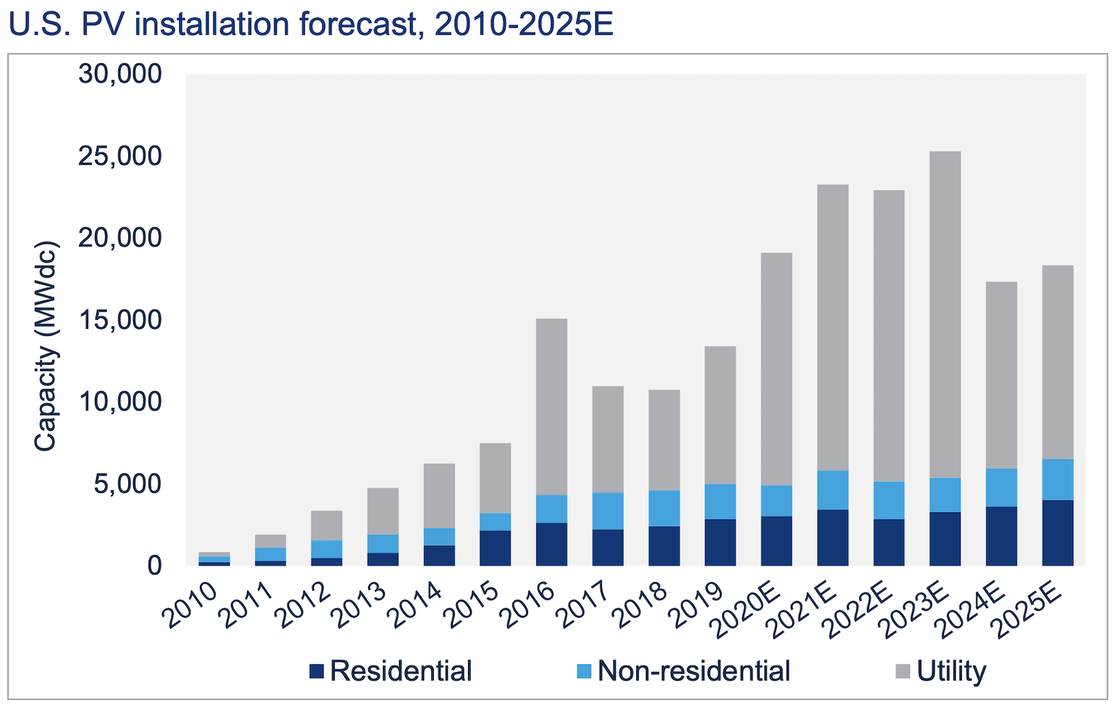

Screenshot of data via Wood Mackenzie's U.S. Solar Market Insight reportNew data released this morning shows that total U.S. solar installations will reach a new record this year. Why it matters: It's one of several recent signs that the trajectory of the renewables sector has been less hampered by COVID-19 than initially feared. Driving the news: The U.S. saw 3.8 gigawatts of new installed capacity in the third quarter, mostly coming from utility-scale projects. Full-year additions are expected to exceed 19 GW, per the consultancy Wood Mackenzie (see the chart above). What they're saying: "As quarterly volumes demonstrate more resilience to pandemic impacts than originally anticipated — with a faster-than-expected recovery for distributed solar — our outlook for the year has increased since last quarter," notes the analysis released with the Solar Energy Industries Association. Where it stands: The report notes that utility-scale projects were only "minimally" affected by pandemic-related construction delays. But the residential market has been on a roller coaster as lockdowns and other forces caused installations to crater earlier in the year. - In California, the biggest market, installations fell 23% in the second quarter but rose 15% in Q3.

- New York was even more dramatic, falling 73% from Q1 to Q2 and then rebounding by 156% in Q3, the report notes.

- Greentech Media (which Wood Mackenzie owns) has more.

The big picture: Separately, a new International Energy Agency analysis of global electricity markets finds that while global electricity demand is falling 2% this year due to the pandemic, renewable power generation rose around 7%. "Long-term contracts, priority access to the grid and sustained installation of new plants are all underpinning strong growth in renewable electricity production," the report released yesterday finds. IEA also said that installations of new global renewable generating capacity will reach a new record this year. Yes, but: As Generate readers know, the global energy mix — in both electricity and elsewhere — is not changing quickly enough to put the world on a path toward sustained emissions cuts consistent with Paris Agreement goals. - And that brings me to yet a third report or at least part of it. Last week the research firm BloombergNEF released its big annual Climatescope analysis of global clean energy investment trends in emerging markets.

- I won't even try to capture the whole thing here, but one finding of note today: "Pandemic-related disruptions now appear to be giving investors pause and slowing emerging markets clean energy investment flows."

|

No comments:

Post a Comment