| | | | | | | | | | | Axios Generate | | By Ben Geman and Andrew Freedman · Sep 08, 2022 | | 🥞 Good morning! Today's newsletter, edited by Mickey Meece, has a Smart Brevity count of 1,120 words, 4.5 minutes. 📬 Did a friend send you this newsletter? Welcome, please sign up. 🎶 This week in 1984, Billy Ocean released an infectious single that's today's intro tune... | | | | | | 1 big thing: Europe's dangerous days |  | | | Illustration: Aïda Amer/Axios | | | | Europe is entering the most treacherous terrain yet in its bid to move away from Russian energy — and the U.S. can only provide limited help, at least for now, Ben writes. Why it matters: The West's response to Russia's invasion of Ukraine has seismically upended the global energy trade at a pace and scale unseen in decades. - The stakes for Europe couldn't be higher. Consumers face soaring costs, and energy-hungry European industries are already in distress and cutting output.

What's next: EU energy ministers will gather tomorrow to discuss emergency measures to shield residents and industries from sky-high power and gas costs. - European Commission president Ursula von der Leyen said Wednesday that officials will discuss imposing a cap on the price of gas from Russia.

- Other plans include mandatory targets for member states to cut peak energy demand, caps on soaring energy company profits, and redirecting revenues to protect vulnerable households and businesses.

The intrigue: President Biden pledged that the U.S. would send more gas to the EU in a bid to help Western allies wean themselves off Russian supplies. - And it has — but the two regions face physical constraints on how much near-term supplies can keep growing.

- The U.S. is basically using all of its available capacity to liquefy natural gas and Europe has limited infrastructure to actually accept the imports.

- Anna Mikulska, an expert in gas markets and geopolitics, tells Axios that while U.S. companies have ramped up liquefied gas shipments to Europe, greater competition for those supplies could loom.

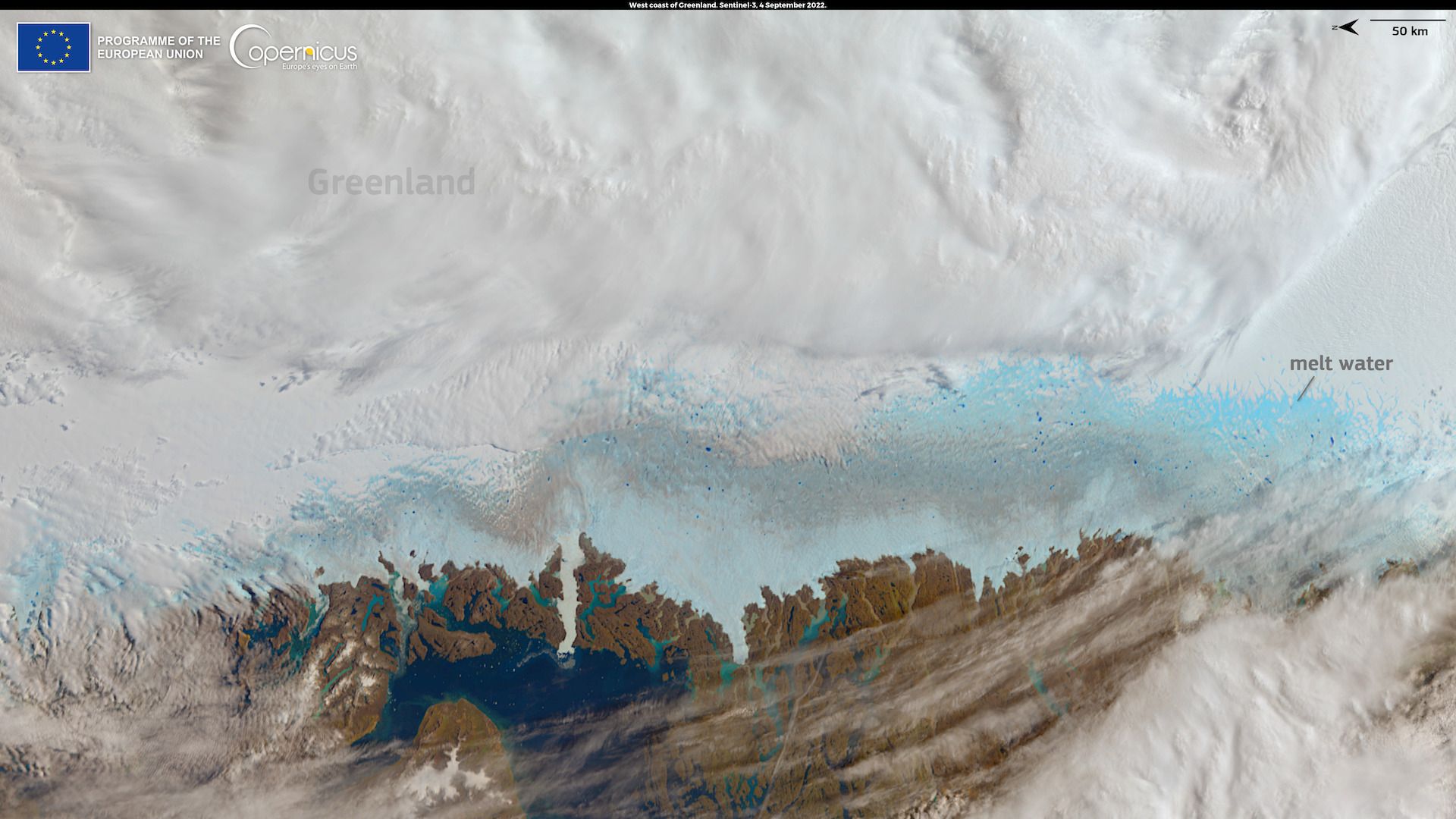

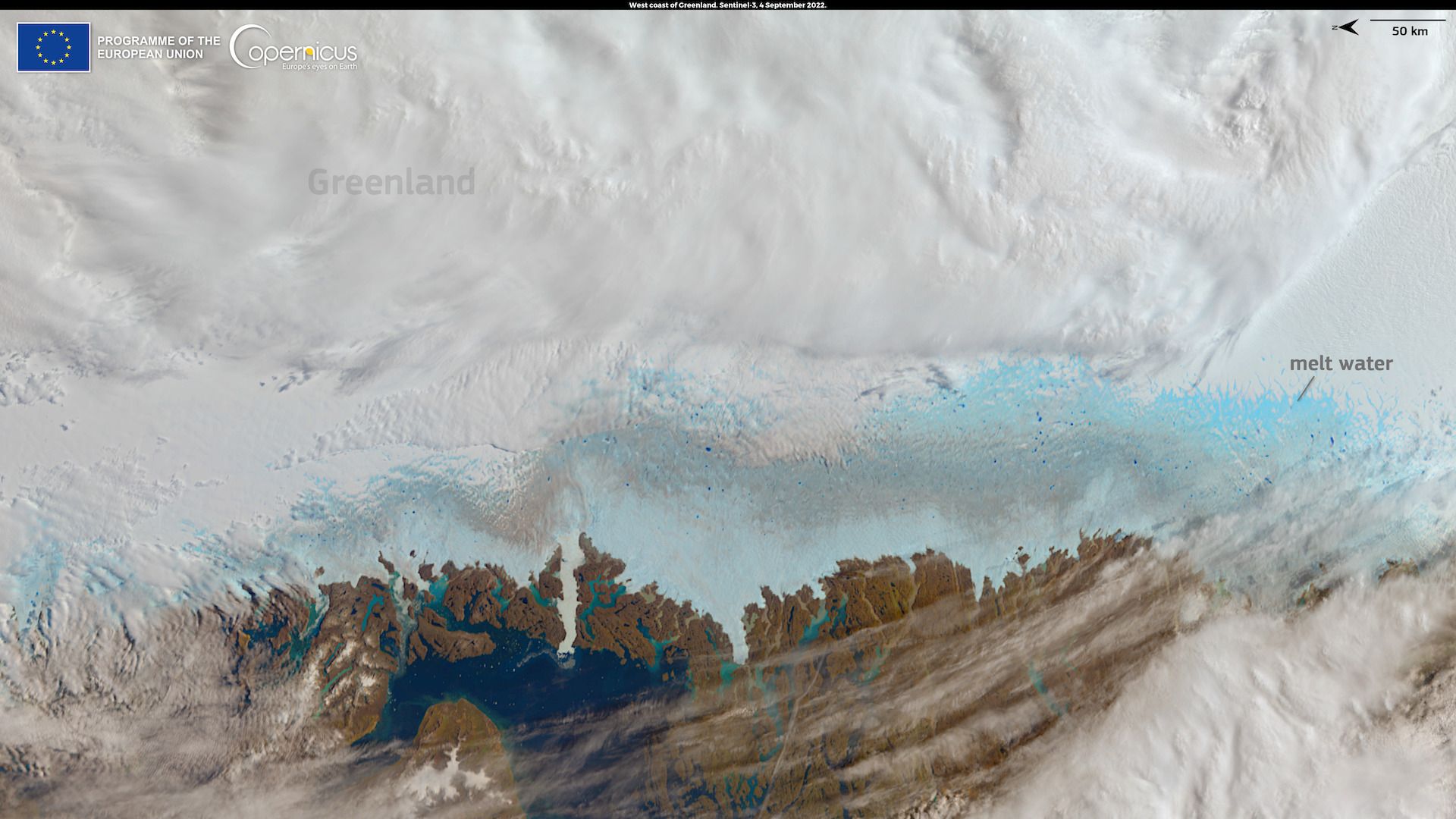

Read the whole story. |     | | | | | | Bonus: More U.S. gas arrives in Europe |  Data: Rystad Energy; Chart: Axios Visuals Europe has become the top destination for U.S. LNG exports. On a volume basis, U.S. global exports — already the world's largest — are slated to rise further this decade, Ben writes. |     | | | | | | 2. One EU bright spot: solar power growth |  Reproduced from Ember; Chart: Axios Visuals Solar is having a record-smashing year in Europe, saving money on natural gas in the process, per a new report, Ben writes. Driving the news: Solar provided 12% of the bloc's power in May-August, avoiding almost $29 billion in natural gas costs, the clean energy think tank Ember finds. Why it matters: It's a bright spot for the EU in what's otherwise a dismal period of high energy costs and uncertainty over supplies. Yes, but: While the EU is looking to boost clean energy as it breaks up with Russian supplies, in the near term fossil fuels are getting a boost. The FT reports that coal-fired generation in Germany, the EU's largest economy, is up 17% this year compared to 2021. |     | | | | | | A message from Chevron | | At Chevron, we're working to keep up with growing energy demand | | |  | | | | Chevron is increasing U.S. production to keep up with growing energy demand. By the end of this year, we plan to increase our oil and natural gas production in the Permian Basin by 15% over 2021 levels. And we're expected to reach 1 million barrels of oil per day by 2025. Learn more about our efforts. | | | | | | 3. Greenland's record September melt event |  | | | Meltwater off the Greenland ice sheet's southwest side on Sept. 4. (European Union, Copernicus Sentinel-3 imagery) | | | | Greenland saw its largest September melt event on record in the past week, Andrew writes. Why it matters: The fate of the globe's coastal cities is dependent upon the future of the land-based ice sheets, primarily in Greenland and Antarctica. - Greenland is already the world's largest contributor to sea level rise.

- Sept. 1 typically marks the end of its melt season.

Driving the news: With a strong high-pressure area located over southeastern Greenland last weekend, southerly winds pushed warm air up and over the island. - The Summit Station, located at 10,000 feet in elevation, saw its first-ever September above-freezing reading on the third, said Ted Scambos, a researcher at the University of Colorado.

- Scambos told Axios the event was "unprecedented in the 44 years of continuous satellite monitoring."

Zoom in: The event was among the biggest melt spikes of the entire 2022 melt season, said climate scientist Xavier Fettweis. - Fettweis said the meltwater running off into the ocean amounted to 11.92 billion tons per day at its peak, which put it on the top 10 list of observed melt events of any time of year.

- In total, the ice sheet lost about 20 billion tons of water during the weekend-long extreme melt event, some of it via rainfall that fell on the ice pack, Fettweis said.

- While the sea level rise that would result from this one episode won't be noticeable, it's a sign that the ice is increasingly being exposed to potentially destabilizing spells of unusually mild weather.

Washington Post has more. |     | | | | | | 4. New Fed official speaks; BlackRock pens letter |  | | | Illustration: Aïda Amer/Axios | | | | Two key signals of how the worlds of finance and politics are colliding came yesterday, Andrew writes. - First, Michael S. Barr, the new chief banking regulator, signaled the Fed's upcoming moves on climate in a speech at the Brookings Institution.

Driving the news: How the Fed should assess climate-related risks to the financial sector is a politically fraught issue. Zoom in: Barr offered a timeline on the bank's closely watched climate risk scenario analyses. He said in the next year, the Fed plans to conduct the first "pilot" project that would "better assess the long-term, climate-related financial risks facing the largest institutions." Meanwhile, BlackRock, which has become synonymous with ESG investing, released a letter yesterday it sent to 19 Republican state attorneys general who have criticized the company for steering money away from fossil fuel companies. What they're saying: In its reply, Dalia Blass, BlackRock's head of external affairs, defends the firm's strategy. - "Governments representing over 90% of global GDP have committed to move to net-zero in the coming decades," the letter states.

- "We believe investors and companies that take a forward-looking position with respect to climate risk and its implications for the energy transition will generate better long-term financial outcomes."

- The letter also pushes back against the boycott accusation: "BlackRock does not boycott energy companies or any other sector or industry."

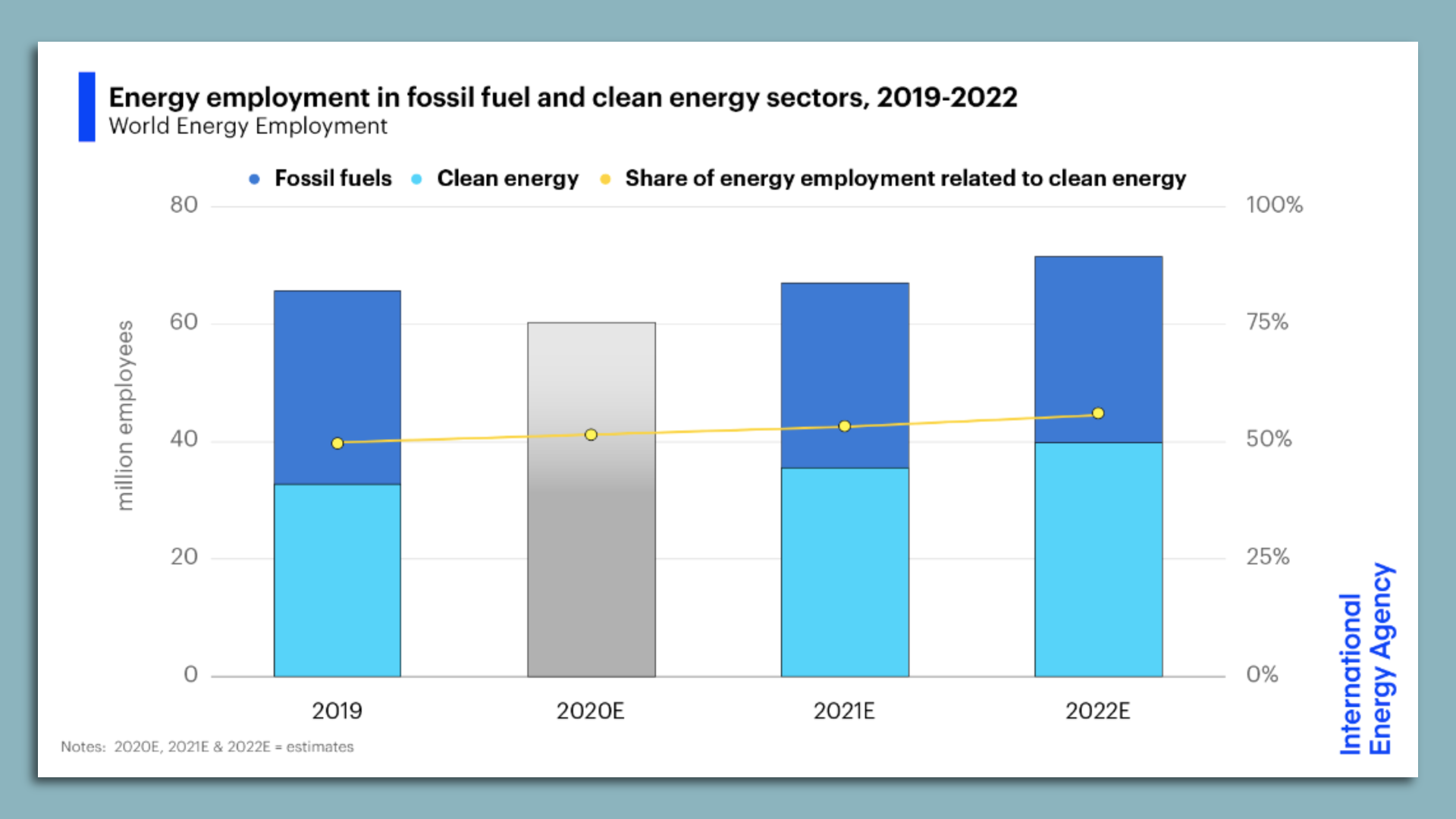

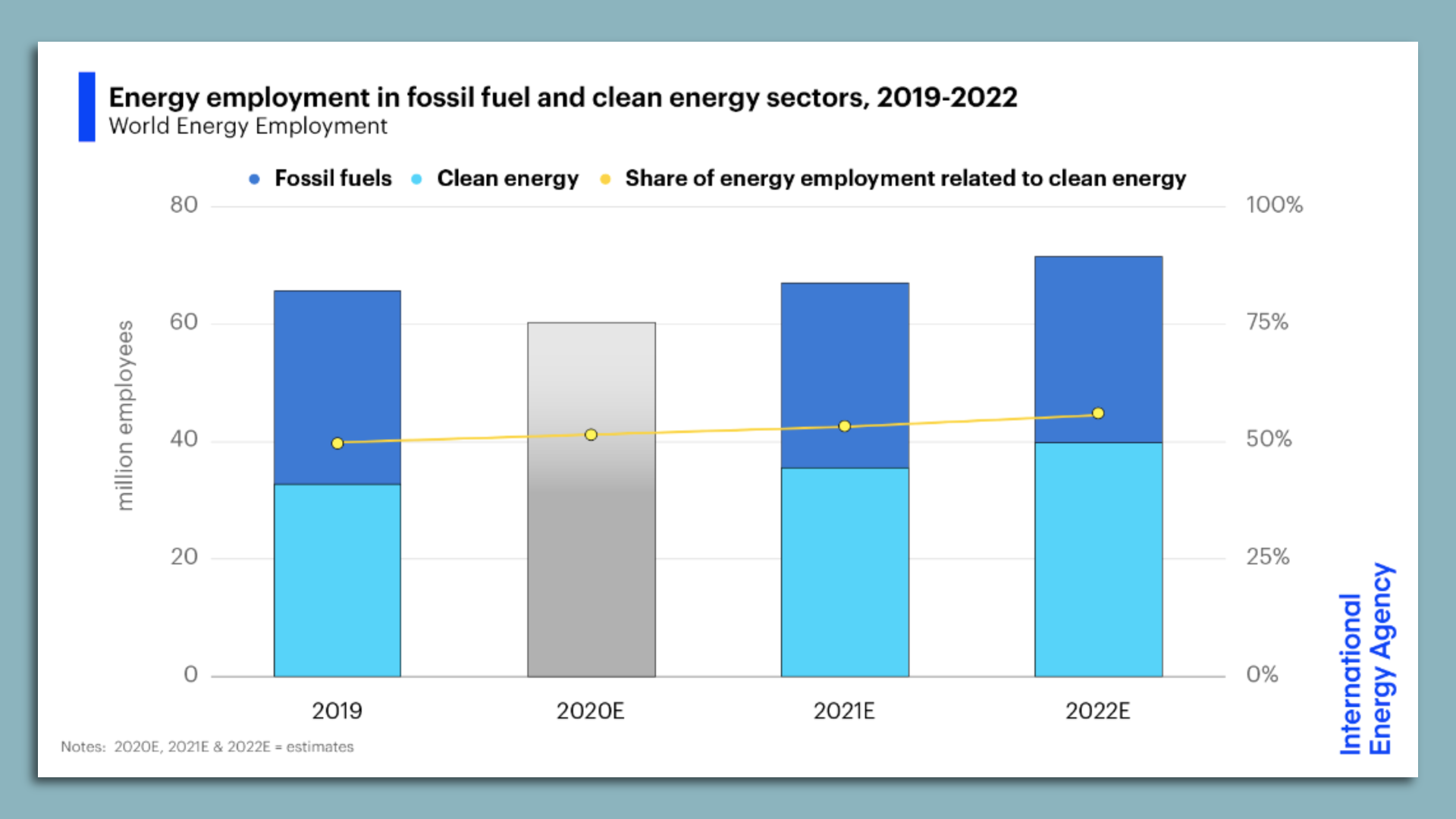

|     | | | | | | 5. Need-to-know numbers: jobs, oil, solar |  | | | Image courtesy of the International Energy Agency | | | | Over 50% of the global energy workforce is now employed in "clean" sectors, the International Energy Agency said in a new report, Ben writes. Why it matters: It's IEA's first detailed analysis of global energy employment. The intrigue: "Wages in clean energy jobs lag behind those in the fossil fuel industry, where unionization rates are higher and risky work has been compensated with higher pay," the AP's coverage notes. Some more data points on our radar... 🛢️ $82.48 per barrel, the U.S. benchmark crude price following declines this week that brought prices to their lowest levels since January (though they're moving up slightly this morning). "Recession woes, weak Chinese export/import data and COVID-related lockdowns are the primary price drivers at the moment," PVM Oil Associates analyst Tamas Varga said via Bloomberg. ☀️ 40%, the amount of additional U.S. solar growth expected over the next five years compared to baseline projections before the new climate law. - That's a key finding in the latest market analysis via the Solar Energy Industries Association and the firm Wood Mackenzie.

- However, the quarterly report also sees near-term headwinds as the pace of new utility-scale installations fell in Q2.

- "Supply chain constraints and trade policy issues continue to suppress utility-scale solar installations," it states.

|     | | | | | | A message from Chevron | | At Chevron, we're working to keep up with growing energy demand | | |  | | | | Chevron is increasing U.S. production to keep up with growing energy demand. By the end of this year, we plan to increase our oil and natural gas production in the Permian Basin by 15% over 2021 levels. And we're expected to reach 1 million barrels of oil per day by 2025. Learn more about our efforts. | | | | 🙏Thanks for reading and we'll see you back here tomorrow. |  | | Why stop here? Let's go Pro. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment