| | | | | | | Presented By Chime | | | | Axios Markets | | By Aja Whitaker-Moore ·Jun 25, 2021 | | Welcome back! Thank you for all of your messages and kind words over the last few weeks. - Starting on Monday, Sam Ro will be sending this newsletter to your inbox every day! Stay in touch at aja.moore@axios.com or on Twitter @AjaWMoore.

🚨 Situational awareness: May PCE data is scheduled to be released at 8:30am ET. The PCE index is the Fed's preferred measure of inflation and rose 0.7% in April. Today's T.G.I.F. Smart Brevity count is 1,091 words, 4 minutes. | | | | | | 1 big thing: Jobless claims are a useless indicator |  | | | Illustration: Sarah Grillo/Axios | | | | The Department of Labor's weekly tally of initial claims for unemployment insurance has become an unreliable economic indicator, writes Axios Markets correspondent Sam Ro. Why it matters: Initial claims data has been popular among economists, traders and forecasters because it's published more frequently than any other major report on the economy. Driving the news: According to Labor data released Thursday, 411,000 Americans filed initial claims last week. While this was higher than the 380,000 expected, at least one top economist warns there are issues with the data. What they're saying: "[F]ilings can be impacted by a range of different factors and we think the data could be particularly noisy now that some states have started reducing the programs available for benefits and more states plan to do this in the coming weeks," wrote JPMorgan economist Daniel Silver on Thursday. - On June 12, Alaska, Iowa, Mississippi and Missouri phased out extra benefits that were added in response to the pandemic. Eight more states did the same the following week.

- According to the new report, Iowa, Mississippi and Missouri reported declines in claims from the prior week, while Alaska saw the number rise.

- But Labor itself implies that we shouldn't read too much into the changes, explicitly stating that the newest weekly claims numbers "are not directly comparable to claims reported in prior weeks."

If all that weren't enough, Maryland announced on Monday that it found 508,000 potentially fraudulent claims since May, which is massive for just one state. And this may just be scratching the surface. The big picture: "All of these types of issues make it challenging to use the claims data to get a reliable signal about labor market conditions," Silver said in his report. Be smart: These are just claims. And anyone can file a claim. Even people with jobs who have no chance of qualifying for payment. - Currently, only around 36% of those filing an initial claim ultimately qualified and received a benefit payment. It was even worse last year, going as low as 20% during much of the year.

- This is far below the pre-pandemic trend of 40%-45%.

- "Many states are still having a problem with backlogs [of unprocessed claims]," Jane Oates, a former Labor Department official in the Obama administration, tells Axios' Courtenay Brown.

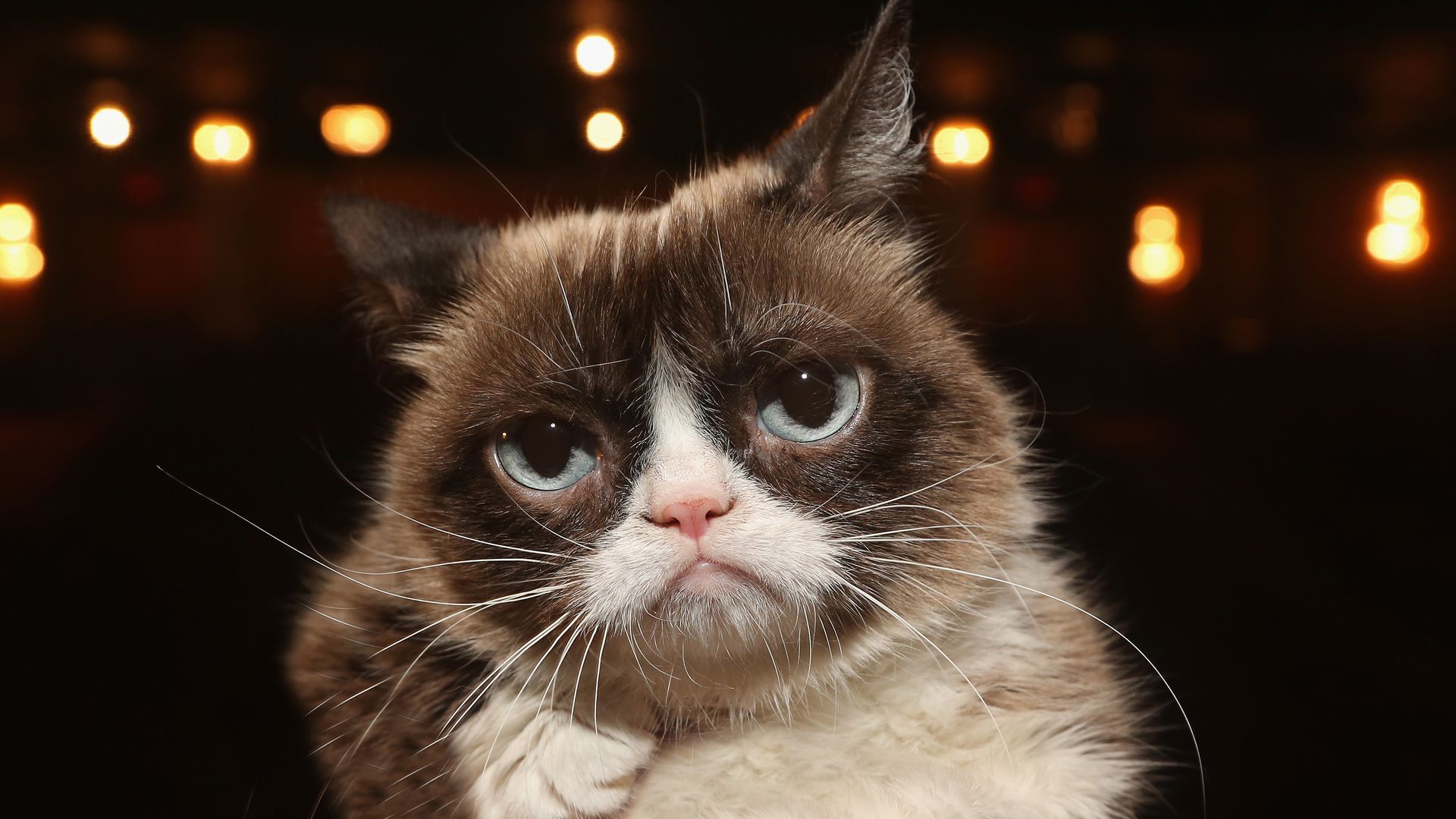

What to watch: These extra UI benefits in all U.S. states will expire by Sept. 4. Maybe by then, some of these other noisy variables will have stabilized and initial claims will be useful again. |     | | | | | | Bonus map: State of jobless benefits |  Data: Axios research; Cartogram: Michelle McGhee/Axios A total of 26 states will have phased out extra unemployment benefits by July 31, Sam writes. Why it matters: The availability of these extra benefits has kept at least some workers out of the labor force, a San Francisco Fed study found, exacerbating labor shortages. Yes, but: There are also other factors keeping able workers out of the labor force including fear of COVID-19 and child care issues. |     | | | | | | 2. Catch up quick | | The Fed announced it was lifting dividend and share buyback restrictions on the country's largest banks. (Yahoo Finance) Nike's quarterly earnings crushed expectations as sales surged 96%. (CNBC) Chinese ride-hailing company Didi is looking to raise $3.9 billion in an IPO that could give the company a valuation north of $70 billion. (WSJ) |     | | | | | | A message from Chime | | Chime profits with you – not off of you | | |  | | | | Next week, millions of Chime users will receive their paycheck direct deposits up to 2 days early^. Each month, everyday Americans access $2B early through Chime so they can build wealth and support their local economies. Learn how Chime does it. | | | | | | 3. Businesses are investing in themselves |  Data: U.S. Census Bureau; Chart: Axios Visuals A new Census report on durable goods orders confirms businesses are confident — and they're spending money on themselves, Sam writes. Why it matters: Core capital goods orders, or those for durable goods that aren't aircraft or defense-related, collapsed in 2020 amid the pandemic. Now companies are spending again — on themselves as well as on share buybacks and M&A. By the numbers: The May report showed core orders unexpectedly eased — barely — by 0.1% to $75.2 billion, missing economists' expectations for a 0.6% gain. - However, that level of orders is a whopping 16% above pre-pandemic levels. It was at $66.5 billion in March 2020.

What they're saying: "The underlying trend in core orders is still rising strongly," Pantheon Macroeconomics' Ian Shepherdson said. "Don't worry about the reported 0.1% dip in May core capital goods orders; it followed a huge 2.7% jump in April." |     | | | | | | 4. BuzzFeed finds itself a SPAC |  | | | BuzzFeed enters the limelight. Photo: Bruce Glikas/FilmMagic | | | | BuzzFeed is going public this year, 15 years after it was founded, as part of a SPAC deal that also involves buying Complex Media for $300 million from its current corporate owners, writes Axios' chief financial correspondent Felix Salmon. Why it matters: The expected $1.5 billion valuation for BuzzFeed and Complex combined is significantly lower than the $1.7 billion valuation that BuzzFeed had on its own five years ago. But it's still an eye-watering 375 times last year's net income. The big picture: Because this is a SPAC (special purpose acquisition company) deal and not an IPO, BuzzFeed doesn't need to reveal how much money it has been losing in recent years. - Instead, the official presentation concentrates on forward projections, such as a forecast that revenue will rise from $421 million in 2020 to over $1 billion in 2024. (The actual revenue growth rate in 2020 was -1%.)

What they're saying: BuzzFeed has no shortage of BuzzWords in its official press release. - "BuzzFeed has developed a scalable, repeatable, data-driven flywheel to ensure a steady flow of fresh and relevant content," we're told, which will help "accelerate revenue growth through synergies and monetization opportunities".

Felix's thought bubble: OMG LOL WOW. |     | | | | | | 5. The stock market's bet on mental health care |  Data: Yahoo Finance; Chart: Axios Visuals Mental health care provider LifeStance Health has traded publicly for two weeks, and its stock has soared 57% from its $18 IPO price, giving the company a $10.6 billion valuation, writes Axios' Bob Herman. Why it matters: LifeStance's business rests on the idea that future demand for mental health services will continue to grow in the wake of the pandemic. By the numbers: LifeStance, which is predominantly owned by private equity firm TPG, registered $377.2 million of revenue in 2020 and is on pace for roughly $600 million this year. - As of April, LifeStance operated 370 outpatient clinics with 3,300 psychiatrists, therapists and other mental health clinicians.

The big picture: LifeStance's business model is simple: People aren't getting enough care for their mental health conditions. So, build new clinics, attract mental health providers with better-paying, in-network insurance contracts, and then take a cut. - Mental health providers are more likely than any other specialty to be in their own practice, which means solo practitioners don't have leverage against large insurance companies and consequently are out-of-network.

The bottom line: "There's not a shortage of clinicians. There's a shortage of clinicians accepting commercial insurance," said LifeStance CEO Mike Lester, who owns roughly 6% of the company, a stake worth more than $600 million. Go deeper. |     | | | | | | A message from Chime | | Chime reduces service fees to help people build wealth | | |  | | | | Americans pay nearly $9 billion a year in overdraft bank fees. Chime is changing that. By providing early access to direct deposits^, eliminating service fees & creating ways to safely build credit history, Chime helps Americans get ahead. | | | | Thanks for reading! |  | | The tool and templates you need for more engaging team updates. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment