| | | | | | | Presented By Fidelity | | | | Axios Pro Rata | | By Dan Primack ·Jul 12, 2021 | | | | | | Top of the Morning |  | | | Illustration: Annelise Capossela/Axios | | | | "It was done through a pre-approved stock trading plan." - That line is very familiar to reporters looking into suspicious trades by top corporate execs, particularly if they come ahead of negative news like poor earnings, failed mergers or product recalls. But we might not need to hear it too much longer.

Driving the news: Bipartisan legislators are pushing a receptive SEC to make major changes to Rule 10b5-1, which was established in 2000 to help companies create executive trading plans that wouldn't fall afoul of insider trading rules. At issue: Academic research has determined that insiders often are able to limit losses via 10b5-1 plans. This is particularly true for single-trade plans, which often are adopted and executed just before quarterly earnings releases. Why now: "The data suggest corporate insiders trades are much more aggressive than what we have seen historically, with the only exception being the 2007-2008 financial crisis," says Dan Taylor, a Wharton accounting professor whose research on 10b5-1 trading has been cited by members of Congress. - He adds that legislators may have been influenced by media coverage of trades by executives at COVID-19 vaccine makers like Pfizer and Moderna, even though such sales were ahead of positive news. Moderna execs, for example, would have done better by holding onto their shares — and Taylor doesn't believe any proposed changes would have applied to the vax maker trades.

State of play: The House of Representatives in April passed a 10b5-1 bill, and Sens. Chris Van Hollen (D-Md.) and Deb Fischer (R-Neb.) last month reintroduced their version. - Neither bill mandates any fixes, instead asking the SEC "to study" such things as limiting the time frame during which 10b5-1 plans can be adopted and delaying the time between adoption and first trades.

- New SEC chair Gary Gensler has indicated support for such moves, which Dan Taylor calls "data driven and a paragon of evidence-based rulemaking."

The bottom line: When we see insider trading in the future, tied to deals or anything else, we may be more able to call it by its name. |     | | | | | | The BFD |  | | | Illustration: Aïda Amer/Axios | | | | Chinese antitrust regulators blocked the proposed $5.3 billion merger of Huya (NYSE: NUYA) and DouYu (Nasdaq: DOYU), two game streaming companies backed by Tencent. - Why it's the BFD: This reflects how China's crackdown on local tech giants is expanding well beyond data privacy and offshore listings. It's also a big win for Amazon's Twitch, which could have faced a viable challenge from the the combined Huya/DouYu.

- Also: Reuters reports that Chinese regulators will force Tencent to give up exclusive rights to music labels, while WSJ reports that TikTok owner ByteDance shelved IPO plans in March after regulators raised data security concerns.

- Bottom line: "It's a sign that regulators will no longer tolerate the kind of transactions that created giants such as food-delivery behemoth Meituan. For Tencent boss Pony Ma, a bigger problem may be revisiting past acquisitions." — Robyn Mak, Breakingviews

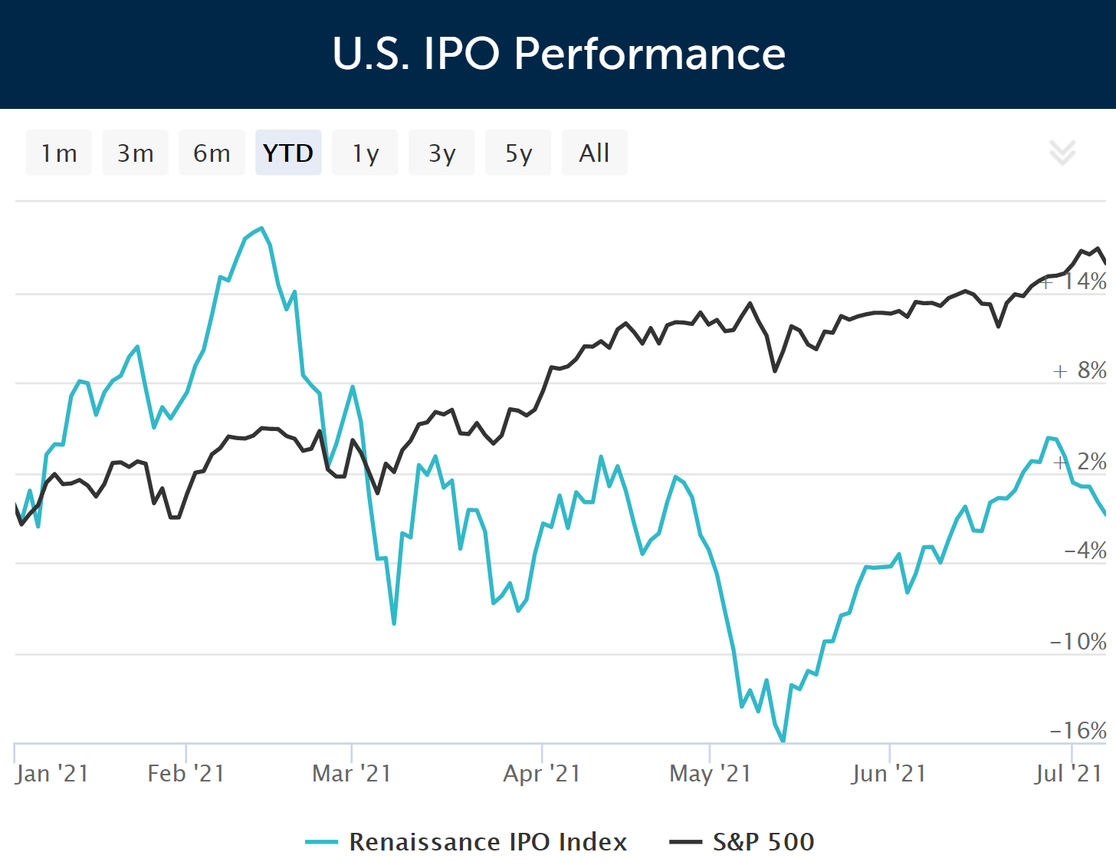

|     | | | | | | Venture Capital Deals | | • Flipkart, an Indian e-commerce giant, raised $3.6 billion at a $37.6 billion valuation co-led by GIC, CPP Investments, SoftBank and Walmart. Other backers include DisruptAD, Qatar Investment Authority, Khazanah Nasional Berhad, Tencent, Willoughby Capital, Antara Capital, Franklin Templeton and Tiger Global. http://axios.link/S7SS • Netskope, a Los Altos, Calif.-based cloud access security company, raised $300 million at a $7.5 billion valuation. Iconiq Growth led, and was joined by fellow insiders Lightspeed Venture Partners, Accel, Sequoia Capital Global Equities, Base Partners, Sapphire Ventures and Geodesic Capital. http://axios.link/qoqm • Tide, a British financial platform for businesses, raised $100 million in Series C funding at a $650 million post-money valuation. Apax Digital led, and was joined by insiders Anthemis, Augmentum, Jigsaw, Local Globe, SBI and SpeedInvest. www.tide.co • Jasper Card (f.k.a. CreditStacks), a customized credit card startup, raised $24 million in new Series A funding. Benslie International Fund led, and was joined by 500 Startups, Gauss Ventures, Off The Grid Ventures, OurCrowd and SIBF. www.jaspercard.com • Flash, a Brazilian HR benefits platform, raised $22 million in Series B funding. Tiger Global led, and was joined by Monashees, Global Founders Capital, Citius and Kauffman Fellows. http://axios.link/stM8 • VU, an Argentinian fraud and identity protection startup, raised $12 million in Series B funding from Globant, Agrega Partners, NXTP Ventures, Bridge One, the IDB Lab and Telefónica. http://axios.link/SIj5 • Frontier, an online jobs marketplace that pre-tests applicants, raised $2.8 million led by NFX. http://axios.link/mDJ8 |     | | | | | | A message from Fidelity | | Going public? Get your equity comp plan started right | | |  | | | | Fidelity Stock Plan Services is here to provide strategic, actionable insights from decades of helping companies with equity compensation plans. Learn how Fidelity Stock Plan Services can help you make key equity plan decisions–from day one. | | | | | | Private Equity Deals | | • CVC Capital Partners invested $470 million for a stake in Aleph Holding, a provider of digital ad sales enablement solutions for media companies. http://axios.link/Jxln 🏀 Dyal Capital Partners is in advanced talks to buy around a 5% position in the Sacramento Kings franchise at a $1.5 billion valuation, per the WSJ. We previously discussed the Kings stake, in a piece that also previewed Dyal buying into the Phoenix Suns. http://axios.link/0F6I • Hillhouse Capital Management is in pole position to buy the King Koil China mattress business from Advent International for more than $2 billion, per Bloomberg. http://axios.link/00jo • KPS Capital Partners agreed to pay $1.3 billion for a control stake in the commercial sweeteners unit of Tate & Lyle (LSE: TATE). http://axios.link/FJyl • Lone Star Funds is in talks to buy Collierville, Tenn.-based chemicals maker AOC Resins from CVC Capital Partners for more than $2 billion, per Bloomberg. http://axios.link/GbaW • Luminate Capital Partners invested in Compliance & Risks, an Irish provider of market access and product compliance SaaS. http://axios.link/udzT • SoftBank is in talks to buy a 10% stake in South Korean hotel booking platform Yanolja for around $870 million, ahead of a U.S. IPO, per local media reports. http://axios.link/3BBv 🍷 Sycamore Partners agreed to pay $1.2 billion to buy Ste. Michelle Wine Estates from Altria Group (NYSE: MO). http://axios.link/0buk 🚑 TA Associates offered the buy the medical unit of Smiths Group (LSE: SMIN) for 2 billion, per the Daily Mail. http://axios.link/M9Fb 🚑 Thoma Bravo invested in Greenphire, a King of Prussia, Pa.-based provider of financial lifecycle management software for clinical trials. www.greenphire.com ⚡ Turnspire Capital Partners agreed to buy Daniel, a Houston-based maker of flow and energy measurement technologies, from Emerson Electric (NYSE: EMR). www.emerson.com |     | | | | | | Public Offerings | | • Colis Privé, a French parcel delivery firm, postponed an IPO that had been scheduled for July, per Reuters. Shareholders include Amazon. http://axios.link/RBmH 🚑 Immuneering, a Cambridge, Mass.-based developer of gene therapies for cancer, filed for an IPO. It plans to list on the Nasdaq (OMGA) and raised $82 million from firms like Citadel (8.6% pre-IPO stake), Cormorant (8.6%), Rock Springs Capital (5.5%) and T. Rowe Price (5.5%). http://axios.link/o7Jm 🚑 Omega Therapeutics, a Cambridge, Mass.-based epigenomics company, filed for an IPO. The pre-revenue company plans to list on the Nasdaq (OMGA) and raised from firms like Flagship Pioneering (62.9% pre-IPO stake), GHarbourVest (6.7%), Fidelity (5.6%), Invus, BlackRock, Cowen, Point72, Logos Capital and Mirae Asset Capital. http://axios.link/05yE 🚑 Nalu Medical, a Carlsbad, Calif.-based maker of nerve stimulation implants for chronic neuropathic pain, filed for an IPO. It plans to list on the Nasdaq (NALU) and raised over $130 million. Shareholders include Boston Scientific (32.4% pre-IPO stake), Longitude Venture Partners (15.9%), Decheng Capital (14.7%), Advent Life Sciences (14.1%) and Endeavour Medtech (13.6%). http://axios.link/hd9z 🚑 Rani Therapeutics, a San Jose, Calif.-based developer of a "robotic pill" for drug delivery, filed for an IPO. It plans to list on the Nasdaq (RANI) and raised around $220 million from firms like InCube Ventures, GV, Novartis, AstraZeneca, Ping An Ventures and Shire. http://axios.link/lEXn 🚑 RxSight, an Aliso Viejo, Calif.-based maker of intraocular lenses, filed for an IPO. It plans to list on the Nasdaq (RXST) and raised around $240 million from firms like Longitude Venture Partners (9.8% pre-IPO stake), H.I.G. BioVentures (7.5%) and RA Capital Management (6.2%). http://axios.link/2mfB 🚑 Tenaya Therapeutics, a South SF-based gene therapy developer focused on heart disease, filed for an IPO. The pre-revenue company plans to list on the Nasdaq (TNYA) and raised $250 million from firms like The Column Group (34.4% pre-IPO stake), Casdin Capital (10%), Fidelity (5.9%), RTW Investments (5.9%), RA Capital Management and GV. http://axios.link/AF8V • Weber, a Palatine, Ill.-based maker of outdoor grills backed by BDT Capital Partners, filed for an IPO. It plans to list on the NYSE (WEBR) and reports $89 million of net income on $1.5 billion in revenue for 2020. This comes just days after rival grill-maker Traeger filed for its own IPO. http://axios.link/hXWP |     | | | | | | SPAC Stuff |  | | | You can't spell space without SPAC... Photo: Patrick Fallon/AFP via Getty Images | | | | • MSP Recovery, a Coral Gables, Fla.-based company focused on Medicare and Medicaid secondary payment recovery, agreed to go public at an implied value of $32.6 billion via Lionheart Acquisition Corp II (Nasdaq: LCAP). http://axios.link/dB8q • Activate Permanent Capital, a sustainability SPAC led by former EnerNOC CEO Tim Healy, filed for a $250 million IPO. http://axios.link/XzQV 🚑 AfterNext HealthTech Acquisition, a health tech SPAC from TPG Capital, filed for a $300 million IPO. http://axios.link/Jse5 • Blue Whale Acquisition I, a media and entertainment SPAC formed by Mubadala Capital, filed for a $200 million IPO. http://axios.link/dZEM |     | | | | | | Liquidity Events | | 🚑 Abry Partners agreed to sell Sentry Data Systems, a Deerfield Beach, Fla.-based pharmacy procurement and compliance platform, to Craneware (AIM: CRW) for $400 million. http://axios.link/D9wD • Advent International agreed to sell German coating resins maker Allnex to Thailand's PTT Global Chemical for €4 billion. http://axios.link/Rb51 |     | | | | | | More M&A | | • Amplifon (Milan: AMP) agreed to buy Bay Audio, a hearing care retailer in Australia and New Zealand. http://axios.link/ruSC • Daily Mail & General Trust (LSE: DMGT), owner of the Daily Mail newspaper, said its founding family and top investor are considering a $1.1 billion takeover offer. http://axios.link/0KyM • Houlihan Lokey acquired London-based boutique corporate advisory firm Baylor Klein. www.hl.com 🚑 Novo Nordisk agreed to buy an experimental heart therapy from Prothena (Nasdaq: PRTA), for upwards of $1.23 billion. http://axios.link/PnzR |     | | | | | | It's Personnel | | • Lucy Fan joined impact investment firm North Sky Capital as a VP. She previously was with battery storage company Peak Power. www.northskycapital.com • Shelby Wanstrath joined Vista Equity Partners as managing director of corporate growth initiatives. She previously co-led private equity for the Teacher Retirement System of Texas. http://axios.link/3lqu |     | | | | | | Final Numbers | Source: Renaissance Capital. Data through June 9, 2021. |     | | | | | | A message from Fidelity | | Fidelity can help lighten the work of your equity comp plan | | |  | | | | Fidelity is the only equity provider top-rated for customer satisfaction for 10 years running. What this means: They deliver service that helps you with your equity compensation plan starting at day one, and continuing beyond. See how. | | | | 🙏 Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and inside traders to sign up. |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment