| | | | | | | Presented By ProEdge, a PwC Product | | | | Axios Markets | | By Aja Whitaker-Moore ·May 12, 2021 | | Good morning! Was this email forwarded to you? Sign up here. Situational awareness: For inflation watchers, April CPI data are scheduled to be released at 8:30am ET. Economists are expecting one of the largest year-over-year gains in a decade. Send tips, or feedback to aja.moore@axios.com or hit me up on Twitter @AjaWMoore. (Today's Smart Brevity count: 1,194 words, 4.5 minutes.) | | | | | | 1 big thing: Birth rate falloff continues |  | | | Illustration: Annelise Capossela/Axios | | | | China released its census report on Tuesday, showing that the number of births in the country last year dropped 18% from 2019. And China isn't alone — populations have been stagnating globally for decades, including in the U.S., Axios' Hope King writes. Why it matters: China has long relied on its large population — the biggest in the world — as a core engine for economic growth. The way that it, and officials across the globe, deal with changing demographics will lead to shifts in the economy and geopolitics. State of play: China's falling birth rate is the direct effect of its 30-year one-child policy. - The country is now reversing course aggressively, with officials calling for incentives to encourage births.

- In the U.S., the rising cost of healthcare, education and housing, coupled with a lack of government and corporate support for families, make it difficult to reverse the trend.

What they're saying: Low birth rates impact labor supply and consumer demands, can reduce entrepreneurship and innovation and lead to monetary policy changes, according to demographer Lyman Stone. - Older people consume more services, causing economies like the U.S. to shift away from manufacturing, he says.

- When younger populations shrink, incumbent companies may face less competition from new entrepreneurs.

- Older populations also have higher savings and less desire for new investments, reducing interest rates.

Case in point: Greece, which has one of the fastest-aging populations in the world, dipped into negative interest rates in 2019. By the numbers: China reported 12 million births in 2020, compared with 14.7 million in 2019. Its total population now stands at 1.41 billion. - People 60 and older make up 18.7% of the population, up from 13.3% in 2010.

- The working-age population (15-59) is now 63.4% of the total, down from 70% in 2010.

- The country has already had to boost its pension pools, and officials are slowly increasing the retirement age to limit the impact on its workforce.

What to watch: Immigration debates will heat up as economies weigh the impact of moving workers across borders to increase labor forces. |     | | | | | | 2. Catch up quick | | Equities fell globally on Tuesday as a selloff in technology stocks spread to other sectors, and inflation concerns weighed on markets. (WSJ) A judge has dismissed the National Rifle Association's bankruptcy filing, saying the organization filed for bankruptcy in bad faith. The NRA made the filing shortly after New York attorney general Letitia James filed a suit accusing the group of fraud. (Axios) Gas stations are running out of gas in the Southeast, as drivers appear to be hoarding after the shutdown of the Colonial Pipeline over the weekend. (Yahoo) The SEC issued a statement urging caution for anyone considering investing in the bitcoin futures market, calling it a "highly speculative investment." (SEC) |     | | | | | | 3. Ginkgo Bioworks gives SPACs a spark |  | | | Ginkgo Bioworks CEO Jason Kelly at the Milken Institute Global Conference in 2019. Photo: Kyle Grillot/Getty Images | | | | The synthetic biology leader Ginkgo Bioworks will go public via the SPAC company Soaring Eagle Acquisition, writes Axios Future author Bryan Walsh. Why it matters: The deal — one of the biggest SPACs yet — values Ginkgo at an implied $15 billion, and will channel funding into CEO Jason Kelly's plans to turn the company into the Amazon Web Services (AWS) of synthetic biology. Our thought bubble: Axios Pro Rata author Dan Primack notes the death of SPACs has been greatly exaggerated, as the sizable Ginkgo deal illustrates. Yes, there's been a slowdown in new issuance thanks to paperwork created by SEC guidance, and PIPE investors have gotten pickier. - But there are around 420 active SPACs seeking deals — all of which have an expiration date — with another 278 in the IPO pipeline.

What's happening: Ginkgo builds made-to-order microbes for companies in a range of industries, including fragrances and food ingredients. - It takes advantage of the growing ability of scientists to design and print DNA on demand — the field now known as synthetic biology.

- Ginkgo — the first synbio unicorn — was most recently valued privately at $4.86 billion. The Boston-based company has pivoted to the broader pharma industry, receiving a $1.1 billion loan in November from the U.S. International Development Finance Corporation to optimize COVID-19 vaccine manufacture and expand testing efforts.

- A report released last year by McKinsey Global Institute projected bioengineered products could have a direct economic impact of as much as $4 trillion over the next 10 to 20 years.

The big picture: Gingko increasingly sees itself as a "platform," Kelly tells Axios, charging customers for the use of its biological foundry "like AWS does for data center cycles." - Ginkgo also takes royalties or equity in the biological apps developed on its platform — "like the Apple App Store," says Kelly. With the money generated by the SPAC deal, "I want to create an ecosystem of services that sits around the much more technical platform."

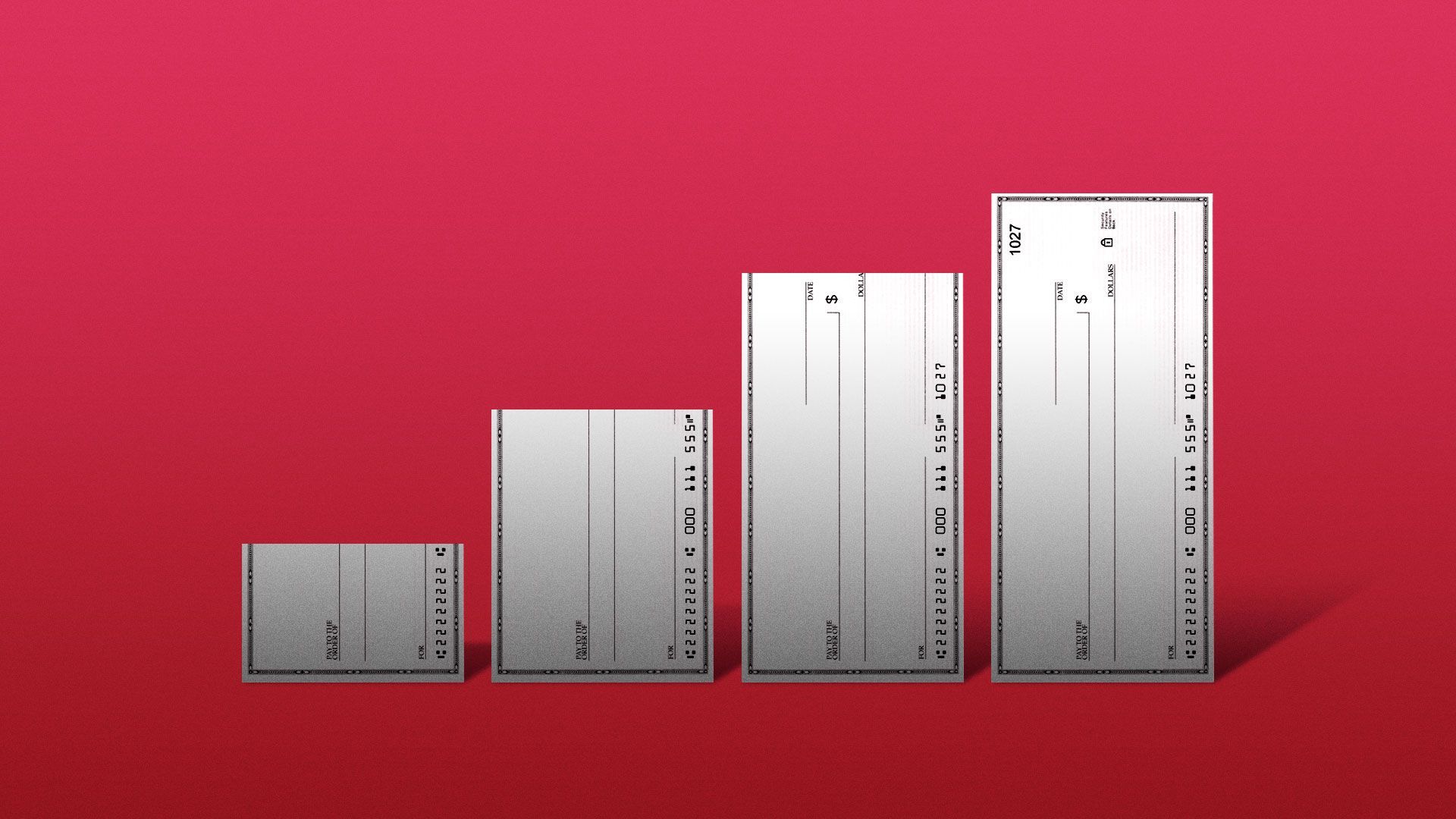

The bottom line: Ginkgo's SPAC deal is a bet on a future where coding biology will be as easy — and potentially as lucrative — as coding computers. Go deeper. |     | | | | | | A message from ProEdge, a PwC Product | | Align skills and culture with the changing nature of work | | |  | | | | Readying the enterprise for the future typically includes investment in new technologies. But it also requires ensuring your organization has the right skills to make the most of these technologies. Read the guide from ProEdge, a PwC Product. | | | | | | 4. Follow the stimulus money |  | | | Illustration: Eniola Odetunde/Axios | | | | New data from the JPMorgan Chase Institute released Wednesday shines a light on how and when stimulus checks were used by Americans over the last year, Hope writes. Why it matters: While D.C. debated the size and frequency of stimulus payments, many economists had argued the crisis caused by the pandemic required a large response. The new data shows that the stimulus played a key role in boosting the cash buffers of low-income families disproportionately impacted by the pandemic. - The largest year-over-year declines in income from labor were felt by lower-income households. Those households also had the highest increase in total income as a result of government programs.

By the numbers: Stimulus saving and spending among those disproportionately impacted was bigger and faster than in other socioeconomics groups, according to the Institute's report, which is based on anonymized checking account activity by families that use Chase bank. - After the April 2020 stimulus checks were deployed, median cash balances rose by about $900 versus 2019 levels, and from there fell by roughly $500 by the end of December.

- In May of last year, lower-income households had doubled their balances relative to 2019, while balances among the highest-earning families were up by roughly 40%.

- However, those gains were more quickly depleted for low-income families. They lost 70% of their 2020 balance gains by the end of December, while the highest-income families lost 48%.

Go deeper: Overall, more Americans saved stimulus money the last round. |     | | | | | | 5. Optimism rises among small business owners |  Data: NFIB; Chart: Axios Visuals Small business owners' optimism improved during April, even as many struggled to fill open positions, writes Axios business editor Kate Marino. Why it matters: Small businesses were hit hard with closures at the beginning of the pandemic, and an uneven recovery has proved that business owners still face a mountain of uncertainty. The details: The NFIB Small Business Optimism Index increased 1.6 points in April, to 99.8, from a month before. - The index is up from a reading of 95 in January, but down from 104 in the fall.

- The reading is about 2 points above the historical average.

The labor picture appears to be improving, but slowly. Firms surveyed hired an average of 0.31 workers over the past few months. What they're saying: "Small business owners are seeing a growth in sales but are stunted by not having enough workers. Finding qualified employees remains the biggest challenge for small businesses and is slowing economic growth," says Bill Dunkelberg, the group's chief economist. - "Owners are raising compensation, offering bonuses and benefits to attract the right employees."

Yes, but: 44% (seasonally adjusted) of all owners reported being unable to fill job openings, up 2 percentage points from March. - About 8% cited labor costs as their top business problem, and 24% said that labor quality was their top problem.

Inflation watch: Businesses are raising prices at a rate not seen since the early 80s. A net 36% of small business owners are hiking prices, up 10 points over March (seasonally adjusted). |     | | | | | | A message from ProEdge, a PwC Product | | Align skills and culture with the changing nature of work | | |  | | | | Readying the enterprise for the future typically includes investment in new technologies. But it also requires ensuring your organization has the right skills to make the most of these technologies. Read the guide from ProEdge, a PwC Product. | | | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment