Dear Reader,

In the winter of 1999, I wrote my first newsletter.

Huddled over a borrowed laptop, I spent months writing and rewriting what I believed to be the most important story of the decade.

A story about a coming technological and economic disruption that would change everything in America, and in the process, destroy one of the country's highest-rated and most widely-held stocks.

I had no "right" to tell this story.

I wasn't a stockbroker or financial analyst.

I'd never worked for an investment bank or on Wall Street.

And beyond having access to the SEC's enormous database of financial statements and annual reports, I had no special insights into corporate America.

I did, however, know two things that most investors didn't:

#1. I knew the Internet was going to transform the world's economy more profoundly than any technological innovation since the invention of electricity.

#2. And I knew Wall Street and the financial media were doing a horrendous job of accurately explaining the opportunities and risks of this coming revolution.

I mean, with so much fiber optic cable being laid along our country's railroads and ocean floors it was obvious to me that long distance telecommunication prices would plunge to practically zero.

A decline that would decimate the existing telecom sector, opening the doors to a massive new internet economy.

Yet, nobody else was telling people what was coming.

So, from the kitchen table of my tiny, 3rd-floor apartment in Baltimore, I took it upon myself to tell the story.

That first letter – where I accurately predicted the demise of AT&T, one of America's most dominant and widely held stocks – went on to form the foundations of Stansberry Research…

Over the next two decades, my partners and I grew the company into one of the world's largest and most successful financial research firms ever.

Together, we broke many of the most important economic and financial stories of the 21st century:

We exposed the corruption at the heart of General Motors, warned of the collapse of Fannie Mae and Freddie Mac, and the crash of General Electric We laid bare how the U.S. government's bailouts, money printing, and soaring debt burden would lead to a crisis of civil society…and predicted in near-perfect detail the riots, lockdowns, and inflation we've been tortured by for years.

More recently, after a brief retirement, I returned to warn the adoption of so-called Diversity, Equity, and Inclusion (DEI) policies would poison some of our most storied companies.

A year before Boeing's planes started to fall apart mid-flight, I wrote a report titled, "Coming Soon: The Boeing Collapse" and detailed why this once great company was dying.

Why am I telling you all this?

Because I'm back with another message that I believe could change everything for those who're intelligent enough to pay attention.

But this isn't a prediction about a new technology, an economic shift, or the political and cultural state of our country.

In fact, you can't really even call it a prediction.

This is more like a statement of fact. You see, an almost inevitable event is unfolding in the financial markets right now that has the potential to be the defining story of 2024.

It involves a rare market anomaly that I believe is going to make some people very wealthy.

Almost nobody in the mainstream media or Wall Street has connected the dots on what's going on, but that ignorance won't last for long. When they wake up to this situation, billions of dollars will flood in.

Starting tomorrow, I'm going to sit down each morning and write an email (like this one) that brings you up to speed on what's going on.

I'll explain what this market anomaly is… why it has occurred… what it means for a select group of stocks… and why it will likely never appear again…

And, most importantly, how you can take advantage of it with my full investment strategy, including the exact names of the companies to buy (and avoid).

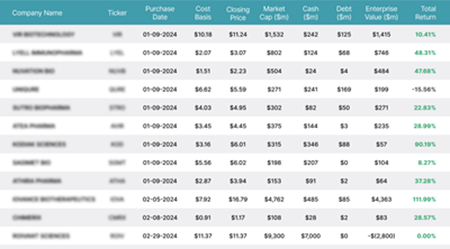

Since we first identified this market discrepancy, 10 out of 12 stocks we're targeting are up by at least double digits… but this is only the beginning.

|

No comments:

Post a Comment