|

Bollinger Bands: the secret of distance |

| Bollinger Bands look like two lines (bands) that run above and below the moving average. When the price abnormally deviates from the current trend, these bands start to converge or diverge and the distance between them changes—at that, we can predict a certain market situation. |

| By default, the period of the indicator is set to 14, and the standard deviation is set to 2. You can adjust them yourself depending on the selected timeframe and instrument. |

How to understand signals |

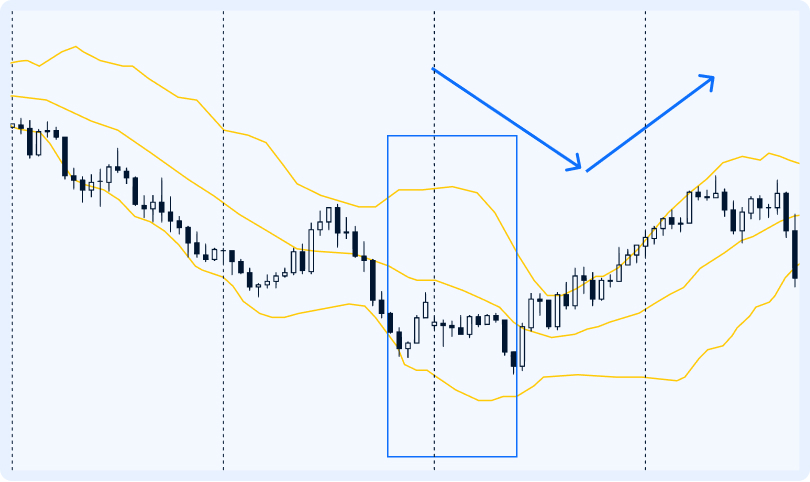

The bands are approaching the moving average |

| If they are gradually narrowing, the market is calming down, and the price begins to consolidate. |

|

| Sharp convergence indicates that volatility has decreased and predicts a strong trend movement. |

|

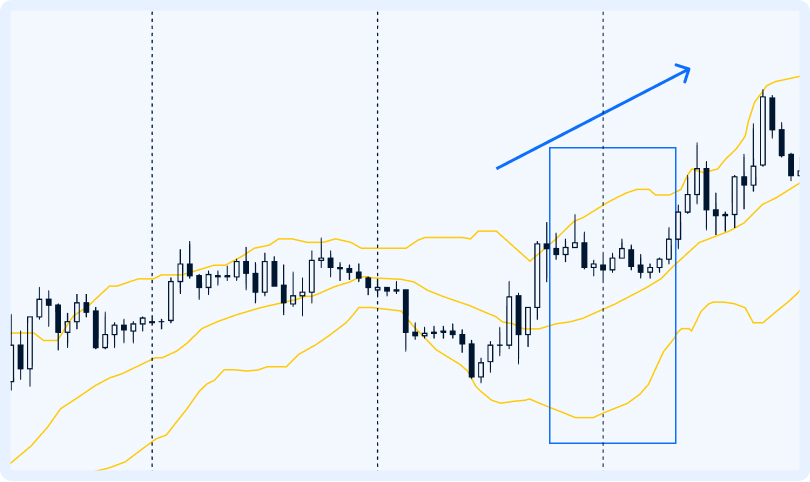

The bands move away from the moving average |

| A smooth expansion of the range signals either that the current trend is strengthening, or that a new one is emerging. |

|

| If the bands have diverged sharply, the market is highly volatile. We can expect a trend reversal. |

|

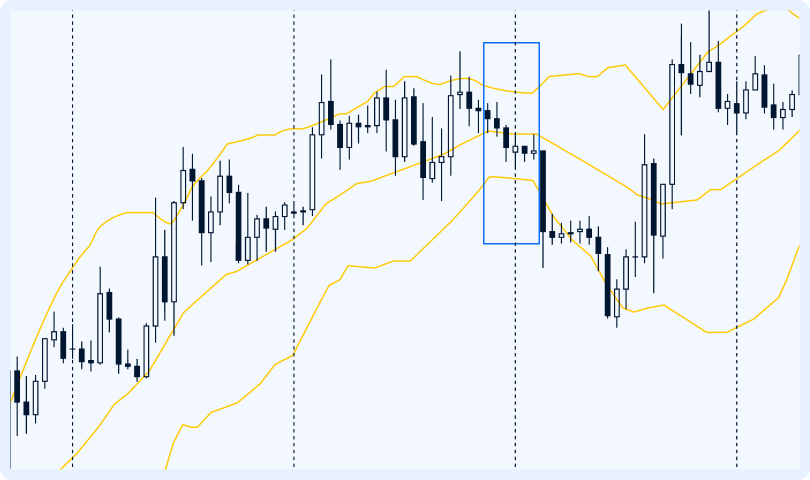

The price chart went beyond a line |

| Either it is a small price correction within the current trend, or it is a reversal of the current trend. The exact analysis depends on the specific chart. |

|

Conclusions: |

| 📌 Most often, the price moves within the Bollinger Bands and pushes away from them. |

| 📌 The narrowing or widening of the bands serves as a signal to understand the strength of the trend and to determine a reversal or consolidation of the price (flat). |

| 📌 No indicator is always accurate, so please keep that in mind. First, master the new tool on a demo account. |

No comments:

Post a Comment