| | Amanda Heckman

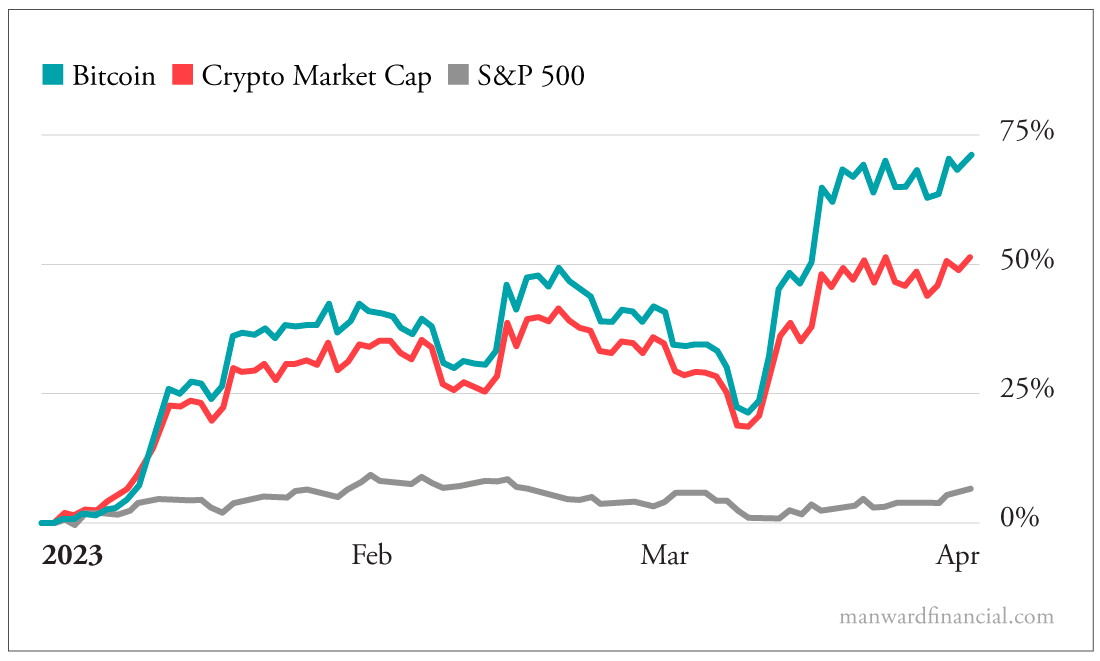

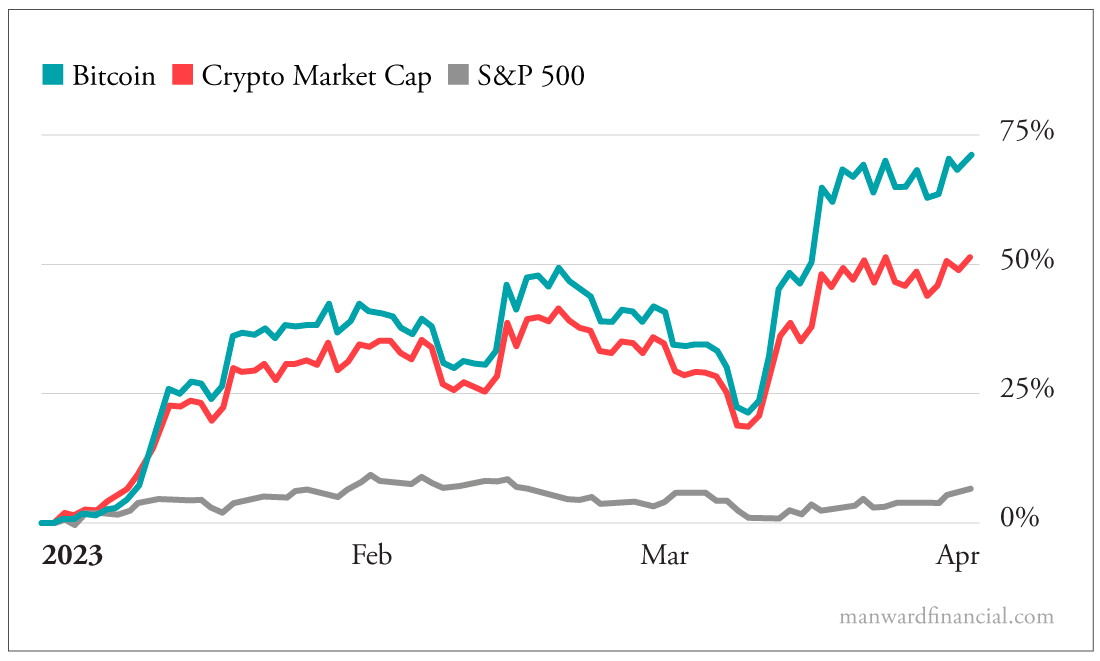

Editorial Director | Bitcoin is still going strong. Yes, despite legal challenges and threats from the SEC and now the CFTC, the crypto market is holding steady. Bitcoin has been rising swiftly since the news broke of Silicon Valley Bank's demise. And it kept going higher even after Signature Bank faltered. It almost sounds like the setup to an April Fools' joke. Conventional logic suggests that crypto should be circling the drain under these circumstances. But these gains are nothing to laugh at... [Former CBOE Trading Legend Showed Members 246% Total Gains While the S&P Was Down 20% During the COVID Crash. Now He's Hosting a Free Class Revealing the Answer to Big Wins. Click for More! ] ] Bitcoin's price has been hovering around $28K since mid-March - which, if you're doing the math at home, puts it at a 70% gain year to date. And the crypto market has surged 50% this year... hitting a $1 trillion market cap once again... All while the S&P 500 has eked out a paltry 6% gain.

View larger image What gives? Isn't crypto supposed to be "mostly over," in the words of The Atlantic? Nope, not at all. Crypto's surge has come for many reasons... which all boil down to this... Government ineptitude. And we're pretty sure that's a disease for which there is no cure. Money for Nothing One of Manward's favorite maxims is "money goes where it's treated best." And in a world of low interest rates... money loved how crypto treated it. Investors began speculating in order to find the best returns on their cash. As the Fed kept money cheap and dropped dollars from the sky to keep the economy from imploding thanks to the pandemic... Bitcoin and its brethren were among the biggest beneficiaries. Cash poured into the sector. But the good times went on for far too long. Only when the highest inflation figure in decades forced the Fed to raise interest rates did the crypto market cool off... Which of course caused many folks to crow about its defeat. But don't look now... because the Fed's already turning tail. The bank scares in March forced the Fed to back off... and mull lowering rates to keep everyone happy. And that sent crypto soaring. The hint of cheaper money is fueling speculation once again. Dirty Word The other main reason for crypto's surge might seem like a dirty word in this freedom-loving newsletter... Regulation. But for more than a year, we've insisted that crypto needed smart regulation in order to be seen as a legitimate investment vehicle. While "smart" regulation may be too much to ask... at least something's finally happening. For years, the SEC has been hemming and hawing over how crypto should be regulated... who should do it... and what exactly crypto is. Now... all signs are pointing toward most crypto assets being labeled securities. And while that will be trouble for many crypto businesses and exchanges... it will bring needed stability to the market. The question mark that's been hanging over the sector will finally go away. Investors who have stayed away because of the "Wild West" nature of crypto will finally feel confident enough to get in. But the push toward regulation also shows how badly the government has mishandled crypto all this time. Just look at the mess with Coinbase. Last week, we learned the SEC is coming for the crypto exchange. The SEC is concerned that Coinbase is violating securities laws by selling... you know... non-security securities. Crypto. But here's the thing... Coinbase is a public company. It IPO'd back in 2021. The SEC sifted through its financials with a fine-toothed comb when it went public. Now the SEC has a problem with its business. Whoops. Really, the party that looks bad here... is the government. And the fact that the market hasn't flinched in the face of the SEC's threats... and now, the CFTC's look into Binance... just proves the staying power of crypto. As the SEC (finally) gets its act together and the Fed fuels cheap-money speculation... crypto's bull run will be here for the long run. Even more, once the SEC declares most cryptos securities... we're going to see an explosion in the little-known security token market. Much like cryptos, security tokens trade on the blockchain... but they're 100% SEC-approved and provide a way for anyone to own just about anything. Talk about a democratic asset! Trillions of dollars will be in play during this once-in-a-generation shift in the markets. Andy covers all the exciting details... and shows what's at stake... in his latest presentation. Get all the details here. One thing to remember about the markets is they are forward-looking. So even when things look uncertain, stocks are looking six months ahead. And that's how Alpesh found this week's Stock of the Week. The numbers look good... the stock's on a strong upward trend... and it's significantly undervalued. Click here or on the image below to watch his latest video. Stock market sell-offs hurt. They can be swift and painful. But they don't need to be. It's been made quite clear in recent years that buying on dips is an easy way to boost your profits. And you can use this simple trick to know exactly when to buy. Keep reading. "I think that the tokenization of assets is going to be one of the greatest innovations in the financial markets since the introduction of paper assets." - Mike Novogratz, Galaxy Digital Want more content like this? | | | | | Amanda Heckman | Editorial Director Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years sharpening Andy's already razorlike wit... and has worked with numerous bestselling authors and award-winning financial gurus along the way. | | | |

No comments:

Post a Comment