Good morning. After three high-profile departures in the last 24 hours, TV news hasn't been this tumultuous since Brick impaled a guy with a trident in 1974. We've got all the details below, plus: Aaron Rodgers finally gets traded, LVMH makes history, and Snap users wish its latest update would disappear. —Cassandra Cassidy, Sam Klebanov, Molly Liebergall, Abby Rubenstein, Neal Freyman | | | |  | Nasdaq | 12,037.20 | | |  | S&P | 4,137.04 | | |  | Dow | 33,875.40 | | |  | 10-Year | 3.496% | | |  | Bitcoin | $27,431.63 | | |  | Getty | $6.63 | | | | *Stock data as of market close, cryptocurrency data as of 3:00am ET. Here's what these numbers mean. | - Markets: Markets continued to be as bland as unsalted mashed potatoes yesterday. Though there's been little movement lately, things could get spicier because Microsoft, Alphabet, Amazon, and Meta all report their earnings this week. For now, Getty Images got a big boost from an investment firm offering to acquire it in a deal that values the photo company at nearly $4 billion.

| | | | Photo Illustration: Hannah Minn/ Photo: Getty Images Yesterday was a big day for shake-ups in the cable news world: Fox News broke up with Tucker Carlson, and shortly after, CNN announced that they ousted Don Lemon. Both stars were major personalities for their networks. What's behind all the moves? For Carlson, it's likely more about what's been happening in the courtroom than on-air. - Dominion's defamation lawsuit against Fox, which the network settled less than a week ago for $787.5 million, made Carlson's private text messages public—including some that criticized Fox's senior leadership. Those messages played a role in his departure from Fox, per the Washington Post.

- Plus, former Fox News producer Abby Grossberg filed a lawsuit last month accusing Carlson and his executive producer, Justin Wells, among others, of sexism and harassment. Wells was let go along with Carlson, and, according to the LA Times, Grossberg's lawsuit was the main factor in the decision, handed down by Rupert Murdoch, to fire Carlson.

Meanwhile, Lemon was at the center of on-air controversies. He made headlines in February for saying that "a woman is considered to be in her prime in her 20s and 30s and maybe 40s," and more recently had combative interviews with some guests. The bottom line for networks It appears that Carlson was worth over $500 million—that's how much Fox Corp.'s market value dropped after news of his departure broke. It's not entirely surprising: Tucker Carlson Tonight was as synonymous with Fox as Law & Order is with NBC. It was one of the top shows on cable news, regularly drawing more than 3 million nightly viewers. For CNN, the decision to terminate Lemon, who had been at the network for 17 years, came after certain guests declined to appear with him and his popularity with audiences waned, sources told the New York Times. But it could be the start of bigger changes at the network, which may be looking for fresh stars, the paper reported. What's next for the news? As cable news viewership continues to decrease, all the major networks are launching new shows and overhauling programming to try to recapture the ratings glory days of 2015.—CC | | Have you ever wondered what it would be like to invest in a company before their planned public listing? Meet Monogram, the company planning to use surgical robots and 3D-printed technology to create knee implants that are custom made for each patient. According to Monogram, the problem is straightforward. Today, surgeons perform around 1.7m knee replacement surgeries annually, but as many as 100k of these fail. That's exactly why Dr. Doug Unis founded Monogram. With the help of advanced surgical robotics and personalized, 3D-printed implants, Monogram is trying to make knee replacement surgeries safer, less invasive, and more precise. They've already received FDA approval for their implant components. Now they're planning to list on the Nasdaq—and they're offering you a chance to invest in their current round and join(t) their effort. Last day to complete your investment is May 10. | |  Aaron Rodgers traded to the NY Jets, ESPN reports. After 18 seasons with the Green Bay Packers, the four-time MVP quarterback is headed to NYC in a long-anticipated trade. Uncertain of his next move this winter, Rodgers famously entered a darkness retreat in Oregon and apparently left the experience with the desire to pay a lot more for housing. Rodgers's move from Green Bay to New York near the end of his career is reminiscent of Brett Favre's trade to the Jets 15 years ago, which allowed a young Rodgers to take the reins at Lambeau Field. Aaron Rodgers traded to the NY Jets, ESPN reports. After 18 seasons with the Green Bay Packers, the four-time MVP quarterback is headed to NYC in a long-anticipated trade. Uncertain of his next move this winter, Rodgers famously entered a darkness retreat in Oregon and apparently left the experience with the desire to pay a lot more for housing. Rodgers's move from Green Bay to New York near the end of his career is reminiscent of Brett Favre's trade to the Jets 15 years ago, which allowed a young Rodgers to take the reins at Lambeau Field.

First Republic Bank lost $102 billion in deposits last month. That's not good. The regional lender that got swept up in March's bank turmoil said that deposits plunged nearly 41% last quarter, and they would have fallen by more than 50% if 11 large banks hadn't plugged it with $30 billion to shore up confidence. But what little faith was restored seems to have evaporated, not least because execs ended their earnings call yesterday after just 12 minutes. The bank's stock, already down 87% this year, dropped by another ~18% after it released its results. First Republic Bank lost $102 billion in deposits last month. That's not good. The regional lender that got swept up in March's bank turmoil said that deposits plunged nearly 41% last quarter, and they would have fallen by more than 50% if 11 large banks hadn't plugged it with $30 billion to shore up confidence. But what little faith was restored seems to have evaporated, not least because execs ended their earnings call yesterday after just 12 minutes. The bank's stock, already down 87% this year, dropped by another ~18% after it released its results.

Apple triumphs in Epic app store dispute—again. An appeals court upheld Apple's victory in Fortnite-maker Epic Games's antitrust lawsuit over Apple's App Store fees. The US Court of Appeals for the 9th Circuit affirmed a 2021 trial ruling in the blockbuster legal case that Apple wasn't running the store like a monopoly. Though the appeals court upheld part of the ruling that favored Epic, Apple called the court's decision "a resounding victory," noting that it won on nine out of 10 of the suit's claims. Apple triumphs in Epic app store dispute—again. An appeals court upheld Apple's victory in Fortnite-maker Epic Games's antitrust lawsuit over Apple's App Store fees. The US Court of Appeals for the 9th Circuit affirmed a 2021 trial ruling in the blockbuster legal case that Apple wasn't running the store like a monopoly. Though the appeals court upheld part of the ruling that favored Epic, Apple called the court's decision "a resounding victory," noting that it won on nine out of 10 of the suit's claims.

| | Marc Piasecki /Getty Images Europe finally has a company worth $500 billion since LVMH hit the milestone market valuation yesterday. The French conglomerate best known for flashy fashion and upmarket alcohol that scream "affluence" recently became the 10th largest company in the world. As Bloomberg notes, selling status is to France what Big Tech is to the US—three of France's Top 4 most valuable companies are luxury brands. And LVMH is France's Apple: Both industry behemoths sell wallet-busting products, thrive even amid economic downturns, and produce some of the most recognizable products of their home countries. If you need more proof that LVMH dominates, its owner Bernard Arnault is the world's richest man, with a net worth of nearly $212 billion. He's also set up a real-life succession battle among his children, who all hold key roles in the company. But France's other high-end labels also saw their stock prices soar in the first quarter of 2023 thanks to… - China's reopening, which buoyed demand for products that help folks splurge and wear their wealth on their sleeves.

- A strong euro and stable margins that ensure healthy profits.

Looking ahead…Though times have been good for the high-end, the luxury boom could slow if a recession hits and gets people thinking twice before dropping a car's-worth of cash on a handbag.—SK | | | Level set on savings. It's never too late to seek financial advice. And if you're worried about saving enough for retirement, SmartAsset can help. Their retirement quiz shows you how your savings stack up against the recommended amount for people your age—and how a financial advisor can help. Get your results. | | Francis Scialabba Snapchat's latest update has elicited the types of reviews typically reserved for a restaurant that just gave food poisoning to its entire dining room. "My AI," a ChatGPT-enabled bot, went live to Snapchat's 750 million active users on Wednesday. The response: a wave of one-star app store reviews that sank Snapchat's weekly average rating to 1.67. The bot was immediately unpopular—Snap's stock price took a hit as soon as it was announced last week (though it has since regained some ground). And now that people have had time to ask it some questions, the feature is, as one reviewer put it, "freaking kids and adults out." - My AI seems to have more access to personal info than it's letting on. Users report that, when asked, the bot says it doesn't know their location…but it can accurately suggest a nearby restaurant.

- The bot also stays pinned to the top of the chat screen. You can't get it out of sight unless you're willing to pay $4 a month for Snapchat+. Even then—like the feeling of sending a photo meant for your significant other to your family—it can't be deleted, just hidden.

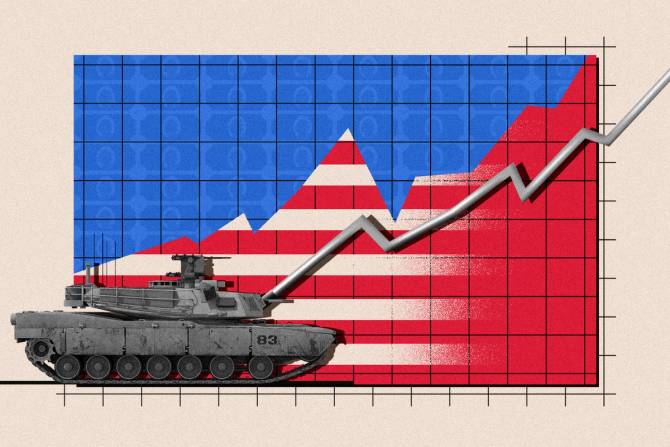

Zoom out: Snapchat has a history of enraging its users with unpopular updates (remember the 2020 redesign?), but these changes have actually resulted in a flurry of new users, data from Sensor Tower shows.—ML | | Francis Scialabba Stat: Global military spending hit an unprecedented high of $2.2 trillion last year, thanks in part to the war in Ukraine and the ambitions of China, according to the Stockholm International Peace Research Institute. But nobody spends on the military like the US spends. The US' $877 billion expenditure was three times bigger than the country with the next largest budget, China—and amounted to more cash than the next 10 biggest spenders paid out combined (including China). Quote: "I'll split 50% royalties on any successful AI generated song that uses my voice." While most of the music industry seems to be panicked over "Heart on My Sleeve," the viral AI-generated song by not-quite Drake and The (virtual) Weeknd, Grimes, for one, is taking it as inspiration for future collabs she doesn't actually have to work on. The artist tweeted Sunday that she'd accept her standard agreement for collaboration for AI-made jams and continued, "Feel free to use my voice without penalty. I have no label and no legal bindings." Read: The future of AI relies on a high school teacher's free database. (Bloomberg) | | - Former NBCUniversal CEO Jeff Shell, the other big cable news figure axed recently, was being investigated for allegedly harassing CNBC senior international correspondent Hadley Gamble, her lawyers say.

- Disney began a second round of layoffs yesterday as part of its efforts to save $5.5 billion by cutting 7,000 jobs.

- Coinbase sued the SEC to force the agency to answer its petition for rules regulating cryptocurrencies. The SEC has been cracking down on crypto firms, and it has warned it might take action against Coinbase.

- Writer E. Jean Carroll's civil lawsuit accusing former President Donald Trump of raping her decades ago is scheduled for trial today.

- Ed Sheeran is defending his hit "Thinking Out Loud" against claims it ripped off Marvin Gaye's "Let's Get It On" in court this week.

| |  From Adam Levine's DMs to the record company that passed on The Beatles: The 50 worst decisions in music history. From Adam Levine's DMs to the record company that passed on The Beatles: The 50 worst decisions in music history.

It's National Park Week: But if that's too mainstream for you, here are the best state parks. It's National Park Week: But if that's too mainstream for you, here are the best state parks.

PSA: Google Meet will now let you turn off individual video feeds—without telling your coworkers you did it. PSA: Google Meet will now let you turn off individual video feeds—without telling your coworkers you did it.

Rise to the occasion: A simple bread recipe for beginners. Rise to the occasion: A simple bread recipe for beginners.

Bring your best: Quarterback Caleb Williams knows peak performance starts with proper hydration. Hit the field, gym, or boardroom with AC+ION's purified alkaline water, blended with electrolytes and minerals to help you Get Seriously Hydrated.* Bring your best: Quarterback Caleb Williams knows peak performance starts with proper hydration. Hit the field, gym, or boardroom with AC+ION's purified alkaline water, blended with electrolytes and minerals to help you Get Seriously Hydrated.*

Sounds rich: Combine rich girl (and guy!) tips with rich flavor for a perfect podcast blend. Master your finances in the latest Money with Katie episode, sponsored by Vin Social. Start listening now.* Sounds rich: Combine rich girl (and guy!) tips with rich flavor for a perfect podcast blend. Master your finances in the latest Money with Katie episode, sponsored by Vin Social. Start listening now.*

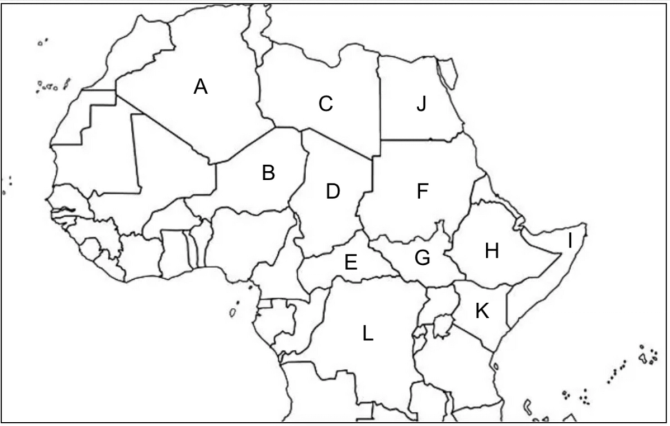

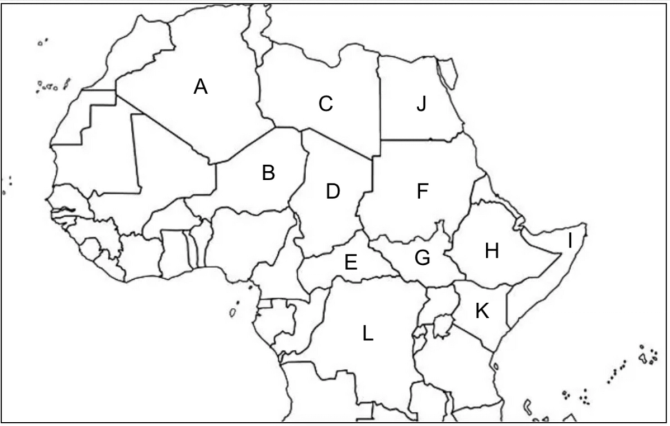

*This is sponsored advertising content. | | Brew Mini: In 1996, a tech startup IPO'd in what was the largest public listing for a tech startup at the time. Think you know what it is? Play today's Mini to find out. World geography trivia Violence has broken out in Sudan as two generals (who used to be allies) vie for control of the country. Can you spot Sudan on this map?  | |  Late filings? No problem. Help your employees file their returns successfully despite the delay with HR Brew's guide. Download now. Late filings? No problem. Help your employees file their returns successfully despite the delay with HR Brew's guide. Download now.

Want to be a better leader? Join us tomorrow, April 26, at 3pm ET as we discuss leadership lessons with former Stripe COO Claire Hughes Johnson. Register here. Want to be a better leader? Join us tomorrow, April 26, at 3pm ET as we discuss leadership lessons with former Stripe COO Claire Hughes Johnson. Register here.

Wondering whether you're better off buying or renting these days? You're not alone. We're sitting down with Zillow TODAY to unpack the current housing market so you can make smarter decisions. Register here. Wondering whether you're better off buying or renting these days? You're not alone. We're sitting down with Zillow TODAY to unpack the current housing market so you can make smarter decisions. Register here.

| | |

No comments:

Post a Comment