| What did the Fed say on December 16? EUR/USD 2020-12-17

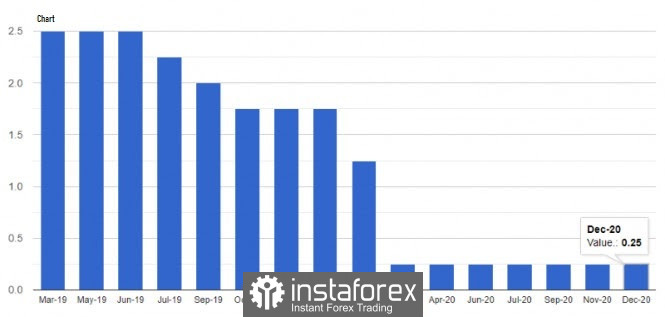

(EUR / USD after the Fed's decision) The Federal Reserve is giving their commitment in using their full suite of tools supporting the US economy at this trying and most challenging times, thereby contributing to its goals of maximum employment and price stability. The COVID-19 pandemic gives enormous human and economic hardship in the United States and around the world. The economic activity and employment is in recovery but it will remain below their levels at the beginning of the year. The weaker demand and earlier falling of oil prices is keeping the consumer price inflation at the bay. The overall financial conditions remain favorable, partly reflecting policy measures to support the economy and the flow of credit to households and businesses in the United States. The economy's track will significantly depend on the spread of the virus as the ongoing public health crisis will continue to put pressure on economic activity, employment and inflation in the short term and poses significant risks to the economic outlook in the medium term. The Committee aims to achieve maximum employment and inflation of 2% in the long term. Since, the inflation will be consistently below this long-term target, the Committee will aim for inflation to be moderately above 2% for some time, for inflation to average 2% over time and for long-term inflation, expectations will remain stable at 2% The Committee expects to maintain a flexible monetary policy until these results are achieved. They decided to maintain the target range for the Federal funds rate at 0 to a% and expect that it will be appropriate to maintain this target range until labor market conditions reach the levels agreed with the Committee. The estimate of maximum employment and inflation went up to 2% and should moderately exceed 2% for quite some time. In addition, the Federal Reserve will continue to increase its holdings of Treasuries by at least $ 80 billion per month and agency-backed mortgage-backed securities by at least $ 40 billion per month until significant further progress is made on maximum employment and asset price, the stability goal. These asset purchases will contribute to the smooth functioning of the market and favorable financial conditions, thereby supporting the flow of credit to households and businesses. The Federal Reserve will continue to increase its holdings of Treasuries by at least $ 80 billion per month and agency mortgage-backed securities by at least $ 40 billion per month until significant further progress will be made in meeting the Committee's goals for maximum Employment and Price Stability. These asset purchases contribute to a smooth market and favorable financial conditions, thereby supporting the flow of credit to households and businesses. The Federal Reserve will continue to increase its holdings of Treasuries by at least $ 80 billion per month and agency mortgage-backed securities by at least $ 40 billion per month until significant further progress is made in meeting the Committee's goals for maximum Employment and Price Stability ... These asset purchases contribute to the smooth functioning of the market and favorable financial conditions, thereby supporting the flow of credit to households and businesses. The Federal Reserve will continue to increase its holdings of Treasuries by at least $ 80 billion per month and agency mortgage-backed securities by at least $ 40 billion per month until significant further progress is made in meeting the Committee's goals for maximum Employment and Price Stability ... These asset purchases contribute to the smooth functioning of the market and favorable financial conditions, thereby supporting the flow of credit to households and businesses. The Federal Reserve will continue to increase its holdings of Treasuries by at least $ 80 billion per month and agency mortgage-backed securities by at least $ 40 billion per month until significant further progress is made in meeting the Committee's goals for maximum Employment and Price Stability ... These asset purchases contribute to the smooth functioning of the market and favorable financial conditions, thereby supporting the flow of credit to households and businesses. In assessing the appropriate monetary policy stance, the Committee will continue to monitor the impact of incoming information on the economic outlook. The Committee will be prepared to adjust monetary policy accordingly if risks will arise that could hinder the achievement of the Committee's objectives. The Committee's assessments will take into account a wide range of information, including data on public health, labor market conditions, inflationary pressures and inflation expectations, as well as financial and international developments. Voted for monetary policy measures by Jerome H. Powell, Chairman; John C. Williams, Vice-Chairman; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neil Kashkari; Loretta J. Master; and Randal K. Quarles. Trading recommendations for starters on GBP/USD and EUR/USD for December 17, 2020 2020-12-17

EUR/USD: Previous day's review The Euro showed high activity yesterday. As a result, both the update of the local high and the sharp changes in the quote will be likely observed. Important events in the economic calendar: The preliminary data on the business activity index was published in Europe, which came out much better than forecast. The index in the service sector rose from 41.7 points to 47.3 points, while it rose from 53.8 points to 55.5 points in the manufacturing sector. Therefore, the positions of the euro receive impressive support, which resulted in the update of the local high. The US published a similar index in the afternoon, where expectations almost coincided with the forecast. Yesterday's main event was the Federal Open Market Commission (FOMC) meeting, where the key interest rate remained in the same level of 0-0.25% per annum, which initially favored the US dollar. During the press conference, the head of the Central Bank said that all programs to hype the markets with dollar liquidity will continue. Following this, the US dollar has rapidly become cheaper. What happened on the trading chart? Initially, the local high of the medium-term upward trend was updated, where the quote found variable resistance in the area of 1.2211, forming a correction in the direction of 1.2125. There was high activity during the results of the Fed meeting and the press conference, which eventually returned the quote to the area of the conditional high.

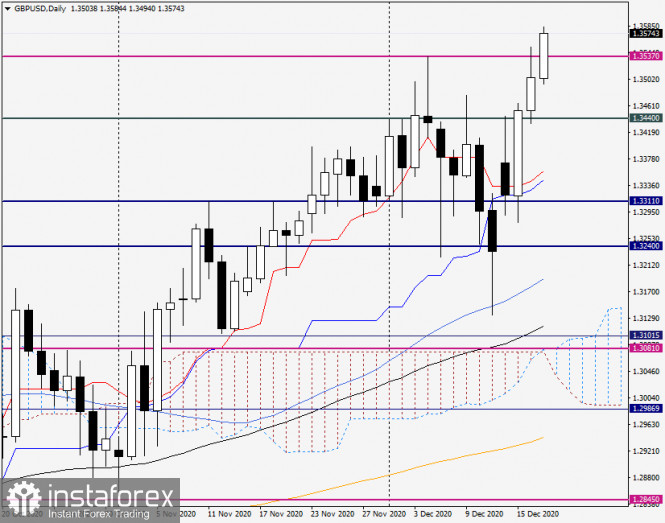

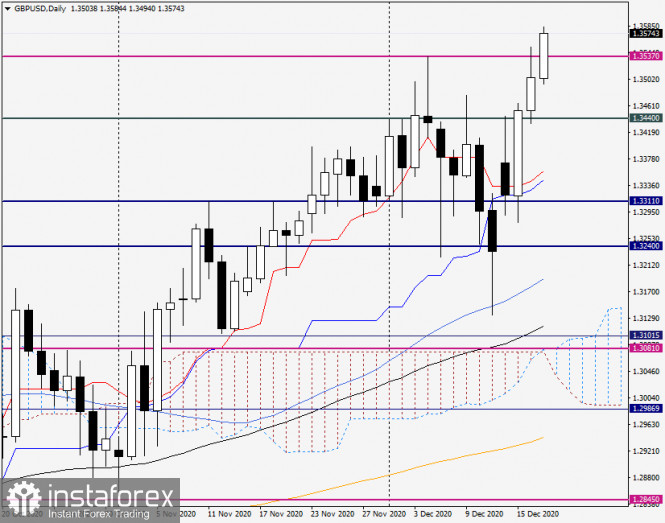

GBP/USD: Previous day's review On December 16, the pound showed an active upward interest again. As a result, the local high of the medium-term trend was updated. Important events in the economic calendar: UK inflation was initially published, where an acceleration from 0.7% to 0.8% was expected, but as a result, the growth rate of consumer prices slowed to 0.3%. It might seem that we are faced with a negative factor for the UK economy, but there was none. The pound did not even react to the statistics and divergence of expectations. All the blame was the speculative hype associated with positive expectations for the Brexit trade deal. Britain's preliminary data on the business activity index was published at 9:30 UTC+00, where the index in the service sector rose from 47.6 points to 49.9 points, while the index in the manufacturing sector even rose from 55.6 points to 57. 3 points, with a forecasted growth of 55.9. The Fed meeting and press conference had a similar effect on the GBP/USD pair. Initially, there was a strengthening of the dollar, followed by a weakening. What happened on the trading chart? The pound sterling updated the local high, reaching the coordinates of 1.3550. This was followed by a pullback towards 1.3450. At the end of the trading day, the quote returned to the level of 1.3500, signaling the recovery process of the upward interest. Trading recommendation for EUR/USD on December 17 The final data on Europe's inflation will be published today, where we can expect the previous indicator at the deflation level of -0.3, following from the preliminary estimate. Market participants may not react due to the data confirmation. In the second half of the day, there will be a publication of weekly data on the number of unemployment claims in the United States. Its volume is expected to increase, which may have a negative impact on the position of the dollar. If we carefully look at the current trading chart, it can be seen that the quote has already updated yesterday's high, where the Euro continues to sharply rise. It can be assumed that the level of 1.2300, where stops were observed in history, can serve as the next resistance level. A pullback cannot be ruled out, in case of repetition of the regular basis with the area of 1.2300.

Trading recommendation for GBP/USD on December 17 The main focus today is the results of the Bank of England meeting at 12:00 Universal Time. Due to the rising risks, the regulator is likely to expand the quantitative easing program, following the path of the European Central Bank and the Federal Reserve System. This step will result in the pound sterling's local weakening. At the same time, the speculative hype associated with expectations of a positive result on the Brexit trade negotiations may return buyers. This is already happening in the market, where the recovery of a relatively recent pullback led to an update of the local high. The moving tactics with the information flow stays the same: Good news about Brexit may lead to the pound's strengthening. Bad news about Brexit may lead to the pound's weakening.

Trading plan for EUR/USD and GBP/USD on December 17, 2020 2020-12-17 Yesterday, the foreign exchange market was pretty much leaving from side to side, and it can be said with all confidence that it was the busiest trading day recently. In addition to a whole heap of macroeconomic data, which, by the way, went largely unnoticed, there is also the meeting of the Federal Commission on Open Market Operations, and new statements regarding Brexit. It is worth starting, as the day began with the growth of European currencies, the reason for which was the next loud statements of various officials. If you believe the representatives of London and Brussels, the parties seem to have already reached agreements on all possible issues, and it remains only to solve the problem with fishing. All major disagreements have already been resolved. It is clear that this gave everyone confidence that there will be no unregulated Brexit, and the UK and the European Union will not experience an economic shock on January 1. The alarming thing is that since that fateful referendum, such statements have been made more than once. If I remember correctly, it is at least twice a year. Only time after time, after such loud statements, the parties suddenly suspended negotiations, and mutual accusations of all mortal sins poured in. They say that one or the other side puts up some unexpected requirements and conditions that are simply cannot be accepted. But in fact, from time to time, from one round of negotiations to another, the same unsolvable issue always creeps over - the norms of state regulation and measures of state support for the economy. As a matter of fact, it is around this topic that everyone has been trampling for several years. But at the moment, everyone is optimistic about the future, as some kind of breakthrough is once again announced.

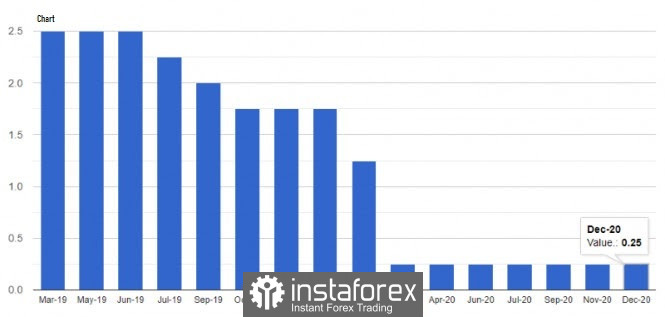

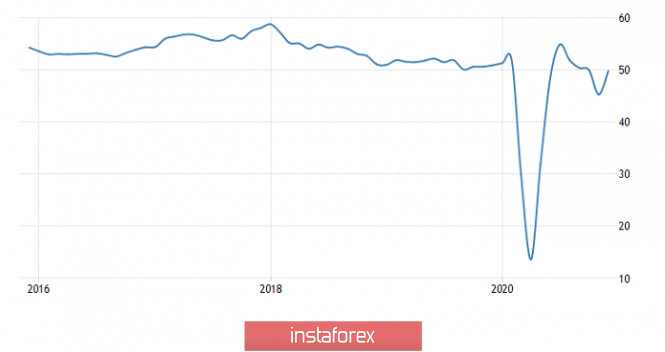

Meanwhile, things in the British economy are really not in the best condition, although preliminary estimates of business activity indices suggest the opposite. In particular, the index of business activity in the service sector increased from 47.6 points to 49.9 points. The manufacturing index rose from 55.6 points to 57.3 points. As a result of all of this, the composite index rose from 49.0 points to 50.7 points. However, we expected a slightly larger growth. In addition, the business activity index largely reflects the sentiment of business, and if you tell them that the trade agreement is about to be signed and everything will be fine, then this very business will look to the future with optimism. However, inflation clearly suggests that everything is not doing good, as the growth rate of consumer prices slowed from 0.7% to 0.3%. The growth was expected to 0.8%. Inflation (UK):

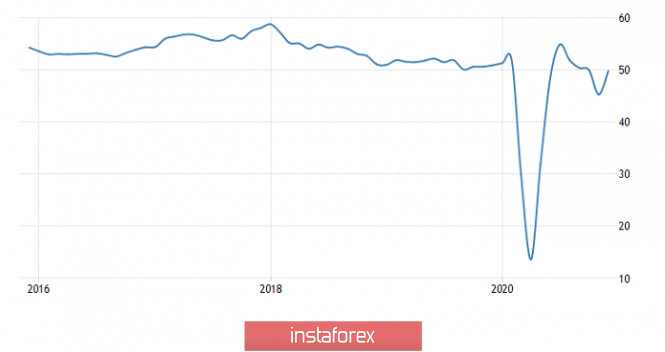

European business activity indices actually exceeded even the wildest expectations. In particular, the index of business activity in the service sector increased from 41.7 points to 47.3 points. The index of business activity in the manufacturing sector increased from 53.8 points to 55.5 points. Well, the composite index of business activity rose from 45.3 points to 49.8 points. The most interesting thing about all this is that all business activity indices were predicted to decline. But the trick is that these measurements were made even before Germany announced the introduction of a strict quarantine, the same as it was in effect this spring. So then, the business was still hoping for Christmas holidays and the like. Now, Europe has no time for Christmas. Brexit has nothing to do with it, because in the long run, if London and Brussels can not sign a trade agreement, Europe only benefits. Composite Purchasing Managers' Index (Europe):

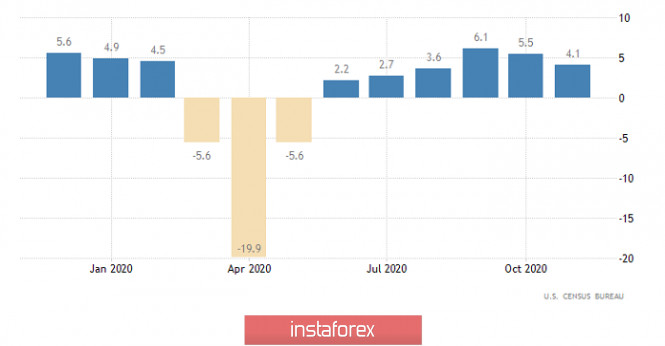

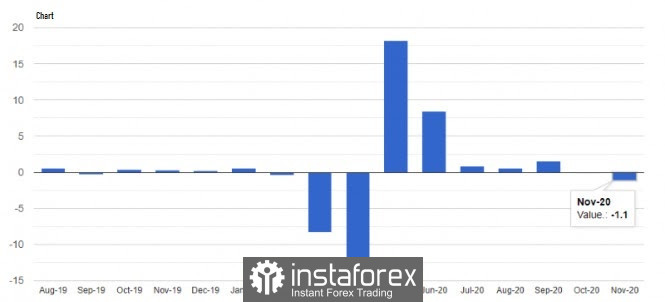

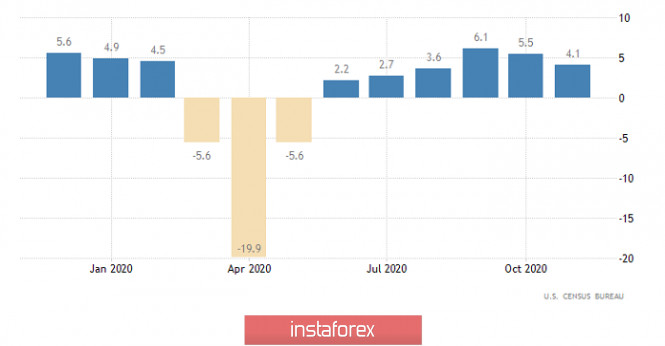

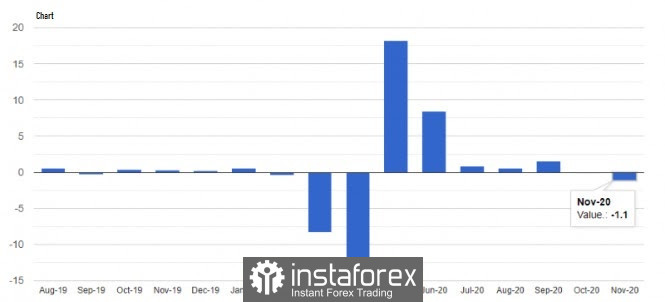

However, if European currencies were growing before the opening of the American session, then as soon as American traders started working, the direction of movement changed dramatically. We can not say that it's all about macroeconomic statistics, which turned out to be simply horrific. Therefore, the growth rate of retail sales slowed from 5.5% to 4.1%, although a slowdown to 5.4% was forecasted. Ergo, sales literally collapsed. In addition, the index of business activity in the service sector fell from 58.4 points to 55.3 points. The manufacturing PMI fell from 56.7 points to 56.5 points. As a result, the composite PMI fell from 58.6 points to 55.7 points. Of course, the decline was expected, but not so significant. Retail Sales (United States):

It's all about the Federal Open Market Commission meeting—or rather, its highly-anticipated results. Virtually, no one doubted that the Federal Reserve would further ease monetary policy by expanding its quantitative easing program. Well, since everyone anticipating such a decision, then as usually happens, the market goes in the opposite direction until the event itself. But at the most crucial moment, the unthinkable happened, and the dollar began to strengthen at an incredible speed. It turned out that the Federal Reserve left everything as it is, and no one expected this. But the situation was corrected by Jerome Powell. During his press conference, the head of the Federal Reserve System noted that both quantitative easing programs will operate as long as necessary. In fact, they are extended indefinitely. This can only be called as another expansion of the quantitative easing program. At the same time, the Federal Reserve System did not even bother to indicate at least some terms of validity of these programs, which means that it is completely unclear how much more money will be additionally poured into the American economy. But in general, such a step was quite expected. The epidemiological situation in the United States is simply terrifying, and it is at the time to call it apocalyptic, and the Congress and the Senate can not decide on measures to support the economy. Therefore, the Federal Reserve is forced to take over the function of saving the American economy.

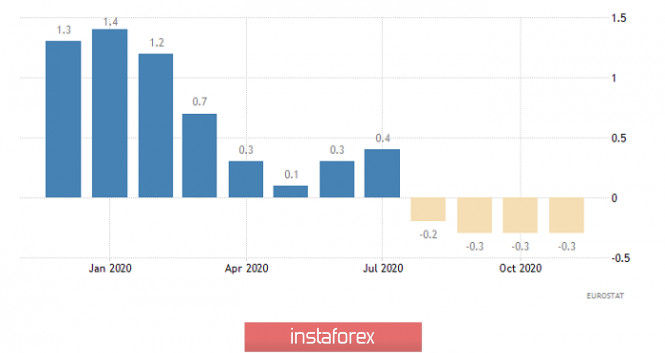

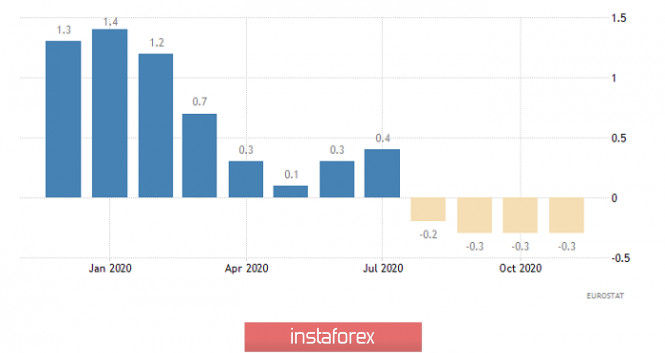

Only a slightly less busy day awaits us today, and the first thing we can probably pay attention to is the inflation in Europe. However, these data will not affect the foreign exchange market at all. First, the rate of decline in consumer prices should remain at the same level of -0.3%. Deflation in Europe has been going on for four months in a row. Secondly, this is the final data, and they are already considered by the market at the time of publication of the preliminary assessment. Inflation (Europe):

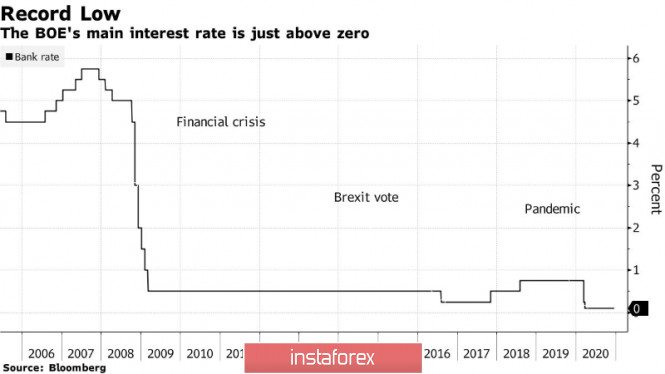

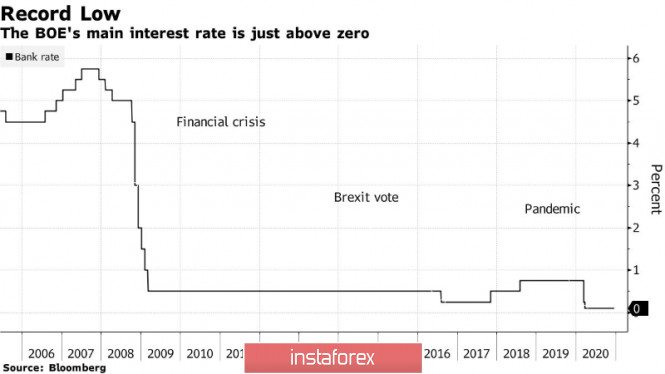

The main event of today will be the meeting of the Board of the Bank of England, which may well present unexpected surprises, and seriously stir up the foreign exchange market. Formally, the Bank of England has no choice but to ease its monetary policy whether it is an expansion of the quantitative easing program, or a reduction in the refinancing rate. After all, the European Central Bank and the Federal Reserve have done just that. And since the world's largest central banks are taking such measures, the others have no choice but to follow their example. Otherwise, significant economic losses could be incurred. With Brexit, everything is not so clear, and there is still no trade agreement, just rumors and optimistic forecasts. But the timing is tight, and if no agreement is signed, then from January 1, the British economy will experience a real shock. And of course, the coronavirus pandemic should not be forgotten, which is still going on, although everyone is only doing that, shouting about the vaccine and the like. However, quarantine measures only tighten. In general, there are plenty of reasons for some easing of monetary policy. But just because of the uncertainty regarding Brexit, the Bank of England may decide to leave everything as it is for now, and wait for the final resolution of the situation. The British regulator has done this more than once. The trouble is that there are enough reasons for easing monetary policy, and delaying the adoption of this decision can play a bad joke with the Bank of England. Nevertheless, if the parameters of monetary policy remain unchanged, the pound may well overcome the highs of the last couple of years. Well, if the Bank of England still decides to take emergency measures, then its rapid decline is worth waiting for.

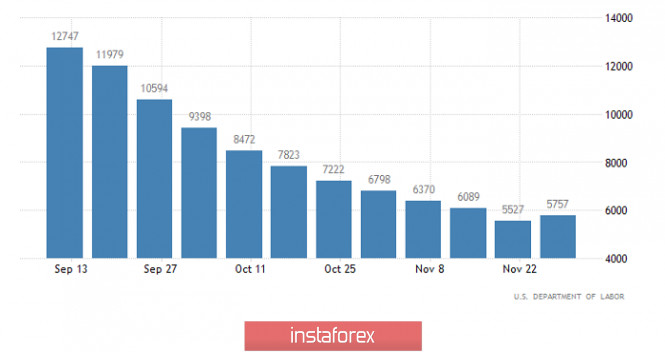

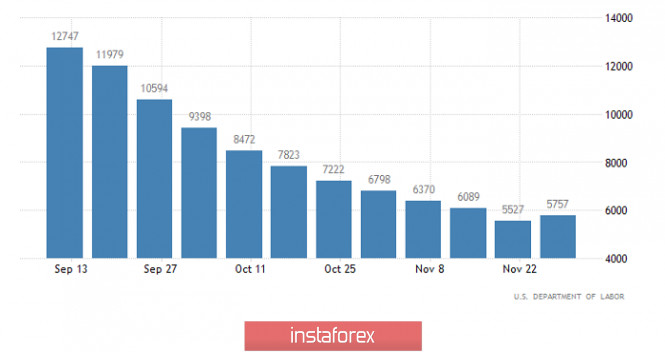

It is clear that against this background, no one will pay attention to applications for unemployment benefits in the United States. Although they are of some interest, since after the growth last week, their number may again go down. Thus, the number of initial applications should be reduced from 853 thousand to 815 thousand. The number of repeated applications may decrease from 5,757 thousand to 5,650 thousand. This means that it is still too early to panic. Yes, the labor market recovery has certainly slowed down considerably, although unemployment is still extremely high. But the most important thing is that this very recovery is still ongoing, which means that there is still hope that the economy will soon recover from the blow caused by the coronavirus pandemic. Number of repeated applications for unemployment benefits (United States):

The euro/dollar currency pair, consistently updating local highs, reached 1.2235, where the resistance area of 1.2250/1.2300 is located in the immediate vicinity. It can be assumed that the resistance area will try to restrain buyers, which can lead to stagnation and, as a result, to a correction.

The pound/dollar currency pair has once again updated the local maximum of the medium-term upward trend, touching the area of interaction of trading forces of 1.3550/1.3650 as a result. It can be assumed that the 1.3550/1.3650 area will try to restrain buyers and direct trading forces to a pullback or stop. In the condition that the speculative hype does not decrease, and the quote manages to be fixed above 1.3650 in the four-hour period, then further moves in the direction of 1.3750-1.3800 are not excluded.

EUR/USD and GBP/USD: The Fed's policy decisions brought out a temporary bull market for the US dollar. 2020-12-17 The Bank of England will meet today to discuss its further action on interest rates. However, the decision should be made in the face of the face of which, since it is not completely uncertain whether the negotiators will succeed in bringing out a trade deal with the UK. The inaction of the central bank, which we have witnessed recently, could seriously hit the economy if a deal was not concluded.  GBP: Many predict that the monetary policy will remain unchanged, but the Bank of England could signal an adjustment if a trade deal was not reached. The central bank last increased its bond purchase program six weeks ago, but according to the statements of Andrew Bailey, it still has the capability to further increase the volume of its bond purchases and pump money into the financial system. But sadly, this would not prevent long queues of trucks if borders are closed on January 1 and a trade agreement is never signed. At the moment, like the central banks of other countries, the Bank of England is focused on keeping the cost of borrowing as low as possible. Its base interest rate is at an all-time low of 0.1%, and the bond purchase program has increased to £ 895 billion ($ 1.2 trillion). Regarding Brexit, the failure to conclude a free trade agreement would mean the immediate imposition of duties and customs checks on goods at the borders, which will only worsen the economic components and hit the supply chain. According to a number of economists, the failure of the parties to conclude a trade deal will lead to a decrease in UK GDP by 1.5% in 2021.  Based on Bailey's statements, the first step that the Bank of England could do is to raise the volume of its bond purchases and extend the quantitative easing programs. The second solution, though it is only by theory, will be the introduction of negative interest rates, which the central bank is in no hurry to resort to. Only a serious deterioration in economic activity can force it to make such changes. With regards to the GBP / USD pair, pound bulls are aiming for a breakout at 1.3550, as going beyond which will make it easier for the quote to reach the 36th figure. But if there is bad news on Brexit, the GBP / USD pair will return to 1.3475 and 1.3405. The inaction of the Bank of England may also put some pressure on the pound, but this is unlikely to lead to a major sell-off. EUR: The euro is ready to reach a new local high, especially since yesterday, the policy decisions of the US Fed led to a temporary strengthening of the US dollar, which fueled the risk appetite of traders. The Fed has kept interest rates at zero levels and the volume of bond purchases at $ 120 billion per month, and they projected that fund rates will reach 0.1% by the end of 2022. Only one Fed chief expects a rate hike in 2022, while five of his colleagues expect a change by 2023. The central bank also announced that the US GDP will contract by 2.4% for 2020, but will grow by 4.2% in 2021 and 3.2% in 2022. As for the unemployment rate, the Fed predicts it will reach around 6.7% in 2020, and then fall to 5% in 2021. Then, in 2022, it will reach 4.2%.  Fed Chairman Jerome Powell said economic activity continues to recover, but it was the virus, not the financial conditions, that put pressure on the service sector. He also noted that significant difficulties remain with the vaccine, and therefore the pace of improvement in the labor market has seriously slowed down. Powell then stressed the importance of fiscal support, as such will sustain strong growth dynamics next year. According to him, economic activity will only rise if the US finally achieves massive immunity by mid-2021. If necessary, the Fed will further increase its bond purchase program. Since all these statements were quite expected, the demand for the US dollar did not last as long as it could have under other, more normal circumstances. Therefore, in the EUR / USD pair, after the breakout from 1.2165, there was a large increase in the euro, towards the target level of 1.2250. Reaching this area will strengthen the positions of euro bulls, and will enable the pair to reach the level of 1.2340. But if the quote moves below 1.2160, the euro will collapse to 1.2110 and then to 1.2060. With regards to the state of the US economy, the report published by the IHS Markit confirmed the Fed's statements that economic activity is starting to slow in the US. Business activity has declined in December amid a record rise in COVID-19 infections. In particular, composite PMI came out at 55.7 points, while in the previous month, the index was at 58.6 points. Nonetheless, a value above 50 means an increase in activity. As for the Service PMI, it reached only 55.3 points in December, while in November it was at 58.4 points. Economists expected the indicator to come out at 56.5 points. Manufacturing PMI, meanwhile, reached 56.5 points, while in the previous month it was at 56.7 points.  Data on US retail sales also indicated that the US economy is still suffering. Its figure dropped by 1.1% this November, which suggests that American consumers are clearly spending less amid the second pandemic wave. EUR/USD. Final FOMC meeting results 2020-12-17 The outcome of the final FOMC meeting did not break the upward trend on EUR/USD. In fact, it was not the regulator 's intention to do so. Nevertheless, the US dollar strengthened as a result of the December meeting. However, in a couple of hours - already during the Asian session - the US dollar index reversed downward and broke through the psychologically important level of 90.00 and fell to 89.86. Notably, if the US dollar index goes below the 88.95 target, it will drop to its lowest level in six years. Given the current pace of the bearish movement, this may happen already in the near future. The EUR/USD pair also breaks multi-month records. Bulls consolidated in the area of 1.2200, showing their intention to come closer to the next resistance level of 1.2280. This mark corresponds to the upper Bollinger Band on the daily chart. It seems that the pair will be able to overcome this barrier or test it before the end of December at least.

Looking ahead, the results of the final FOMC meeting turned out to be not as many experts had expected. Consequently, a short-term downward correction occured. Thus, the euro/dollar pair immediately plunged to 1.2125 from 1.2180. Buyers started to increase the number of long positions. As a result, the price went upward, impulsively breaking through the resistance level of 1.2200. Similar things happened to the rest of the major currency pairs. An instant US dollar strengthening was used against it. Notably, the Fed did not give any reason for the weakening of the greenback. Thus, the central bank improved its macroeconomic forecast for the US economy. Previously, the Fed's economists had expected a deeper fall in the economic activity this year. As for the next two years, the American economy was forecast to accelerate. The outlook for September 2021 was revised to 4.1-5% from 3.6-4.7%. The 2022 forecast improved to 3.5%. At the previous meeting, the forecast was at the level of 2.5-2.9%. The 2021-2022 unemployment rate and inflation were revised downward and upward, respectively. As for the quantitative easing program (QE), the Committee decided to maintain monthly bond purchases of at least $120 billion, keeping the total Treasury and agency mortgage-backed securities purchases at $80 billion and $40 billion a month, respectively. The Fed will continue buying bonds until substantial further progress has been made toward the Committee's maximum employment and price stability goals. The regulator kept its key interest rate unchanged. The majority of the Committee members suggest that it will remain at this level at least until the end of 2023. Thus, the Fed slightly increased its macroeconomic forecast for the US economy, keeping the key interest rate unchanged and maintaining the same amount of monthly bond purchases. Against this background, the greenback strengthened and incurred losses later. The main problem of the US dollar is that risk sentiment remains strong. The vaccination against COVID-19 has already begun in the US, Canada, and the UK. This fact dampens the fears of the second wave of the coronavirus.

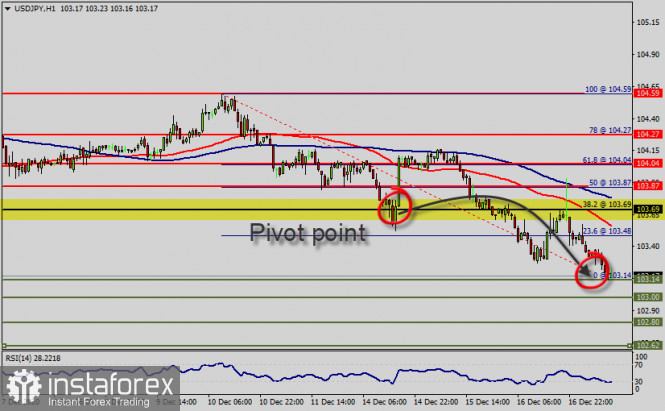

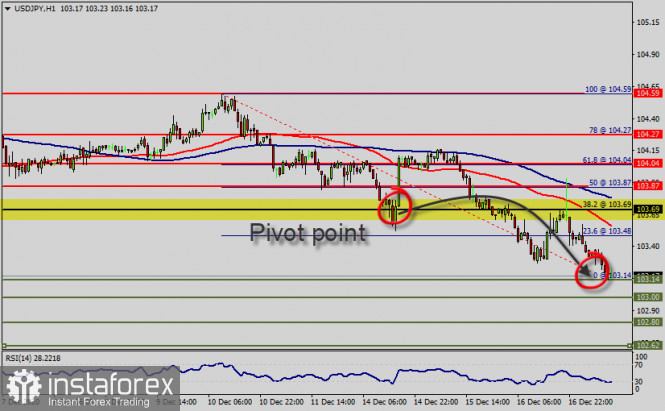

General optimism is also associated with the possible approval of new stimulus aid for the American economy. Lawmakers are now discussing a $908 billion compromise on COVID-19 relief. The bill can be adopted in the very near future - approximately by December 23-24. According to Senate Majority Leader Mitch McConnell, the parties made a significant breakthrough in the negotiations. Currently, they continue working on the document, which requires the approval from both the House of Representatives and the Senate. Apart from that, Senate Democrats have made a similar statement, confirming that lawmakers are one step away from passing the bill. Additional support for the euro was provided by macroeconomic reports. In December, the business activity index in the manufacturing sector of the eurozone rose to 55 points, showing its best results over the past two years. Economists had expected the reading to grow to 53 points. Germany's manufacturing PMI showed similar dynamics. As for the services PMI, the indicator fell less than expected. This fact also contributed to the strengthening of the euro. From the technical point of view, the upward trend on EUR/USD remains a priority. All older time frames without exception show that the pair is at the same level with the upper Bollinger Band and above all the lines of the Ichimoku indicator. All these factors indicate a clear advantage of the bullish trend. The main target is seen at the level of 1.2280, that is, in line with the upper Bollinger Band on the daily chart. Analysis and forecast for GBP/USD on December 17, 2020 2020-12-17 Hi dear traders! Daily chart of GBP/USD  GBP/USD is still following the upward trajectory. Remarkably, the GBP uptrend is unfolding despite the lack of progress in the talks on the trade deal before the UK exits the EU. The Brexit negotiators have got stuck in gridlock, unable to come to the common denominator about fisheries. It means the odds are that the Kingdom will leave the EU without a trade deal. Nevertheless, the pound sterling is taking advantage of the dollar's broad-based weakness. So, GBP/USD is still trading higher. Yesterday, the Federal Open Market Committee made policy updates following the two-day policy meeting. After the press conference, GBP/USD made efforts to break resistance at 1.3537. The price actually spiked briefly above this level and closed below it on Wednesday. At the moment of writing this review, the currency pair is trading above 1.3537 that is at near 1.3582. So, it has prospects for a further advance. It would be a good idea to take notice of the Bank of England's policy meeting. Its decisions could be a market catalyst today. At 02:00 GMT, the British regulator is due to unveil its policy decision on interest rates and the asset purchase facility. Besides, the Monetary Policy Committee is to publish the minutes of the policy meeting. Experts say the policymakers will hardly spring a surprise. The key policy rate is expected to remain at a record low of 0.10%. The regulator is likely to extend bond purchases at the same volume of £875 billion per month. All these factors have been already priced in, so the pound sterling will hardly respond with a sharp move. Anyway, comments from the BoE policymakers could trigger higher volatility of the sterling. Nevertheless, experts assume that GBP/USD is on track to continue its advance. Thus, the pair is likely to close above the level of 1.3537 today. If this happens in practice and resistance is broken, it would be a good idea to plan long GBP deals at a retracement. In case of a correctional decline, an interesting zone for opening long deals would be an area of 1.3555-1.3530. When it comes for COVID-19 developments in the UK, the state of affairs is far from any improvement. The authorities decided to tighten restrictions ahead of Christmas holidays. Across the Atlantic, the US also reports soaring numbers of new cases on a daily basis. From the technical viewpoint, long deals on GBP/USD seem to be a preferable trading idea. So, traders are recommended to plan opening long positions after correctional retracements to the levels of 1.3555, 1.3540, and 1.3530. If closing today, the daily chart reveals a reversal bearish pattern with candlesticks, we will revise our strategy tomorrow, shifting focus towards short deals for the pound sterling. Meanwhile, there are preconditions for GBP/USD to continue moving upwards today. Importantly, the Bank of England policy decisions today could disrupt this forecast and impact on the GBP trajectory across the board. Trade at a profit! Technical analysis of USD/JPY for December 17, 2020 2020-12-17  Overview : USD/JPY : The market opened below the weekly pivot point (103.69). It continued to move downwards from the level of 103.69 to the bottom around 103.14. Few days ago, the level of 103.69 was broken to the downside, constituting a considerable supply level. The USD/JPY pair has faced strong resistance at the level of 103.69 because resistance became support. So, the strong resistance has already faced at the level of 103.69 and the pair is likely to try to approach it in order to test it again. Today, the first resistance level is seen at 103.69 followed by 104.04, while daily support 1 is seen at 102.80. The USD/JPY pair broke support which turned to strong resistance at 103.69. Right now, the pair is trading below this level. It is likely to trade in a lower range as long as it remains below the resistance (103.69) which is expected to act as major resistance today. The bias remains bearish in the nearest term testing 103.14 and 103.00 . Immediate resistance is seen around 103.69 levels, which coincides with the weekly pivot. This would suggest a bearish market because the moving average (100) is still in a negative area and does not show any signs of a trend reversal at the moment. Amid the previous events, the USD/JPY pair is still moving between the levels of 103.69 and 102.62, for that we expect a range of 107 pips in coming hours. Therefore, the major resistance can be found at 103.69 (pivot point, 38.2 of Fibonacci retracement levels) providing a clear signal to sell with a target seen at 102.80. If the trend breaks the minor support at 102.80, the pair will move downwards continuing the bearish trend development to the level of 102.62 in order to test the daily support 2. Overall, we still prefer the bearish scenario which suggests that the pair will stay below the zone of 103.69 this week. Conlcusion : The moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 103.69. Hence, it will be good to sell at 103.69 with the first target of 102.80. It will also call for a downtrend in order to continue towards 102.69. The strong weekly support is seen at 102.69. However, if a breakout happens at the resistance level of 104.04, then this scenario may be invalidated. Daily key levels : - Major resistance: 104.04

- Minor resistance: 103.87

- Pivot point: 103.69

- Minor support: 102.80

- Major support: 102.62

Comment : - The trend is still calling for a strong bearish market from the spot of 103.69 - 104.04.

- Sellers are asking for a high price.

- Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.

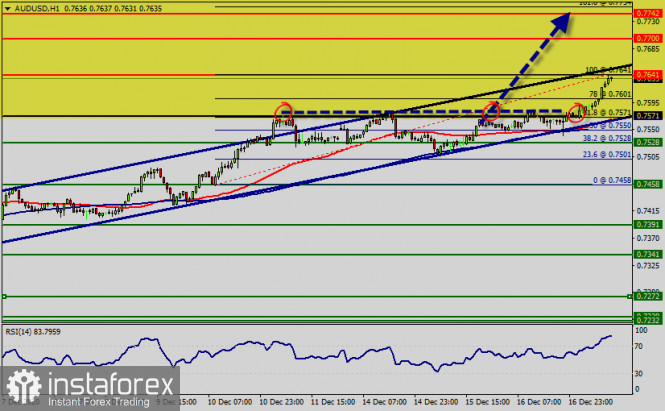

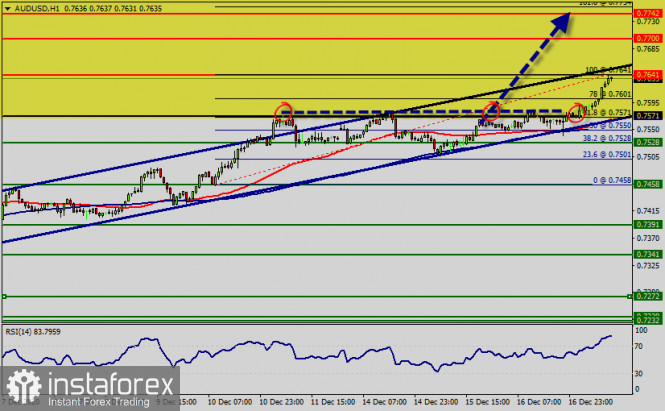

Technical analysis of AUD/USD for December 17, 2020 2020-12-17  Overview: The AUD/USD pair reached 0.7641 now, closing at 0.7641 and touched 0.7601 on Thursday before ending at 0.7641 (new high). Australian strength has triumphed against a background of dollar weakness. The AUD/USD pair broke resistance which turned to strong support at the level of 0.7571 yesterday The level of 0.7571 is expected to act as major support today. The AUD/USD pair is showing signs of strength following a breakout of the highest level of 0.7641. We expect the AUD/USD pair to continue moving in a bullish trend from the support levels of 0.7571 and 0.7601. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Consequently, the first support is set at the level of 0.7571 (horizontal blue line). Therefore, strong support will be found at the level of 0.7571 providing a clear signal to buy with a target seen at 0.7700. If the trend breaks the minor resistance at 0.7700, the pair will move upwards continuing the bullish trend development to the level 0.7742 in order to test the daily resistance 2. On the H1 chart. the level of 0.7571 coincides with 61.8% of Fibonacci, which is expected to act as minor support today. Since the trend is above the 61.8% of Fibonacci level, the market is still in an uptrend. But, major support is seen at the level of 0.7525. Furthermore, the trend is still showing strength above the moving average (100). Thus, the market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. On the other hand, if the AUD/USD pair fails to break through the resistance level of 0.7700 this week, the market will decline further to 0.7571 with a view to test the weekly pivot point. The pair is expected to drop lower towards at least 0.7525 . Also, it should be noted that the weekly pivot point will act as good support (key level today). Trading plan for the EUR/USD pair on December 17. Euro rallied after the Fed meeting yesterday. 2020-12-17

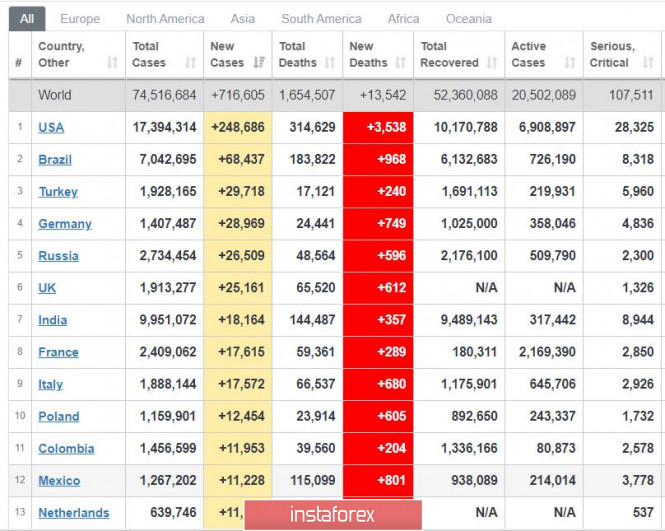

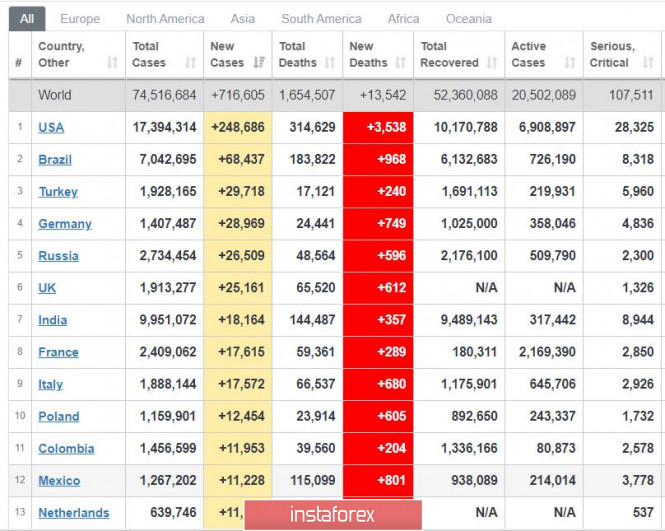

Global COVID-19 incidence grew again, reaching a new peak of 713,000 a day. In the United States, the number of new infections reached 248,000, while deaths have reached 3.5 thousand. The situation in Germany is also bad. The authorities recorded 28,000 new cases yesterday. The only positive news is that vaccination is in full swing both in the UK and the US.

EUR/USD - euro rallied after the Fed meeting yesterday. Open long positions from 1.2215. Open short positions from 1.2124. During the meeting, the Fed decided to leave interest rates unchanged at 0.1%, and the volume of bond purchases at $ 120 billion per month. With regards to its economic forecast, the central bank expects US GDP to reach 4.2% in 2021 and unemployment to decrease to 5%. Trading idea for the EUR/USD pair 2020-12-17  Although the latest policy decisions of the Fed provided temporary support to the US dollar yesterday, it also renewed the risk appetite of traders, thereby raising the price of many world currencies, including the euro.  Clearly, bullish sentiment prevails in EUR / USD. And because of this, a good level for sellers emerged in the trading chart - 1.21200.

Of course, it would be wrong to sell the euro without knowing the risks. Therefore, in the chart above, we presented one of the scenarios that could happen if you decide to short the pair. Price Action and Stop Hunting are used as trading strategies. Good luck! Trading idea for the USD/CAD pair 2020-12-17  The weakness of the US dollar yesterday on the one hand, brought out an oil rally, while on the other hand, upset the buyers of USD / CAD, especially since the quote returned to the yearly low.  But based on the Stop Hunting system, a strong pullback is possible, since the pair left good price levels, on which large players can set up new transactions. In particular, long positions may be opened according to the strategy presented on the chart above. According to the plan, the quotes would form three wave patterns (ABC), the targets of which are 1.27900 and 1.28300. Such follows the classic Price Action and Stop Hunting methods. Of course, traders would still need to monitor and control the risks to avoid losing profit. As mentioned before, this financial market is precarious, but will also give huge profits as long as you use the right approach. Good luck! EUR/USD analysis for December 17 2020 - Upside continuation as we epxected. Upside target set at 1.2350 2020-12-17 BOE leaves bank rate unchanged at 0.10% Prior 0.10% - Bank rate votes 0-0-9 vs 0-0-9 expected

- Gilts purchases £875 billion

- Corporate bond purchases £20 billion

- Total asset program £895 billion (unchanged)

- Existing stance of monetary policy remains appropriate

- Vaccine likely to reduce downside risks to economic outlook

- Recent global activity has been affected by increase in virus cases

- Q4 GDP likely to be a little weaker than expected in November report

- Outlook for the economy remains unusually uncertain

- Should market functioning worsen materially again, stands ready to increase pace of asset purchases to ensure effective transmission of monetary policy

- If needed, there is scope to reevaluate existing technical parameters of QE

- Extends term-funding scheme by six months

Besides acknowledging the potential for the vaccine to limit downside risks to the economy, there isn't much change to policy language in general. The BOE still highlights that the outlook is still "unusually uncertain", while maintaining its pledge for more QE. Further Development

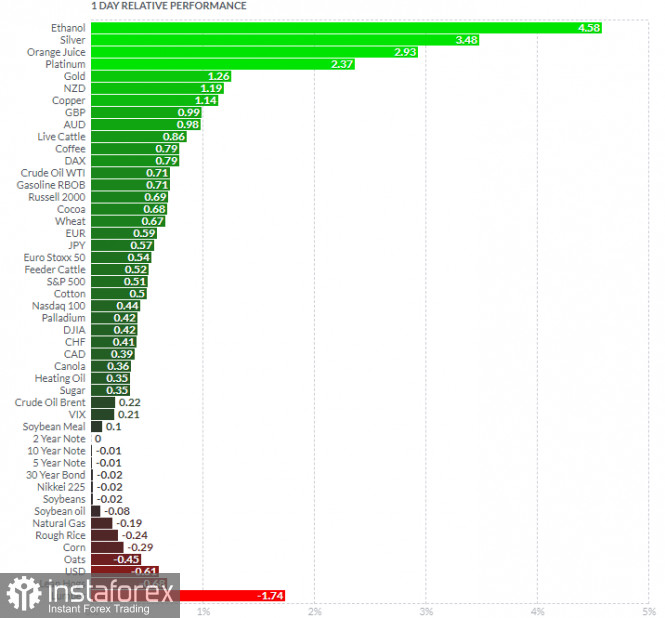

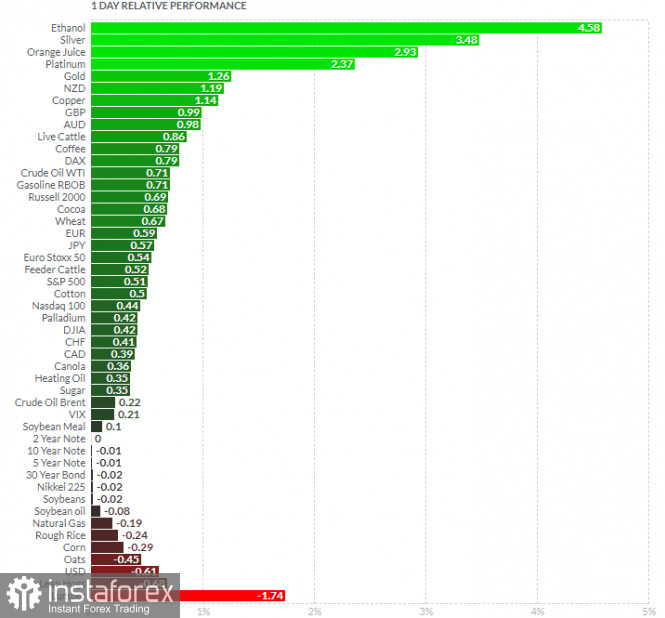

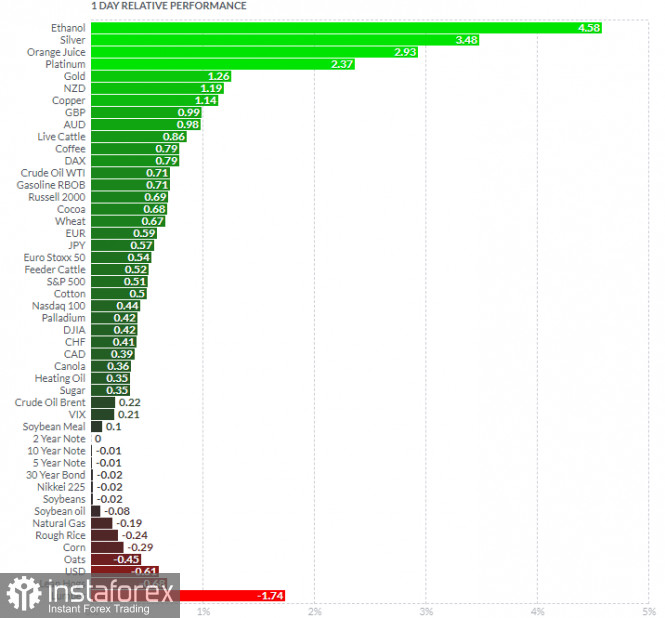

Analyzing the current trading chart of EUR/USD, I found that the buyers are still in control and that EUR is heading towards our main profit targets at 1,2350 and 1,2400. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Silver today and on the bottom Lean Hogs and Lumber. Key Levels: Resistance:1,2350 and 1,2400. Support levels: 1,2178 Analysis of Gold for December 17,.2020 - First target at the price of $1.873 has been reached. Potetnial for upside movement and second targett at $1.897 2020-12-17 EU's Barnier says talks showing good progress, but last stumbling blocks remain The usual stuff that we've been hearing for months on end In this final stretch of talks, transparency & unity are important as ever: Debriefed @Europarl_EN Conference of Presidents this morning on EU-UK negotiations. Good progress, but last stumbling blocks remain. We will only sign a deal protecting EU interests & principles. For those who missed out, talks are likely to stretch on until the weekend again in hopes of a breakthrough or compromise. Then again, it is Brexit after all. What's another missed deadline? 14 days to go. Tick tock, tick tock.

Further Development

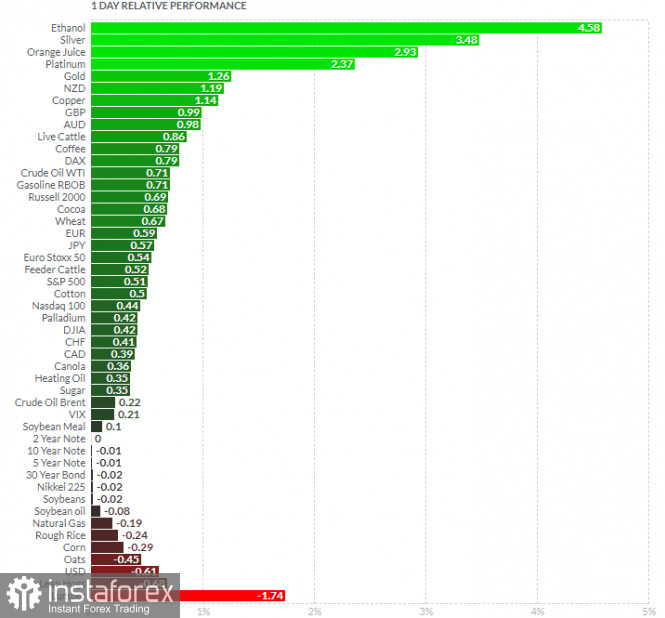

Analyzing the current trading chart of Gold, I found that the Gold reached my first yesterday's target at the price of $1,873 and that is heading to test next upward target at $1,897. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Silver today and on the bottom Lean Hogs and Lumber. Key Levels: Resistance:$1,883 and 1,897 Support levels: $1,817

Author's today's articles: Mihail Makarov  - - Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Alexandr Davidov  No data No data Pavel Vlasov  No data No data Irina Manzenko  Irina Manzenko Irina Manzenko Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

-

-  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  No data

No data  No data

No data  Irina Manzenko

Irina Manzenko  Ivan Aleksandrov

Ivan Aleksandrov  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment