| Why Successful Penny Stock Traders Value Losses - Why losses are more important than wins…

- Reviewing my number one rule…

- And diving into my top student’s losses…

Recommended Link

Dear Penny Stock Millionaire, Consistent trading is about discipline and preparation — andthat’s exactly why successful stock traders value losses. It’s no secret that the market is insane lately. I’ve been making anywhere from $6K to $10K on average every day. Here’s the thing … my daily trade totals aren’t on one single trade. You have to look at the details. It’s why I started Profit.ly. I wanted full transparency. And part of that transparency is showing every single trade. So these days where I make $6K ... $7K ... or $10K, that’s the result of a lot of small trades.* I let those singles add up … but I have losses too. And I know how to cut them quickly. And my number-one rule is to cut losses quickly. It’s impossible to have a perfect win rate in the stock market. And too many traders only focus on their wins, which almost always leads to a big loss at some point. Any trader can be wrong. It can happen to anybody, on any day, on any stock. You have to recognize it and be OK with it. That’s why successful penny stock traders value losses. You don’t have to learn it the hard way. So first, let’s talk about... Why Smart Stock Traders Value Losses It’s part of how they learn to manage risk. For me, doing well in the penny stock niche means having discipline. It’s sticking to my process and trading plan. I have a lot of key trading rules I teach to my students. It’s all to help them learn to trade smarter and protect their accounts. You have to be quick in trading. You have to recognize the pattern, the catalyst, when to take the loss, or when to be more conservative. This is all part of how I adapt with every trade. One of the best tools I’m using right now is the Breaking News chat on StocksToTrade. This tool has been a huge help to me lately. Use this tool. It’s incredible. But even with the best tools, you can’t win every trade. It’s so common for newbie traders to hold onto a losing position. They want to try to get out for a small profit and not take a loss... But that’s exactly what can lead to huge losses. If you’re trading with a small account, that’s dangerous. You can wipe out your entire trading account — all because you can’t learn to let go and MOVE ON. Why Do I Cut Losses Quickly? I’m not right 100% of the time, and I’m OK with that. No trader has a perfect record. But when stock traders value losses, they get better at respecting them. Here’s the funny thing ... Sometimes it takes a big loss to get you to understand the value of your account. You feel it, and you understand the risk. But if you wipe out your account, it’s game over. Remember, you can always re-enter a stock if you’re wrong the first time. Just wait for the pattern to present itself and get in again. Or wait for the next setup. There are so many trades in this market. I know what it’s like to take a big loss. My biggest loss ever was about $500K. You can read about it in my book, “An American Hedge Fund.” That loss changed the way I trade. I don’t want you or any of my students to suffer a loss like that. I want to help save you money in the long run. It’s also about protecting your mindset. Big losses can make you spiral into doubt or revenge trade. Put your ego aside and get out of losing trades early. That can help you better focus on winners and riding the momentum. Recommended Link

A stock that yields 67% a year? Really?

If you're happy with stocks yielding you 4% or 5% a year, you don't need this. But if you want to see how we built a portfolio that now pays us a 67% cash on cash return - with no leverage, options, or gimmicks. | |

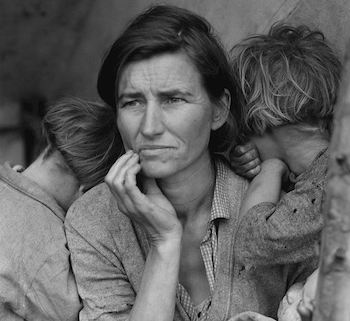

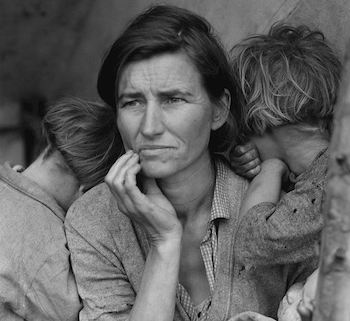

Learn How to Trade Through Volatility We’ve never seen a market quite like this one. The pandemic’s created huge volatility. And volatility is another reason stock traders value losses. When this mania dies down, another hot sector will pop up. It’s your job to prepare now. Despite the volatility, I’m not trading new patterns in this hot market. The plays may be new, but I’m adapting my patterns to what’s happening in the market now. It’s not an exact science. I’ve been doing this for over 20 years. It can get easier with time and experience... It’s why you have to study the past to prepare for the market now and tomorrow. These stocks move FAST. You have to learn the process and become a self-sufficient trader. I can be wrong on any stock. Any trader can. It’s part of the game. But if I stick to my trading plan and don’t let my ego get in the way, I value that more on a discipline scale. Smart, consistent trading is about discipline and preparation. That’s why consistent stock trader value losses. It’s also... Why My Losses Are More Important Than My Wins Here’s something my top students all have in common: They learn from their losses. Every trader loses sometimes. When you’re a newbie trader, you’re likely to take bigger losses than you expect. That’s because you haven’t developed the discipline you need to trade consistently. It’s something I teach in my Trading Challenge. Every rule I teach my students is to help them to trade smarter and stay in the game. You can listen to or follow anybody. But if you don’t know how to cut losses, you can do some damage to your account. It takes a toll on your mindset. And ultimately, you can take yourself out of the game. For me, experience and discipline pay the most over time. Newbies and haters won’t get it … “Sykes values a loss more than a gain — what kind of backward logic is that?!” Well … some of the best lessons are counterintuitive. This is why I’ve been in the market for 20+ years. I understand how to stay in the game. And I get that there’s so much more to trading than winning is good or losing is bad. It’s not just about the money or random wins. It’s what keeps you in the market. You also have to look at your losses. That’s how you find out where the trade went wrong. Remember, studying is essential to become a consistent trader — but that goes beyond just studying patterns. You have to study your losses too. A lot of traders are nailing plays in this market. Let’s look at one of my recent winning trades... Transportation & Logistics Systems Inc. (OTCPK: TLSS) Look at this trade I took on TLSS from June 1 — this was a hot OTC stock:  TLSS chart: 1 day, 1-minute candle — courtesy of StocksToTrade.com TLSS chart: 1 day, 1-minute candle — courtesy of StocksToTrade.com

In this case, one of my favorite morning patterns worked perfectly. I made just under $5,000 on the trade. By the way… I get asked all the time how I find these plays with such nice morning panics. The answer is so simple. I helped design and develop StocksToTrade. You can use it to find the biggest percent gainers with news — which is exactly what I look for to find trades. If you’re not using it, you’re missing out. So yeah, there are a lot of traders making trades like this. But not every trader knows how to keep their losses small. That’s why my losses are so much more important than my wins. Any trader can make money, but not many traders can keep their losses small. Of course I’m happy with my gains. But I’m even happier that I have the discipline to cut losses quickly. Stock Traders Value Losses — My Top Students All my top trading students have taken losses during their trading careers… some bigger than others. But every single one of them learned huge lessons from their losses. They take all the rules I teach seriously. Most of them started with small accounts. They worked their butts off and grew those small accounts over time through small, consistent gains. Let’s see how they’ve learned from their losses... Matthew Monaco Matthew Monaco is one of my newest up-and-coming students. He’s crushed it over the past few months. He gets why stocks traders value losses. He had a BIG loss in March 2020. He was coming up on a $10,000 month — which would have been one of his biggest months ever. But at the end of the month, he told me his ego got in the way. That led to a $5,000 loss in a single day, cutting his month in half. He’s lucky ... He learned that lesson while still profitable on the month. Recommended Link

Are You Ready for the Great Depression of 2021?

According to some economists we’re already in a recession… But now a former CIA and Pentagon advisor is saying this is just the beginning of something much, much worse. And he’s urging Americans to take these FIVE STEPS to protect their wealth and their loved one. | |

Tim Grittani Tim Grittani is on fire! As of June 2020, Grittani reports over $11 million in trading profits. But Grittani didn’t make over $11 million in trading profits by winning every trade ... He did it by learning from his losses. Remember, he’s trading a lot bigger than most of my students — he even told me a “papercut” loss for him was $40,000 at one point. After his third six-figure loss, Grittani had enough. He refined his process and sized down... He kept a journal of every loss to find out where he went wrong. He only allowed himself to trade bigger when his stats told him he was ready. Again, no matter how much you study your losses, you’ll never be able to completely avoid them. But you can help minimize your risk by learning from the past. Let’s look at one more example... Jack Kellogg My Challenge student Jack Kellogg reports slaying in this market. His growth has been crazy in the past few months. Since we’re talking about why stock traders value losses, I gotta talk about Jack ... In May 2020, he posted some impressive numbers... His reported profits of $70K in May are great ... But there’s something that I find far more impressive… His losses were insanely small. With an average gain of over $900 per winning trade, Jack managed to keep his average loss under $250 per losing trade. This shows how much he values his losses. When he’s wrong on trades, he gets out FAST. When he’s right, he lets winners run. This is how I want to see all my students trade. Bottom Line: Stock Traders Value Losses Repeat after me: Stock traders value losses. Learn to think beyond profit and loss. Get into the details. Understand why you’re wrong on any trade. It’s just as important as knowing why you’re right on winning trades. It helps you build a solid strategy. You can mock me for valuing my losses, but this is what real traders do. Newbies only focus on big gains, and they set themselves up for big losses. I talk about small losses because I don’t want my small mistakes to turn into big disasters. You have to learn how to protect yourself from potential big disasters. You need solid risk management — or it will catch up to you eventually. Small gains add up, and your gains need to be bigger than your losses. Your losses can help you learn to trade smarter. It’s how you find discipline in your trading, develop a process, and get into the right mindset. Do you understand why stock traders value losses? Talk to you tomorrow, Tim Sykes

Editor, Penny Stock Millionaires P.S. He’s the man who predicted the 2008 recession… Recognized as the #1 personal finance expert in the world… Author of Rich Dad Poor Dad with 41 million copies sold… Now, he’s coming to you to reveal EXACTLY what’s going on under the nose of every American… an urgent warning to every single American… The biggest transfer of wealth in U.S. history… Unfortunately, nobody will be able to stop this new movement… Not Democrats. Not Republicans. Not Congress… Unfortunately, 99% of Americans don’t understand what’s going on… But today Robert Kiyosaki will blow the lid off the entire operation and help you take 5-steps to protect & grow your wealth during the coming weeks. There’s not much time, click here to get all the details. |

TLSS chart: 1 day, 1-minute candle — courtesy of StocksToTrade.com

TLSS chart: 1 day, 1-minute candle — courtesy of StocksToTrade.com

© 2020 Paradigm Press, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized financial advice.

© 2020 Paradigm Press, LLC. 808 Saint Paul Street, Baltimore MD 21202. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized financial advice.

No comments:

Post a Comment