| | | | | | | Presented By Fidelity | | | | Axios Pro Rata | | By Kia Kokalitcheva ·Jul 03, 2021 | | Welcome back to our Saturday edition after last week's break! - Didi's IPO this week is a reminder that companies use corp dev in creative ways to expand their businesses, so we're taking a look at Uber and Twitter (as well as Washington's desire to curb some of that).

- As always, feel free to send me tips or comments by replying to this email or on Twitter @imkialikethecar.

- Playing on my Spotify: A whole lot of London Grammar

Today's Smart Brevity™ count is 1,086 words, a 4-minute read. | | | | | | 1 big thing: Uber's not-so-secret value |  | | | Illustration: Shoshana Gordon/Axios | | | | Uber has amassed a collection of stakes in other transportation and related companies, such as its piece of newly public Chinese ride-hailing giant Didi. Why it matters: These investments once were viewed as consolation prizes but now are worth more than $13 billion. Flashback: After plowing $2 billion into its Chinese operations, Uber sold its China business in 2016 for an 18% stake in Didi (it's now about 12%). - The timing was important, a source close to the deal tells Axios. Uber had just raised $3.5 billion from Saudi Arabia's sovereign wealth fund in May, and executives felt the company was in its strongest position to negotiate a favorable deal as it had showed it could easily raise large bags of cash to keep competing.

- This gave Uber a template when it considered its operations in Russia, which it eventually sold to rival Yandex.

Uber has continued to make these sorts of deals since CEO Dara Khosrowshahi took over in 2017. - While selling Uber's autonomous driving unit was unthinkable under former CEO Travis Kalanick, the company recently shed it in exchange for a sizable stake in Aurora Innovation. In turn, Aurora is now in the process of going public via a SPAC.

- Uber did the same with its "flying taxi" unit.

Between the lines: The pandemic's pressure on Uber to focus on its core businesses, coupled with the reality that self-driving cars will take much longer than predicted, made selling units focused on autonomous driving and bikes the smart move, says D.A. Davidson managing director Tom White. - And unlike Yahoo's valuable stake in Alibaba, which largely propped up Yahoo's valuation as its core business decayed, Uber's ride-hailing and delivery businesses are very much alive and kicking.

- Still, White cautions that even though some of these companies are going public, Uber's stakes aren't cash and aren't as liquid as they seem since they can't be easily offloaded without affecting the price.

- And the newly announced probe into Didi's cybersecurity operations by Chinese regulators could turn into a serious problem (it's already put a damper on its stock price).

The bottom line: "While some of these investments are strategic and Uber will remain involved for the foreseeable future, others are likely to be significant sources of liquidity," Uber CFO Nelson Chai said on a Q1 earnings call with analysts. |     | | | | | | 2. What's trending at Twitter |  | | | Illustration: Sarah Grillo/Axios | | | | Twitter has used the past year to supercharge new product development ambitions with a slew of acquisitions, while some of its larger rivals have been slowed down by antitrust investigations. Why it matters: Twitter has been criticized by users for not evolving its product to keep up with new trends and user needs. - It also infamously shut down some of its high-profile acquisitions, including Vine and Periscope.

Zooming in: A number of Twitter's most recent buys — such as Scroll, Revue, Squad and Breaker — have directly fed into some of its main product expansions. - Scroll, an app that removes ads from news sites for $5, and newsletter service Revue are padding Twitter's subscription-based offerings.

- Podcast-listening app Breaker and video-chat app Squad rolled up into the company's Spaces product, its audio chatroom competitor to Clubhouse (which Twitter tried to buy for $4 billion).

What they're saying: "When Jack [Dorsey] came back to the company [in 2015]… he worked so hard to define our purpose and then to fiercely prioritize what those initiatives are," Jon Chen, Twitter's newly appointed head of corporate development, explains of the company's M&A approach. - Chen, who joined Twitter in 2013, adds that priorities that are often changing can lead to acquisition missteps.

The big picture: Twitter's recent approach is reminiscent of Snap, which has cleverly acquired nascent companies to incorporate innovative tech. - For example, Snap's early acquisitions of Scan, which became its Snapcodes; Looksery, the backbone of its Lenses feature; and Vergence Labs, the foundation of its connected eyewear, Spectacles.

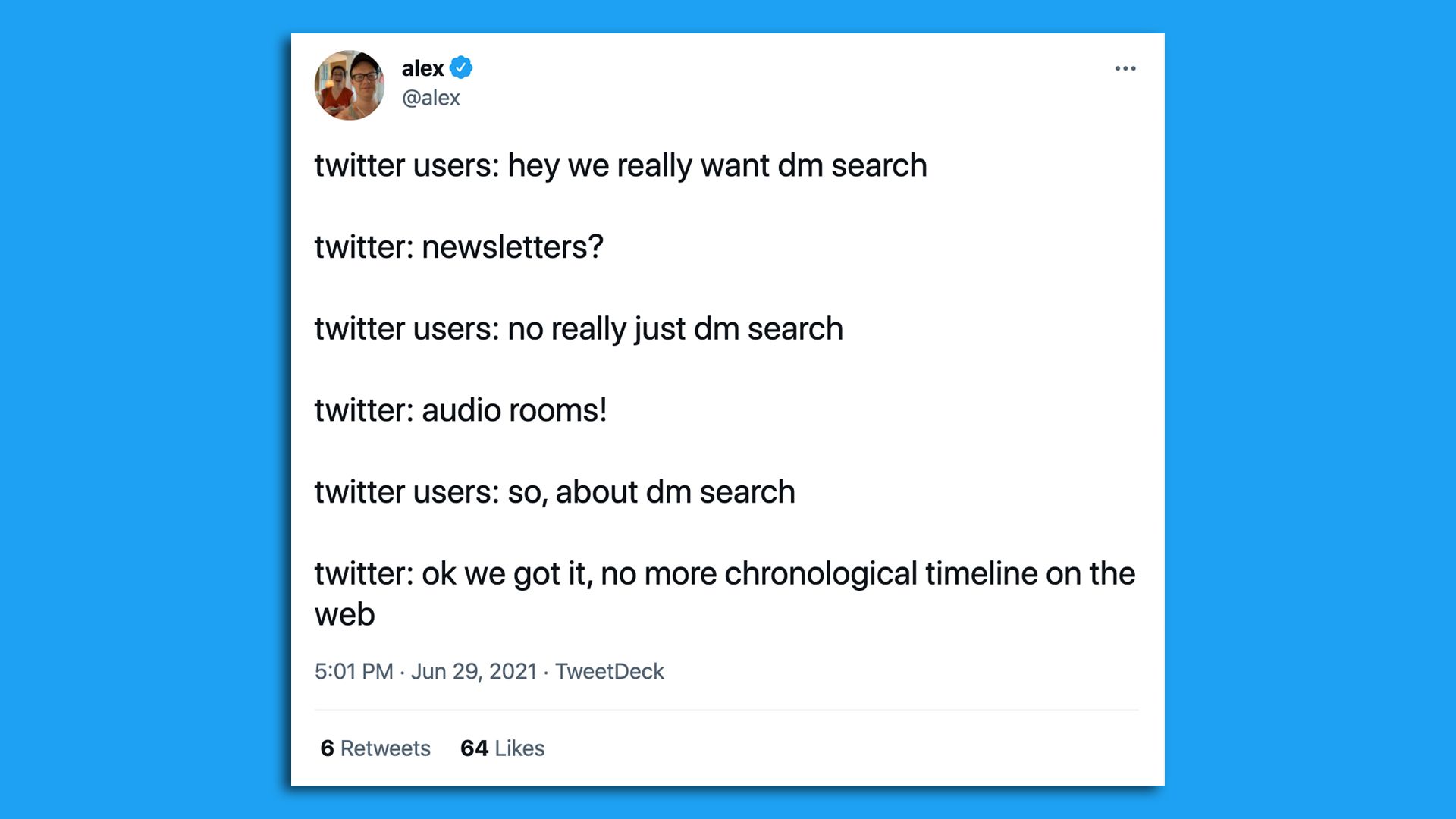

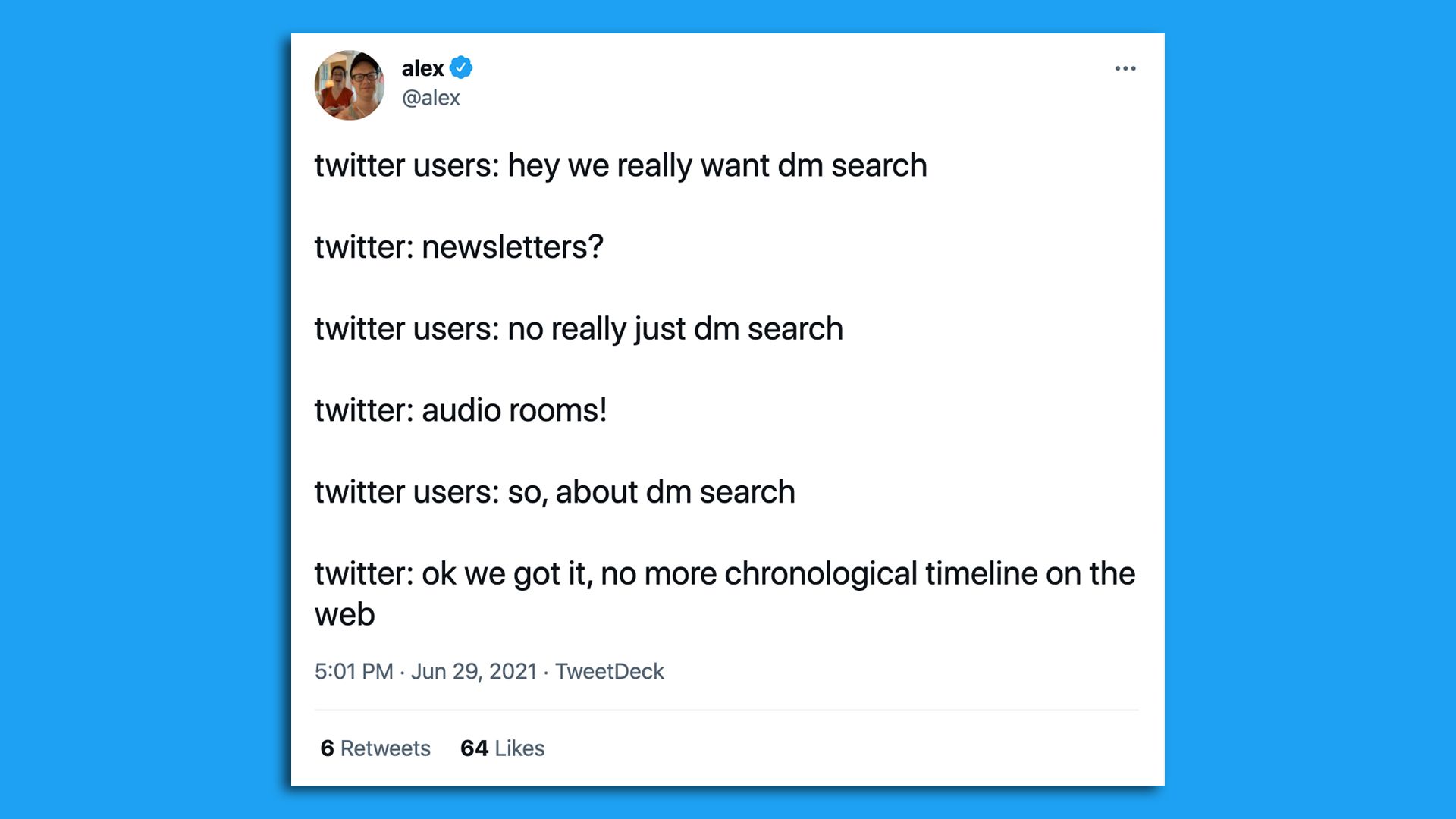

|     | | | | | | Bonus: Meme reactions |  | | | Screenshot via @alex/Twitter | | | | Twitter's Chen is unfazed by the memes lampooning his company's new acquisitions as distractions from fixing long-running product issues. - "For every negative meme that's out there, there are probably more positive ones," he says, adding that user feedback has spawned a number of its popular features.

|     | | | | | | A message from Fidelity | | Need help with your equity comp plan? Fidelity is here | | |  | | | | Fidelity is the only equity provider top-rated for customer satisfaction for 10 years running. What this means: They deliver service that helps you with your equity compensation plan starting at day one, and continuing beyond. See how. | | | | | | 3. Meanwhile, on the Hill... |  | | | Illustration: Brendan Lynch/Axios | | | | M&A is a popular tool among tech companies — and Washington is intent on doing something about it. State of play: A package of bills recently made it through the House Judiciary Committee, ahead of what proponents hope will be a full House vote. - The Platform Competition and Opportunity Act seeks to stop big tech companies from buying up startups they see as potential threats, and would require them to show that a deal would not harm competition in their market.

- The Merger Filing Fee Modernization Act would raise fees for mergers valued at $1 billion or more to better finance enforcement agencies.

Between the lines: M&A has been a hot topic in the antitrust discussion among lawmakers and regulators. - The argument usually goes something like this: A big tech company, seeing a small new one creating an increasingly popular competing app, swoops in to buy the young startup with its piles of cash and promises of exciting work, thereby taking out potential threats before they become significant.

- On the other side: Silicon Valley insiders argue that selling to a larger company is a valuable Plan B that makes it easier for entrepreneurs to make the leap. And of course, it offers more opportunities for venture capitalists to get returns on their investments.

Yes, but: Representatives from California, whose state is home to three of the targeted companies, are split on the bills, suggesting the road to passage might be rocky. |     | | | | | | 📚 Due Diligence | - VCs push back on DOJ antitrust concerns (Axios)

- In deal with Didi, Uber frees itself to expand in other markets (Bloomberg)

- Snapchat has changed through acquisitions, and it's hunting for more people and tech to buy (LA Times)

|     | | | | | | 🧩 Trivia | | Snapchat infamously turned down an offer from Facebook in 2013 to be acquired for $3 billion, but in 2006, Facebook had turned down its own similar offer. - Question: Who wanted to buy Facebook and for how much? (See answer below.)

|     | | | | | | 🧮 Final Numbers |  Data: Uber; Chart: Axios Visuals Note: All numbers are from Uber's 2021 Q1 earnings disclosures, with the exception of Didi, which is the most current size of its stake, according to Uber. |     | | | | | | A message from Fidelity | | Going public? Get your equity comp plan started right | | |  | | | | Fidelity Stock Plan Services is here to provide strategic, actionable insights from decades of helping companies with equity compensation plans. Learn how Fidelity Stock Plan Services can help you make key equity plan decisions–from day one. | | | | 🙏 Thanks for reading! See you on Tuesday for Pro Rata's weekday programming, and please ask your friends, colleagues and favorite M&A execs to sign up. Trivia answer: Yahoo offered to buy Facebook for $1 billion in 2006 (a sum that sounds so quaint now that it's hit $1 trillion in market cap). |  | | It'll help you deliver employee communications more effectively. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment