| | | | | | | Presented By Babbel | | | | Axios Markets | | By Dion Rabouin ·Jan 20, 2021 | | Good morning! Was this email forwarded to you? Sign up here. (Today's Smart Brevity count: 1,072 words, 4 minutes.) 🎙 "We Americans of today, together with our allies, are passing through a period of supreme test. It is a test of our courage, of our resolve, of our wisdom, our essential democracy. If we meet that test—successfully and honorably—we shall perform a service of historic importance which men and women and children will honor throughout all time." - See who said it and why it matters at the bottom. | | | | | | 1 big thing: Janet Yellen said all the right things |  | | | Illustration: Aïda Amer/Axios | | | | Treasury Secretary nominee and former Fed chair Janet Yellen's confirmation hearing before the Senate Finance Committee on Tuesday showed markets just what they can expect from the administration of President-elect Joe Biden: more of what they got under President Trump — at least for now. What it means: Investors and big companies reaped the benefits of ultralow U.S. interest rates and low taxes for most of Trump's term as well as significant increases in government spending, even before the coronavirus pandemic. - Last week Fed chair Jerome Powell reassured markets in remarks to Princeton's Bendheim Center for Finance that the Fed isn't even thinking about thinking about thinking about raising rates.

- And Yellen's testimony provided reassurances that the rest of the bullish environment for risk assets will remain in place.

Key statements: "The focus right now is on providing relief and on helping families keep a roof over their heads and food on the table, and not on raising taxes," Yellen said. - "Neither the president-elect nor I, propose this relief package without an appreciation for the country's debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big."

- "Over the next few months, we are going to need more aid to distribute the vaccine; to reopen schools; to help states keep firefighters and teachers on the job."

- "To avoid doing what we need to do now to address the pandemic and the economic damage that it's causing would likely leave us in a worse place economically and with respect to our debt situation than doing what's necessary."

How it works: Rock bottom interest rates mean companies can issue debt for virtually nothing (or even less in the age of negative-yielding corporate bonds) and can therefore borrow their way out of slow- or no-growth periods. - Low rates also increase the amount of money in the economy — an environment that's been supercharged thanks to the Fed's quantitative easing and corporate bond-buying programs.

- Adding trillions in deficit spending from the federal government further increases the money supply and makes it harder for big companies to fail, regardless of their ability to sell their products or generate a profit.

The bottom line: Fears of runaway inflation, inefficient markets and excess debt derailing the economy had kept policymakers from attempting such a cocktail in years past. - But with inflation unable to hold above 2% for more than a decade and an economy incapable of supporting itself without massive intervention, stock traders have cast off such concerns.

|     | | | | | | 2. Catch up quick | | Procter & Gamble raised its fiscal 2021 outlook after announcing it handily beat analysts' expectations for revenue and earnings growth in its second fiscal quarter. (CNBC) JPMorgan, Citi and Wells Fargo saw their stocks fall despite solid earnings and an announcement that they released a combined $5 billion in reserves socked away to offset loan losses stemming from the coronavirus pandemic. (FT) Alibaba founder Jack Ma was seen for the first time since early November in an address to teachers in an online conference. (Bloomberg) |     | | | | | | 3. Presidential returns |  Data: Yahoo Finance; Chart: Andrew Witherspoon/Axios The stock market was a favored measuring stick of the economy by President Trump and with Tuesday marking his last day in office it showed he came up just short of President Clinton and President Obama. By the numbers: The stock market selloff that followed the outbreak of the coronavirus pandemic wiped out three and a half years' worth of market gains for Trump. As of March 23, 2020, the S&P 500 had lost 1.5% since Trump's first day in office. - But thanks to the 70% rally that has taken place since then, the country's 45th president was able to finish his term with a more impressive market record than most modern presidents.

Of note: Clinton's dramatic stock market gains were powered in part by an easing interest rate cycle from the Fed, which cut rates to the lowest they had been in 20 years — 4.4% — at the start of his term. - Obama's stock returns were aided greatly by the S&P's massive 40% fall in 2008 that pushed the Fed to drop interest rates to near 0% and Congress to pass what was then the largest stimulus package on record, the $831 billion American Recovery and Reinvestment Act.

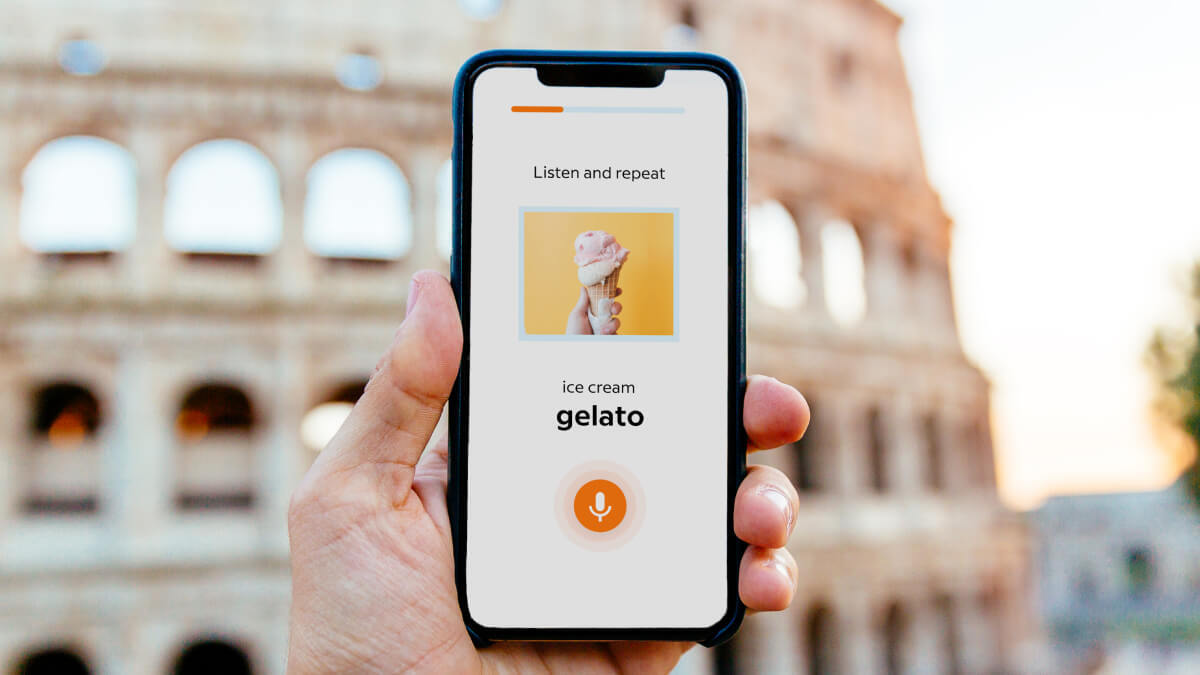

|     | | | | | | A message from Babbel | | Start speaking a new language in three weeks | | |  | | | | In 2021, let language take you places with Babbel. The background: This language learning app gives you bite-sized, manageable lessons in a variety of languages. It'll have you speaking the basics in three weeks. Sign up today and get 60% off. | | | | | | 4. Strong global subscriber growth powers Netflix's stock higher |  | | | Illustration: Rebecca Zisser/Axios | | | | Axios' Sara Fischer writes: Netflix said that it added another 8.5 million global subscribers last quarter, bringing its total number of paid subscribers globally to more than 200 million. The big picture: Positive fourth-quarter results show Netflix's resiliency, despite increased competition and pandemic-related production headwinds. - The company experienced explosive growth during the first half of last year, but growth began to slow toward the second half of the year after pandemic-related lockdowns lifted in the third quarter.

- Netflix beat expectations on earnings and revenue, in addition to global subscriber additions, for the fourth quarter.

- The stock was up nearly 6% in after-hours trading Tuesday after the tech giant reported its earnings.

Details: The company says it believes it's "very close to being sustainably" free cash flow positive and anticipates free cash flow will break even for the full year in 2021. This means it will likely no longer need to raise external financing for its day-to-day operations. - Netflix has been cash-flow positive for the last three quarters. This is mostly because the pandemic lightened some of the streamer's production and marketing expenses, but it's an important milestone for the company nonetheless.

By the numbers, per CNBC: - Earnings per share: $1.19 vs. $1.39 expected, according to a Refinitiv survey of analysts.

- Revenue: $6.64 billion vs. $6.626 billion expected, according to Refinitiv.

- Global paid net subscriber additions: 8.5 million vs. 6.47 million expected, according to StreetAccount.

What's next: While the pandemic has stalled most of Hollywood's production schedule, Netflix seems on track to be able to deliver its programming slate in full. - The company released a teaser of its 2021 film slate last week, promising a new film debut every week.

Go deeper ... Netflix's earnings over the past year: |     | | | | | | 5. SUV emissions rose during the pandemic |  Data: IEA; Chart: Axios Visuals Axios' Ben Geman writes: A remarkable new finding from the International Energy Agency: While energy-related carbon emissions fell steeply last year, emissions from SUVs actually rose slightly (by an estimated 0.5%). Why it matters: The analysis underscores the rising prominence of SUVs in the global vehicle market. It's a trend that makes cutting emissions from transportation harder because bigger vehicles generally consume more fuel. The big picture: "Despite the effects of the pandemic on overall car use, SUVs consumed more oil last year than they did in 2019," IEA said, noting that SUVs used 5.5 million barrels of oil per day last year. "Remarkably, we estimate that the increase in the overall SUV fleet in 2020 cancelled out the declines in oil consumption by SUVs that resulted from Covid-related lockdown measures," the analysis adds. |     | | | | | | A message from Babbel | | Start the new year with a new language | | |  | | | | In 2021, let language take you places with Babbel. The background: This language learning app gives you bite-sized, manageable lessons in a variety of languages. It'll have you speaking the basics in three weeks. Sign up today and get 60% off. | | | | Thanks for reading! Quote: "We Americans of today, together with our allies, are passing through a period of supreme test. It is a test of our courage, of our resolve, of our wisdom, our essential democracy. If we meet that test—successfully and honorably—we shall perform a service of historic importance which men and women and children will honor throughout all time." Why it matters: On Jan. 20, 1945, Franklin D. Roosevelt was sworn-in for an unprecedented, and never repeated, fourth term as President of the United States. - The quote comes from the beginning of his fourth inaugural address.

| | | | Axios thanks our partners for supporting our newsletters.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment