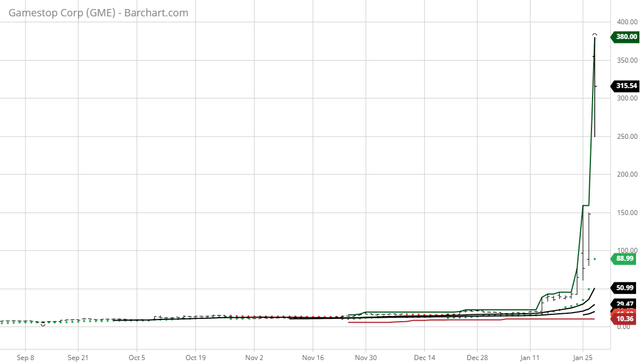

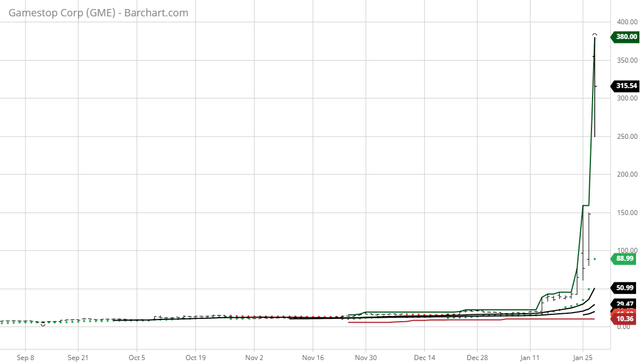

The Barchart Chart of the Day is Gamestop (NYSE:GME). I am not recommending buying at this level but want to answer a question I am asked over and over again: Why didn't I see this stock earlier??!!??.

Barchart gives you 13 different methods to find BUY signals. Today as I write this article Gamestop (GME) hit a hit of 384.36. Lets look at all 13 of Barchart's last BUY signals and were you could have bought in: Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart Opinions with date of last buy signal and price: - Trend Spotter 12/22 @19.46

- 20 DMA 12/17@14.83

- 20-50 MACD 8/21@5.03

- 20-100 MACD 8/26@5.11

- 20-200 MACD 8/28@5.39

- 50 DMA 12/5@13.85

- 50-100 MACD 9/9@7.35

- 50-150 MACD 8/11@4.35

- 50-200 MACD 9/8@7.70

- 100 DMA 8/12@4.52

- 150 DMA 8/12@4.52

- 200 DMA 8/21@5.03

- 100-200 MACD 9/4@7.65

I think Barchart gave you all the BUY signals you ever needed. The first BUY signal the 50-150 MACD came at 8/11@4.35 for a 6,991.15% return. The last Buy signal the Trend Spotter came at 12/22@19.46 for a 1,485.13% return. In my personal screens I was alerted on 9/9 @7.55 for a 3,939.26% return. Don't you think its time to give Barchart a better look?? The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment