| | | | | | | Presented By Yieldstreet | | | | Axios Markets | | By Sam Ro ·Aug 05, 2021 | | Today's newsletter is 1,317 words, 5 minutes. 📈 of the day: 1.51 billion, the number of trips Uber provided through its platform in Q2 2021. | | | | | | 1 big thing: Stocks got cheaper as they rallied |  Data: FactSet; Chart: Axios Visuals A widely followed valuation metric suggests stocks have been getting cheaper over the past year, even as prices have surged to new highs. Why it matters: When market caps balloon, it's tempting to think that the stocks must eventually fall in order to get to more reasonable levels. - This doesn't have to be the case when earnings prospects are improving.

The big picture: Perhaps the most popular measure of value in the stock market is the forward price/earnings (P/E) ratio. Simply put, that's the market value of a company divided by what it's projected to earn over the next 12 months. - When the ratio is above some long-term average, the stock is thought to be expensive. If it's below average, then it's cheap.

By the numbers: The S&P 500's forward P/E touched a high of 23.6 on Aug. 28, 2020, according to FactSet. That day, the S&P closed at 3,508. Since then, the forward P/E has trended lower, registering at 21.2 as of July 30. - During that period the S&P surged 25% to 4,395.

Between the lines: This dynamic has largely been driven by months of improving expectations for earnings. - And during the current earnings season, most companies have proved that analysts' forecasts for earnings continue to be too conservative.

Flashback: These unusually conservative expectations for earnings can be tracked back to early 2020 and how analysts reacted to COVID-19. - "During the worst part of the pandemic, analysts were basically flying blind," Liz Ann Sonders, chief investment strategist at Charles Schwab, tells Axios. "What they ended up doing in that environment was they erred on the side of just slashing estimates."

- Companies went on to report better-than-expected earnings quarter after quarter. But analysts have maintained conservative forecasts, which Sonders says kept the forward P/E "artificially high."

Yes, but: Even at a forward P/E of 21.2, this multiple is above average. According to FactSet, the 10-year average multiple is closer to 16.2. But, but, but: Sonders cautions against putting too much weight into long-term historical averages as the macroeconomic environment has evolved greatly. - She notes that the historically low-interest rates we have today are supportive of higher valuations.

- Also, an increasing share of the S&P consists of high-growth tech companies, which come with justifiably high valuations.

The bottom line: An elevated P/E ratio alone is not a reason think stocks are doomed to fall. - "Sometimes high multiples are not 'what you see is what you get,'" Anastasia Amoroso, chief investment strategist at iCapital Network, tells Axios.

- "It is typical in a quickly recovering economy to see earnings get revised higher and beat consensus, leading to same or even lower multiples. When accounting for these higher earnings, the 'true' multiples may not be as expensive as they seem."

Keep reading |     | | | | | | 2. Catch up quick | | JPMorgan Chase is pitching wealthy clients on an in-house bitcoin fund, according to sources. (Coindesk) President Biden and top U.S. automakers will announce their goal to have electric vehicles represent 50% of sales by 2030. (Axios) Uber earnings beat expectations driven by strong bookings. (Yahoo Finance) |     | | | | | | 3. Fed vice chair Clarida talks rate hikes |  | | | Photo: Andrew Harrer/Bloomberg via Getty Images | | | | Federal Reserve vice chairman Richard Clarida made waves on Wednesday with his decidedly hawkish tone. Why it matters: All eyes have been on Fed officials as they telegraph their views on the economy and monetary policy. - With the economy progressing, everyone wants to know when the Fed will taper its quantitative easing program and when will it start hiking interest rates.

Driving the news: In a speech on Wednesday, Clarida said the surprising pace of economic improvement could justify an interest rate hike in 2023. - He expects the unemployment rate will fall from 5.9% today to 3.8% by the end of 2022, which he characterized as "maximum employment."

- Along with inflation "well-anchored" at 2%, he says the "necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022."

- "Commencing policy normalization in 2023 would, under these conditions, be entirely consistent with our new flexible average inflation targeting framework."

- Treasury yields jumped when Clarida made those comments.

Yes, but: Clarida's term ends on Jan. 31, 2022 — meaning he won't have a say in the ultimate decision. But, but, but: He's not the only Fed official who thinks 2023 is ripe for rate hikes. In June, we learned that 13 of 18 members of the Fed's policy-setting committee expected to see at least one rate hike by the end of 2023. The forecast among the group calls for two hikes during the period. The bottom line: Expect various Fed members to continue voicing opinions that may conflict with Fed chair Jerome Powell or official policy statements. But keep in mind that no single voice necessarily reflects the consensus. |     | | | | | | A message from Yieldstreet | | How to diversify your portfolio like the ultra-wealthy | | |  | | | | You can diversify your investment portfolio while generating passive income with Yieldstreet. Here's how: The platform lets savvy investors go beyond crypto and the stock market, giving them access to alternative investments such as art, real estate and more. Put your money to work. | | | | | | 4. Why investors should ignore economists |  | | | Illustration: Aïda Amer/Axios | | | | What kind of investor would ignore economics? A successful one, says legendary hedge fund manager Howard Marks in the memo we wrote about on Monday, Axios Capital author Felix Salmon writes. Why it matters: Nearly all investors — Marks included — have views on the economy, how it works, and where it's headed. Many of them go to great lengths to disseminate and popularize those views. (Looking at you, Ray Dalio.) But that's all marketing, not investing. The big picture: One of Marks' investing tenets holds that economic forecasting is "not critical to investing." - "I can count on one hand the investors I know who successfully base their decisions on macro forecasts," he writes.

Marks asks the only question that matters: "If you invest on the basis of your macro views, how often have they helped?" - There are two common answers to that question. The first, which is typical among individual investors, is "very rarely." Investors tend to overestimate future inflation in developed markets and underestimate the likelihood of a major negative shock in emerging markets.

- Institutional investors, on the other hand, if they're honest, will tend to say that they don't invest on the basis of their macro views.

Between the lines: A huge part of being an institutional investor is sales and marketing — persuading individuals that you're a smart and safe place for them to put their money. - Because stocks do well when the economy does well, and do badly when the economy does badly, those individuals will invariably ask about your economic outlook. So investors need an answer to that question.

- Once they become adept at answering those questions, they end up being asked those questions even more frequently. While the answers don't help in terms of investment returns, they do often help convey an aura of general expertise that in turn helps to retain and increase their total funds under management.

The bottom line: There's no utility to listening to investors when they're in economic-pundit mode. And there's also no utility in trying to use economic forecasts to make money. Almost no one* can do that. - *Subscribers to Axios Markets are, obviously, the exception.

|     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. American services overcome constraints |  The U.S. services sector is growing at a record pace. Why it matters: Labor shortages and supply chain issues have hindered business activity across sectors, but not so much that businesses aren't able to grow at a high clip. By the numbers: The ISM services PMI, an index that tracks activity in nonmanufacturing industries, jumped to a record high 64.1 in July from 60.1 in June. - All 17 services industries reported growth in July.

- The employment index rose to 53.8 from 49.3 in the prior month, which suggests hiring conditions are improving.

- However, the supplier deliveries index climbed to 72.0 from 68.5, meaning it's taking longer on average for vendors to get supplies to their customers.

- Also, the prices paid index increased to 82.3 from 79.5, which means inflation.

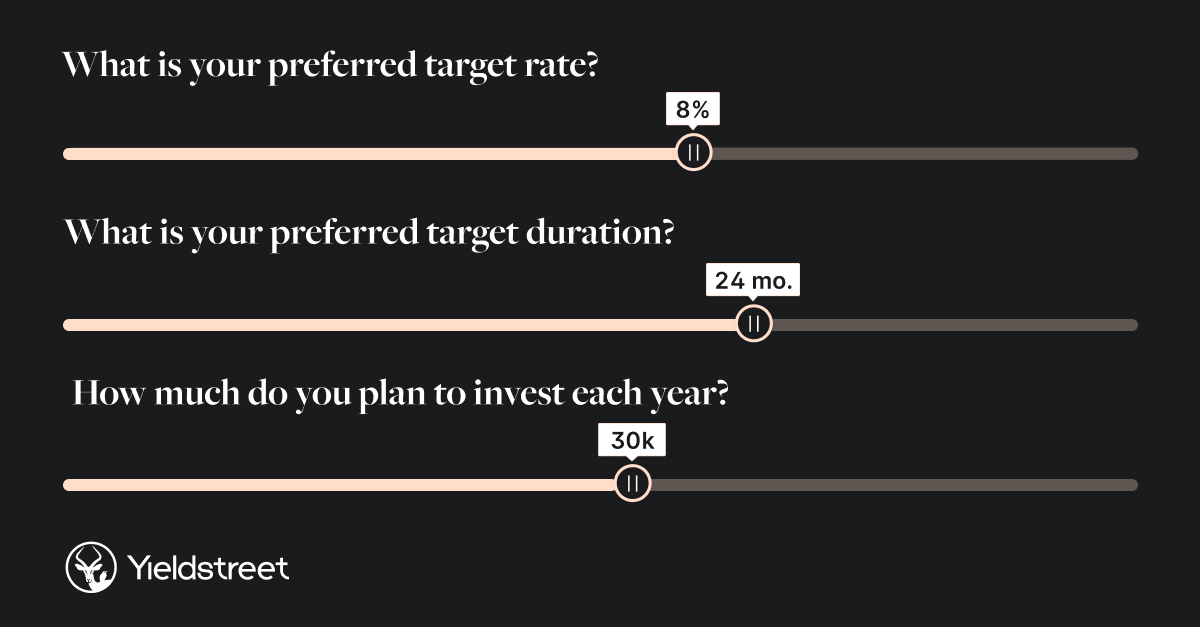

The big picture: "Rising case counts and the particularly virulent Delta variant are threatening to disrupt the recreation renaissance we have been counting on to drive a services spending boom this summer," Wells Fargo's Sarah House wrote. "Through July at least, the service sector is still cranking at full throttle." |     | | | | | | A message from Yieldstreet | | Now you can invest like the ultra-wealthy | | |  | | | | Yieldstreet, an alternative investment platform, has returned over $1 billion in principal and interest to investors to date. More info: Their deals typically have short durations — three months to five years — and target annual yields of 3-15%. Join 300,000+ members today. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment