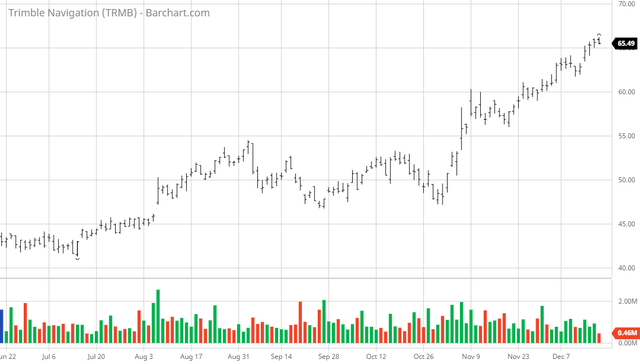

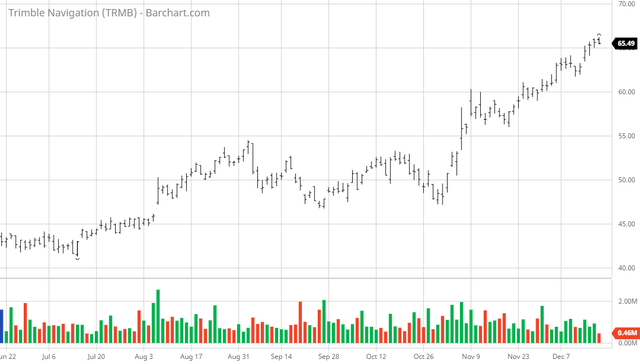

The Barchart Chart of the Day belongs to the scientific and technical instrument company Trimble Navigation (NASDAQ:TRMB). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 11/4 the stock gained 24.08%. Trimble Inc. provides technology solutions that enable professionals and field mobile workers to improve or transform their work processes worldwide. It operates through four segments: Buildings and Infrastructure, Geospatial, Resources and Utilities, and Transportation. The Buildings and Infrastructure segment offers field and office software for route selection and design; systems to guide and control construction equipment; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; 3D conceptual design and modeling software; building information modeling software; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; applications for sub-contractors and trades; and an integrated workplace management software. The Geospatial segment provides surveying and geospatial products, and geographic information systems. The Resources and Utilities segment offers precision agriculture products and services, such as guidance and positioning systems, automated and variable-rate application and technology systems, and information management solutions. It offers manual and automated navigation guidance for tractors and other farm equipment; solutions to automate application of pesticide and seeding; water solutions; Farmer Core, a software subscription that enables farmers to connect their farm operation; and forestry solutions for forest management and timber processing. The Transportation segment offers solutions for long haul trucking, field service management, rail, and construction logistics industries; and transportation management, analytics, routing, mapping, reporting, and predictive modeling solution under Trimble brand name. It has strategic alliance with Boston Dynamics. The company was formerly known as Trimble Navigation Limited and changed its name to Trimble Inc. in October 2016. Trimble Inc. was founded in 1978 and is headquartered in Sunnyvale, California.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signals

- 95.90+ Weighted Alpha

- 64.23% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 15.06% in the last month

- Relative Strength Index 76.46%

- Technical support level at 65.08

- Recently traded at 65.55 with a 50 day moving average of 56.56

Fundamental factors: - Market Cap $16.42 billion

- P/E 34.55

- Revenue expected to grow 7.00% next year

- Earnings estimated to increase 6.50% this year, an additional 7.10% next year and continue to compound at an annual rate of 7.00% for the next 5 years

- Wall Street analysts issued 4 strong buy, 4 buy and 6 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 398 to 21 that the stock will beat the market

- 6,870 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment