Editor's note: This bull run isn't over yet... With inflation, geopolitical conflict, and the upcoming presidential election weighing on stocks, many investors are reluctant to put their money to work right now. But Vic Lederman – editorial director of our corporate affiliate Chaikin Analytics – says investors' cash levels can provide a guiding light amid this ongoing uncertainty... That's why he believes it's critical for investors to understand why U.S. investors' current cash allocations indicate this bull market still has plenty of room to run. In today's Masters Series, originally from the January 11 issue of the Chaikin PowerFeed e-letter, Vic talks about the pros and cons of saving a ton of cash in times of economic uncertainty... analyzes investors' current cash allocation levels... and explains why this data signals you should remain bullish right now...

What Investors' Cash Levels Tell Us Today By Vic Lederman, editorial director, Chaikin Analytics It's good to have some cash lying around for a rainy day... Life is unpredictable. One day, everything is fine. But then... a curveball comes along. You could lose your job, get sick with a debilitating illness, or become a victim of identity theft. Sure, you could file for unemployment benefits when you're out of work. But the way prices of everything have been soaring, government assistance probably won't get you very far. One bad illness or accident can land you deep in debt. And if you're lucky enough to have health insurance, high deductibles and rising insurance premiums will quickly drain your finances. Having enough spare cash lying around can make these unpredictable situations easier to navigate and overcome. It's what a lot of older folks like to call "keeping cash under the mattress." But how much cash do we put "under our mattress"? For most U.S. investors, that figure is usually 22% of investable assets. That's according to the American Association of Individual Investors ("AAII"), which has conducted a survey of regular investors since 1987. The AAII also found out that, on average, investors place 16% of their money in bonds and 62% in stocks. These allocations fluctuate depending on how bullish or bearish people feel about the economy... For example, during the dot-com boom toward the end of 1999, investors were particularly bullish. They had just 12% of their investable assets held in cash, while 76% was in stocks. But when the bubble burst, a recession hit. And by the time unemployment peaked in 2003, investors were holding 38% of their funds in cash. That was triple their cash allocation before the crash. During the depths of the financial crisis in 2009, investors were so fearful that they set aside 45% of their assets as cash. They cut their stock allocation to a mere 41%. So today, how are individual investors feeling? Let's take a look at what their cash allocations are telling us...

| Recommended Links: | |

U.S. Dollar to 'Go Crypto' Trillion-dollar institutions like Fidelity Investments and BlackRock are backing bitcoin, driving the price above $65,000 in early March. But one highly respected crypto expert, who first started mining bitcoin in 2013, says that what's coming next could have implications far beyond the bitcoin market. It'll surprise you... and could blindside millions of people. Get the full story here while there's still time. |  | |

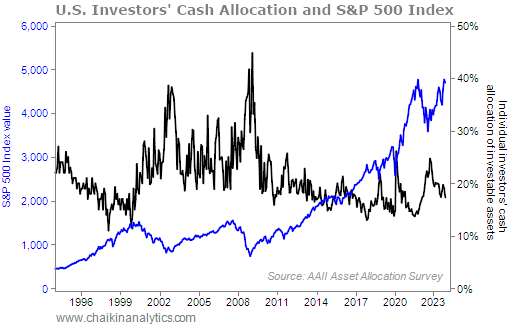

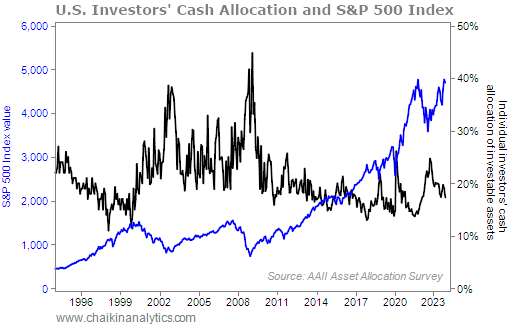

Right now, investors are feeling particularly bullish. And it shows in their allocation toward cash. Take a look at that compared with the S&P 500 Index...

For all the talk about a coming recession, unemployment is near a 50-year low. U.S. gross domestic product ("GDP") grew an annualized 3.3% in the fourth quarter. And the S&P 500 is in a bull market that's just 16 months old. As a result, investors have allocated just 17% of their investable assets into cash. That's a drop from 25% during the market correction in October 2022. Meanwhile, their stock allocation has risen from 62% to 68%. Even then, investors are far from being overly optimistic about stocks. That's because history shows that when investors are highly bullish, they've been willing to put more money to work in the stock market. And they're perfectly fine with holding less cash than they have today. Indeed, as you can see in the chart above, the past three peaks in the market saw cash holdings among individual investors fall to less than 15%. If the economy keeps performing well and unemployment stays low, folks will be comfortable taking more money "out from under the mattress" and putting it to work instead. Also, keep in mind that this is an election year. Historically, these have proven to be positive for stocks. Dating back to 1937, the average gain for the S&P 500 during election years comes in at about 10%. To put it all together, U.S. investors are still sitting on a good deal of cash in a year when they could be putting more to work in the markets. This tells me that we likely haven't seen the peak of this current bull market. So I'm still bullish today. Good investing, Vic Lederman

Editor's note: Chaikin Analytics founder Marc Chaikin predicted the 2020 and 2022 crashes, the 2021 bull run, and last year's historic banking crisis. Now, he's sounding the alarm to reveal what's coming next for the stock market throughout this election year... Marc recently went on camera to share the one move you must make following the Super Tuesday primaries in order to protect your portfolio. Plus, he shared the name of the No. 1 stock you must buy ahead of the presidential election. Catch up on the full details here... |

No comments:

Post a Comment