| Trading plan for the EUR/USD pair on November 26. Global COVID-19 incidence has increased again. The European currency is trying to grow, but a reversal may happen instead. 2020-11-26

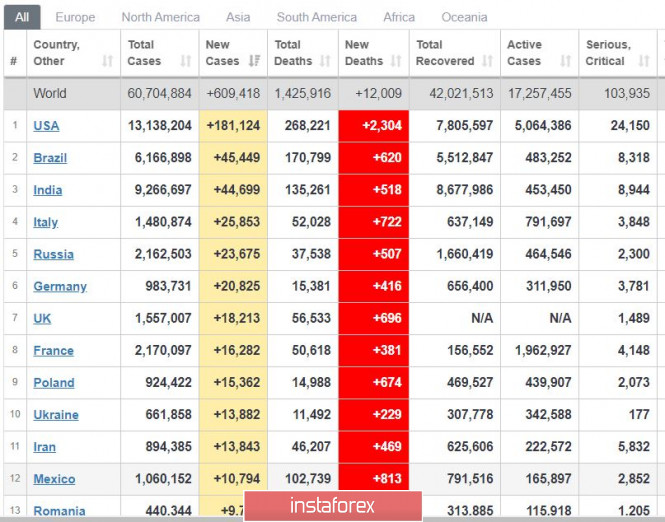

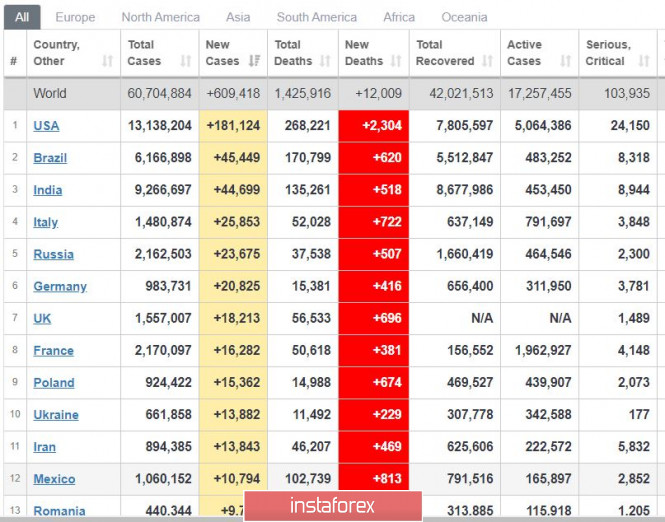

Global COVID-19 incidence has increased again, albeit below November highs. The figure reached 609,000 yesterday, but thankfully is still below the peak which is 660,000. Death rate, on the other hand, has approached new highs, amounting to 12,000 a day. Vaccines developed by Pfizer and Moderna are expected to come out by December 11th, while the drug manufactured by AstraZeneca still needs further observation and approval.

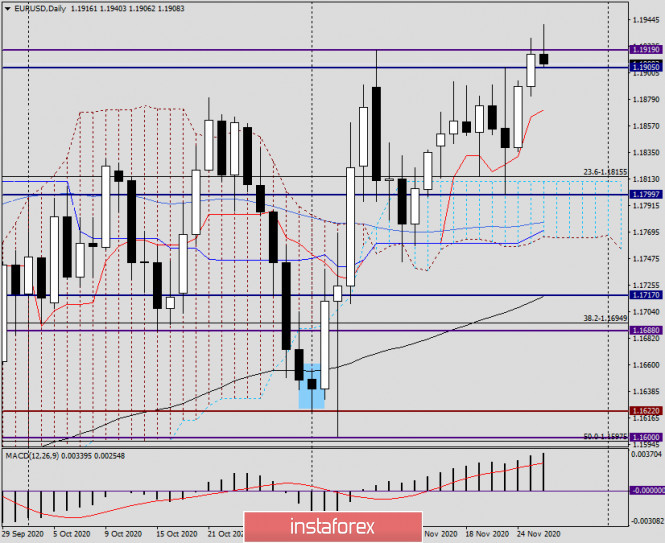

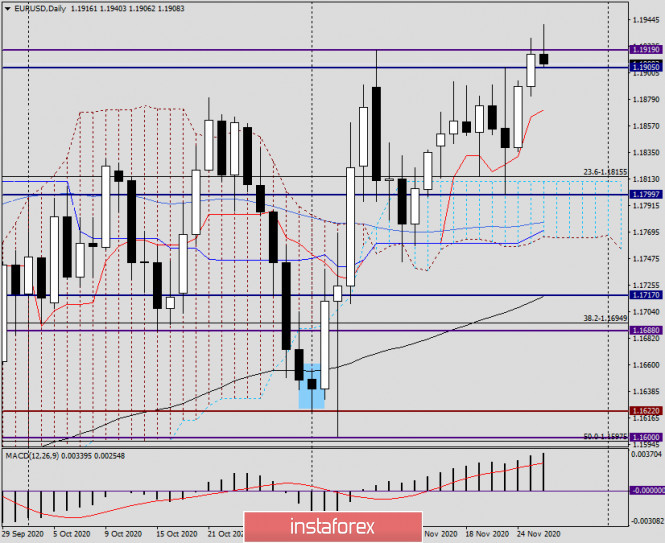

EUR / USD - The euro is trying to grow amid a narrow market, but because of the holiday in the US, market volatility will be low, thereby postponing this attempt. As a result, even if a consolidation above 1.1920 technically signals an upward trend, a sharp downward reversal may occur because of the very sluggish growth. Keep long positions from 1.1906 to 1.1880. Open short positions from 1.1880 to 1.1925. Trading idea for the GBP/USD pair 2020-11-26  The continued weakening of the US dollar, plus the hopes for a post-Brexit deal between the UK and the EU, brought the GBP / USD pair close to the round level of 1.34, which is a good area for sellers to place their weekly stop orders.  The area is about 100 pips away from the level of 1.35:  In this situation, it is extremely risky to be in short positions, because over the medium term, traders could be fooled into placing stop orders at 1.34 and 1.35, which, in most cases, leads to losses. Instead, it would be better to open long positions with buy stop order at 1.34, and then take profit around the level of 1.35. Stop loss may be placed at 1.33. Such guarantees a strong bullish momentum between 1.34 and 1.35. (Price Action and Stop Hunting were used for the above strategy) Good luck! Overview and forecast for EUR/USD on November 26, 2020 2020-11-26 Little has changed in recent days and everything is going as expected. In the United States, Democratic candidate Joe Biden is preparing to take office as President. For several days now, the new White House administration has been actively forming and announcing staff appointments. I will not list everything, however, I will note that Biden is gathering the old guard of "hawks". To make it clear what kind of team Biden is assembling, I will give one very characteristic example. One of the appointees described the bombing of Yugoslavia in 1999 as very weak. It was necessary to bomb harder to finally finish off the Serbs. If you consider that at the very beginning of the election race, Biden called Russia enemy #1, it becomes clear what to expect from the foreign policy of the new White House administration. Meanwhile, the current President, Donald Trump, is celebrating Thanksgiving with the entire nation. The day before, according to the tradition adopted in the United States, he pardoned two turkeys, which this year will not be on the festive table. Trump has already conceded defeat. And although several states are continuing legal proceedings over vote fraud, this is already an empty formality. Despite his controversial policies, Trump, during his presidency, has not unleashed a single military conflict or bombed a single new country. This is the first time this has happened since the elder Bush. Regarding the problem of COVID-19, the second wave of the pandemic is gradually subsiding in Europe, and the authorities of several European countries, on the eve of the Christmas holidays, are preparing to gradually lift restrictions. However, the problem of COVID-19 is still very relevant, and the main issue now is the vaccination of the population. Daily

The EUR/USD currency pair is steadily moving up, breaking through level after level. Now, at the time of writing, the euro/dollar is trading near 1.1920. As previously assumed, the resistance of sellers in the area of 1.1900-1.1920 turned out to be very strong and so far prevents further growth of the quote. However, the closing of yesterday's trading above the significant level of 1.1900 allows us to expect that EUR/USD will still be able to continue the upward trend. If this happens, the next target of the euro bulls will be the most important price area of 1.2000-1.2010, where the key psychological level and trading highs of October 1 this year are held. According to trading recommendations, I suggest looking for options for buying the pair after corrective pullbacks to the price zone of 1.1905-1.1890 or after a true breakdown of the resistance of 1.1920, on a rollback to this level. Let me remind you that a true breakout involves fixing the rate above or below the broken level, depending on whether this is resistance or support. In this case, we consider buying on a pullback to the broken resistance zone of 1.1900-1.1920, if such a breakdown happens. At the same time, if bearish reversal patterns of candlestick analysis appear in the designated resistance zone on the daily, four-hour, or hourly charts, a signal will appear to open sales. EUR/USD analysis for November 26 2020 - Downside breakout of the rising wedge pattern in the background. Potential for drop towards 1.1840 2020-11-26 Eurozone October M3 money supply +10.5% vs +10.3% y/y expected Latest data released by the ECB - 26 November 2020 Slight delay in the release by the source. Broad money growth continues to swell in the euro area, with loans to households keeping steady at +3.1% y/y while loans to corporates were seen at +6.8% y/y - down slightly from the annual change last month. Further Development

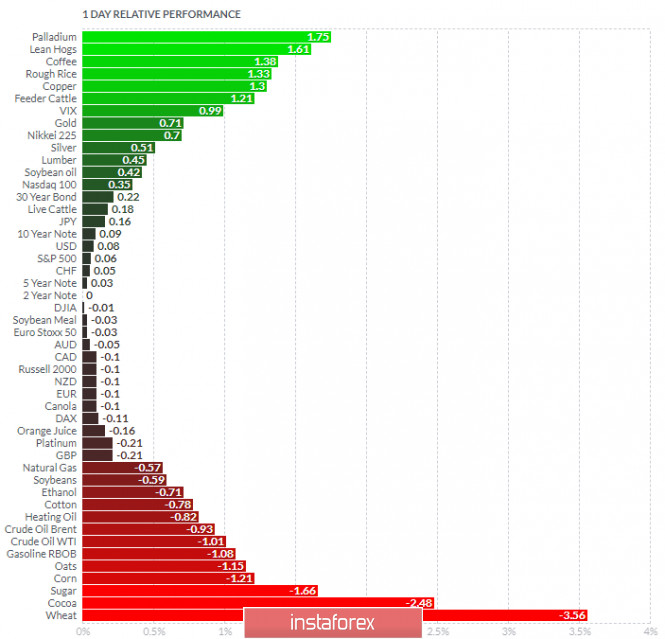

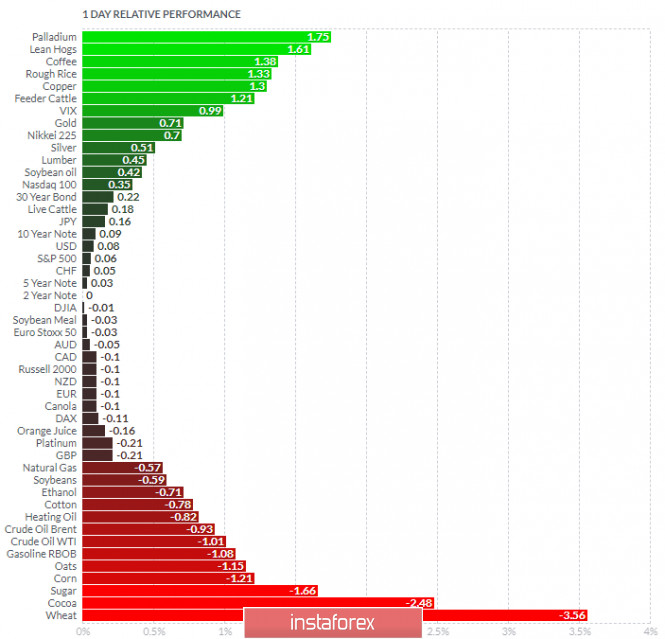

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today andthat EUR got downside breakout of the rising wedge in the background, which is good sign for further downside price.+ Watch for selling opportunities on the rallies with the downside targets at 1,1880, 1,1843 and 1,1804. Key resistance is set at 1,1940 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Palladium and Lean Hogs today and on the bottom Wheat and Cocoa. Key Levels: Resistance: 1,1940 Support levels: ,1880, 1,1843 and 1,1804. Analysis of Gold for November 26,.2020 - Potential completion of the ABC upside correction and downside rotation towards $1.800 2020-11-26 ECB's Kazimir: ECB to focus on recalibration on tools that have worked Comments by ECB policymaker, Peter Kazimir Tools that have "worked". Clearly more hints that rate cuts are off the table for December. This just reaffirms that extending PEPP and enhancing TLTROs are the likeliest options that the governing council will stick with.

Further Development

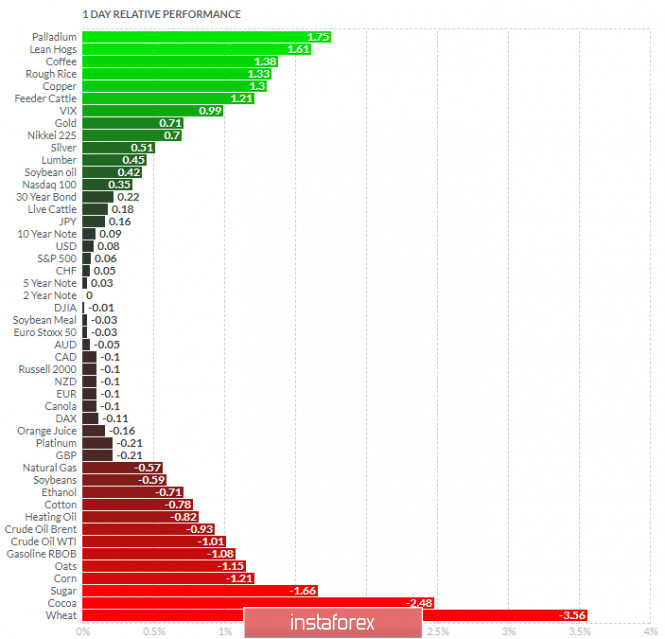

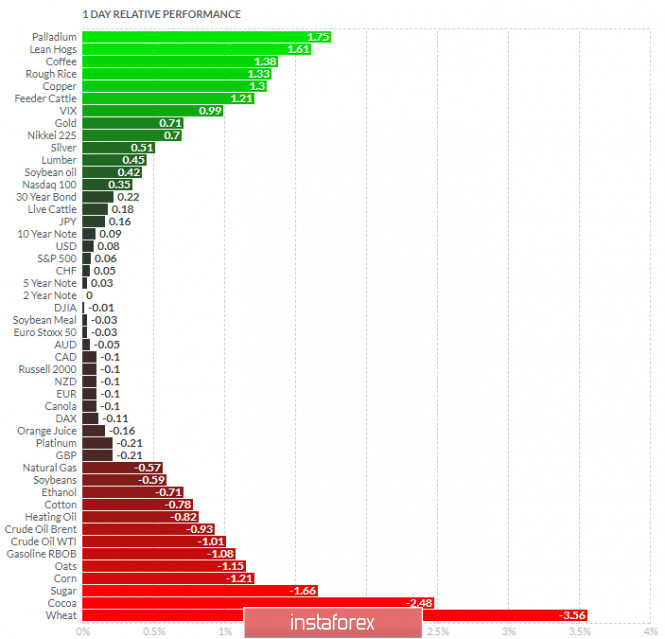

Analyzing the current trading chart of Gold, I found that the buyers got exhausted today andthat Gold might start downside continuation based on the last strong downside swing. Watch for selling opportunities on the rallies. Take profit levels are set at the price of $1,800 and $1,795 Key resistance is set at $1,817/20 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Palladium and Lean Hogs today and on the bottom Wheat and Cocoa. Key Levels: Resistance: $1,817 Support levels: $1,800 and $1,795

Author's today's articles: Mihail Makarov  - - Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

-

-  Andrey Shevchenko

Andrey Shevchenko  Ivan Aleksandrov

Ivan Aleksandrov  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment