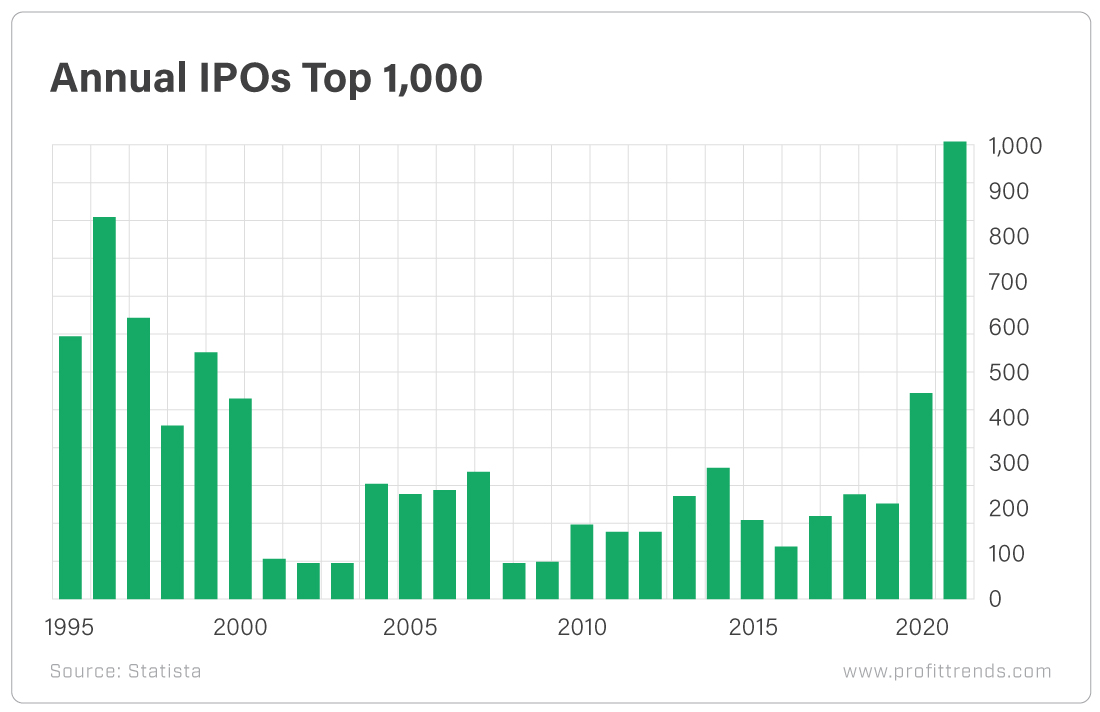

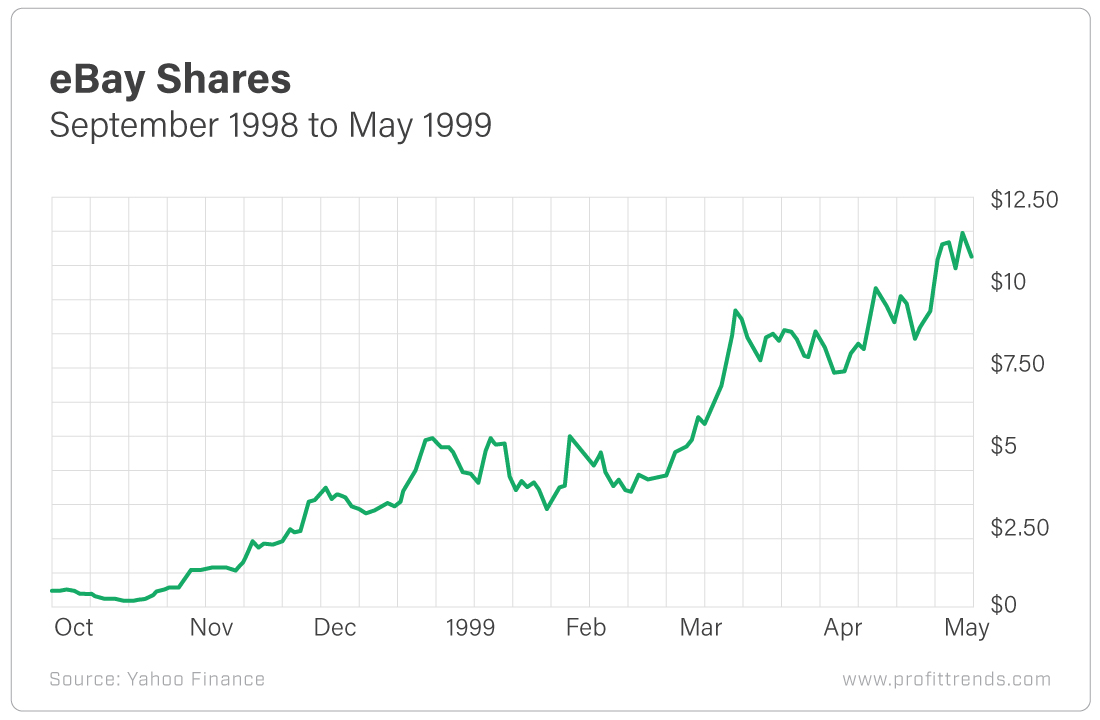

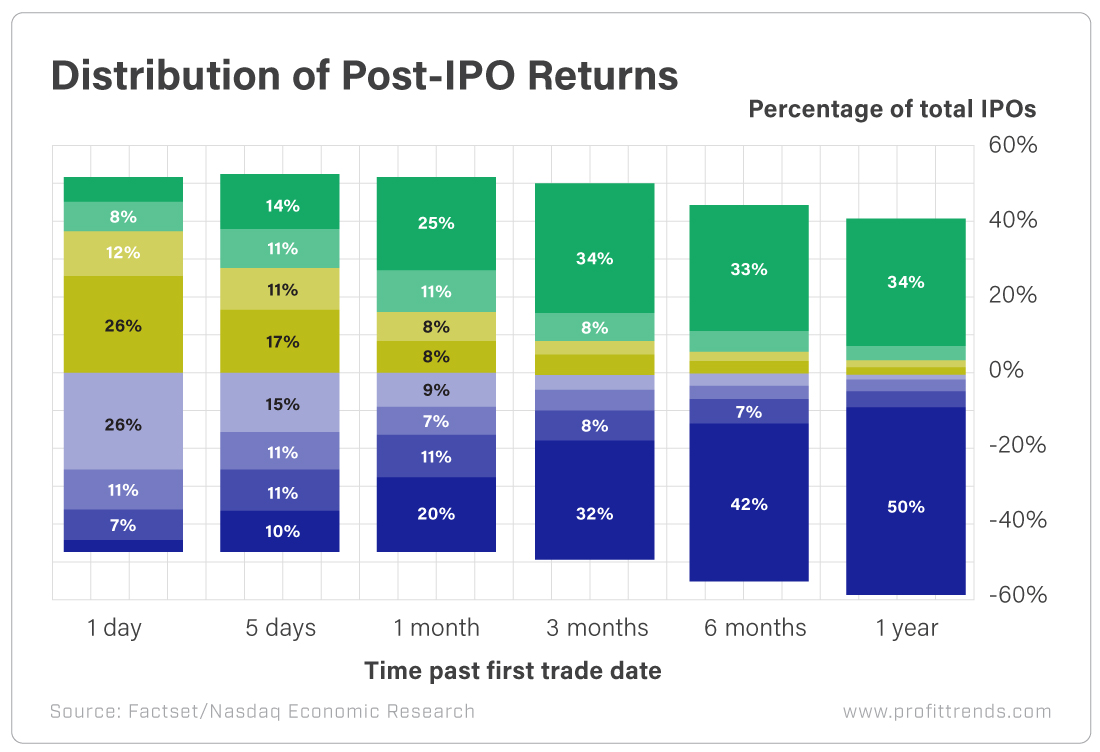

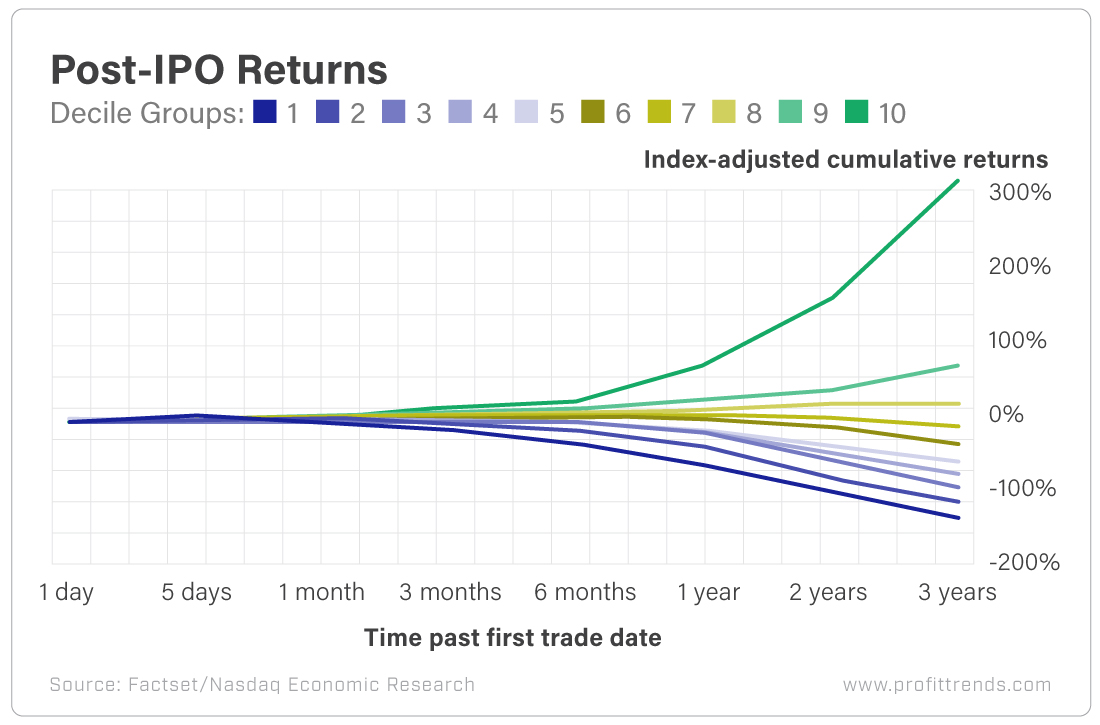

Day One Dummies During the glory days of the 1980s and 1990s, IPOs minted millionaires easily enough. And the worst part was that investors didn't even need to be selective. Throwing a dart at a board often resulted in positive returns. But in a roaring bull market like the one we saw in those days, everyone is a genius... until they're not. In fact, from 1990 to 1999, the average six-month return of a new IPO was 12.9%. That was almost double the return of those companies' peers during the same stretch. And it was 3.5 times better than the average return of IPOs in their first six months in the 1980s. Investors would have been foolish not to race in and snag a piece of every debut that they could. And there were true gems, like eBay (Nasdaq: EBAY), which rose more than 1,200% in its first six months! But over the past two decades, the story has changed dramatically. This has happened in part because of the loosening of regulations on EGCs. But the push to get new startups to market doesn't mean they are as financially solid as those of the past. Today, the average return in the first six months after an IPO is -1.9%. This is not only a massive step down from the hot-stove returns of the 1980s and 1990s but also a considerable underperformance relative to those companies' peers - they are lagging behind by 6.2%! And as we dig further into the data, the harsh realities get even clearer. An Anniversary of Regret We've all seen the headlines about the massive first-day returns of IPOs. The mainstream financial media reports on these breathlessly, helping whip investors into a frenzy. But here's a sobering stat: Six months after going public, more than 50% of companies underperform the market. And most of them underperform by 10% or more! At the one-year anniversary of going public, a truly significant disparity in performance emerges. More than half of new companies underperform the market by 10% or more. Meanwhile, a much smaller portion outperform the market by more than 10%. And as time goes on, these become tales of two very different cities in terms of performance. The divergence between the underperformers and the outperformers grows even wider. That means investing in IPOs with a "shotgun approach" doesn't work like it used to. Successful IPO investing requires being quite selective, and it requires a strategy to separate the wheat from the chaff. YOUR ACTION PLANIn a recent presentation, I broke down how investors can do precisely that. It boils down to a handful of critical criteria. Investing in recent debuts can be very profitable - life-changing even - if an investor takes the right approach and knows how to avoid the duds. Patience, due diligence and knowing which catalysts to look for are all part of the code to unlocking post-IPO fortunes. Unfortunately, day one investors often end up victims. They buy into the hype and the public relations campaign leading to up an IPO, and seeing those first-day returns triggers a greed reflex... a true FOMO moment. And their financial independence can suffer from it. Don't be a day one dummy. IPOs are fresh off their best year ever. More than 1,000 U.S. companies went public in 2021, smashing the previous record set in 1996 - when only 664 companies went public. And during 2021's record-breaking run, we saw big IPO gains like 111% on Affirm... 208% on Zim Integrated Shipping Services... even 508% on Digital World Acquisition. However, thanks to the secret you're about to discover, the gains could have been much, much bigger. Click here to reveal the secret to life-changing gains. |

No comments:

Post a Comment