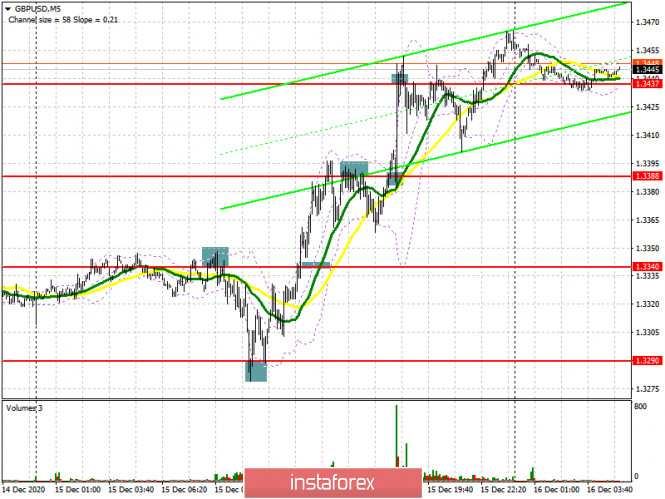

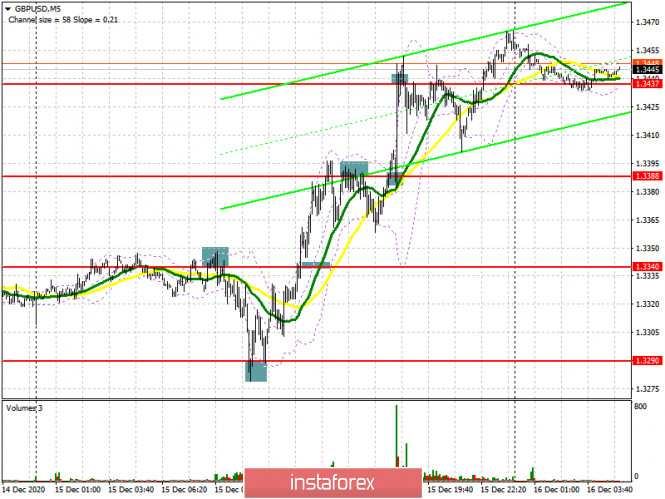

| GBP/USD: plan for the European session on December 16. COT reports. Buyers' optimism may lead to renewing the 1.3534 high 2020-12-16 To open long positions on GBP/USD, you need: I analyzed several good signals for entering the market in my afternoon forecast. The US session was also quite interesting, producing four more signals. Let's sort them all out with you. The 5-minute chart shows how the bears are protecting resistance at 1.3340 in the first half of the day and testing it from the bottom up produces a good sell signal, which was immediately realized in the support area of 1.3290, bringing around 50 points of profit. Then the attention shifted to a false breakout of support at 1.3290, where I recommended opening long positions immediately on a rebound. I marked the area on the chart, an excellent entry point to buy the pound appeared after it was tested from top to bottom. As a result, the upward movement was 50 points, but the bulls were not going to stop there. Buyers of the pound hoped to return to the 1.3340 level, however, this area was not tested from top to bottom and it would be logical to miss this signal. After growing further, a false breakout of the 1.3388 level led to a small correction by 20 points, afterwards the bulls returned to the market and produced a good point to buy after a breakout and surpassing the 1.3388 level. I marked it on the chart. Rising from 1.3388 led to a renewal of the 1.3437 high, where it was necessary to sell the pound immediately on a rebound in order to correct by 20-30 points, which happened.

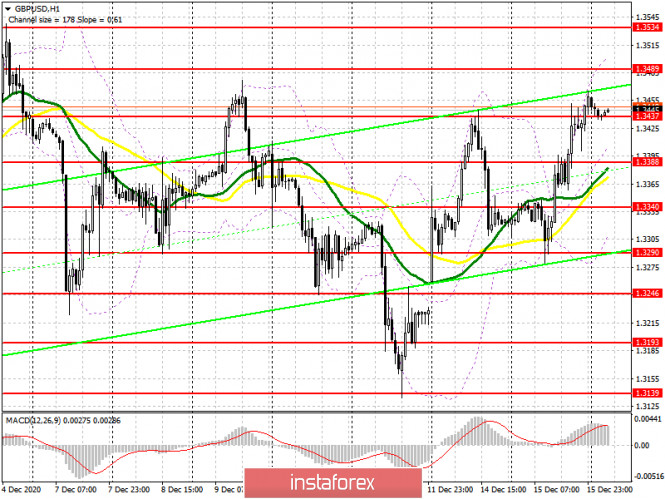

Bulls must maintain control over the 1.3437 level, as the upward trend depends on it. Forming a false breakout there in the first half of the day will be an excellent signal to open long positions in hopes for the pound to recover in the short term. In this case, the goal is for a breakout and being able to surpass resistance at 1.3489, testing it from top to bottom, produces an additional entry point into long positions and an exit to a high of 1.3534, where I recommend taking profits. The next targets are resistances 1.3604 and 1.3648, but they will only be available if we receive good data on the UK services and manufacturing sector, as well as good news on the Brexit deal. In case bulls are not active in the support area of 1.3437, it is best not to rush to buy, but to wait for the pair to fall and update the 1.3388 low. However, I recommend opening long positions from this level only after forming a false breakout. A larger support level is seen in the 1.3340 area, where you can buy GBP/USD immediately on a rebound, counting on a correction of 20-30 points. To open short positions on GBP/USD, you need: Bears will focus on regaining control above 1.3437. Settling below this range and testing it from the bottom up produces a good signal to open short positions, in hopes for a downward correction to the support area of 1.3388, where the moving averages play on the side of the pound buyers. Surpassing this level produces a good signal to sell the pound in hopes for it to fall to a low of 1.3340, where I recommend taking profits. Bad news on the trade deal will sharply pull down GBP/USD to lows of 1.3290 and 1.3246. If the pound continues to rise in the first half of the day after good reports on the state of the manufacturing and services sectors, then the bears should not rush to short positions. The optimal scenario for selling the pound will be failure to surpass 1.3489 and forming a false breakout there. I recommend selling GBP/USD immediately on a rebound from the high of 1.3534, or even higher, from the new large resistance at 1.3604, counting on a downward correction of 25-30 points within the day.

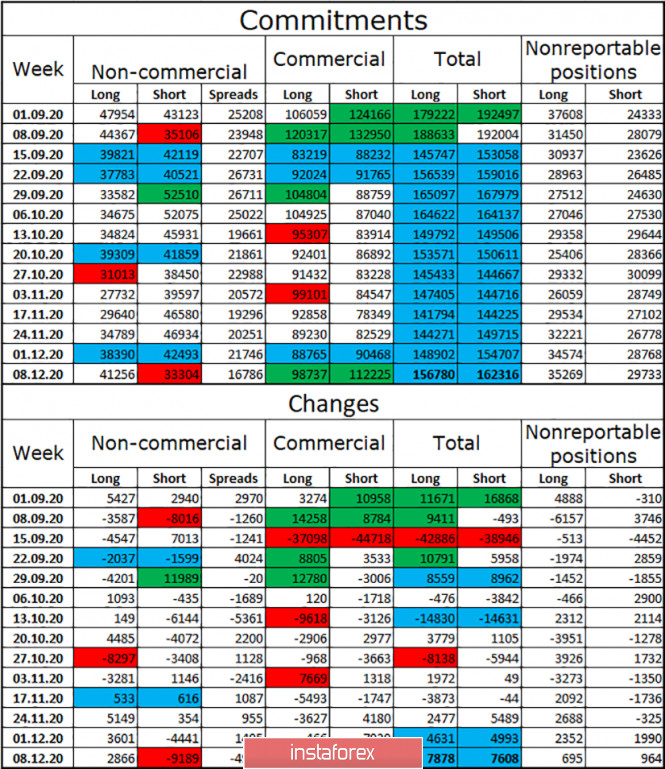

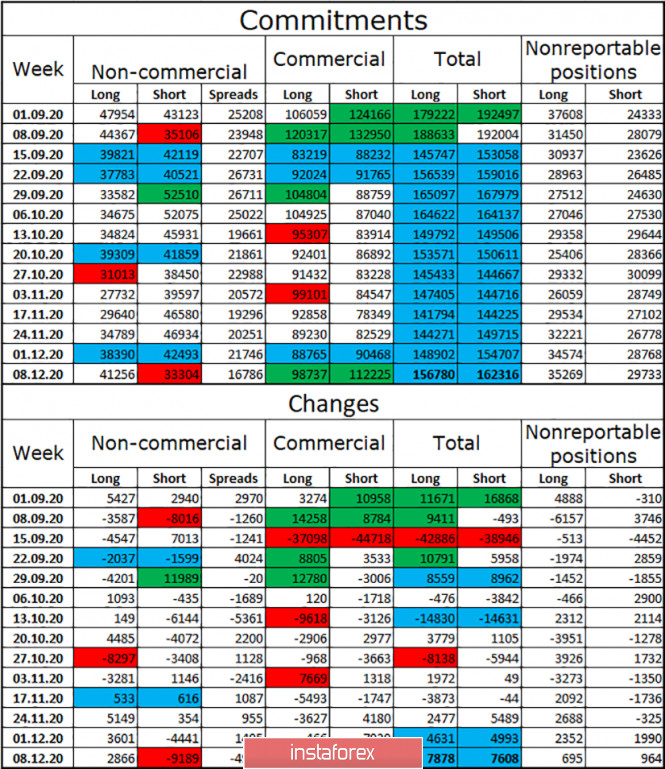

The Commitment of Traders (COT) reports for December 8 notes significant interest in the British pound. Long non-commercial positions rose from 37,087 to 39,344. At the same time, short non-commercial positions decreased from 44,986 to 33,634. As a result, the non-commercial net position became positive and jumped to 5,710 against a negative value of -7,899 a week earlier. All this suggests that traders are ready to bet on the pound's succeeding growth at the beginning of 2021 and on the buyers' advantage in the current situation even when there is no trade deal at the moment, and take note that there is just around two weeks left until the end of the year. Indicator signals: Moving averages Trading is carried out above 30 and 50 moving averages, which indicates that the pound will continue to recover in the short term. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart. Bollinger Bands A break of the middle border of the indicator around 1.3375 will increase the pressure on the pound. Growth will be limited by the upper level of the indicator in the 1.3490 area. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Technical Analysis of GBP/USD for December 16, 2020 2020-12-16 Technical Market Outlook: The GBP/USD pair has broken above the short-term trend line resistance seen around the level of 1.3400 and made a local high at the level of 1.3469. The next target for bulls is seen at the level of 1.3476, 1.3515 and at the swing high at 1.3538. For now the local technical support is located at the level of 1.3306. The momentum is now strong and positive and the market conditions are not overbought yet. Please notice, the up trend at the daily time frame chart is still in progress. Weekly Pivot Points: WR3 - 1.3813 WR2 - 1.3637 WR1 - 1.3455 Weekly Pivot - 1.3298 WS1 - 1.3125 WS2 - 1.2955 WS3 - 1.2786 Trading Recommendations: The GBP/USD pair is in the down trend on the monthly time frame, but the recent bounce from the low at 1.1411 made in the middle of March 2020 looks very strong and might be a reversal swing. In order to confirm the trend change, the bulls have to break through the technical resistance seen at the level of 1.3518. All the local corrections should be used to enter a buy orders as long as the level of 1.2674 is not broken.

Technical Analysis of EUR/USD for December 16, 2020 2020-12-16 Technical Market Outlook: The EUR/USD bulls are still trying to break higher above the level of 1.2177, the previous swing high, but the last attempt has ended with a Bearish Engulfing pattern at the H4 time frame chart. The demand for EUR is high and the momentum is strong and positive as well, so if the technical resistance located at the level of 1.2154 and 1.2163 is broken, EUR could rally higher towards the level of 1.2411 by the end of the year. The larger time frame trend remains up. Weekly Pivot Points: WR3 - 1.2281 WR2 - 1.2233 WR1 - 1.2171 Weekly Pivot - 1.2118 WS1 - 1.2069 WS2 - 1.2005 WS3 - 1.1960 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up. This means any local corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1609. The key long-term technical resistance is seen at the level of 1.2555.

Indicator Analysis. Daily review for the EUR/USD currency pair 12/16/20 2020-12-16 Trend Analysis (Figure 1). Today, the market will try to continue going up from the level of 1.2150 (closing of yesterday's daily candle) to reach the upper fractal of 1.2177 (red dotted line), the daily candle from 12/04/20. After reaching this level, there will be a work going up with the target of 1.2262 at the target level of 161.8% (blue dotted line). Much will depend on the news that comes out at 19.00 and 19.30 UTC (dollar).

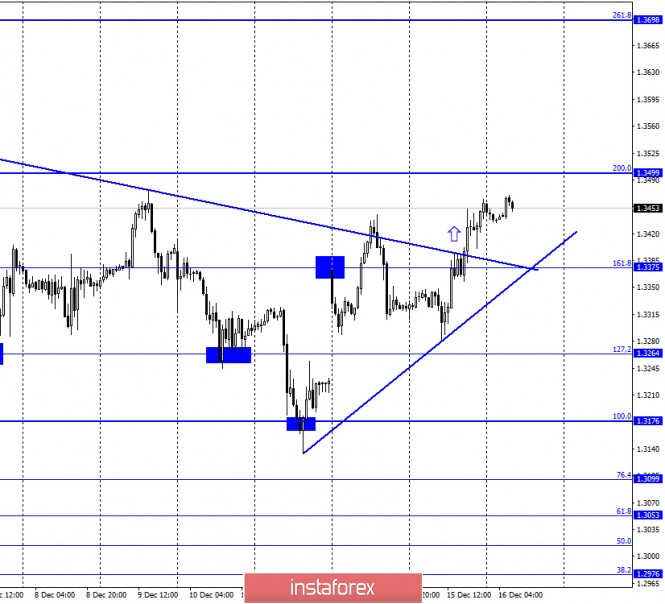

Figure 1 (daily chart). Comprehensive Analysis: General Conclusion: Today, the price will continue to go up to reach the upper fractal of 1.2177 (red dotted line), the daily candle from 12/04/20. After reaching this level, there will be a work going up with the target of 1.2262 at the target level of 161.8% (blue dotted line). Alternative scenario: when moving up and reaching the upper fractal of 1.2177 (red dotted line), the daily candle from 12/04/20, the price may start to go down at the retracement level of 14.6% at 1.2093 (red dotted line). Indicator analysis. Daily review on the GBP/USD currency pair for December 16, 2020 2020-12-16 Trend analysis (Figure 1). Today, the market from the level of 1.3455 (closing of yesterday's daily candlestick) will try to continue moving up to reach the resistance line of 1.3499 (red bold line). If this level is tested, further upward movement with the target of 1.3538 is the upper fractal (blue dotted line) is possible.

Figure 1 (Daily Chart). Comprehensive analysis: - Indicator analysis - up

- Fibonacci levels - up

- Volumes - up

- Candlestick analysis - up

- Trend analysis - up

- Bollinger bands - up

- Weekly chart - up

General conclusion: Today, the price from the level of 1.3455 (closing of yesterday's daily candlestick) will try to continue moving up to reach the resistance line of 1.3499 (red bold line). If this level is tested, further upward movement with the target of 1.3538 is the upper fractal (blue dotted line) is possible. Alternative scenario: the price from the level of 1.3455 (closing of yesterday's daily candlestick) will try to continue moving up to reach the resistance line of 1.3499 (red bold line). In the case of testing this line, it is possible to work down with a target of 1.3411 pullback level of 14.6% (blue dotted line). EUR/USD. US dollar and the Fed 2020-12-16 The US dollar index continues to gradually update the lows, slowly going near the psychologically important level of 90.00. The downward dynamics has gained a pullback nature, which allows the EUR/USD bulls to open long positions, without being affected by euro's problems (tightening of quarantine in key EU countries, ECB's dovish rhetoric, deflation in the eurozone, etc.). In particular, euro's temporary weakening allows the buyers of the pair to enter purchases at a better price, thus indicating the strength of the upward trend. On the other hand, the US dollar still shows its vulnerability, especially before the results of the Fed's December meeting.

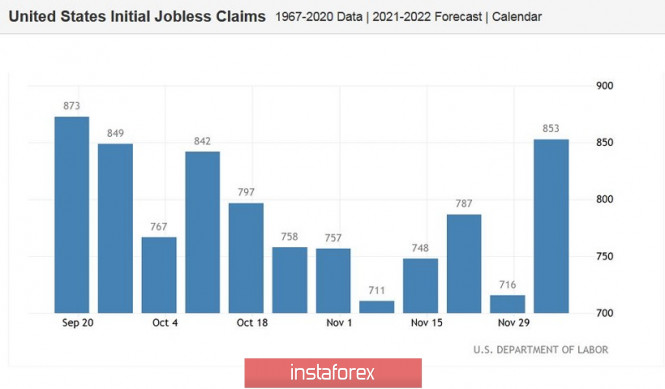

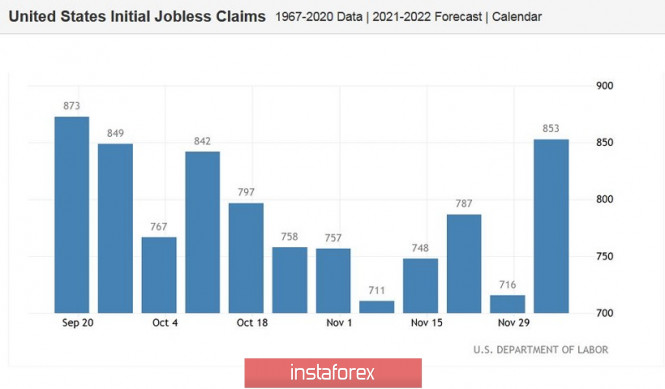

A lot of diverse fundamental factors affect the US dollar, which has been used by the market as the main protective instrument for a long time. First, there is a political factor. The Electoral College put an end to the presidential race after weeks of uncertainty: Joe Biden is officially the 46th president of the United States.There are still ceremonial formalities, which will end on January 20 – Inauguration Day. Nevertheless, Mr. Biden can already be considered the elected head of state, especially amid the latest decisions of the Supreme Court, which rejected all claims in favor of Trump. Although he continues to say that the fight is not over, it is indeed over and even prominent party members of the head of the White House were forced to admit this fact. For example, Senate Majority Leader, Mitch McConnell, congratulated Biden yesterday on his victory. This political gesture is indicative. So, now that political tensions in the United States have significantly eased, the dollar's position was negatively affected. Another factor is the COVID-19 pandemic, which is also unable to help the US dollar. Recent anti-records in the United States failed to provoke a surge in anti-risk sentiment in the currency market. Mass vaccination can be the primary reason, which started in the United States on Monday. In this regard, vaccination points have already been deployed in 150 hospitals across the country, and this number will increase to 600 by the end of the year. It is estimated that about 100 million Americans will be vaccinated by mid-spring. Considering such prospects, the USD weakened again, as the market simply ignores the current coronavirus anti-records. Congress political battles about a new stimulus package for the US economy have also supported the US dollar for a long time (since May this year). However, the last bipartisan bill, which was introduced this Monday, will still be approved in the very near future. Both Republicans and Democrats supported its main provisions, although there is currently a struggle for certain points of the document. Yesterday, House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin discussed the bill by phone. Following the talks, the Democratic representative assured journalists that the remaining unresolved issues in the draft budget can be resolved quickly and easily. Amid rising general optimism (including the above-mentioned), the safe dollar came under pressure again. Moreover, the Fed will continue to take an extremely soft position regardless of possible events in Congress. According to general forecasts, the Fed will keep its base interest rate at 0-0.25% per annum today. At the same time, traders expect Fed's updated macroeconomic forecasts and comments on the prospects for the economy. The main intrigue about the December meeting is related to the prospects of the incentive program, in particular, to what extent the regulator is going to implement QE and for how long? In addition, there have been rumors in the market recently that the Fed may shift its focus from short-term to long-term instruments of the debt market. It is worth noting that there is no consensus regarding the Fed's possible actions in the market. Some experts believe that the Fed will take a wait-and-see position today in the light of the emerging progress in the negotiations on a new stimulus package of Congressmen. Meanwhile, other analysts (most of which) assume that the Fed will soften its policy by expanding the scope of the stimulus program and extending its effect. The recent macroeconomic reports speak in favor of the second scenario. For example, there was a sharp growth in the number of initial applications for unemployment benefits (853 thousand) last week. According to the latest Nonfarm, the number of people employed in the non-agricultural sector in November increased by only 245 thousand, although experts expected to see this indicator much higher – at almost half a million (480 thousand). The growth in the number of people employed in the manufacturing sector was also disappointing. It only rose by 27 thousand, instead of the expected growth of 53 thousand. November's unemployment rate also fell, but it refers to lagging economic indicators. Therefore, we should focus more on timely data.

Slow and uncertain dynamics is also demonstrated by the US inflation. The general consumer price index in November rose to 0.2% in monthly terms, while it remained at the level of October in annual terms. As for the core inflation index, a similar trend can be observed – a slight (+ 0.2%) growth in monthly terms, and stagnation in annual terms. Therefore, it is very likely that Jerome Powell will disappoint the dollar bulls today. The US dollar might also fall under a wave of sales again, taking into account the ongoing issue of the possible result of the Fed's December meeting. The first upward target for the EUR/USD pair is the level of 1.2177 (two and a half year high reached last week). The main target is still the psychologically important level 1.2200, which also coincides with the upper Bollinger Bands line on the daily scale. It is too early to talk about more ambitious targets, since buyers of the pair need to at least consolidate in the area of the 22nd value. GBP/USD. December 16. COT report. The pound finds the strength to continue growing 2020-12-16 GBP/USD – 1H.

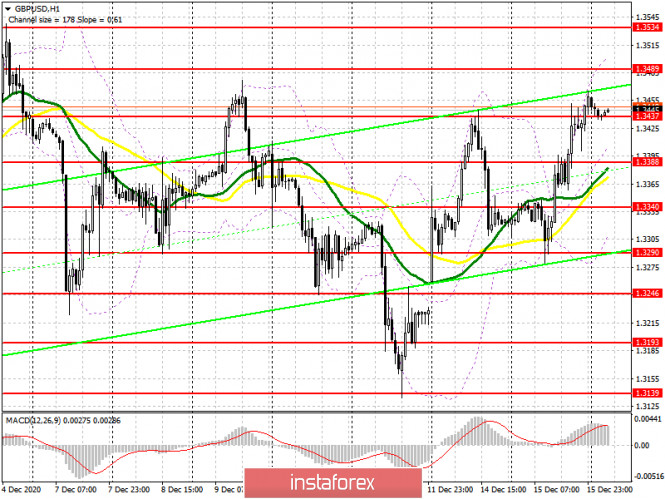

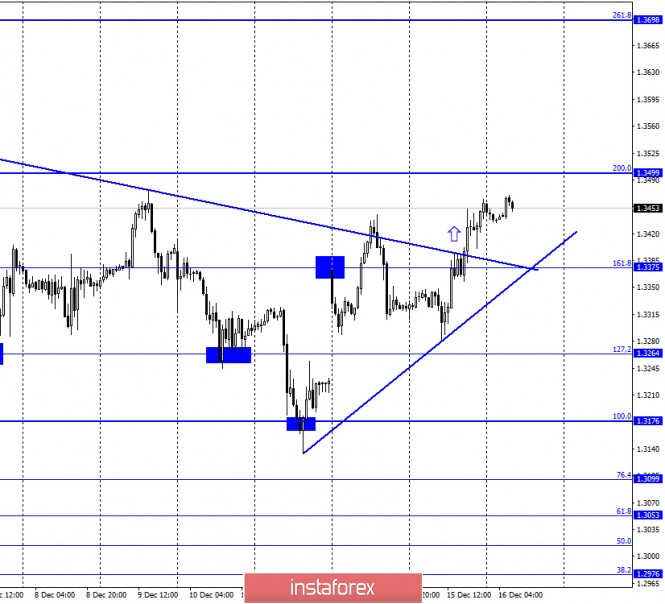

According to the hourly chart, the quotes of the GBP/USD pair still performed a consolidation over the downward trend line, thus, the mood of traders changed to an upward one. Almost immediately, a new upward trend line was formed. The pair's quotes continue the process of growth in the direction of the corrective level of 200.0% (1.3499), which is almost near 2.5-year highs. It remains a mystery why traders continue to buy the British. However, I have only to state the fact that economic reports continue to be ignored, and traders continue to believe that a deal between the UK and the EU will still be concluded. The most interesting thing is that traders continue to ignore even official information. In particular, it says that both the EU and the UK (their leaders) advise everyone to prepare for Brexit'y "No Deal", that is, without a deal. That is, the leaders of the EU and Britain themselves do not believe that Michel Barnier and David Frost will be able to break the deadlock in the negotiations. Thus, the negotiation process now continues "for a show". They say that while there is still at least a slim chance of a deal, we will continue negotiations. Although before the New Year, there are only 2 weeks left before the end of the transition period. However, traders are not at all confused by this fact. Therefore, the British pound continues to grow, which is very difficult to explain. GBP/USD – 4H.

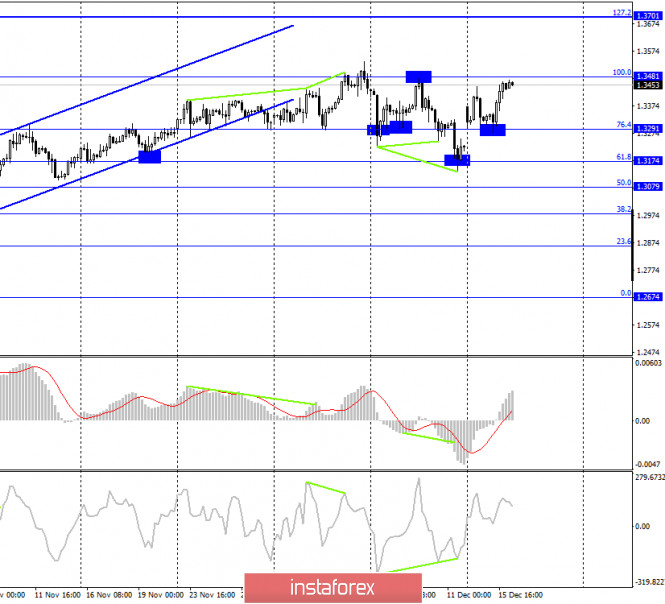

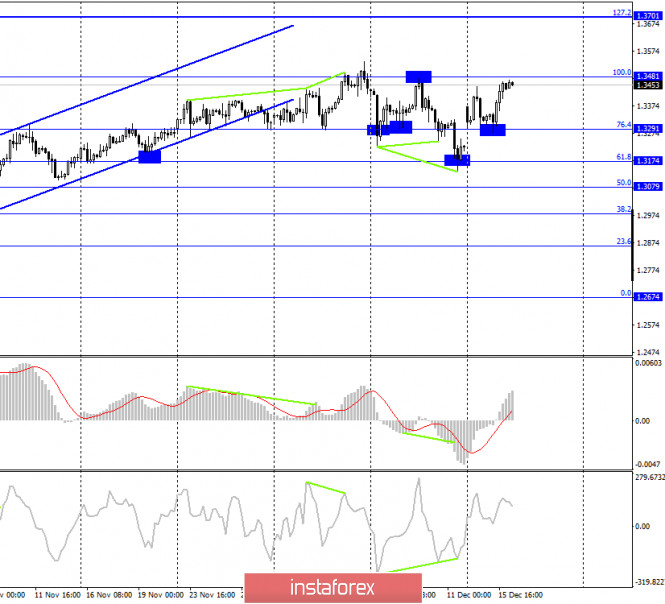

On the 4-hour chart, the GBP/USD pair also continues the process of growth in the direction of the Fibo level of 100.0% (1.3481). The bullish divergence of the CCI indicator also worked in favor of the beginning of the pair's growth. The rebound of quotes from this level will work in favor of the US currency and some fall in the direction of the corrective level of 76.4% (1.3291). Fixing above it will increase the probability of further growth towards the next Fibo level of 127.2% (1.3701). GBP/USD – Daily. On the daily chart, the pair's quotes performed a rebound from the corrective level of 100.0% (1.3513). However, for now, they have begun the process of returning to this Fibo level. Fixing above it will cancel the option with a drop in quotes and return the pair to an upward trend. GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. Overview of fundamentals: On Tuesday, the UK will report on the unemployment rate and applications for unemployment benefits. Both recorded growth, which is negative for the British. Only wages were slightly pleased, as they rose slightly more than expected. However, the British continued to grow. News calendar for the United States and the United Kingdom: UK - PMI for the manufacturing sector (09:30 GMT). UK - Services PMI (09:30 GMT). US - changes in the volume of retail trade (13:30 GMT). US - manufacturing PMI (14:45 GMT). US - PMI index for services (14:45 GMT). US - FOMC decision on the main interest rate (19:00 GMT). US - FOMC covering statement (19:00 GMT). US - economic forecast from FOMC (19:00 GMT). US - FOMC press conference (19:00 GMT). On December 16, the UK and the US will release business activity indices in the service and manufacturing sectors. However, the evening summary of the Fed meeting will be more important. COT (Commitments of Traders) Report:

The latest COT report showed a new increase in the number of long contracts in the hands of speculators. This time, their total number increased by 2,866 contracts, and the number of short-contracts decreased by 9,189 units. Thus, the mood of speculators has become much more "bullish" and is becoming so for the third week in a row. Given this fact, the growth of the British is quite understandable, although the information background is not quite on the side of the British currency. However, given that speculators have again taken up quite large purchases of the pound sterling, we can assume its new growth. In this regard, I recommend that you carefully monitor the level of 1.3513 on the daily chart. Closing above it will confirm the intention of traders to re-open long contracts. The total number of open long and short contracts for all groups of traders remains approximately the same. GBP/USD forecast and recommendations for traders: At this time, I recommend that you be extremely careful with opening any deals on the British. The pair continues to move very raggedly and often changes direction. New purchases of the British dollar had to be opened, as it was fixed above the trend line on the hourly chart, with the target level of 200.0% (1.3499). I recommend selling the British dollar with the target level of 127.2% (1.3264) if the closing is performed under the ascending trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price.

Author's today's articles: Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Irina Manzenko  Irina Manzenko Irina Manzenko Grigory Sokolov  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  Irina Manzenko

Irina Manzenko  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

No comments:

Post a Comment