to require their on-premise employees to be vaccinated, according to a Morning Consult poll of small businesses commissioned by American Express. That compares to 31% who say that such a mandate is unlikely or that they certainly won't impose one, Axios Capital author Felix Salmon writes. Why it matters: Many large businesses, from Facebook to Morgan Stanley, have announced vaccine mandates. New York City restaurants and gyms are also going to be fully vaxxed as of next month. Between the lines: Many of those announcements came after the poll was conducted, between May 27 and June 24. As a result, the true number of small businesses likely to impose a mandate is likely higher than 50%. - The vaccine mandates aren't here yet. The Census Bureau's Small Business Pulse Survey has started asking businesses whether, in the past week, they've required employees to have proof of COVID-19 vaccination before physically coming to work. In mid-July, some 5.5% of businesses answered yes, up from 2.2% in early April.

Of note: Small business owners are not much more vaccinated than the population as a whole, with 67% fully vaxxed as of when they were polled. Still, 34% of them went so far as to say that they would require proof of vaccination before allowing unmasked shoppers to enter their stores. Keep reading |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Merge at your own risk |  Data: FTC; Chart: Danielle Alberti/Axios The Federal Trade Commission can't keep up with the "tidal wave" of mergers that need its careful scrutiny, Kate writes. Driving the news: The FTC said Tuesday in a blog post that it won't be able to finish reviewing all the deals on its plate within its standard 30-day period — and that it will notify companies via form letter if a review remains open longer than 30 days. - Companies that, after receiving the form letter, proceed with deals that haven't been fully investigated are "doing so at their own risk," the agency said.

Why it matters: The 30-day waiting period for antitrust review is a mainstay of M&A deal procedure. Companies expect to move on after the antitrust purgatory expires. And for investors who make bets on M&A, extended timelines for deal closures can substantially eat into their returns. Context: President Biden unveiled an antitrust-focused executive order last month that, among many other things, called for closer scrutiny of mergers. - The FTC's new chair, Lina Khan, has made no secret of the fact that she'd like to use the agency's enforcement powers more aggressively.

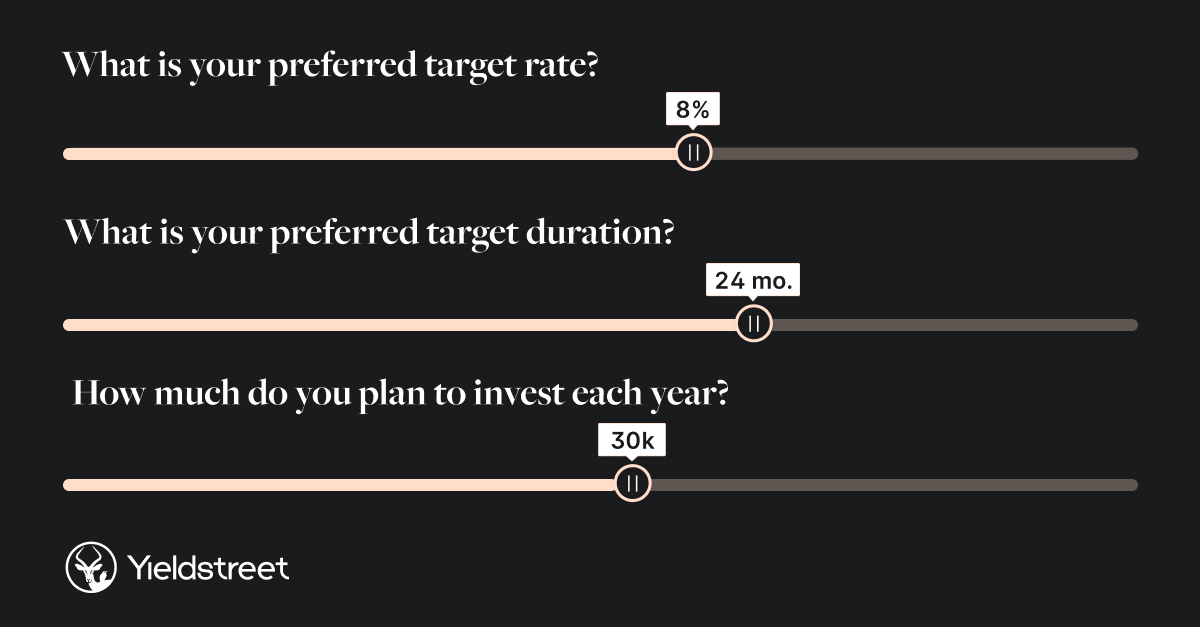

Some of the larger deals announced in the past few months include Datavant's $7 billion acquisition of Ciox Health, Danaher's $9.6 billion purchase of Aldevron, and Discovery Communications' $43 billion merger with AT&T's Warner Media. The bottom line: The FTC isn't going to let mergers slide through without proper scrutiny — and it's going to take as much time as it needs. |     | | | | | | A message from Yieldstreet | | Now you can invest like the ultra-wealthy | | |  | | | | Yieldstreet, an alternative investment platform, has returned over $1 billion in principal and interest to investors to date. More info: Their deals typically have short durations — three months to five years — and target annual yields of 3-15%. Join 300,000+ members today. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment