| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tuesday, August 27, 2024

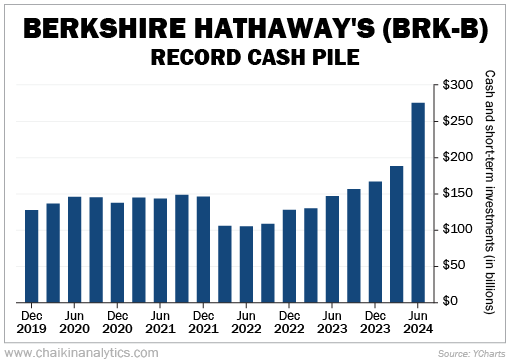

Berkshire Hathaway Has a Big Cash 'Problem'

Subscribe to:

Post Comments (Atom)

Shutdowns Are Bullish

Plus, use this to plan out your 2025 trades... December 23, 2024 Shutdowns Are Bullish BY MICHAEL SALVATORE, E...

-

insidecroydon posted: " Become a Patron! What's on inside Croydon: Click here for the latest events listing...

No comments:

Post a Comment