| | | | | | | Presented By Fidelity | | | | Axios Pro Rata | | By Dan Primack ·Jul 16, 2021 | | | | | | Top of the Morning |  | | | Cover: Penguin Random House | | | | WeWork founder and former CEO Adam Neumann nearly walked away from a multibillion-dollar investment because of a request that he viewed as antisemitic, according to an exclusive excerpt from an upcoming book called "The Cult of We" by Wall Street Journal reporters Eliot Brown and Maureen Farrell. Setting the scene: Neumann, who was born in Israel and is Jewish, was in Tokyo in early 2017 to finalize a giant investment from SoftBank, which planned to use money from a $100 billion fund whose largest investor was Saudi Arabia. - On a private flight back to America, Neumann told colleagues that SoftBank asked if he'd pledge not to give any of his own proceeds to the Israeli military, because it could be problematic for SoftBank's Middle Eastern investors. SoftBank denies that it made the request.

- "We're taking toxic money," Neumann reportedly said, threatening to walk. He didn't intend to give money to Israel's military, but felt the request was antisemitic and also violated WeWork's corporate mantra of inclusiveness.

- He was talked down on the flight by former WeWork executive Jen Berrent, who pointed out that Saudi Arabia might object to both her religion and her sexual orientation, but that WeWork could take the money and do something positive with it.

Brown and Farrell write: "Neumann would wrestle for months with the implications of taking the money. ... Would he be personally responsible for funding the Saudi government and anything negative they might do with it? How can we ever be sure that won't happen?" - In the end, Neumann and WeWork took the money. But Neumann never made any promises about what he'd do with his cut.

Fast forward: Neumann was fired from WeWork in September 2019, following a failed IPO. He later sued SoftBank and later received at least $480 million as part of a settlement that enabled WeWork to go public via a SPAC. |     | | | | | | The BFD |  | | | Illustration: Eniola Odetunde/Axios | | | | General Atlantic is raising $4 billion for a growth equity fund focused on climate technologies, Axios has learned. - Why it's the BFD: Massive flooding in Europe. Wildfires in Canada, with smoke reaching Greenland. Droughts causing massive amounts of animal death. Another heat dome forming. Hottest June on record in the U.S. And on and on and on.

- Details: GA will seek to raise $3 billion from outside investors, while $1 billion will come from existing managed accounts. It also announced the creation of a dedicated climate investment team called BeyondNetZero, which will be chaired by former BP CEO John Browne. Axios has learned that another senior member will be Lance Uggla, current president of IHS Markit (which is being acquired by S&P Global).

- Bottom line: Stemming the impact of climate change will require new, scalable technologies, in combination with deployment of existing renewable energy solutions.

|     | | | | | | Venture Capital Deals | | • Netradyne, a San Diego-based provider of commercial driver safety solutions, raised $150 million in Series C funding. SoftBank Vision Fund 2 led, and was joined by insiders Point72 Ventures and M12. http://axios.link/2kyX • Delhivery, an Indian delivery startup that was recently valued at $3 billion, raised $100 million from FedEx Express. http://axios.link/T1P1 • Shopmonkey, a San Jose, Calif.-based provider of auto repair shop SaaS, raised $75 million in Series C funding. Bessemer Venture Partners and Index Ventures co-led, and were joined by Iconiq Growth and insiders Headline and I2BF. http://axios.link/aqBm • Abodu, a Redwood City, Calif.-based maker of prefab backyard homes, raised $20 million in Series A funding. Norwest Venture Partners led, and was joined by Initialized Capital. http://axios.link/lZA8 • Daloopa, a New York-based provider of data extraction tech for financial institutions, raised $20 million in Series A funding led by Credit Suisse Asset Management. http://axios.link/eRuV 🚑 Stemson Therapeutics, a San Diego-based developer of hair loss solutions, raised $15 million in Series A funding. DCVC led, and was joned by AbbVie Ventures and Genoa Ventures. http://axios.link/FI6N • Verve Motion, a Cambridge, Mass.-based developer of exo-suits for grocery workers, raised $15 million in Series A funding. Construct Capital led, and was joined by Founder Collective, Pillar VC, Safar Partners and OUP. http://axios.link/kFmg • Lightyear, a New York-based network procurement startup, raised $13.1 million in Series A funding. Ridge Ventures led, and was joined by Zigg Capital. http://axios.link/DF3R • Play2Pay, a Miami-based bill payment startup, raised $13 million in Series A funding led by Telesoft Partners. http://axios.link/rBHa • Taager, an Egyptian social e-commerce platform, raised $6.4 million in seed funding. 4DX Ventures led, and was joined by Raed Ventures, Beco Capital and Breyer Capital. http://axios.link/t66M • Nym, a Swiss privacy startup, raised $6 million in Series A funding led by Polychain Capital. http://axios.link/tqX3 • Leap, a social learning startup for those over 55, raised $3.1 million in seed funding co-led by Creandum and South Park Commons. http://axios.link/H3Qf |     | | | | | | A message from Fidelity | | Thinking of going public? Think about your equity comp plan | | |  | | | | Fidelity Stock Plan Services is here to provide strategic, actionable insights from decades of helping companies with equity compensation plans. Learn how Fidelity Stock Plan Services can help you make key equity plan decisions–from day one. | | | | | | Private Equity Deals | | • Athene Holding (NYSE: ATH), the Apollo-backed insurer and annuities seller, agreed to buy British mortgage lender Foundation Home Loans from Fortress Investment Group. http://axios.link/zS9B • JC Flowers agreed to invest $300 million for a 30% stake in London-based cryptocurrency trading platform LMAX Group. http://axios.link/ZpqG • SCF Partners acquired Hydrasun, a British provider of fluid control equipment. www.hydrasun.com |     | | | | | | Public Offerings | | • Bridge Investment Group, a Salt Lake City-based real estate investment manager with $26 billion in AUM, raised $300 million in its IPO. It priced in the middle of its $15-$17 range, for a $1.8 billion fully diluted value, and will list on the NYSE (BRDG). http://axios.link/6EOn • Paytm, an Indian digital payments provider, filed to raise up to $2.2 billion in a local IPO. It has raised over $5 billion in private funding, most recently at a $16.6 billion valuation. Shareholders include Alibaba, SoftBank and T. Rowe Price. http://axios.link/Xifh • Scribd, a San Francisco-based digital content platform, is in talks to go public in 2021 via IPO or SPAC at around a $1 billion valuation, per Bloomberg. It's raised around $100 million since its 2007 founding, from firms like Khosla Ventures, Redpoint Ventures and Spectrum Equity. http://axios.link/7Edc 🚑 Stevanato Group, an Italian pharma packaging company, raised $672 million in its IPO. It priced at the low end of its $21-$24 range, for a $6.4 billion market value, and will list on the NYSE (STVN). http://axios.link/8rge 🚑 TScan Therapeutics, a Waltham, Mass.-based developer of T-cell therapies for cancer, raised $100 million in its IPO. It priced at the low end of its $15-$17 range, for a $384 million fully diluted market value, and will to list on the Nasdaq (TCRX). The company had raised $190 million from Baker Brothers (24.7% pre-IPO stake), Novartis (10.4%), 6 Dimensions Capital (9%), Bessemer Venture Partners (6.6%), Longwood Fund (6.6%), GV (6.2%) and Pitango (5.7%). http://axios.link/zYdO |     | | | | | | SPAC Stuff |  | | | Illustration: Sarah Grillo/Axios | | | | • Aurora, a Mountain View, Calif.-based self-driving company, agreed to go public via Reinvent Technology Partners Y (Nasdaq: RTPY). The deal would give Aurora around an $11 billion equity value, including a $1 billion PIPE. - Reinvent is affiliated with Reid Hoffman, who's already an investor in Aurora via VC firm Greylock. Other backers include Index Ventures and Sequoia Capital.

- Go deeper: Autonomous trucks wow Wall Street

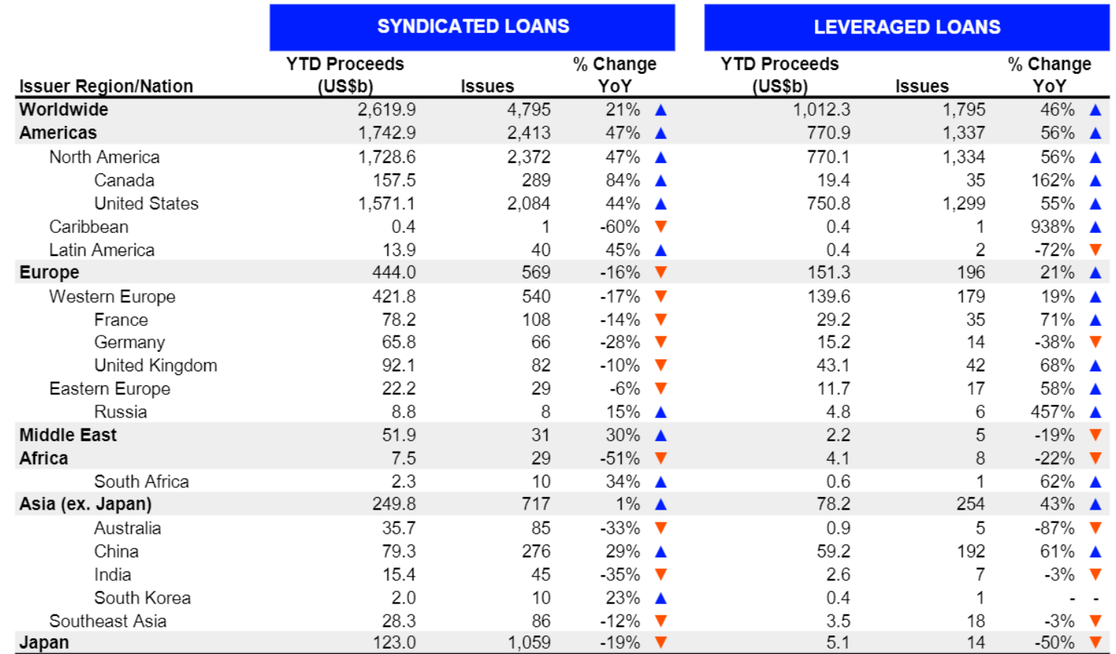

• Fathom Digital Manufacturing, a Hartland, Wis.-based 3D printing firm backed by Core Industrial Partners, agreed to go public via Altimar Acquisition Corp. II at a $1.5 billion valuation. http://axios.link/0nCd 🚑 HeartFlow, a Redwood City, Calif.-based cardiac diagnostic platform, agreed to go public at an implied $2.4 billion enterprise value via Longview Acquisition Corp. (NYSE: LGV), a SPAC formed by healthcare hedge fund Glenview Capital. HeartFlow had raised over $550 million from firms like USVP, Capricorn Investment Management, Wellington Management and Baillie Gifford. http://axios.link/7X3P • Abri SPAC I, a fintech and insure-tech SPAC, filed for a $50 million IPO. http://axios.link/Ye27 ⚡ Enphys Acquisition, an Ibero-America renewable energy SPAC, filed for a $250 million IPO. http://axios.link/ojSz |     | | | | | | More M&A | | • Intel (Nasdaq: INTC) is in talks to buy GlobalFoundries, a U.S. chipmaker owned by Mudabala Investment Co., for around $30 billion, per WSJ. http://axios.link/wBXL |     | | | | | | Fundraising | | • Nautic Partners, a Providence, R.I.-based midmarket PE firm, is raising up to $2.5 billion for its 10th fund, per an SEC filing. www.nautic.com 🚑 Shore Capital Partners of Chicago raised $366 million for its fourth healthcare private equity fund, plus $213 million for its first business services fund and $107 million for its first real estate fund. www.shorecp.com |     | | | | | | It's Personnel | | • Cécile Cabanis joined Tikehau Capital as deputy CEO. She previously was an EVP with Danone Group. www.tikehaucapital.com • Shang Yanchun and Lu Man both left $1 trillion sovereign wealth fund China Investment Corp., per Bloomberg. Yanchun led a TMT group for CIC Capital, while Man led manufacturing deals. http://axios.link/CN7H |     | | | | | | Final Numbers | Source: Refinitiv Deals Intelligence. Data through July 15, 2021. |     | | | | | | A message from Fidelity | | Fidelity can help lighten the work of your equity comp plan | | |  | | | | Fidelity is the only equity provider top-rated for customer satisfaction for 10 years running. What this means: They deliver service that helps you with your equity compensation plan starting at day one, and continuing beyond. See how. | | | | ✔️ Thanks for reading Axios Pro Rata! Please ask your friends, colleagues and WeWorkers to sign up. |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment