| | | | | | | Presented By BlackRock | | | | Axios Markets | | By Matt Phillips and Emily Peck · Oct 06, 2022 | | Hey folks! Please forgive a bit of New York-centrism this morning, as we look at some implications of the atrocious year in the markets for the city that never sleeps. We've got 1,178 words, a 4.5-minute read. Let's go. | | | | | | 1 big thing: New York City's Wall Street worries |  | | | Illustration: Aïda Amer/Axios | | | | Wall Street's deep slump is a growing problem for New York City, which is still struggling to ramp up its pandemic recovery, Matt writes. Why it matters: The city is heavily reliant on personal income tax revenues, which, in turn, hinge on Wall Street. The dismal state of the markets this year is a blow to an ecosystem built around Manhattan's banks, brokerage firms and money managers. - It also coincides with the slowing flow of federal and state dollars that subsidized city finances throughout the COVID crisis.

- Taken together, this sets the stage for growing pressure on city budgets, likely requiring increased taxes, decreased spending, or a combination of both.

How it works: Booming markets create taxable income and capital gains for city coffers, as traders and investors make a mint. - Hot markets also generate deal activity at banks, which advise on mergers and shepherd new bonds and stocks to market — all for hefty fees.

- They also juice the law firms, accountants and advertising agencies that feed off the Street.

What they're saying: "When finance is doing well, that whole ecosystem is doing well. And that shows up as higher personal income tax collections," says Ana Champeny, vice president for research at Citizens Budget Commission, a think tank focused on fiscal issues in New York. By the numbers: Just one part of the financial services industry — the securities sector, where stocks and bonds are brought to market, traded or sold to investors — accounted for about 23% of the city's 2021 personal income tax revenue, according to the Office of the New York State Comptroller. - That's because Wall Street had a tremendous 2021. The Fed's efforts to push interest rates lower to cushion the economy during COVID had sent markets soaring.

- The city's Independent Budget Office (IBO) estimated Wall Street profits hit $61 billion in 2021, just shy of the record hit in 2009.

Yes, but: Now, Wall Street is having one of the worst years on record, with bond and stock prices plunging and a dearth of dealmaking. - The IBO forecasts Wall Street profits will fall nearly 60% in 2022.

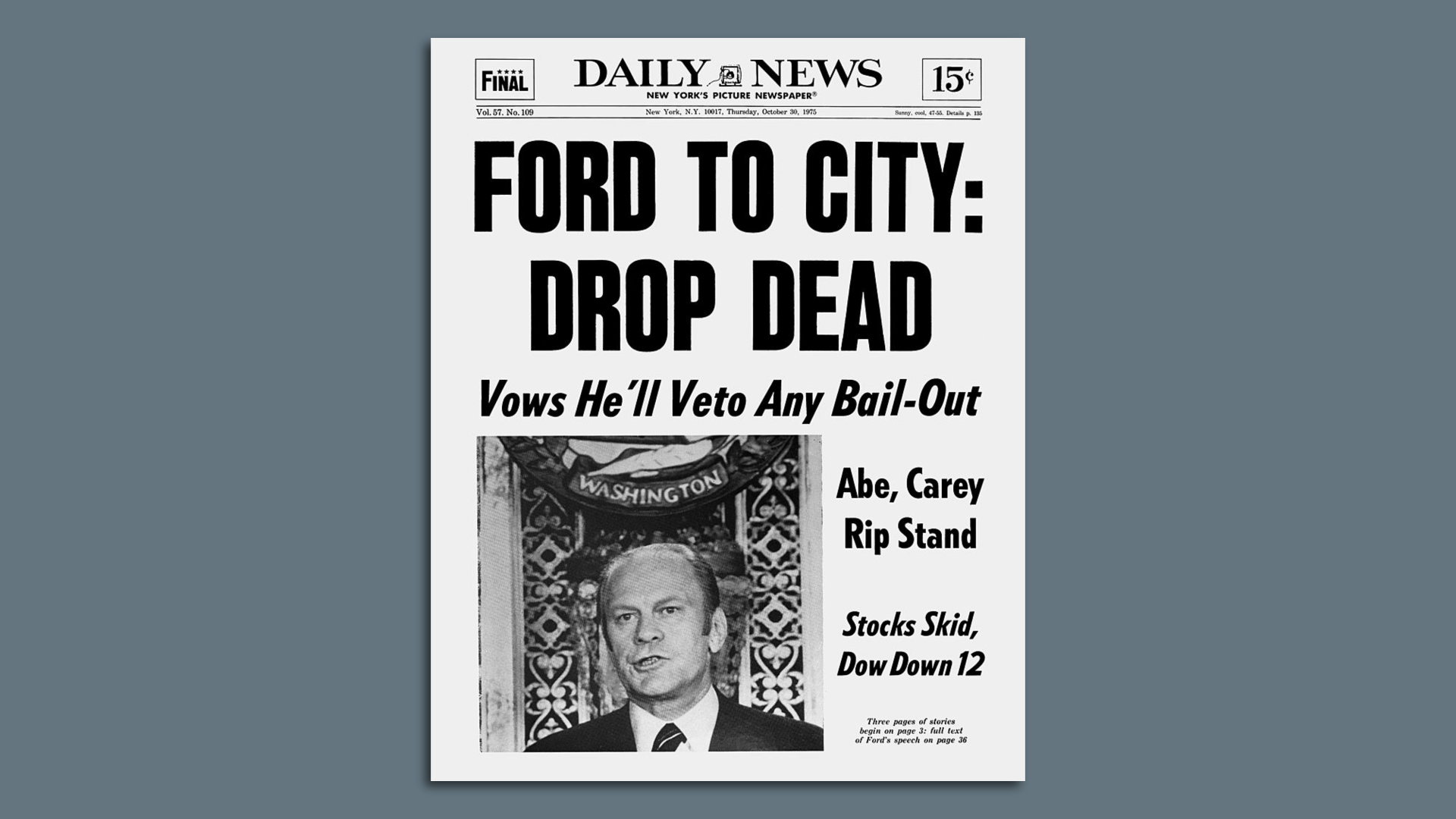

The impact: "Given its outsized role on the tax base, it's potentially quite serious" for the city, says George Sweeting, acting director of the IBO. Go deeper. |     | | | | | | 2. Flashback: '70s New York |  | | | Photo: New York Daily News Archive/Getty Images | | | | Another famously difficult time for Wall Street — the 1970s — coincided with a fiscal crisis in New York City, Matt writes. - But, but, but: Reforms linked to that near-financial-death experience should ensure New York won't face a repeat.

The big picture: "The city has very strict budget rules now," Richard Ravitch, former chairman of the Metropolitan Transportation Authority and former lieutenant governor of New York State, tells Axios. Ravitch helped resolve the city's debt crisis in the mid-'70s. Flashback: The '70s were a lost decade for the markets. As inflation raged and the Federal Reserve raised interest rates, stocks essentially went nowhere between late 1968 and late 1982. - In New York City, after years of financial mismanagement and economic turmoil, the fiscal crisis came to a head in May 1975, when Wall Street banks refused to roll over the short-term debt the city relied on to pay its bills, pushing it to the brink of bankruptcy.

What eventually quelled the crisis: a state takeover of city finances, an influx of state money, tax hikes, the creation of a new public benefit corporation, and — after President Ford first rejected a bailout for the city, resulting in the famous New York Daily News headline, above — loan guarantees from the federal government. - But that help came with strings, including structural changes like more transparent budgeting practices and an end to short-term borrowing to cover operating expenses.

Now: "The city, by law, can't borrow its way out of trouble," says William Glasgall, senior director of public finance at the Volcker Alliance, a nonprofit think tank. - Yes, but: Even if another crisis isn't in the offing for NYC, the expected sharp decline in tax revenues will likely result in growing budget deficits in the coming years, especially as federal COVID aid runs out.

- The state's comptroller recently warned the city could face a budget gap of nearly $10 billion in coming years.

The bottom line: That will likely require difficult political decisions on raising taxes and cutting spending. |     | | | | | | 3. Catch up quick | | 🛢Biden administration angered by OPEC+ oil output cut. (The Guardian) 🐦 Elon Musk tried and failed to negotiate a lower price for Twitter (NYT) 🚲 Peloton to cut another 500 jobs in turnaround effort. (WSJ) |     | | | | | | A message from BlackRock | | Invested in the future of communities | | |  | | | | At BlackRock, we are serving the communities that help the country thrive. We are proud to invest in the projects that build our economy, with $20 billion in U.S. roads, bridges and transportation invested on behalf of our clients. Learn more. | | | | | | 4. A chart no bank wants to see |  Note: Credit Suisse 3.625% senior notes due 2024, UBS 1.008% senior notes due 2024; Data: MarketAxess' BondTicker; Chart: Axios Visuals Credit Suisse has a pretty strong capital position — but the markets are behaving as though it doesn't, Axios' Felix Salmon writes. Why it matters: When it comes to banking, perception can rapidly become reality. By the numbers: A Credit Suisse dollar bond maturing in 2024 traded briefly at a yield above 10% yesterday. The bank's shares closed at 4.11 Swiss francs, giving it a market capitalization of just $11 billion, or less than a quarter of its book value. Between the lines: Credit Suisse's bonds are trading as though they carry a non-negligible chance of default. - In order for a default to happen, the bank would first have to burn through 37 billion Swiss francs of tier-one capital, 15.8 billion Swiss francs of "contingent convertible" bonds that automatically convert to equity if the bank becomes stressed, and 44.2 billion Swiss francs of "going concern capital."

- That's almost $100 billion of loss-absorbing capital in total. Credit Suisse might be facing losses and restructuring charges, but nothing of remotely that magnitude.

The big picture: Banks are designed, from their architecture to their marketing, to always seem strong and impregnable. They like to throw around terms like "fortress balance sheet." - The minute that a bank starts looking weak, its clients and counterparties are prone to move their business elsewhere. That can cause losses which cause even more defections, and so on in a vicious cycle.

The bottom line: Credit Suisse has so far failed to change the market narrative. What it probably needs is a reassuring investment from Warren Buffett. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Charted: Rate lock |  Data: Black Knight; Chart: Axios Visuals Most homeowners in the U.S. are locked into some really low mortgage rates — with little incentive to sell their homes, Emily writes. Why it matters: This is what "golden handcuffs" look like on a chart. - Nine out of 10 homeowners have a mortgage rate of 5% or less.

- The average rate on a 30-year mortgage now is 6.75%, per data from the Mortgage Bankers Association.

- Keep in mind that at a time of rising inflation — particularly for shelter — the real cost of these monthly payments is going down.

Meanwhile, despite recent price declines, the average home is worth 42% more now than it was 2.5 years ago, according to Black Knight data. - So if you move, your new house is likely going to cost more money — plus you'll pay a higher mortgage rate.

|     | | | | | | A message from BlackRock | | Invested in the future of retirees | | |  | | | | All across the country, people are working hard to build a better future. So, we are hard at work, helping them achieve financial freedom. At BlackRock, we are proud to manage the retirement plan assets of over 35 million Americans. Learn more. | | | | 🎃👻 1 thing Emily likes: spooky season. This isn't about the markets. It's about Halloween month! In the Northeast where I live, the leaves are changing colors. The air is crisping up. There are apples, apple cider and apple cider doughnuts everywhere. Houses are decked out with pumpkins, and ghostly decor. - It's sweater weather, my friends!

- I'm trying to hold out on buying Halloween candy, but I'm not sure how much longer before I break. Reese's Peanut Butter Cups are my fave. What's your go-to? Reply to this email and share your thoughts on this very important topic.

Today's newsletter was edited by Kate Marino and copy edited by Mickey Meece. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment