| | | | | | | Presented By Williams Companies | | | | Axios Markets | | By Sam Ro ·Aug 27, 2021 | | Today's newsletter is 1,300 words, 5 minutes. 🚴♂️ of the day: 19.9, the average number of monthly workouts per connected Peloton customer. | | | | | | 1 big thing: Apparel makers have a new supply problem |  | | | Illustration: Aïda Amer/Axios | | | | New COVID lockdowns in Vietnam are creating supply problems for some well-known U.S. brands. Why it matters: Big retailers have reported healthy demand from consumers, even amid elevated levels of COVID infections in recent weeks. The main challenge hindering sales has been limited supply. Driving the news: Vietnam, a leader in footwear and apparel manufacturing, imposed strict lockdowns this week as the country attempts to contain the spread of the coronavirus. - "We are working through an extended closure of factories in Southern Vietnam," Abercrombie & Fitch CFO Scott Lipesky said on a call with analysts on Thursday. "We'll see how it plays out. [But it's] out of our control at this point."

- "We have a lot of product there, and we're trying to get it in," Urban Outfitters CEO Richard Hayne said on a call with analysts on Tuesday. He added that the company is starting to limit size options for some dresses and bottoms on order from Vietnam.

By the numbers: Not all companies disclose the details of where they source goods. However, Bank of America analysts recently compiled some numbers based on their research. - Gap and Lululemon Athletica each source about a third of their production from Vietnam, the analysts found. Nike sources 51% of its footwear and 30% of its apparel from the country.

What they're saying: "The hope is the lockdowns in Vietnam end by mid-September with as many factory workers as possible vaccinated by then," Joe Feldman, assistant director of research at Telsey Advisory Group, tells Axios. - "Some companies are conservatively forecasting the lockdowns end by October 1, which would put them at approximately ten weeks."

Zoom out: Most apparel and footwear makers order most of their goods months before they plan on selling them. And so experts believe that new disruptions will have a limited incremental impact on the upcoming holiday shopping season. - Matt Powell, senior industry adviser at The NPD Group, tells Axios that should production disruptions persist, "It probably begins to be felt [during the holiday shopping season], but it's really a spring 2022 event."

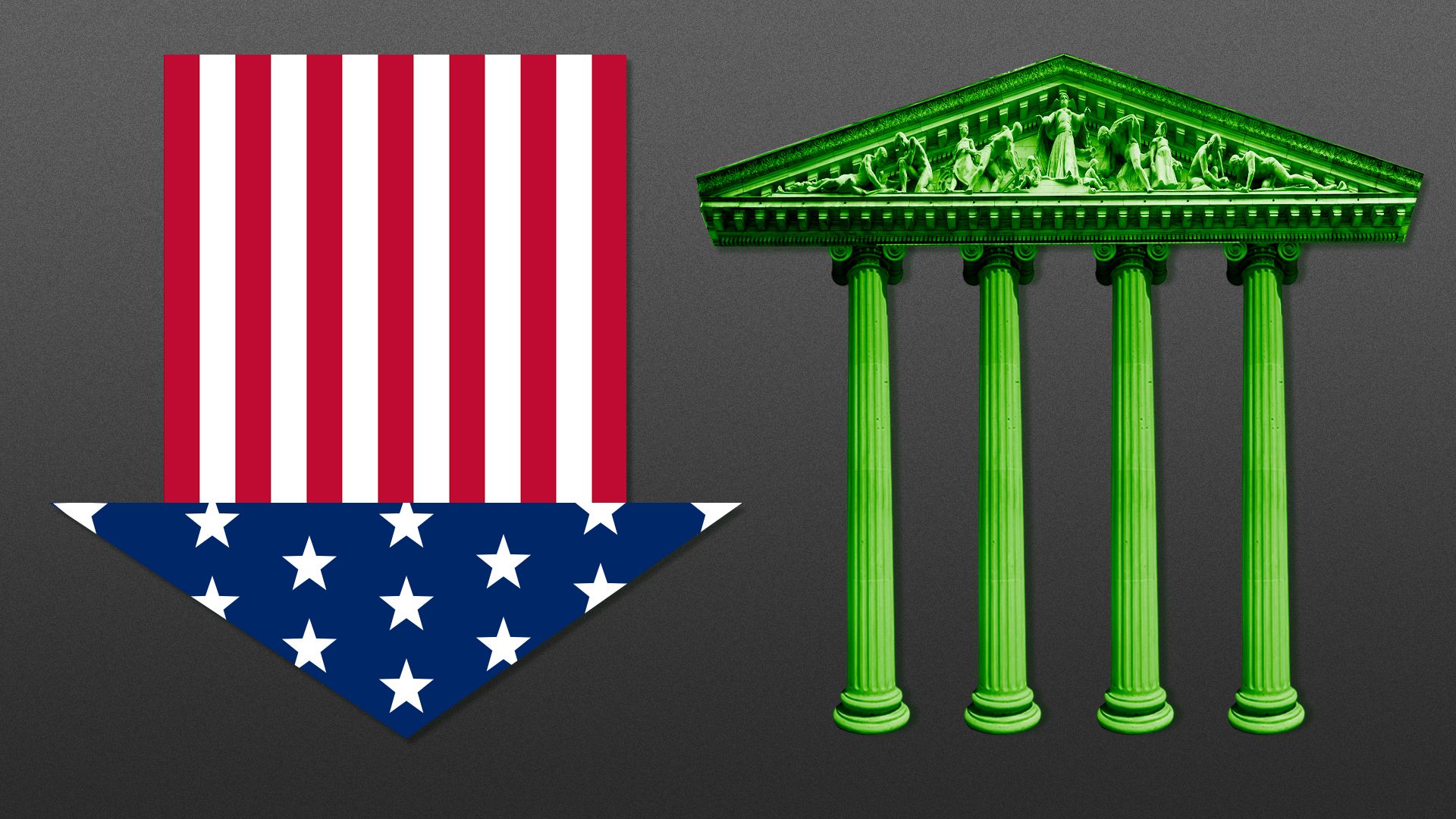

The big picture: The matter of supply chain disruptions is not new, and so what's happening in Vietnam now just adds incremental insult to injury. What to watch: Most of the big retailers have just announced their quarterly results, which means it could be another three months before we get another granular update from the companies most exposed to Vietnam. Read more. |     | | | | | | 2. Catch up quick | | China plans to ban U.S. IPOs of data-heavy Chinese tech companies. (WSJ) Peloton reported a wider-than-expected quarterly net loss and provided a disappointing outlook for sales. (CNBC) President Biden's advisers are considering recommending the renomination of Jerome Powell to Fed chair with the nomination of Lael Brainard to Fed vice chair. (Bloomberg) |     | | | | | | 3. The stock market is not the economy |  | | | Photo Illustration: Shoshana Gordon/Axios. Photo: Tim Graham/Getty Images | | | | Economists have recently been paring back expectations for U.S. economic growth, even as financial market forecasters ramped up their expectations for U.S. stock prices. Why it matters: The divergence in these two measures implies an uneven economic recovery as the stock market tends to slant toward financially powerful large corporations. Driving the news: On Thursday, BofA's U.S. equity strategy team raised its 2021 forecast for S&P 500 earnings per share to $204 from an earlier estimate of $185, following what it characterized as "another blowout earnings quarter." - While BofA maintained its bearish year-end S&P price target of 3,800, Wells Fargo made waves on Tuesday cranking up its target to 4,825 from its prior target of 3,850.

- This implies another 8% gain in the market by the end of the year from Thursday's close.

- "Strong returns beget higher prices," Wells Fargo strategist Chris Harvey said. "Over the last 31 years, there have been nine instances where the S&P 500 had a price return of 10%+ in the first eight months of the year; over the next four months, the index averaged another +8.4%."

- This follows a slew of upwardly revised targets Axios covered earlier this month.

State of play: But last Friday, BofA's U.S economics team actually lowered its outlook for Q3 U.S. GDP growth to 4.5% from 7.0%, citing slower activity amid the spread of the Delta variant. The big picture: While GDP is a measure of activity across the entire U.S. economy, the stock market — as measured by the S&P — largely reflects the financial performance of the country's largest companies, which have a much greater ability to compete than the country's small businesses. - Unlike GDP, which is a hard measure of activity, the stock market reflects prices determined by traders and investors, who in turn can be driven by forces like sentiment.

- Stock prices can also be affected by various technical forces like supply and demand.

The bottom line: Over much longer periods of time, stock prices and GDP have generally moved in the same direction as they are exposed to the same overarching trends like aggregate demand. But over shorter periods of time, they'll sometimes move in different directions, reminding everyone they are not the same. |     | | | | | | A message from Williams Companies | | Check out the newly released 2020 Sustainability Report | | |  | | | | Williams' 2020 sustainability report details a near-term goal of 56% reduction in emissions from the company's 2005 levels, by 2030. The plan: Leverage our natural gas-focused stategy today to fight climate change and build a clean energy economy for the future. Download now. | | | | | | 4. Your next delivery via drone |  | | | In Logan, Australia, a family awaits their package delivery via drone. Photo: Wing | | | | This weekend, Google's drone delivery service, Wing, expects to hit 100,000 deliveries in Logan, Australia, two years after starting operations there, Axios' Joann Muller, co-author of What's Next, reports. Why it matters: On-demand delivery is growing alongside an explosion in e-commerce, fueled by changes in consumer behavior during the pandemic. With roadways ever more congested, airborne delivery could sometimes be a faster option. Our thought bubble: Walmart's announcement earlier this week that it would start offering last-mile delivery is a reminder that getting products delivered to customers more quickly represents an opportunity for players in the ever-increasingly competitive retail business. State of play: There are various commercial drone trials in the U.S., but the Federal Aviation Administration is still writing safety and navigational rules. - For now, drones can't fly beyond the line of sight of the operator, which limits any kind of regular delivery service.

- Google's Wing has an FAA waiver to test drone deliveries in a portion of Christiansburg, Virginia.

How it works: Wing's operation in Logan is a live, automated, on-demand service. - Customers use the Wing app to place orders from one of 11 participating vendors.

- Available items include coffee, food, hardware, clothing, pet supplies and beauty products — up to 3 pounds.

- The vendor secures the order inside the package and attaches the box with a clip to the underside of the drone, which itself weighs just 10 pounds.

- Wing's software chooses the optimal route to the destination.

When the drone arrives, it descends and hovers while the package is dropped down on a line. When it reaches the ground, the clip automatically releases the package, and the line recoils inside the drone. Be smart: Drone deliveries could be a novel service, but the real opportunity for drones is industrial. They can be used to survey and inspect buildings, pipelines and bridges, for example, keeping workers safely on the ground. Go deeper. |     | | |  | | | | If you like this newsletter, your friends may, too! Refer your friends and get free Axios swag when they sign up. | | | | | | | | 5. Small manufacturers are the most optimistic: report |  | | | A worker inspects a Carhatt hat at the Industrial Sewing & Innovation Center manufacturing facility in Detroit. Photo: Emily Elconin/Bloomberg via Getty Images | | | | More small businesses in the manufacturing sector expect to see higher sales next quarter, relative to operators in other industries, Axios' Hope King reports. - A National Federation of Independent Business quarterly report released Thursday shows that a net positive 9% of small manufacturers said in July that they expected sales growth in the next 3 months.

- That compares to a net negative of 1%, 6% and 12% of businesses in the services, retail and construction industries, respectively.

Why it matters: Among the 1,440 business responses, more manufacturers also said they plan to increase hiring. - Of those surveyed, 41% of manufacturing companies said they plan to create new jobs in the next three months — 14 percentage points higher than the overall small business economy.

Of note: Wednesday's durable goods report highlighted a growing backlog of unfilled orders in the manufacturing sector, as we wrote about yesterday. |     | | | | | | A message from Williams Companies | | Check out the newly released 2020 Sustainability Report | | |  | | | | Williams' 2020 sustainability report details a near-term goal of 56% reduction in emissions from the company's 2005 levels, by 2030. The plan: Leverage our natural gas-focused stategy today to fight climate change and build a clean energy economy for the future. Download now. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment