| | | | | | | Presented By Northern Trust | | | | Axios Markets | | By Aja Whitaker-Moore ·Jun 17, 2021 | | Welcome back Thursday crew. (Today's Smart Brevity count: 1,203 words, 4.5 minutes.) Send tips, or feedback to aja.moore@axios.com or write to me on Twitter @AjaWMoore. | | | | | | 1 big thing: The day everything — and nothing — changed |  | | | Illustration: Sarah Grillo/Axios | | | | The Federal Reserve surprised the market Wednesday with new hints about its timeline for a rate liftoff — and an acknowledgment of taper talk, writes Axios' Kate Marino. Investors were on one hand relieved the Fed may act to keep the market from getting (more) overheated, and on the other skittish about the pending removal of the punchbowl. Why it matters: The signals point to a Fed that's increasingly willing to contemplate a pullback from the emergency market support that began last spring in reaction to the pandemic. But don't expect these changes to happen any time soon. What changed: The "dot plot" of Fed member sentiment indicates a median expectation of two rate hikes by the end of 2023, up from zero. (More on the dot plot below.) - Fed chair Jerome Powell acknowledged that this week's meeting of the Federal Open Market Committee is the "talking about talking about tapering" meeting.

- That means that it may actually begin discussing the appropriate timeline to taper its $120 billion per month asset purchases at its next meeting (July 27-28).

What didn't change: There still won't be any tapering until December or the beginning of next year — at the earliest. - The Fed still isn't likely to hike interest rates for years.

What they're saying: "The Fed is still going to be remaining accommodative from a policy standpoint," Don Ellenberger, senior portfolio manager at Federated Hermes, tells Axios. - Especially considering the "real" fed funds rate, after accounting for inflation of around 2%, will be negative for the next two or three years, Ellenberger notes.

State of play: Markets went into risk-off mode, with equities declining and the Treasury yield curve flattening somewhat. - The market's reaction is probably "a bit of digestion, and a bit of position-squaring," Ellenberger says. After that works its way through the system, markets may very well return to new highs in the short term.

Our thought bubble: Axios' Felix Salmon points out that rates have been at zero for well over a year and will remain at zero for well over a year, which makes all Fed announcements inherently anticlimactic. - In a desperate attempt to find something — anything — to seize upon, observers turn to the dot plot and parsing the semantics of "talking." But the big picture remains exactly what we knew it would be: No change to anything.

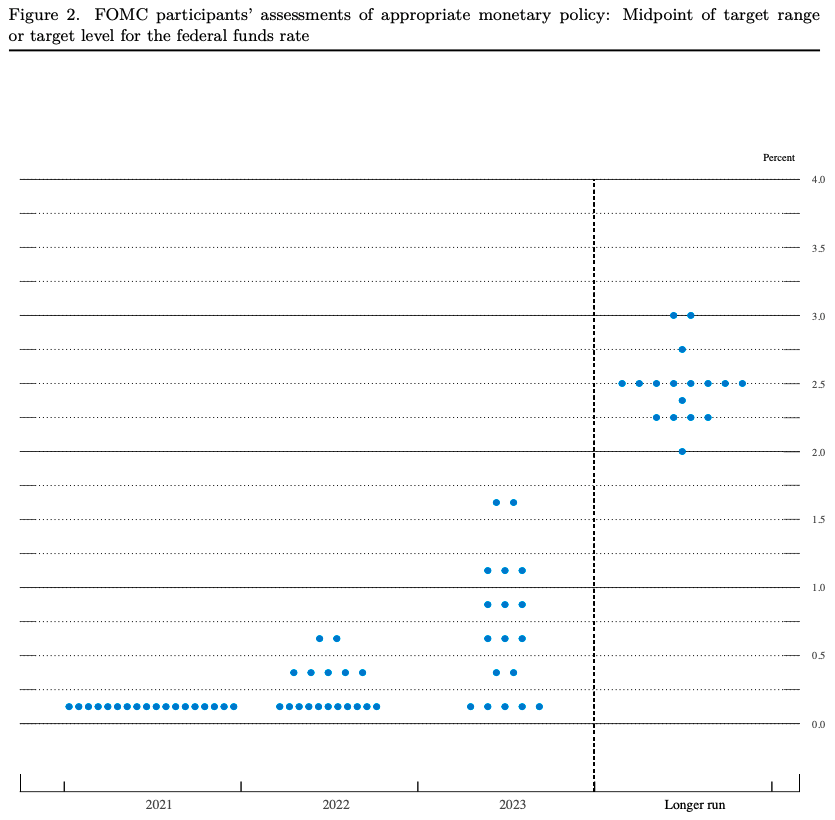

|     | | | | | | 2. Catch up quick | | The Republicans' House campaign arm will begin accepting contributions in cryptocurrency. (Axios) Trading revenue at some of the biggest investment banks is tumbling from last year's blockbuster levels. (WSJ) The World Bank has rejected El Salvador's request to help the country implement bitcoin as legal tender, potentially hampering the government's goal of making the digital currency accepted across El Salvador within three months. (Axios) |     | | | | | | 3. Here are the dots. Now ignore them. | | Chart: Federal Reserve Board The Fed updated its "dot plot," which tallies where each member expects the benchmark fed funds rate to be at the end of 2021, 2022 and 2023, Axios' Markets correspondent Sam Ro writes. Driving the news: The new median dots imply there would be two rate hikes by the end of 2023. This compares to the March dot plot that implied no rate hikes in that year. - Stocks sold off and interest rates jumped on the change, suggesting market participants are worried tighter monetary policy is coming sooner.

What they're saying: Powell explicitly pushed back on this interpretation, saying: "Dots are not a great forecaster of future rate moves. … Dots are to be taken with a grain of salt." Others former Fed chairs agree... "I think that one should not look to the dot plot, so to speak, as the primary way in which the Committee wants to or is speaking about policy." - — Janet Yellen, March 19, 2014"I think you could also retitle this conference "Why We Don't Like the Dot Plot." I think the dot plot is like the advanced level of the video game. If you haven't been to the first 12 levels, forget about the dot plot." — Ben Bernanke, Nov. 30, 2016 |     | | | | | | A message from Northern Trust | | How to navigate possible tax policy changes | | |  | | | | There is much uncertainty and speculation surrounding the ultimate form of tax policy changes announced by the Biden Administration. Gain insight at the intersection of changing tax policy and managing complex wealth from The Northern Trust Institute. Ready for reform? | | | | | | 4. Earnings are lifting the stock market 📈 |  Data: FactSet; Chart: Axios Visuals The stock market's recent trend could be described as just going higher — with the S&P 500 setting its intraday record high of 4,257 on Tuesday. Despite bubble concerns and pockets of investing mania, fundamentals are supporting it, Sam writes. Why it matters: The stock market has rallied almost unabated in the past year, more than recovering all of its early pandemic losses, leading some to question if prices have detached from economic reality and gotten frothy. Be smart: No discussion on stock prices is complete without addressing earnings, specifically expectations for earnings growth. After all, the theoretical value of a company is the present value of all of its future earnings. What they're saying: "The rally in stocks over the past year has been driven entirely by fundamentals," Credit Suisse's Jonathan Golub wrote in a research note, adding that the trajectory of stock prices and the earnings expectations have been rising almost hand in hand as seen in the chart above. The other side: Skeptics note that the market's valuation — as measured by the ratio of price divided by expected earnings — is around 21. This is significantly above its 10-year average of 16, suggesting that stocks may be overvalued. Yes, but: Many experts ranging from the billionaire investor Warren Buffett to the Fed chair himself Jerome Powell have long argued that historically low interest rates justify elevated valuations like what we're seeing today. The bottom line: Stocks are inherently risky, so there will always be reasons to be worried about prices falling. But lack of earnings growth is not one of them. And earnings growth is the most important driver of value. |     | | | | | | 5. How unemployment fraud shows up in economic statistics 👀 |  Data: BLS, The Century Foundation; Chart: Axios Visuals Felix provides a sneak peek of his Axios Capital newsletter, which this week is a deep dive into unemployment fraud. The fraud is not hard to see in economic statistics, once you realize it's there. By the numbers: Before the pandemic, continued unemployment claims — the number of Americans claiming unemployment benefits for two weeks or longer — were counted at 2,152,733. That was one-third of the official number of unemployed Americans, measured in the monthly household employment survey, which was 6,504,000. - Since the CARES Act boosted unemployment benefits, however, continued claims have been consistently significantly higher than the total number of unemployed. In August, for instance, there were 29,570,321 continued claims, which was well over double the official unemployment count of 13,742,000.

How it works: During the pandemic — between the week of March 21, 2020, and the week of June 5, 2021 — there have been a total of 83,506,986 initial claims for unemployment insurance. On top of that, there have been 27,315,075 initial claims for Pandemic Unemployment Assistance, according to data compiled by The Century Foundation. - Add them up, and you get more than 110 million layoffs over the course of the pandemic — out of a total workforce of about 15o million people.

Where it stands: Recently, America has been experiencing a period of massive labor shortages, where employers have been desperate for workers and certainly haven't been laying them off in large numbers. Yet continued unemployment claims are still running at more than three times their pre-pandemic level. Go deeper by subscribing to Axios Capital before noon today! |     | | | | | | A message from Northern Trust | | State of the state: A relocation checklist | | |  | | | | A move across state lines requires careful planning to avoid unintended tax consequences. Review Northern Trust's checklist before relocating to a different state to understand and prepare for the financial implications of your move. Learn more. | | |  | | The tool and templates you need for more engaging team updates. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment