| | | | | | | | | | | Axios Markets | | By Felix Salmon · Dec 10, 2022 | | It's holiday shopping season; I hope you manage to buy gifts for all your loved ones before they increase in price. - In this week's newsletter: Why you shouldn't fear a stock-market decline — or even a recession. Plus more on crypto gambles and ESG investing. The whole thing is 1,343 words, a 5-minute read.

| | | | | | 1 big thing: All I want for Christmas is cheaper stocks |  | | | Illustration: Sarah Grillo/Axios | | | | The stonks are too damn high. One good thing that could happen for America over the coming weeks would be for the stock market to embark upon another significant decline. Why it matters: A buoyant stock market is constraining the Fed and, ultimately, hurting the country. There's a financial media convention that higher = better, when it comes to the stock market — but that's not always the case. The big picture: The Fed's big problem is that the economy continues to run too hot, driving inflation well above its 2% target. The current spending spree is fueled at least in part by investors' animal spirits — after all, they've fared pretty well over the past couple of years. By the numbers: The S&P 500's pre-pandemic record high of 3,387 was hit on February 19, 2020. We're now a comfortable 16% above that level, even after accounting for plunges in the likes of Facebook and Tesla. - Even meme stocks continue to defy gravity: GameStop, for instance, which was trading at $1 per share pre-pandemic, is now at $22.

- Dogecoin has risen from 0.2 cents to 9.7 cents.

How it works: A stock market fall would help create the tighter financial conditions that the Fed is attempting to engineer. At the margin, it might even make that final half-point rate hike that much less likely. - Lower stocks would help out those of us who are still saving for retirement, and want to build up our portfolios as cheaply as possible. The best returns come to those who buy low and sell high, which requires stocks to be cheap when they're bought.

Between the lines: A falling stock market does make investors feel bad — especially the relatively affluent Americans who are fortunate enough to boast sizable brokerage accounts. They're the seemingly unstoppable consumers who show no sign of getting the message that the economy might be headed into recession. - If they prefer to funnel their income into newly-attractive cheap stocks rather than spending it on consumer goods, that would help to constrain inflation. They will also have a reduced "wealth effect" from the market.

For hourly workers or anybody living paycheck-to-paycheck, stock-market wealth is generally a hypothetical irrelevance. Falling stocks would do little if any harm to the precariat — and might even help to reduce inequality. - And because unemployment is so low and laid-off workers are finding it easy to get a new job, few people will find themselves in the forced-sale situation of having to dip into their stock-market savings in order to make up for lost income.

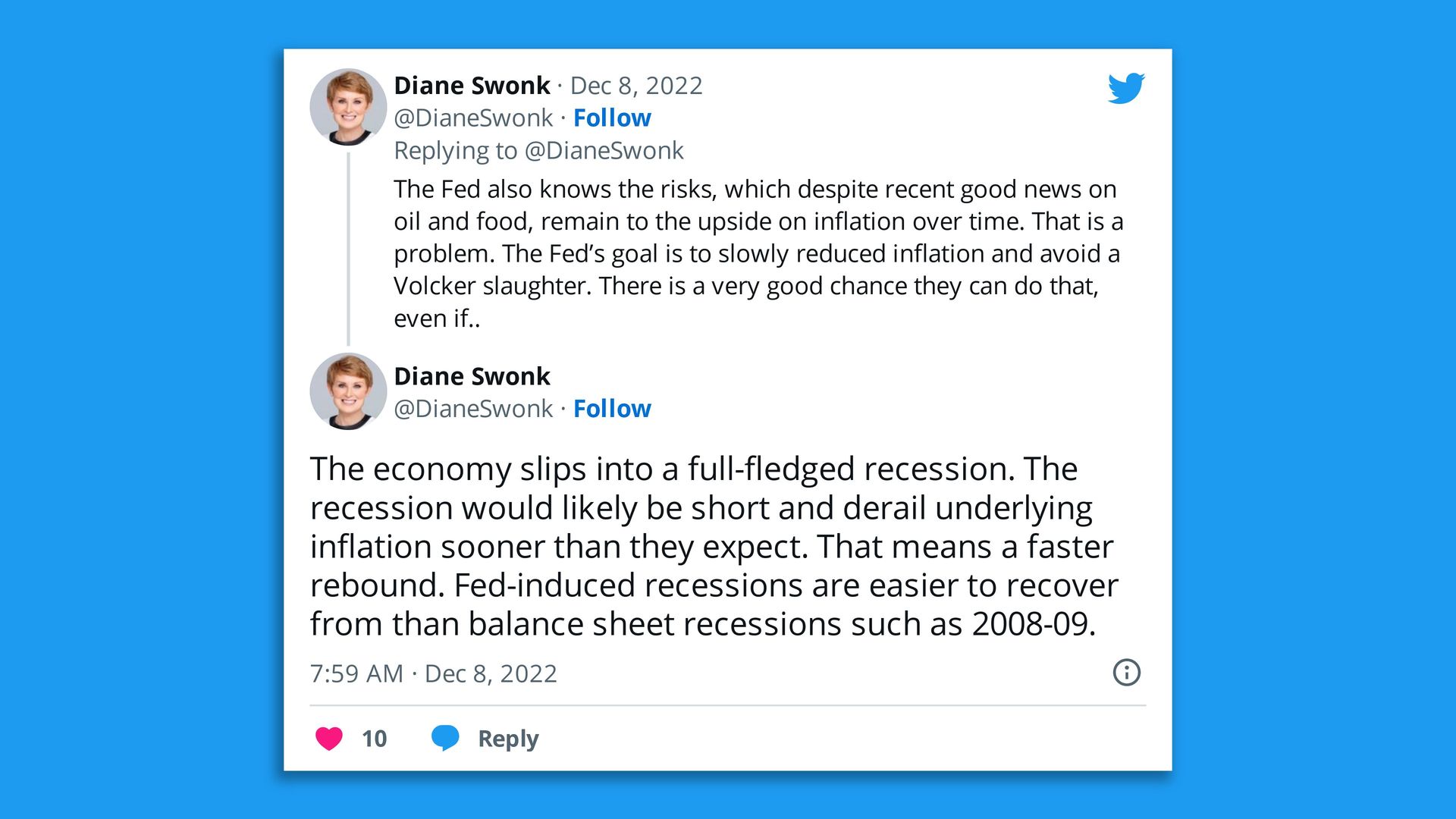

The bottom line: Another correction in the stock market would be salutary in the short term, while being very unlikely to have any real effect on its long-term performance. |     | | | | | | 2. Even a recession could be a good thing |  | | | Screenshot: Diane Swonk / Twitter | | | | I don't want a recession as a Christmas present this year. But there's a case to be made that a recession could be the the optimal outcome in terms of sustainable long-term growth. Why it matters: Fed economists — and many others — tend to believe that predictably low inflation is a necessary precondition for strong and stable growth. - The faster that we can vanquish inflation, on this view, the healthier the economy will be in the long term.

The bottom line: If a short and mild recession gets the economy back on its low-inflation track, that could be preferable to a world in which high inflation persists for years. |     | | | | | | 3. How crypto billions evaporate |  | | | Illustration: Aïda Amer/Axios | | | | Barry Silbert achieved the impossible: He successfully invented a genuinely safe way of earning billions of dollars in crypto. And yet his firm, Digital Currency Group, is currently hunkered down, with a key unit on the brink of bankruptcy. Why it matters: The crypto winter is laying bare the degree to which the "whales" in the space, including billionaires like Silbert, willingly took on ludicrous risks, even as they painted themselves in public as sober entrepreneurs who would embrace regulatory constraints. The big picture: Silbert became dynastically wealthy by getting two big things right. The first was to make a huge bet on bitcoin very early on, in 2013. The second was to create a box known as GBTC, that would do nothing but own bitcoin, and that would be listed on the over-the-counter markets. - GBTC was an early way for individual and institutional investors to own bitcoin without having to worry about being hacked or even having to move money out of their stock-market brokerage accounts.

- It was also a license to print money for Silbert, who charged a 2% management fee to his company, Grayscale, for overseeing the box. That fee amounted to $615 million in 2021 alone.

Between the lines: GBTC threw off so much cash because other crypto players, including the doomed 3 Arrows Capital (3AC), invested billions of dollars into its shares when they were trading at a premium to the underlying bitcoin. - All that money ended up flooding the market with GBTC, which is currently trading at a 45% discount to the bitcoin in the box.

- Grayscale is now in a legal fight with a hedge fund called Fir Tree, which complains that GBTC acts as a roach motel: Bitcoin can go in, but it can't ever come out. If Grayscale allowed investors to redeem GBTC shares for bitcoin, the share price would surge — but Grayscale would lose substantially all of its management fee.

Zoom out: Silbert looks as though he gambled away the cash being thrown off by GBTC. Another one of his subsidiaries, Genesis, lent billions of dollars not only to 3AC but also to Alameda Research, the crypto trading vehicle now in bankruptcy alongside FTX. The Alameda loans, per Reuters, were secured by FTX's in-house currency, FTT. - Silbert's Digital Currency Group also took equity stakes in an astonishing number of other companies — over 200, according to the WSJ.

- DCG was valued at $10 billion in a late 2021 funding round led by SoftBank, but none of the $700 million raised went to shore up DCG's balance sheet; all of it went to employees selling stock.

- Genesis barred customer withdrawals last month.

The bottom line: For most of us, investing in cryptocurrency at all is ridiculously risky. I like to think that if I'd bet massively on bitcoin in 2013, that would suffice for one lifetime in terms of generating outsize wealth. - For the biggest players in crypto, however, there never seems to be any limit to how much is enough. They go on to take ever greater risks — some of which can be big enough to endanger everything they built up over a decade.

|     | | | | | | A message from Axios | | The latest deals delivered to your inbox | | |  | | | | Get ahead of the competition heading into 2023 with exclusive scoops and trends from Axios Pro: Deals. Use code PRO100 at checkout to get $100 of your subscription. | | | | | | 4. Passive isn't green |  | | | Illustration: Sarah Grillo/Axios | | | | Passive investors, the giants of the investing world, have been facing fierce criticism from both sides of the debate over environmentally responsible investing. One of the biggest players has decided to throw in the towel. Why it matters: One of the great successes of the past few years has been NZAM, the Net Zero Asset Managers Initiative. Its 291 signatories, representing $66 trillion of assets under management, have all signed on to a vision of a zero-carbon future. - Now, however, one of the biggest members, Vanguard, has withdrawn from the group.

The big picture: Vanguard, more than any other investing giant, is proudly dedicated to passive investing — the idea that it's a better idea over the long haul to just buy an entire index than it is to try to pick and choose individual stocks to buy and sell. - By their nature, passive investors can't divest from carbon-intensive companies. That's a big problem, for environmentalists who have been loudly campaigning against Vanguard's fossil-fuel investments.

The other side: Joining groups like NZAM carries connotations distasteful to many Republicans, who criticize the members of such groups as being beholden to "woke capitalism." - Vanguard has been on the receiving end of relatively few of those complaints, but BlackRock, another mostly-passive asset manager, is regularly attacked by Republicans. On Thursday, Arizona said it withdrew $543 million from BlackRock money-market funds, for instance.

The bottom line: BlackRock CEO Larry Fink relishes the fight over environmental responsibility. Most other U.S. asset managers don't. |     | | | | | | A message from Axios | | The latest deals delivered to your inbox | | |  | | | | Get ahead of the competition heading into 2023 with exclusive scoops and trends from Axios Pro: Deals. Use code PRO100 at checkout to get $100 of your subscription. | | | | Many thanks to Kate Marino for editing this newsletter, and to Elizabeth Black for copy editing it. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment