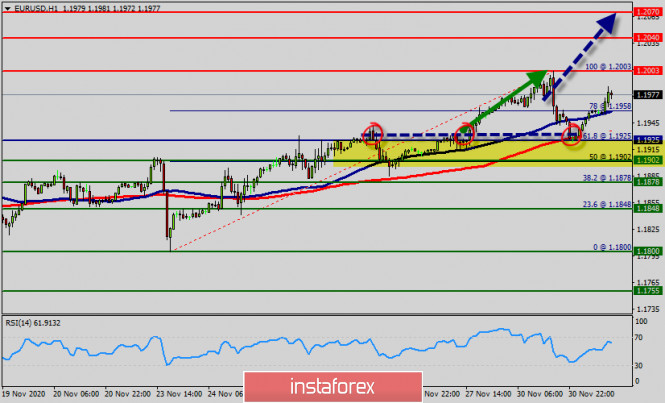

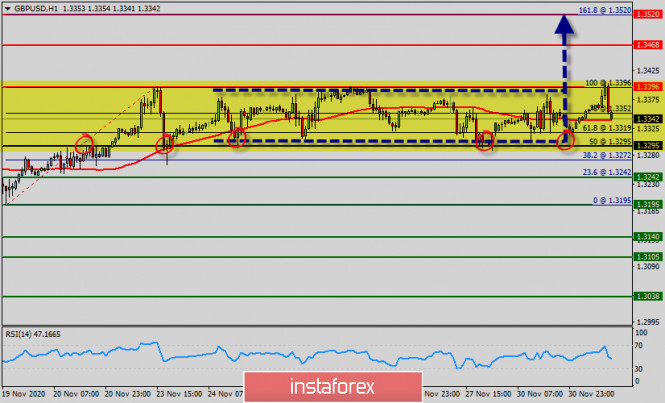

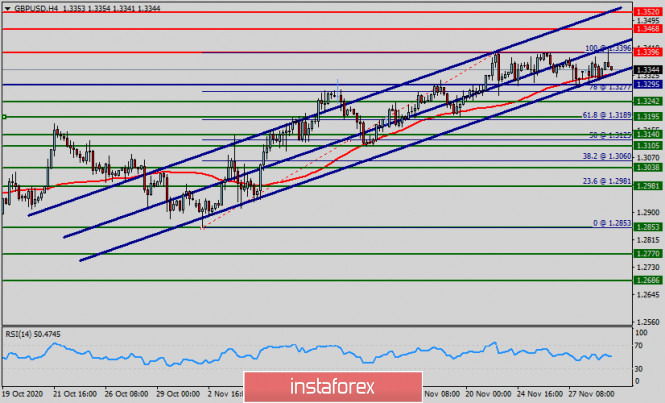

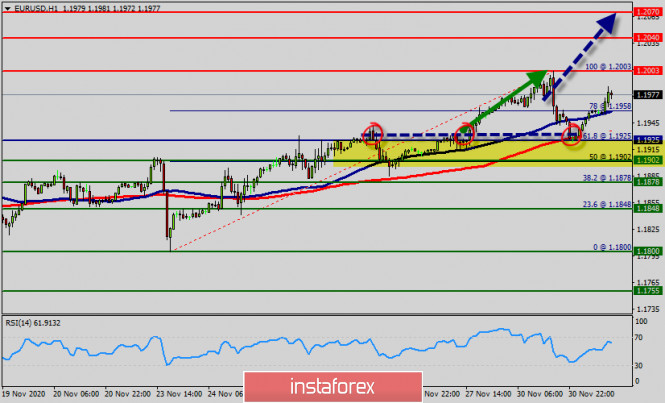

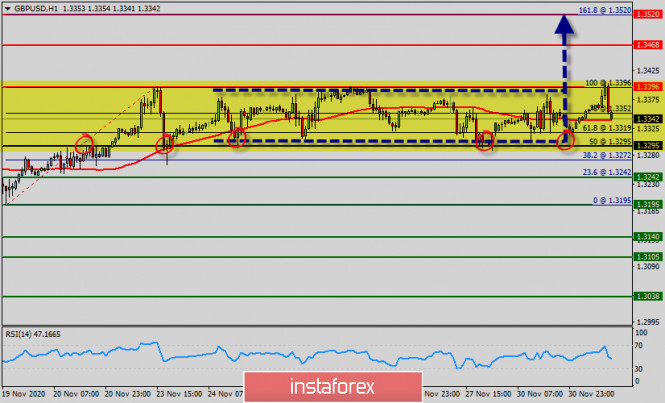

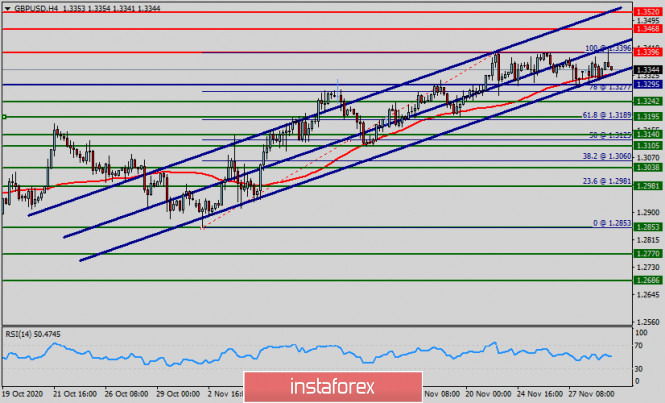

| Technical analysis of EUR/USD for December 01, 2020 2020-12-01  Overview : The EUR/USD pair was trading around the area of 1.1925 - 1.1970 a week ago. Today, the level of 1.1925 represents a weekly pivot point in the H1 time frame. The pair has already formed minor support at 1.1925 and the strong resistance is seen at the level of 1.1925 because it represents the weekly resistance 1. So, major support is seen at 1.1925, while immediate support is found at 1.1958. This resistance (1.1925) has been rejected two times confirming the validity of an uptrend. Please notice that this scenario will be invalidated if the price reverses above the wave 2 highs at the level of 1.1925. If the pair closes above the weekly pivot point of 1.1925, the EUR/USD pair may resume it movement to 1.2003 to test the weekly resistance 1. From this point, we expect the EUR/USD pair to move between the levels of 1.1925 and 1.2040. Equally important, the RSI is still calling for a strong bullish market, because the Relative Strength Index on the one-hour chart is flirting with the 50 level – nearing overbought conditions. As well as the current price is also above the moving average 100. Momentum remains to the upside and the EUR/USD pair is trading above the 100 and 50 Simple Moving Averages. The EUR/USD pair has broken key resistance at the levels of 1.2003, time to buy right now around the spot of 1.2003. Price has finally broken our descending resistance line triggering a strong bullish rise as expected from the are of 1.1925 - 1.2935. We look to sell on strength below major resistance at 1.2003. As a result, buy above the weekly pivot point of 1.1925 with targets at 1.2003 order to form a double top. If the EUR/USD pair is able to break out the first resistance at 1.2003, the market will rise further to 1.2040. In the H1 time frame, the pair will probably go up because the uptrend is still strong. Consequently, the market is likely to show signs of a bullish trend. Since there is nothing new in this market, it is not bearish yet. rebuy deals are recommended above the level of 1.2003 with the targets indicated above. Major resistance is already set at the point of 1.2070. The pair is likely to move upwards continuing the development of a bullish trend to the level of 1.2070 in order to test the weekly resistance 3. However, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss below the last bearish wave at the level of 1.1902. But, we still expect the bullish trend for the upcoming sessions as long as the price is above the 1.1925 price. Trading idea for the EUR/USD pair 2020-12-01  The increased demand for the euro has brought the quote to 1.2, which is the top of the current year. It is not hard to guess how much profit (and sell stops) is under this level.  If you have sold the EUR/USD pair in the medium term for the last 3 months, then your last hope is 1.2. There is simply no other option since it is a trap that will slam shut sooner or later. Therefore, to those who are trading short positions, it is best to close part of it now and to move stop loss below 1.2. If you are just starting to sell right now, it is best to drop this idea and go back to this plan only after the quote falsely breaks out of 1.2. But if you are trading long positions, you can take profit on the breakdown of 1.2. This follows the classic Price Action and Stop Hunting strategies. Good luck! Gold might not succeed in reaching $ 3000 high 2020-12-01  There are a lot of predictions for the gold's price next year, which were mostly positive. However, some experts assess the situation on the precious metals market more realistically, believing that it is almost impossible for gold to reach the level of $3000 for 1 ounce and above. This week began with the gold showing a downward trend. Thus, the market is worried of such a reversal of almost 180 degrees, ignoring the upward trend of recent months. Experts fix the correction of the precious metal, fearing that the negative mood will continue. It can be recalled that gold has shown a stable upward trend over the past two years, from August 2018 to November 2020. Two years ago, the price of gold did not exceed $ 1,180 per ounce, although it rose to a record $ 2,000 from time to time. Yesterday, it declined to a critical $ 1,765 per ounce, which greatly worried the market. Today, the yellow metal slightly rose and overcame this level. So currently, it is trading at $ 1986 per ounce, not going to yield and strive for new peaks.  Currency strategists at Bank of America believe that next year will be tough for the indicated metal. The high probability of the release of vaccines against COVID-19 exerts pressure on its quotes. Earlier, BoA emphasized that this factor significantly influenced the gold's decline. Given the current conditions, experts have adjusted their previous forecast for gold to the downside. Now, the Bank of America believes that it will be unlikely for gold to rise to $ 3000 per ounce. Based on specialists' calculations, its price will move around $ 2063 per ounce. On the other hand, some experts are positive about the short-term prospects for gold. Bank of America believes that the precious metal will still overcome the barrier of $ 2000 per ounce amid monetary stimulus from central banks. Currency strategists at Citigroup bank also expect it to rise to $ 2,500 per ounce. They believe that a number of factors contribute to the rise in the price of precious metals in 2021, primarily the existing quantitative incentive (QE) program, which is supported by regulators. Experts say that this allowed gold to grow throughout 2020. Other factors such as the total weakening of the USD, high risk of inflation, a sharp decline in yields on key assets and strong volatility in financial markets also contributes to the price growth of gold. Technical analysis of GBP/USD for December 01, 2020 2020-12-01   Overview : On the H4 chart, the chart shows an uptrend channel since last week. The currently price is set at 1.3352. The daily pivot point had already placed at the point of 1.3295. The GBP/USD pair will continue to rise from the level of 1.3295 in the long term. It should be noted that the support is established at the level of 1.3295 which represents the 50% Fibonacci retracement level on the H4 chart. The price is likely to form a double bottom in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.3350. So, buy above the level of 1.3350 with the first target at 1.3396 in order to test the daily resistance 1 and further to 1.3396. Also, it might be noted that the level of 1.3396 is a good place to take profit because it will form a new double top. This suggests the pair will probably go up in coming hours. Additionally, the price is in a bullish channel now. Amid the previous events, the pair is still in an uptrend. From this point, the GBP/USD pair is continuing in a bullish trend from the new resistance of 1.3396. On the H1 chart, the trend of GBP/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.3295 and 1.3469. The daily resistance and support are seen at the levels of 1.3396 and 1.3295 respectively. Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. The market will be moving from its bottom at 1.3295 so as to continue to rise towards the top of 1.3396. The GBP/USD pair broke resistance which turned to strong support at the level of 1.3295. The level of 1.3295 coincides with a ratio of50% of Fibonacci, which is expected to act as major support today. The Relative Strength Index (RSI) is considered overbought because it is above 30. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended above 1.3350 with the first target at the level of 13396. From this point, the pair is likely to begin an ascending movement to the point of 13396 and further to the level of 1.3468. The level of 1.3468 will act as strong resistance. The third resistance has alreadt palced at 1.3520. On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.3242, a further decline to 1.3140 can occur which would indicate a bearish market. Elliott wave analysis of EUR/JPY for December 1, 2020 2020-12-01

EUR/JPY started December by testing the important neckline resistance at 125.17 once this neckline finally gives away, that will open up for a rally towards the former peak at 127.02 and ideally closer to the 129.06 target. Short-term, support is seen near 124.34 and agian at 123.90. R3: 126.43 R2: 125.91 R1: 125.42 Pivot: 125.17 S1: 124.34 S2: 123.90 S3: 123.55 Trading recommendation: We are long EUR from 123.46 and we will move our stop higher to 123.80. Trading idea for the USD/JPY pair 2020-12-01  Weak demand for the US dollar has dragged the USD / JPY pair down to the lowest quotes. But even at such lows, the bulls still have hope. The chart below shows how the quotes have pulled back to best price levels, which are within the large daily triangle:  It is not clear yet when the price will go out of this range, but, relying on the bullish pullback, the best strategy to escape it is as follows:  The plan is simple: wait for the quotes to move above the triangle, and then work for another pullback, but this time only half of the earlier price movement. Such is a classic method of removing existing triangles, which also follows the Price Action and Stop Hunting strategies. Good luck! Elliott wave analysis of GBP/JPY for December 1, 2020 2020-12-01

GBP/JPY has recovered nicely from the corrective low of 138.25 and is currently testing minor resistance neqar 139.87 and a break above here, will open up for a continuation higher to the former peak at 142.72 and ultimately above here too for a rally towards 147.38, but for now let's see if a break above minor resistance at 139.87 can be mustard shortly. Support is currently seen at 139.06 and again at 138.93 R3: 140.32 R2: 139.85 R1: 139.47 Pivot: 139.06 S1: 138.93 S2: 138.60 S3: 138.25 Trading recommendation: We are long GBP from 138.35 and we will raise our stop to 138.20. EUR/USD analysis for December 01 2020 - Potetnial for the second downside leg on the EUR and test of 1.1925 2020-12-01 Eurozone Novem  ber preliminary CPI -0.3% vs -0.2% y/y expected Prior -0.3% - Core CPI +0.2% vs +0.2% y/y expected

- Prior +0.2%

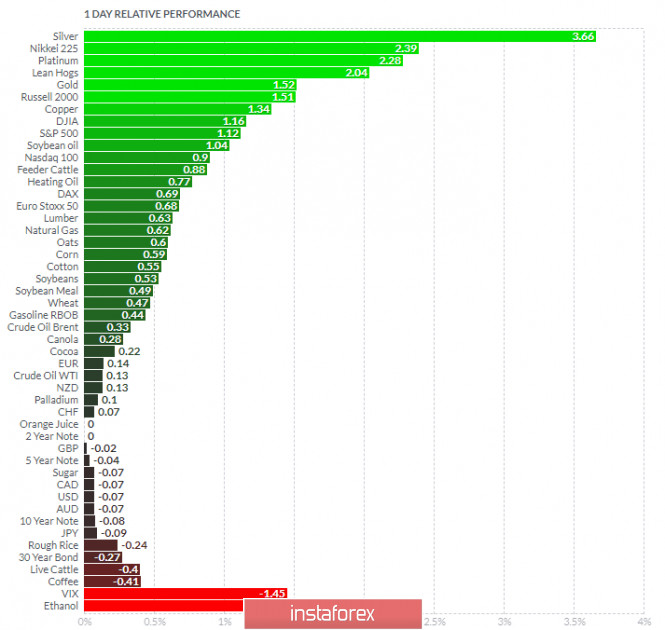

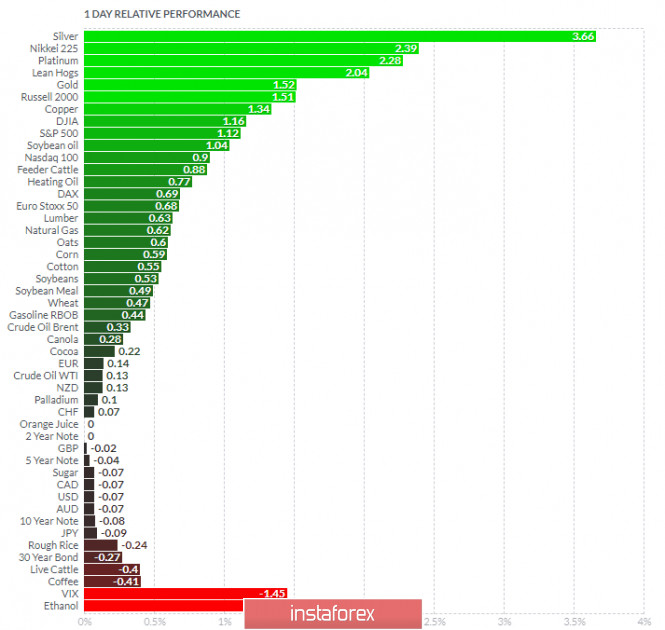

Euro area inflation continues to keep more subdued with the readings unchanged from November, as core inflation stays at a record low. The ECB will be taking added action next month to deal with the fallout from the virus crisis and they will be hoping it will inadvertently spur higher price pressures going into next year as well.= Further Development Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today and the downside roattion would be probably to correct strong upside movement from recent few days. 1-Day relative strength performance Finviz

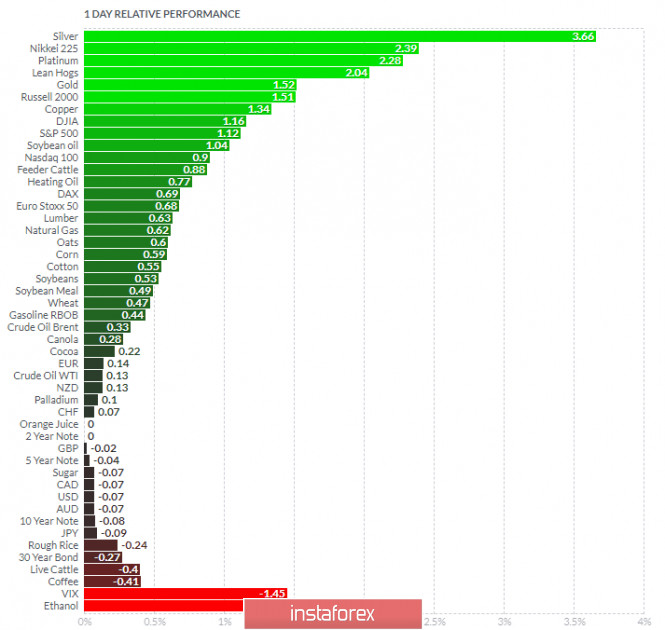

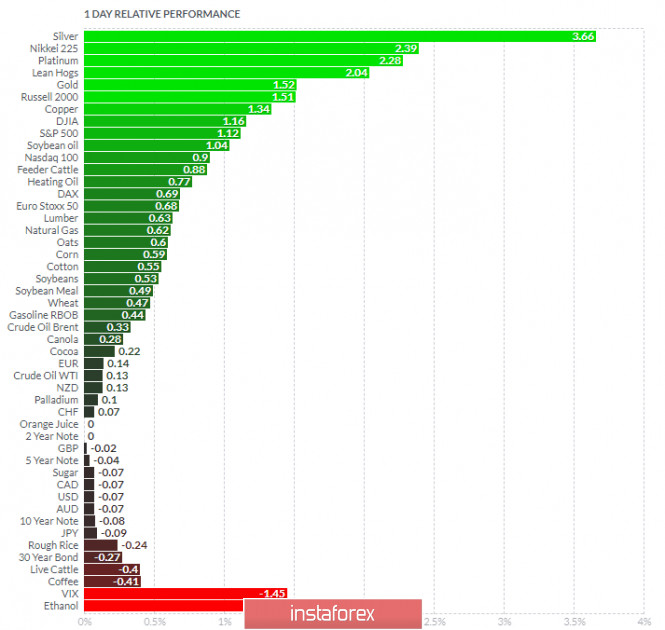

Based on the graph above I found that on the top of the list we got Silver and PLatinum today and on the bottom Ethanol and VIX. Key Levels: Resistance: 1,1985 Support levels: 1,1926 and 1,1914 Analysis of Gold for December 01,.2020 - OVerbought condiiton at the important resistance at $1.810. Potential for the downside rotation towards $1.788 2020-12-01 ECB's Schnabel: 12-month PEPP extension is one option being considered ECB may consider longer duration of favourable TLTRO rate - ECB isn't obliged to do what markets expect from us

- ECB stimulus should sustain, not ease financial stance

- Euro area Q4 economic contraction is very likely

- Stimulus must reflect more protracted pandemic crisis

In other words, she is trying to communicate the message that the need to "recalibrate" in December is largely due to the pandemic crisis being worse than anticipated. As such, they should stick with what worked in March to reflect that.

Further Development

Analyzing the current trading chart of Gold, I found that the buyers got exhausted today and the downside rotation would be probably to correct strong upside movement from recent few hours. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Platinum today and on the bottom Ethanol and VIX. Gold is on the top of the list but with overbought condiiton.... Key Levels: Resistance: $1,810 Support level: $1,788

Author's today's articles: Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko l Kolesnikova  text text Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

ber preliminary CPI -0.3% vs -0.2% y/y expected

ber preliminary CPI -0.3% vs -0.2% y/y expected

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Andrey Shevchenko

Andrey Shevchenko  text

text  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment