| | | | | | | Presented By Fuel Cell & Hydrogen Energy Association (FCHEA) | | | | Axios Generate | | By Ben Geman and Andrew Freedman ·Jul 12, 2021 | | Welcome back! Today's Smart Brevity count is 1,307 words, 5 minutes. 📊 Data point of the day: 107.7°F, the overnight low temperature in Stovepipe Wells, Calif., on July 11. It's the warmest U.S. overnight minimum on record. Situational awareness: Internal EPA documents show chemicals that over time can break down into toxic substances known as PFAS were used in fracking operations. The NYT has more. 🎶 The Funkadelic album "Maggot Brain" turns 50 tomorrow, so those funk pioneers have today's intro tune... | | | | | | 1 big thing: Janet Yellen widens Treasury's climate push |  | | | Illustration: Annelise Capossela/Axios | | | | Treasury Secretary Janet Yellen is planning to meet directly with the heads of multilateral development banks (MDBs) to press for stronger steps on climate change, Ben writes. Why it matters: Her announcement of the gathering shows how Treasury hopes to help steer more public and private capital toward emissions-cutting and adaptation in developing nations. It's also a sign of the Treasury's expanding role on climate, including newly launched assessments of climate-related financial risks. Driving the news: "I plan to shortly convene the heads of the MDBs to articulate our expectations that the MDBs align their portfolios with the Paris Agreement and net-zero goals as urgently as possible," Yellen told a climate conference in Venice Sunday just after the G20 finance ministers' meeting there. - Yellen said she also expects them to "more effectively mobilize" private capital.

- But she also credited "tremendous work" MDBs are already doing.

- World Bank Group president David Malpass told the conference that the group plans to devote an average of 35 percent of its 2021-2025 financing to climate.

The big picture: The U.S. helps fund institutions including the World Bank, the Asian Development Bank, the Inter-American Development Bank and others. - Yellen noted MDBs combined are among the largest sources of climate finance for developing nations.

- She said banks the U.S. contributes to provided a combined $36 billion in climate finance in 2020, and help leverage private capital.

- A separate communique from G20 finance ministers who met in Venice over the weekend also urges stronger steps from MDBs.

Threat level: Yellen's comments come as progress — or lack thereof — on wider climate finance efforts is potentially critical to the success of the United Nations climate talks in November. - Twelve years ago developed nations agreed to jointly mobilize $100 billion annually in funding by 2020 to help poor nations cut emissions and adapt to warming. That target has not yet been reached despite increased funding.

- "$100 billion is a bare minimum. From the Caribbean to the Pacific, developing economies have been landed with enormous infrastructure bills because of a century of greenhouse gas emissions they had no part in. But the agreement has not been kept," U.N. Secretary-General António Guterres told the G20 finance summit Friday.

|     | | | | | | 2. More news from the weekend climate talks | | The joint statement from the G20 finance ministers' meeting endorses "use of carbon pricing mechanisms" among its policy prescriptions, Ben writes. Why it matters: "It is the first time in a G20 communique you could have these two words 'carbon pricing' being introduced as a solution for the fight against climate change," French Finance Minister Bruno Le Maire told reporters, according to Reuters. Another thing that caught my eye: BlackRock CEO Larry Fink warning about unintended consequences from publicly traded energy companies shedding oil production assets in response to pressure on climate. Driving the news: Fink told the climate conference in Venice that corporate emissions disclosures have "reshaped" behavior in mostly good ways, but added: - "[O]ne negative effect it's having is creating a massive incentive for public companies to divest dirty assets," he said.

- "Divesting, whether done independently or mandated by a court, might move an individual company closer to net zero, but it does nothing to move the world closer to net zero."

- Bloomberg has more.

Yes, but: BP CEO Bernard Looney, in a recent interview, defended his company's asset sales. He said they help finance clean energy investments and that buyers also face pressure. - "Those companies have to hire people and therefore are not immune from the societal pressures we are all under, and they usually have to borrow money, and therefore are very much in the debt markets...and see the same pressures we do."

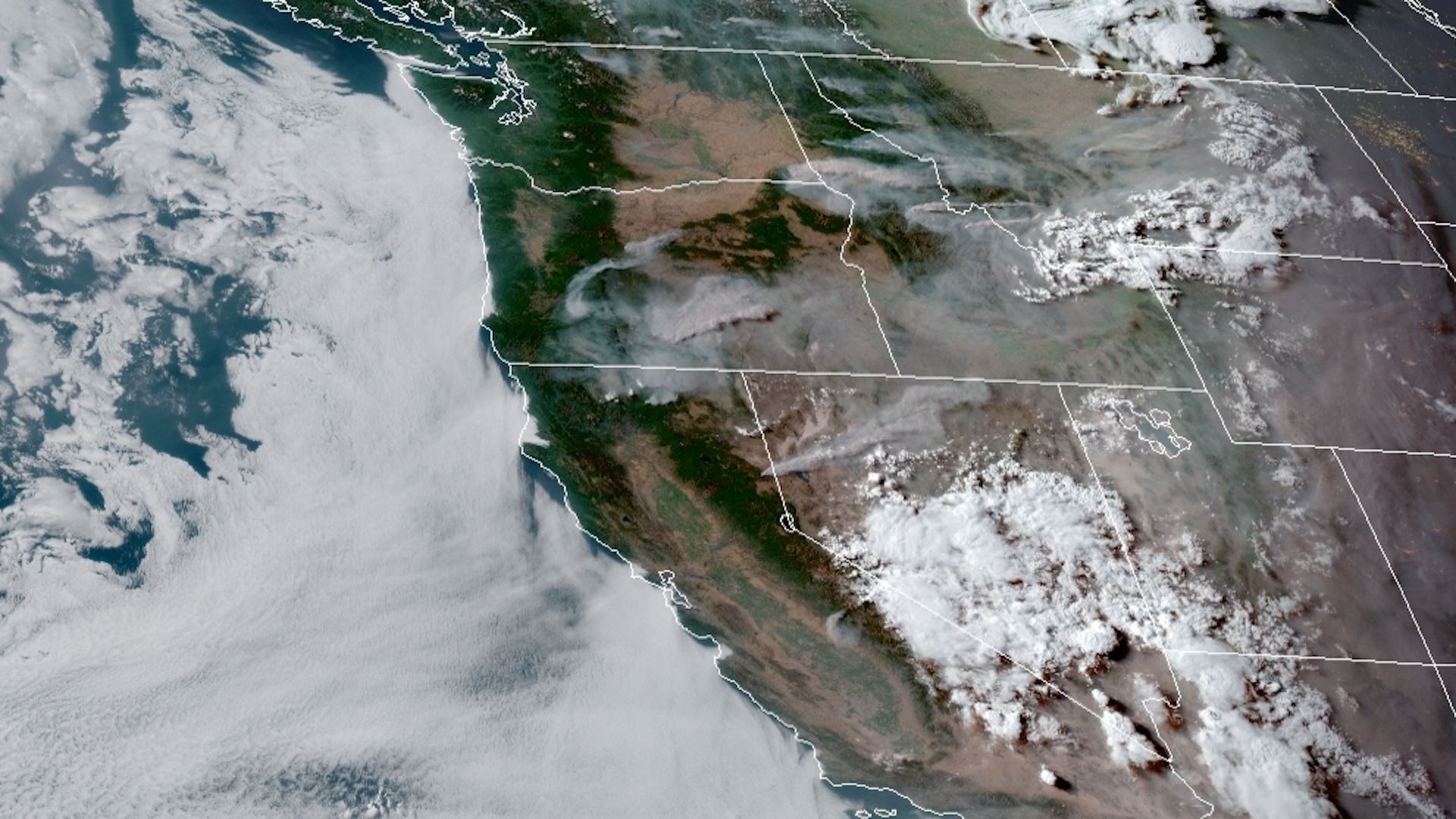

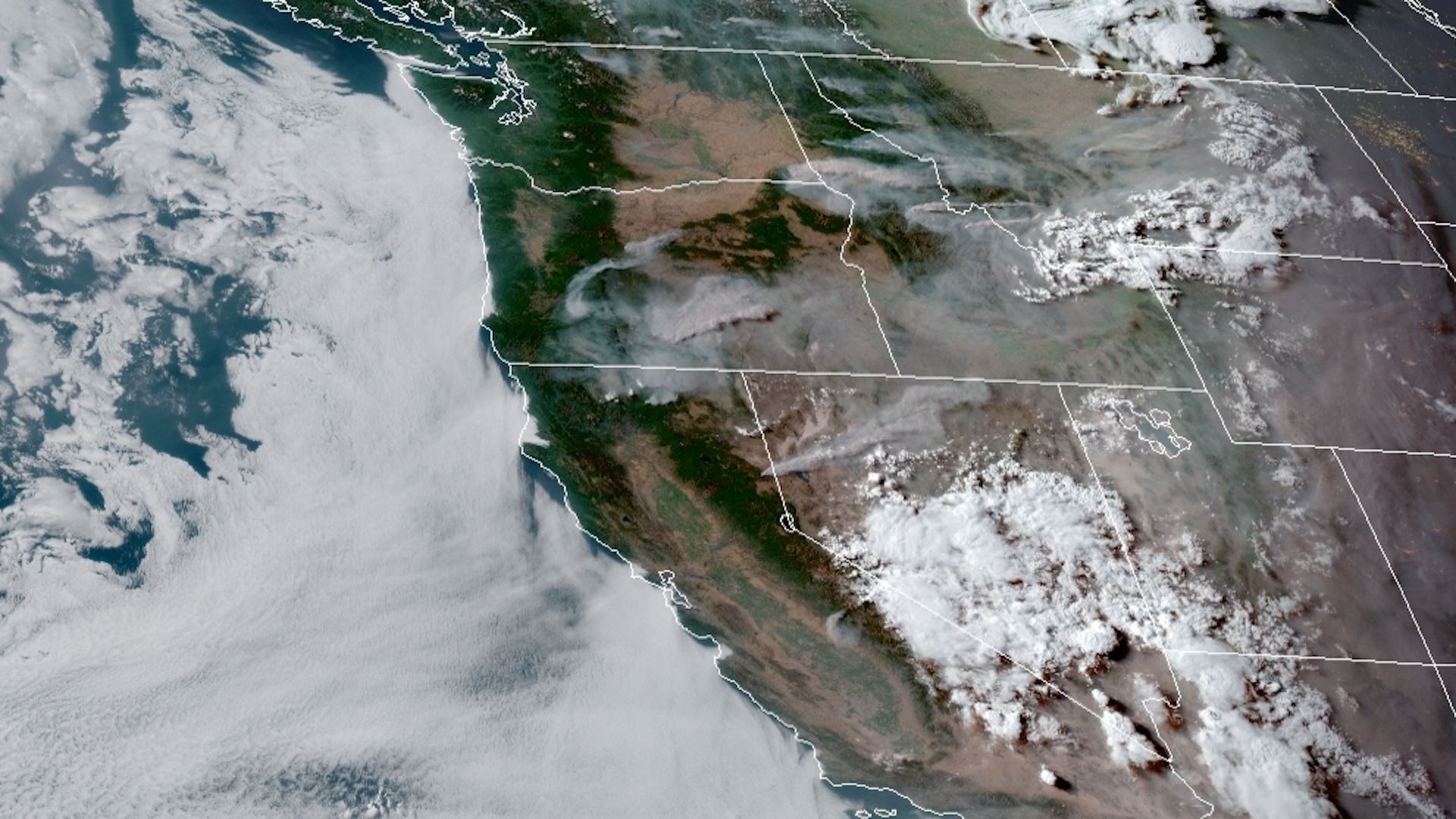

|     | | | | | | 3. The western climate dystopia worsens |  | | | Wildfire smoke plumes seen from space as wildfires erupt in northern California, southern Oregon, parts of Idaho and other parts of the West on July 11. (NOAA/CIRA) | | | | An extreme heat event continues for another day across the West, affecting the power grid and posing a deadly risk to vulnerable populations, Andrew writes. The big picture: Climate change, caused mainly by the burning of fossil fuels, is dramatically increasing the odds, severity and longevity of heat waves, and favors larger wildfires in the West. - This weekend showcased these trends.

Threat level: If you had "Wildfire cuts key electricity link to America's most populous state" on your list of 2021 climate disasters, you were almost proven right this weekend. - The Bootleg Fire in southern Oregon still threatens to sever a power connection between that state and California.

- The high voltage power lines known as Path 66 provide California with about 4,800 megawatts of electricity. The fire reduced that flow on Friday and Saturday.

- The California ISO, which operates the state's grid, has to make up for any shortfall during a high electricity demand period.

- Gov. Gavin Newsom signed an executive order to relieve some of the grid stress, and a "Flex Alert" to conserve power is in effect for Monday.

By the numbers: The heat tied and broke longstanding records: - 117°F: All-time high-temperature record at Las Vegas McCarran International Airport, which was tied on Saturday.

- 107°F: All-time high-temperature record set July 9 at Grand Junction, Colo., where records date back to 1893.

- 130°F: High temperature at Death Valley, Calif. on Saturday, marking one of the warmest days reliably recorded anywhere on Earth.

Context: The heat wave follows the hottest June on record in the U.S., with eight states, including California, Arizona, Nevada and Utah seeing their hottest such month. Go deeper |     | | | | | | A message from Fuel Cell & Hydrogen Energy Association (FCHEA) | | How hydrogen could help decarbonize the globe | | |  | | | | Cutting carbon and creating jobs? Hydrogen can do that. Fueling urban and rural communities? Hydrogen can do that, too. What this means: No matter your point of view, hydrogen is an energy solution that won't fuel the divide. So, let's talk. | | | | | | 4. Why crude prices are all over the place |  Data: FactSet; Chart: Axios Visuals Oil price volatility is back on display this morning as traders mull what's next for the stalled OPEC+ output talks and other forces, Ben writes. Driving the news: As you can see above, this month's OPEC+ impasse on future output levels caused prices to initially rise and then swing both ways. Where it stands: After regaining some ground late last week, prices are dipping again today. The global benchmark Brent crude is at $74.50 this morning, while U.S. prices are at $73.51. What they're saying: "The excitement in oil prices that led Brent close to reaching $78 per barrel has all but dissipated as the OPEC+ discord takes a back seat to market worries over the resurgence of Covid-19 cases globally and the impact on oil demand in the near term," Rystad Energy analyst Louise Dickson said in a note. |     | | | | | | 5. EV racing could boost consumer sales |  | | | New York's Formula E race on Saturday. Photo: ABB FIA Formula E | | | | BMW's Maximilian Günther and Jaguar's Sam Bird won at the thrilling New York City E-Prix racing doubleheader in Brooklyn over the weekend. But race organizers hope the real winners are electric vehicles themselves, Axios' Joann Muller writes. Why it matters: ABB FIA Formula E's all-electric street racing series, held in some of the world's most iconic cities, is meant to showcase EV technology in the very places electric cars are likely to have the biggest impact. - For auto manufacturers, it's also a test bed for innovation in sustainable mobility.

- "If we win and we are successful, we can show the world we are a step ahead on technology," Pascal Zurlinden, director of factory racing for Porsche AG, tells Axios.

Driving the news: New York is the only U.S. stop on this year's Formula E tour, now in its seventh season. As EV technology has advanced, the racing series has evolved too. - Batteries in the first generation of race cars lasted only 25 minutes, so teams had to swap cars midway through the race.

- The current generation of cars has a lightweight 250-kilowatt battery and a top speed of 174 mph, eliminating the need for pit stops during the 45-minute race.

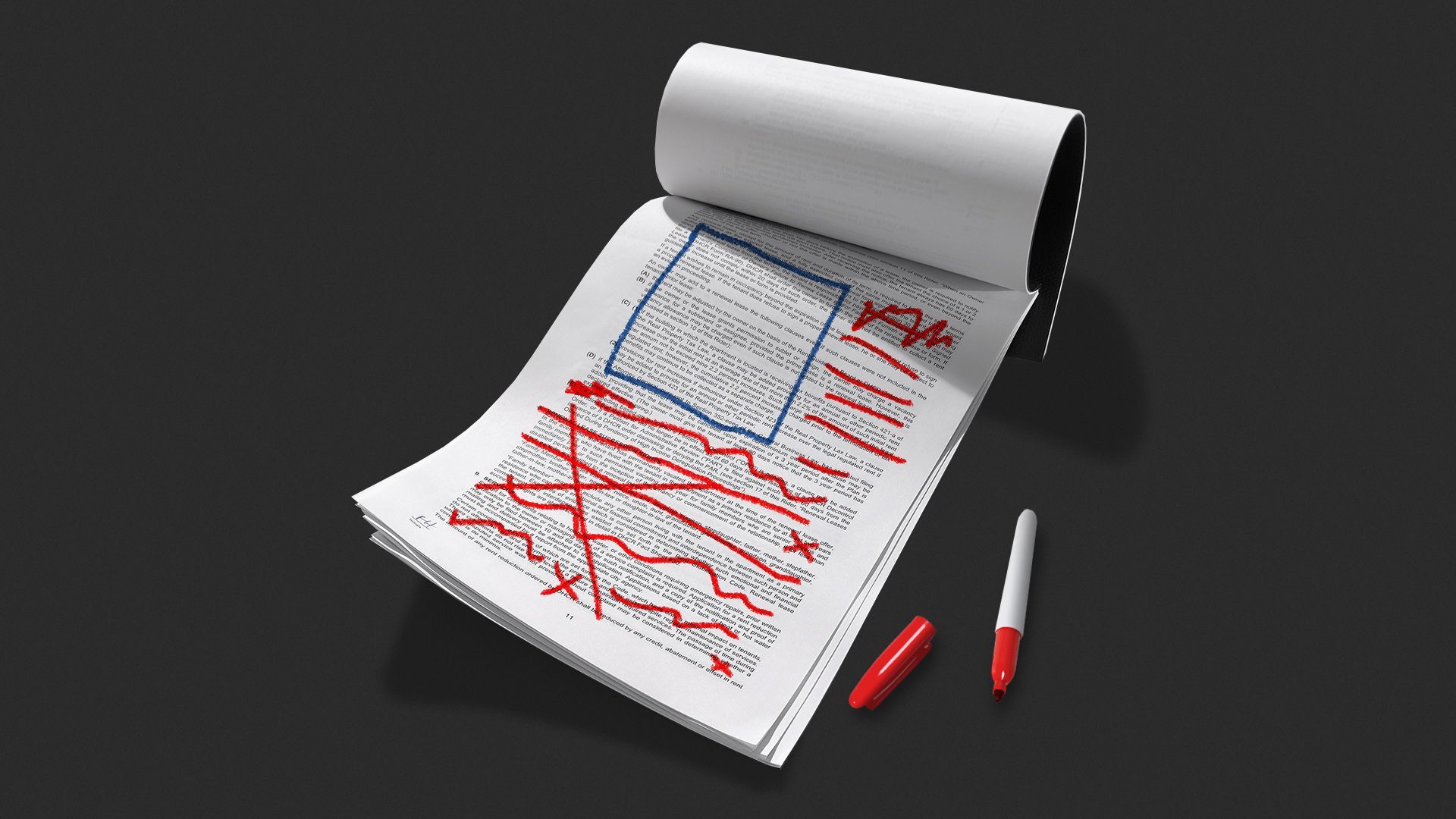

Read the whole story. |     | | | | | | 6. What we're watching: infrastructure talks |  | | | Illustration: Annelise Capossela/Axios | | | | Key negotiators expect the Senate Budget Committee to settle on a roughly $3.5 trillion reconciliation package as the starting point for a Democrat-only plan that includes climate initiatives, people familiar with the matter tell Axios' Hans Nichols. Why it matters: That total is well below the $6 trillion that Sen. Bernie Sanders — the Vermont independent who leads the committee — had initially proposed. A compromise that lowers the total comes as progressives in the Senate and House are pushing for very large new climate investments. Go deeper |     | | | | | | A message from Fuel Cell & Hydrogen Energy Association (FCHEA) | | How hydrogen could help decarbonize the globe | | |  | | | | Cutting carbon and creating jobs? Hydrogen can do that. Fueling urban and rural communities? Hydrogen can do that, too. What this means: No matter your point of view, hydrogen is an energy solution that won't fuel the divide. So, let's talk. | | |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment