| | | | | | | Presented By Conversica | | | | Axios Markets | | By Dion Rabouin ·Mar 16, 2021 | | Good morning! Was this email forwarded to you? Sign up here. (Today's Smart Brevity count: 1,225 words, 4.6 minutes.) 🎙 "Have fun while you can. Fate is an awful thing. You can't tell what will happen; that's why I love to sing."- See who said it and why it matters at the bottom. | | | | | | 1 big thing: The Nasdaq is bouncing back |  | | | Illustration: Sarah Grillo/Axios | | | | Tech stocks led the way as U.S. equity indexes finished higher on Monday — the Dow and S&P closed at record highs and the Nasdaq rose 1%, having now reversed half of its correction from mid-February. Why it matters: Bullish momentum again powered the market higher, as traders continue to put rising COVID-19 cases in Europe, spiking U.S. Treasury yields and a moribund labor market out of mind. What's happening: The first direct stimulus payments began to hit Americans' bank accounts over the weekend and expectations for U.S. economic growth continue to power sky-high expectations. Between the lines: The decline in tech shares that sent the Nasdaq down 10% from its previous record high is quickly being reversed, even as U.S. interest rates remain at elevated levels around 1.6%, the highest they have been in a year. - Since March 8, the Nasdaq has risen 6.8% compared to a 3.8% rise in the S&P and a 3.6% gain for the Dow, suggesting the selloff in tech shares that took place from mid-February to early March could be a short-lived blip rather than a market-changing event.

The big picture: Tech is climbing back even as expectations for U.S. economic expansion increase, suggesting the "buy anything" rally could be making a return — though bearish investors caution that this exuberance could be a contrarian indicator. - The main holdouts from the recent boomlet have been oil and energy stocks, which fell on Monday.

- Energy has been far and away the best performing sector of the market this year.

What's next: After last week's meeting of the European Central Bank, this week is chock full of central bank meetings with press conferences by influential heads every day, beginning tomorrow with the Fed. - The Bank of England meets on Thursday, and the Bank of Japan wraps its meeting Friday.

|     | | | | | | Bonus chart: The new kids on the block |  Data: FactSet; Chart: Axios Visuals The S&P will be getting riskier, as the index's owners announced on Friday they would add Penn National Gaming and Caesars Entertainment to the benchmark equity gauge along with NXP Semiconductors and Generac Holdings. - Those companies will replace Xerox, Flowserve, SL Green Realty and Vontier, which will move to the S&P MidCap 400, with changes scheduled to happen before the start of trading on March 22.

Of note: Penn's stock has risen nearly 800% over the past year, joining Tesla as another new S&P entrant that skeptical market watchers have cautioned is displaying the tenants of a highly speculative asset. |     | | | | | | 2. Catch up quick | | The IRS failed to collect more than $2.4 billion from individuals with an average annual income of nearly $1.6 million who owe back taxes, according to a report from the Treasury Inspector General for Tax Administration. (Bloomberg) More than $8 billion poured into funds for leveraged loans in January and February, the most in more than two years, boosting leveraged loan prices to around their highest since November 2018. (WSJ) Treasury Secretary Janet Yellen is working to forge an agreement on a global minimum tax on multinational corporations, while President Biden looks to implement the largest U.S. tax hike since 1993. (Washington Post) "The economics of investing in bonds (and most financial assets) has become stupid," billionaire investor Ray Dalio writes. "Rather than get paid less than inflation why not instead buy stuff — any stuff — that will equal inflation or better?" (LinkedIn) |     | | | | | | A message from Conversica | | Maximize revenue and revolutionize teams with Conversational AI | | |  | | | | Conversica's new Intelligent Virtual Assistant (IVA) takes care of all the routine inbound outreach so human sales reps can spend more time closing deals. The tool helps businesses: - Improve pipeline quality.

- Expand sales capacity.

- Improve visibility and accountability.

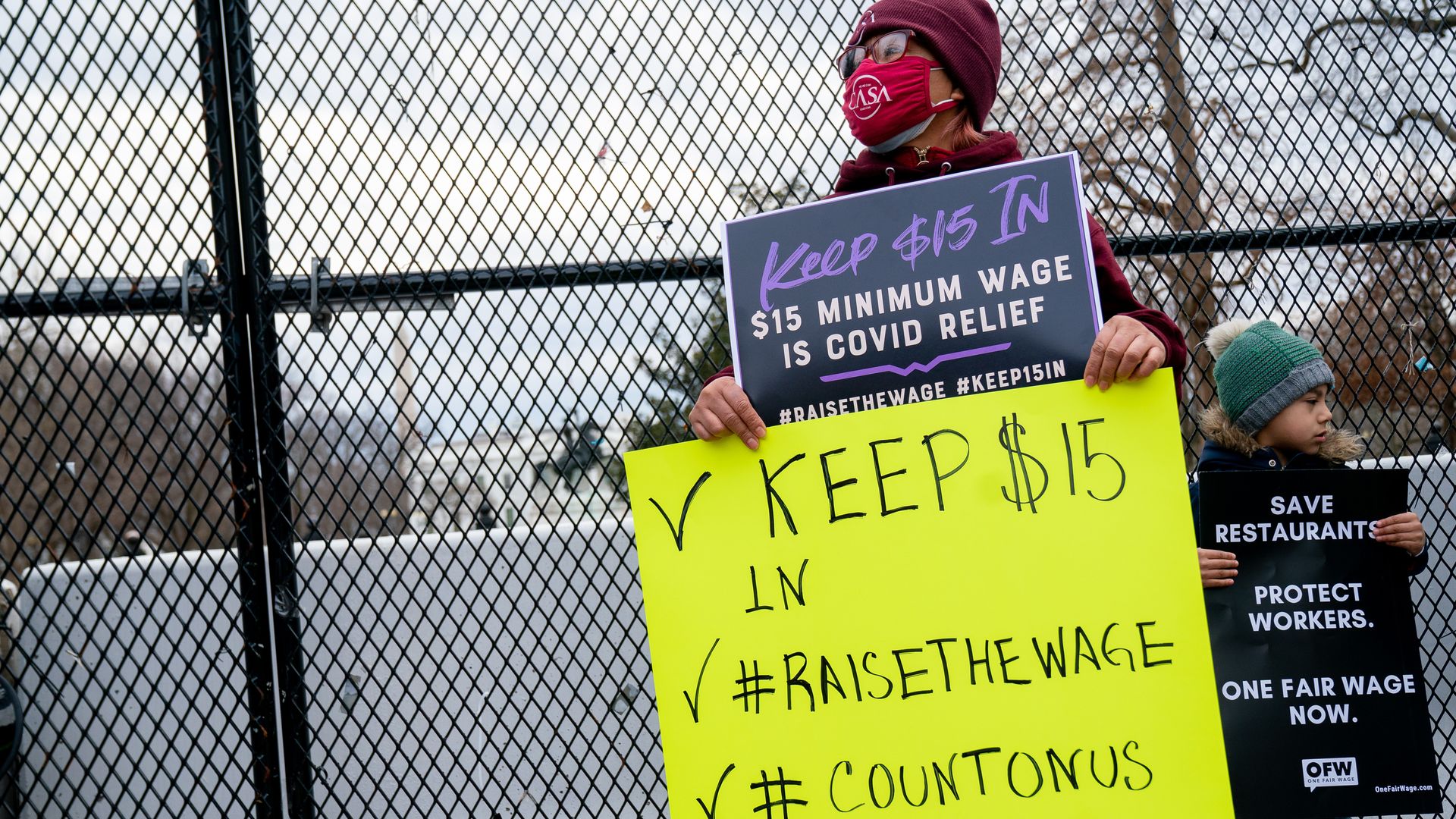

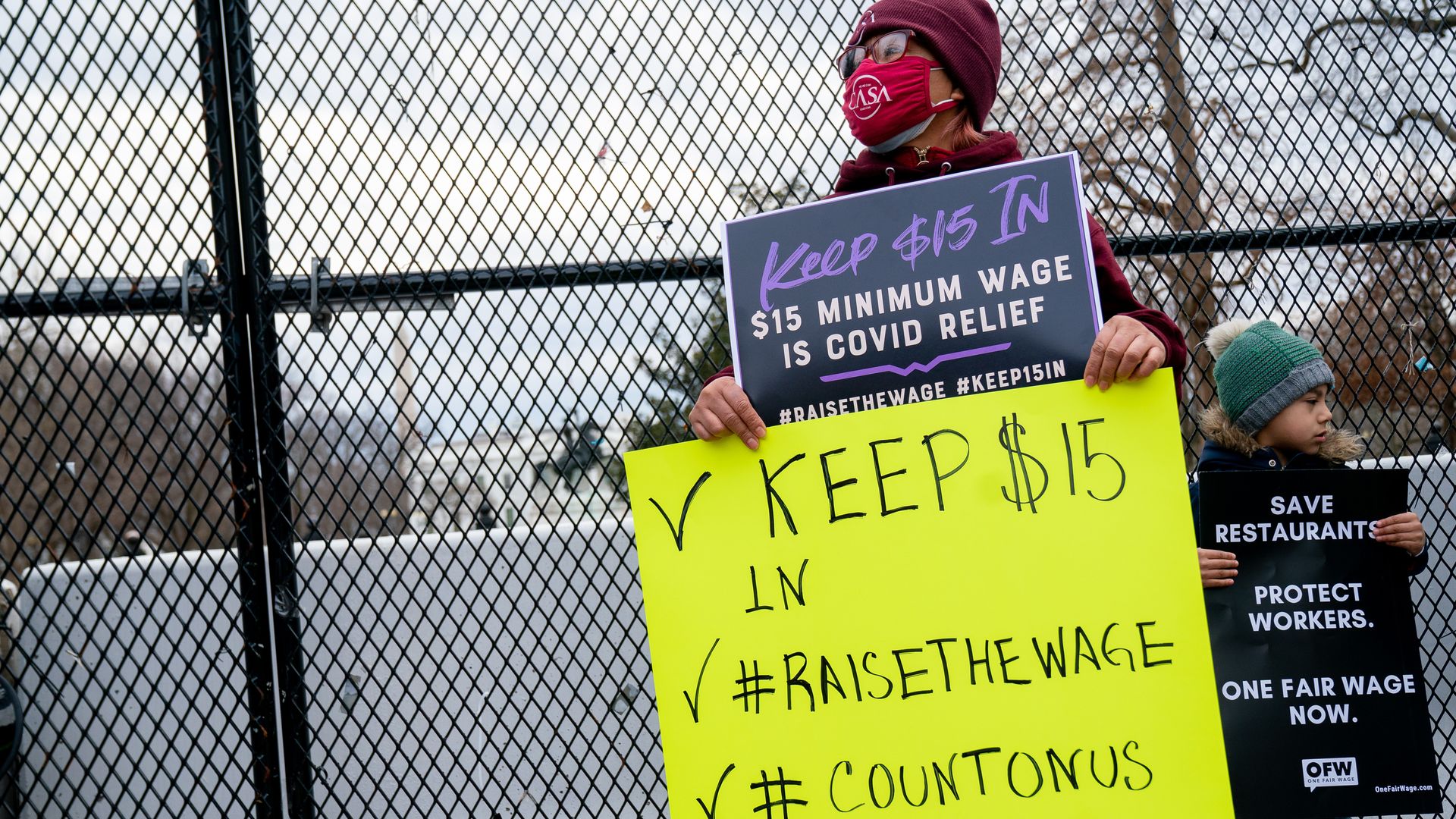

Learn more. | | | | | | 3. Vast majority of Americans support raising federal minimum wage |  | | | Photo: Erin Scott/Bloomberg via Getty Images | | | | Axios' Rebecca Falconer writes: Eight in 10 Americans think the federal minimum wage is too low and two-thirds support increasing it to $15 per hour, according to a new poll from Amazon and survey producer Ipsos. Why it matters: An increase in the minimum wage from the current $7.25 an hour was not included in the $1.9 trillion COVID relief package passed by Congress this month, despite progressives pushing to add the provision to the bill. - The poll suggests there's widespread, bipartisan support for an increase.

What they're saying: "This level of agreement is practically unheard of in contemporary America and reflects an overwhelming public consensus that elected officials should think twice before disputing," Chris Jackson, senior vice president of public affairs at Ipsos, noted in a statement. Zoom in: The poll of 6,354 people, conducted Jan. 28-Feb. 8, found that 80% believe large employers should play a role in raising the federal minimum wage — compared to 73% for politicians and policymakers. ● Even when including undecided respondents, 56% support a $15 per hour minimum wage, the poll notes. Of note: Amazon announced in 2018 a $15 minimum wage for 350,000 employees, both full-time and seasonal. - However, the retail giant's working conditions have come under scrutiny in recent months, with New York filing a lawsuit against Amazon last month, alleging it hasn't complied with workplace rules during the pandemic.

- The company denies the claims.

|     | | | | | | 4. Air travel is coming back...slowly |  Data: TSA; Chart: Axios Visuals TSA officers screened more than 1.35 million people at airports on Friday, the highest number of passengers on a single day since March 15, 2020, the latest sign that air travel is making a comeback. Why it matters: Travel has been battered by the coronavirus pandemic, but data show the trend is moving in the right direction for airlines, airport vendors and hopeful wanderers. - However, that likely also means that ultra-low airfares and travel deals are coming to an end.

Where it stands: "Well over half, 60% of Americans, say they will be traveling for leisure in the next three months, according to a survey done less than a week ago," Micki Dudas, director of AAA Leisure Travel, told reporters. - AAA also found that 84% of those surveyed have at least tentative plans to travel in 2021.

- "The travel industry continues to see a parallel between the vaccine roll out and increased optimism among the traveling public, and a greater comfort level from travelers seeking to book for the summer or fall of this year," Dudas added.

Yes, but: The number of passengers on Friday was still 20% lower than on the same day last year, and down nearly 38% from 2019, TSA data show. - The 7-day average of travelers is only about half of what it was at this point in 2019.

|     | | | | | | 5. Gap between U.S. and German yields widens further |  Data: Investing.com; Chart: Axios Visuals The spread between U.S. and German 10-year government bond yields widened to its steepest level since January 2020 on Monday, as European yields tumbled following the ECB's announcement that it will speed up its pace of bond buying. The big picture: The ECB became the first major central bank to announce an increase in bond buying to stem higher yields. - In contrast, the Fed and chair Jerome Powell have signaled they have no intention of taking action on rising rates.

By the numbers: The 10-year spread ended last year at 146 basis points and has widened by nearly 50 basis points this year, according to data from Tradeweb. - The spread on 30-year government debt has widened to its steepest level since early November 2019 and even the 2-year spread has grown wider this year.

|     | | | | | | 6. Investors are betting the Fed will hike rates sooner than it says | | While the Fed's most recent projections have it holding U.S. rates at near 0% through the end of 2023, investors are ramping up market bets that the central bank will be forced to act sooner. State of play: Money markets have been moving toward pricing in the beginning of Fed tightening by the end of next year and Eurodollar contracts reflect a full quarter-point hike coming around March 2023 and a 75% chance of a rate hike by December 2022, Bloomberg reports. Watch this space: The rising expectation for a move from the Fed is even creeping into Fed fund futures contracts this year. - Data from CME Group's FedWatch tool show investors are pricing in a 10% chance of a rate hike by September, with a 0.3% chance of two hikes.

- Interestingly, those odds remain the same through December.

What they're saying: "The market has no patience for the Fed being patient," David Robin, a strategist at TJM Institutional Securities, tells Bloomberg. - If Powell on Wednesday "pushes back on the current pricing, the markets will likely think he is in denial and therefore accelerate the timing and the magnitude of the Fed's first rate increase."

|     | | | | | | A message from Conversica | | Maximize revenue and revolutionize teams with Conversational AI | | |  | | | | Conversica's new Intelligent Virtual Assistant (IVA) takes care of all the routine inbound outreach so human sales reps can spend more time closing deals. The tool helps businesses: - Improve pipeline quality.

- Expand sales capacity.

- Improve visibility and accountability.

Learn more. | | | | Thanks for reading! Quote: "Have fun while you can. Fate is an awful thing. You can't tell what will happen; that's why I love to sing." Why it matters: On March 16, 1975, the innovator, blues guitarist, singer-songwriter and multi-instrumentalist T-Bone Walker died. Walker is considered one of the most influential blues musicians of all time. | | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment