Chat Open 🦜 I Drops Monday I Battle ⚔️ |

|

Are you ready to CHARGE??? | Operation February Commencing! | | Join Jeff and his army on the next $10,000 Mission in Alpha Hunter! | ⚔️ Enter the Battle TODAY ⚔️ |

|

|

|

Happy Friday, Folks! |

Just a note the Market Master's Room is open all day today to talk with fellow traders. Jason's on at 11EST & JW is back on for Atomic Trades at 3EST (complimentary!). |

And…are you loving earnings season as much as I am? |

Not because of Tesla (TSLA) collapsing 12% on Thursday after it delivered its quarterly report, but because of the volatility opportunities this time of year delivers for prepared options traders like me. |

Don't look now, but next week will bring some of the market's biggest, most volatile stocks to the stage. |

Names like Microsoft (MSFT) and Apple (AAPL) will report earnings on Tuesday and Thursday, respectively, and one of those names is offering an INCREDIBLE amount of information to help me (and you) prepare. |

With 20+ years of trading under my belt, I've learned a lot. |

But one of THE MOST IMPORTANT LESSONS I've learned? |

The one that had the most influence when I created my HUGELY popular Alpha Pulse system? |

Buying straight call or put options where the underlying stock is stretched and implied volatility is high presents a LOW PROBABILITY of success. |

Sure, high implied volatility means the potential exists for large future price swings. |

BUT, it also means that the premium you are paying for those options is bloated. |

So if you are paying a high premium at a time when the rubber band has become stretched, there is a heightened probability you'll be left holding the bag as the value of those options declines as price movement starts to slow. |

Case in point, MSFT. |

Just look at this chart of "Mr. Softee" as it stretches to the top of my CUSTOM Keltner Band study with a recent spike in implied volatility. |

|

Is it possible MSFT can still rally after earnings on Tuesday? |

Absolutely. |

But, in this particular case, I'd rather approach this trade using a MUCH higher probability option strategy than simply buying options. |

In my Alpha Hunter service, I am using the highest probability options SELLING strategies to take advantage of the ideas I find. |

That's right. I said "selling" options, not buying. |

Learn how to find trade ideas that work in your favor as time passes by in 2024. |

These are the same option strategies that have allowed market makers to win the majority of trades for decades. |

They are also the same strategies that have allowed me to present my Alpha Hunter members with ideas like these: |

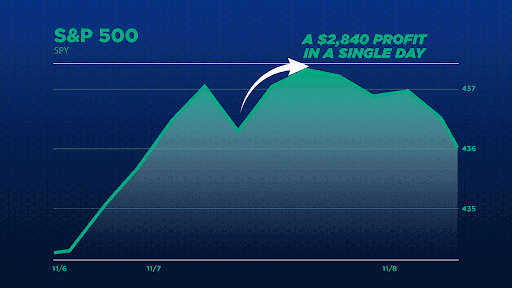

The $2,840 SPY move that played out in a single day: |

| Trading is hard, results not guaranteed and should not be expected to be replicated typically |

|

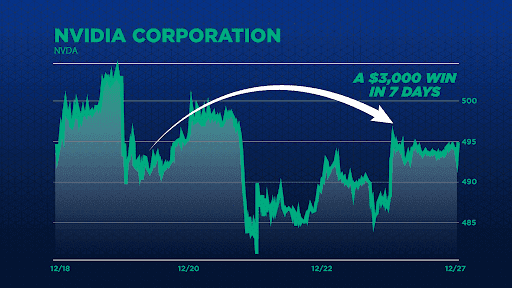

The $3,000 win I took home on NVDA in seven days… |

| Trading is hard, results not guaranteed and should not be expected to be replicated typically |

|

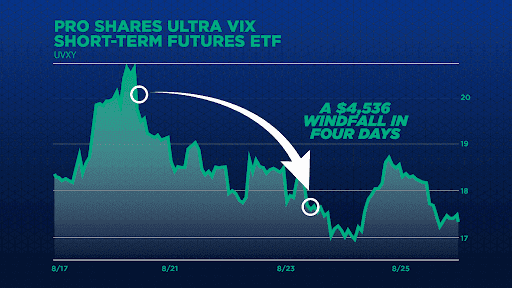

And the $4,536 win I closed out on UVXY in just four days… |

| Trading is hard, results not guaranteed and should not be expected to be replicated typically |

|

Pro Tip: BEAT the Market Makers at their own game this year by learning how to be a seller of options. |

It's never too late for you to come and learn how my Alpha Pulse system works. |

Let me teach you how to use the same strategies that have allowed market makers to win the majority of trades for decades. |

As we build out this service even further, you risk waiting too long to lock in our new, affordable pricing option before prices rise again. |

Trust me, you deserve to be part of the fun that only my Alpha Hunter members are experiencing right now. |

Put my two decades of trading experience in your corner. Let me teach you the strategy I use every single day, and am even teaching my son. |

You can't afford to miss out on learning this game-changing strategy. |

This is a GREAT time to join as THIS is just around the corner… |

|

To YOUR success, |

Jeff Bishop |

P.S. As always, for questions about any of our services, contact our amazing sales team at 1-800-585-4488 / davis@ragingbull.com / jbrown@ragingbull.com. They'd love to hear from you! |

|

Questions or concerns about our products? Email Support@ragingbull.com © Copyright 2022, RagingBull |

|

DISCLAIMER To more fully understand any Ragingbull.com, LLC ("RagingBull") subscription, website, application or other service ("Services"), please review our full disclaimer located at https://ragingbull.com/disclaimer. | *Sponsored Content: If you purchase anything through a link in this email other than RagingBull services, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything. We believe in the companies we form affiliate relationships with, but please don't spend any money on these products or services unless you believe they will help you achieve your goals. |

|

|

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision. |

|

|

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers' trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment. |

|

|

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers. |

|

|

RagingBull.com, LLC shall be entitled to recover attorneys' fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys' fees, costs and disbursements in addition to any other relief to which it may be entitled. |

|

|

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication. |

|

|

|

No comments:

Post a Comment