| | | | | | | Presented By Blackstone | | | | Axios Markets | | By Kate Marino ·Sep 28, 2021 | | ☀️ Good morning, Markets readers! ⛰ I just got back from a refreshing vacation, hiking in the Hudson Valley. If you've attempted Breakneck Ridge, as I did, you know it's no joke. 💪 - I want to hear about your favorite places to hike, so let me know by replying to this email or on Twitter @theKateMarino.

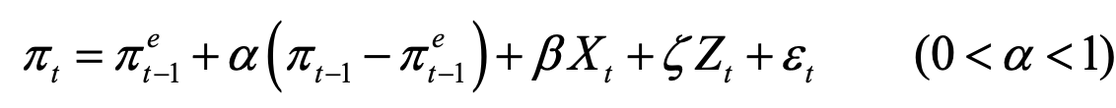

Let's dive in. Today's newsletter is 1,257 words, 5 minutes. | | | | | | 1 big thing: Maybe we can ignore inflation expectations |  | | | Illustration: Sarah Grillo/Axios | | | | Just because we expect inflation to show up, doesn't mean it will. That's the message from an important new paper throwing cold water on a central tenet of monetary economics, Axios' chief financial correspondent Felix Salmon writes. Why it matters: The Fed hikes interest rates when — and only when — it thinks inflation is otherwise going to be too high. That means it needs a formula to determine where it thinks inflation is going to be. But now a senior Fed economist is saying that the key ingredient in that formula "rests on extremely shaky foundations." How it works: The Fed's main formula can be intimidating — it's at the bottom of this piece, for the econ nerds among you. But translated into English, it effectively says that actual future inflation is equal to expected inflation, adjusted by a few variables associated with things like unemployment and supply shocks. - The catch: There's no empirical reason to believe that inflation expectations play a central role in driving observed inflation.

The big picture: If inflation expectations fed into actual inflation, it would be easy to construct a narrative as to why that might be the case. Businesses, for example, might raise their prices in order to stay ahead of expected cost increases in both materials and labor. - Precisely because that narrative is so intuitive, however, it tends to be embraced even when inflation expectations have consistently outpaced observed inflation for decades.

Driving the news: An important new paper from Fed economist Jeremy Rudd systematically dismantles all the reasons inflation expectations play such a central role at the Fed. - "Using inflation expectations to explain observed inflation dynamics is unnecessary and unsound," Rudd writes. "Invoking an expectations channel has no compelling theoretical or empirical basis."

Between the lines: As former Fed economist Claudia Sahm notes, Fed chair Jay Powell was talking about the central importance of inflation expectations as recently as last week. ("Our framework for monetary policy emphasizes the importance of having well-anchored inflation expectations," he said.) The bottom line: It's unlikely that a single paper is going to change the board's mind on something so important. But Rudd's research does serve the purpose of encouraging the Fed to spend much more time looking at observed, rather than expected, inflation. |     | | | | | | Bonus: The formula | | The Fed's formula for forecasting inflation is a doozy... The expectations-augmented Phillips curve that the Fed uses to model inflation, from Rudd (2014) |     | | | | | | 2. Catch up quick | | Senate Republicans voted against a measure that would raise the nation's debt limit, opposing a bill that's needed to avert a government shutdown this week and a federal debt default next month. (NYT) Europe faces a worsening energy supply shortage, as stockpiles of natural gas, coal and even water for energy production are dwindling, and sending prices for natural gas futures and Brent crude surging. (Bloomberg) Merck is nearing a deal to buy Acceleron Pharma, which specializes in treatments for respiratory and blood diseases and has a market value of around $11 billion. (WSJ) |     | | | | | | A message from Blackstone | | Blackstone invests to help power the modern economy | | |  | | | | Blackstone is investing to accelerate the growth of companies shaping the future. Why it's important: Building stronger businesses can lead to better returns for investors, stronger communities and economic growth that works for everyone. Learn more. | | | | | | 3. Two Fed presidents are retiring early |  | | | Robert Kaplan, president of the Federal Reserve Bank of Dallas. Photo: Cole Burston/Getty Images | | | | Speaking of the Fed, two Reserve Bank presidents are stepping down after weeks of criticism triggered by disclosures about their investment activities, Axios' Shawna Chen reports. Driving the news: Boston Fed President Eric Rosengren and Dallas Fed President Robert Kaplan both announced their resignations Monday within hours of each other. Why it matters: Kaplan and Rosengren have been embroiled in controversy because they both owned assets that were sensitive to the monetary policy they were helping shape in 2020. - Both noted that their actions didn't violate the Fed's codes of conduct, but said they would sell their stocks by the end of the month to avoid the appearance of a conflict of interest.

What they're saying: "The Federal Reserve is approaching a critical point in our economic recovery as it deliberates the future path of monetary policy," Kaplan said in a statement. - "Unfortunately, the recent focus on my financial disclosure risks becoming a distraction to the Federal Reserve's execution of that vital work," he added. "For that reason, I have decided to retire," effective Oct. 8, 2021."

Rosengren announced that he would move his planned retirement from June 2022 to Sept. 30 this year. He cited health concerns, including the need for a kidney transplant, as the reason for his departure. - He did not mention the controversy over his trading.

The big picture: Federal Reserve chair Jerome Powell said last week to expect changes to the ethics rules concerning senior central bank officials' personal financial activities, as Axios' Courtenay Brown reported. What to watch, via Courtenay: The resignations and the pledge to revamp the rules give Powell a line of defense during a sprint of Congressional hearings that start today. - He's testifying on pandemic relief programs alongside Treasury Secretary Janet Yellen — but watch for this to come up: Sen. Elizabeth Warren (who's on the panel hosting this morning's hearing) called on the Fed to ban officials from stock trading.

|     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 4. Ford's $11 billion plan to turbocharge U.S. EV industry |  | | | Illustration: Annelise Capossela/Axios | | | | Axios' Joann Muller reports: Ford Motor Company's new $11 billion manufacturing plan, the biggest component of which will sit just outside Memphis, is part of a much bigger effort to put the U.S. at the center of the electric vehicle revolution, executive chairman Bill Ford says. The big picture: Ford's plans — for enormous facilities in both Tennessee and Kentucky, employing a combined 11,000 workers — are ambitious manufacturing efforts designed to minimize their environmental impact. - But Ford says these investments will also help the U.S. build its own supply chain for batteries, rather than continuing to import them from Asia — providing economic security, insulation from supply chain disruptions and ultimately bringing down the price of EVs.

"We need to, as a country, decide — do we want to have a domestic battery industry? And that's something that's kind of starting tomorrow," Ford said in an interview conducted Monday before the announcement. Details: The company is building two battery manufacturing plants in Kentucky, as well as an enormous new complex near Memphis that will include both battery manufacturing and vehicle assembly for electric F-series pickup trucks. - Long term, the plan is to perpetually recycle EV batteries in the U.S., and end imports of batteries made with precious metals like nickel, lithium, cobalt and copper from foreign mines.

- "We'll be importing a lot of these batteries initially, but then they stay within our country and start to be remade into American batteries if you will," Ford told Axios.

- Ultimately, he said, a more robust U.S. supply chain will help bring down the cost of EVs.

"That does require us to completely remake our company in many, many ways. And we're in the process of doing that," said Ford, who is the great-grandson of Henry Ford. The bottom line: "My great-grandfather was the ultimate sort of disruptor," Ford said. "And I think if he looked at what we're announcing ... he might just say, what took you so long? And he'd be right." |     | | | | | | 5. Record demand for business equipment |  Data: Census via FRED. Chart: Axios Visuals Demand for durable goods grew to a recent record in August, Axios' Hope King writes. - New orders reached $263.5 billion, the Commerce Department said on Monday, a 1.8% increase over July. Expectations were for 0.6% growth.

Driving the news: Demand for transportation equipment drove the growth. Meanwhile, defense aircraft and parts, as well as cars and car parts, were a drag on demand. Why it matters: "Continued strong goods demand, widespread shortages including of labour, and low borrowing costs, suggest that the outlook for business equipment investment remains bright," Michael Pearce, senior U.S. economist at Capital Economics, wrote in a research note Monday. What to watch: Shipments may not be able to keep up with new orders as shortages worsen, Pearce cautioned. |     | | | | | | A message from Blackstone | | Blackstone is investing to accelerate medical innovation | | |  | | | | In the past year, Blackstone has invested $16 billion across the life sciences industry. Why it's important: Backing research, technology, treatment, and facilities can advance medical innovation and transform patients' lives. Find out more. | | | | 😎 Thanks for reading! |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment