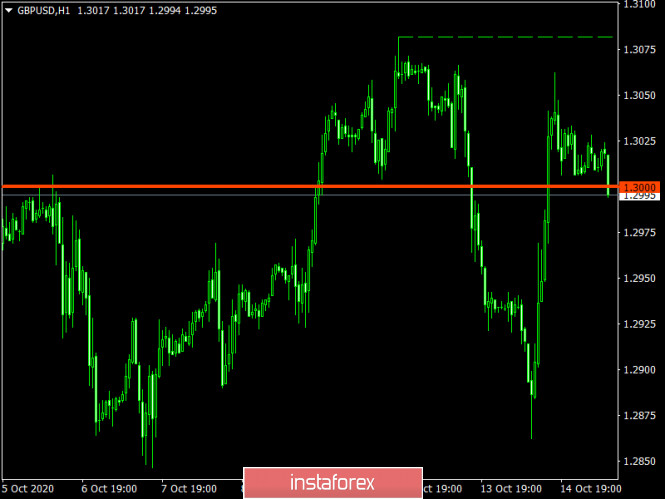

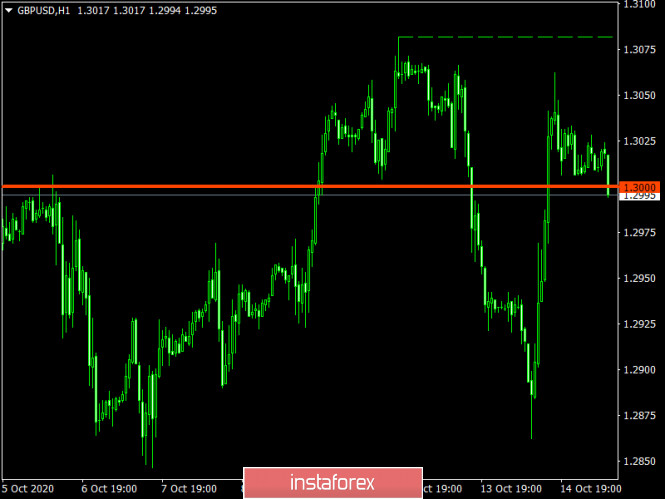

| Technical Analysis of GBP/USD for October 15, 2020 2020-10-15 Technical Market Outlook: The GBP/USD pair has bounced from the main channel upper line seen around the level of 1.2900 and spiked up towards the technical resistance located at 1.3059 again. It looks like this zone will be the key short-term zone for both bulls and bears and only a clear and sustained breakout will show the traders the next direction for Pound. In a case of a bullish scenario, the next target would be 1.3121 and the next target for bears is seen at the level of 1.2868 and 1.2848. Weekly Pivot Points: WR3 - 1.3328 WR2 - 1.3191 WR1 - 1.3137 Weekly Pivot - 1.2992 WS1 - 1.2933 WS2 - 1.2792 WS3 - 1.2730 Trading Recommendations: On the GBP/USD pair the main, multi-year trend is down, which can be confirmed by the down candles on the monthly time frame chart. The key long-term technical resistance is still seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518 is the reversal level) or accelerate towards the key long-term technical support is seen at the level of 1.1903 (1.2589 is the key technical support for this scenario).

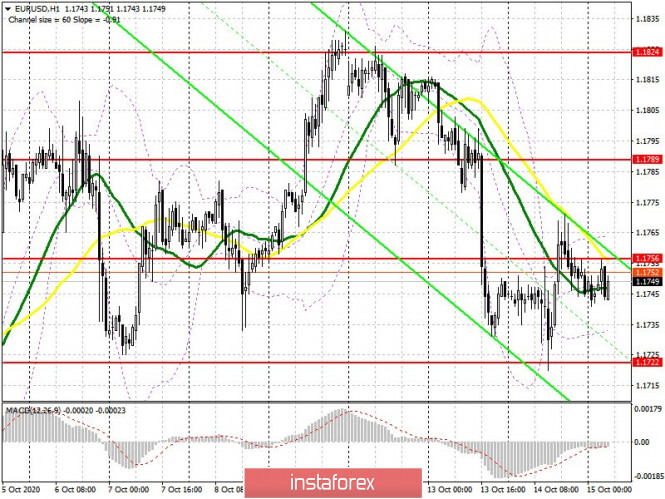

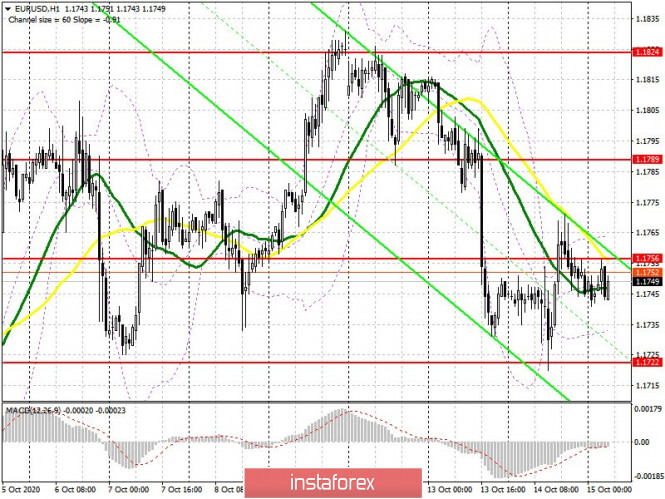

Technical Analysis of EUR/USD for October 15, 2020 2020-10-15 Technical Market Outlook: After the EUR/USD pair had hit the level of 1.1822 again and made a new local high at 1.1830, the bears the reversed all the wave up. This is the 61% Fibonacci retracement level on the weekly time frame chart and had been tested many times in the past and even this time the bears were stronger than bulls again. The market is currently trading at horizontally around the daily lows seen at the level of 1.1746. The nearest technical support is seen at the level of 1.1724, 1.1710 and 1.1696. Weak an negative momentum supports the short-term bearish outlook. Weekly Pivot Points: WR3 - 1.2004 WR2 - 1.1916 WR1 - 1.1875 Weekly Pivot - 1.1792 WS1 - 1.1756 WS2 - 1.1665 WS3 - 1.1629 Trading Recommendations: Since the middle of March 2020 the main trend is on EUR/USD pair has been up, which can be confirmed by almost 10 weekly up candles on the weekly time frame chart and 4 monthly up candles on the monthly time frame chart. Nevertheless, weekly chart is recently showing some weakness in form of a several Pin Bar candlestick patterns at the recent top seen at the level of 1.2004. This means any corrections should be used to buy the dips until the key technical support is broken. The key long-term technical support is seen at the level of 1.1445. The key long-term technical resistance is seen at the level of 1.2555.

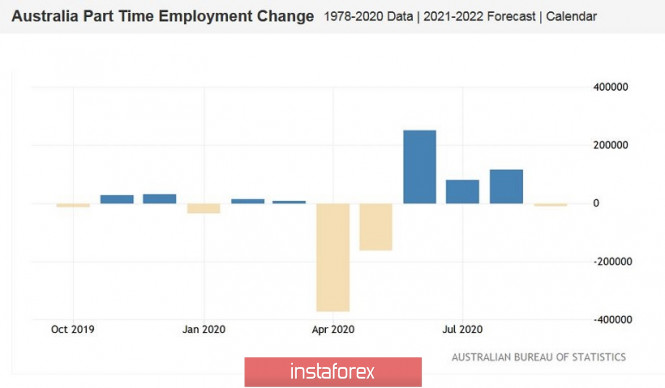

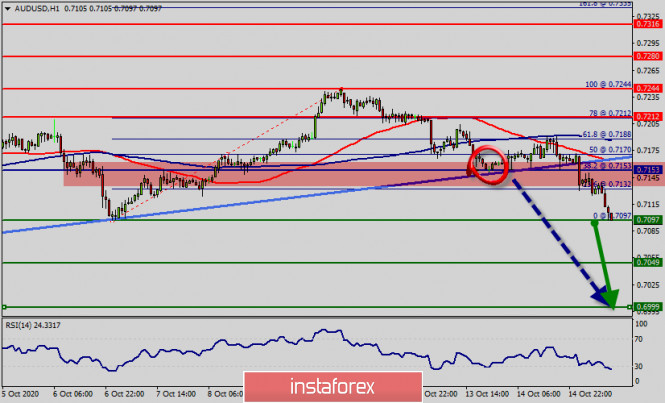

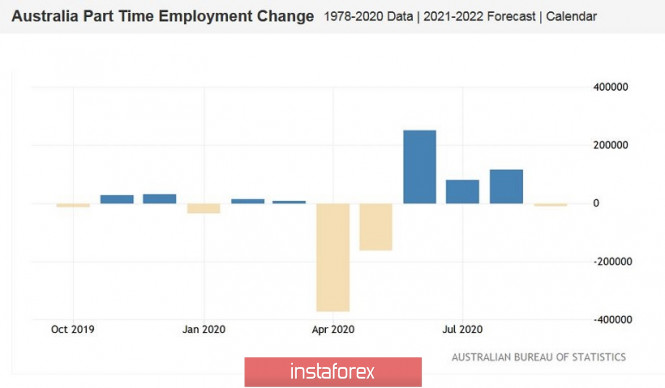

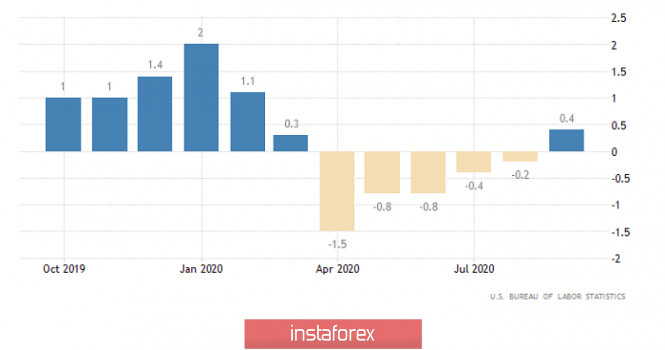

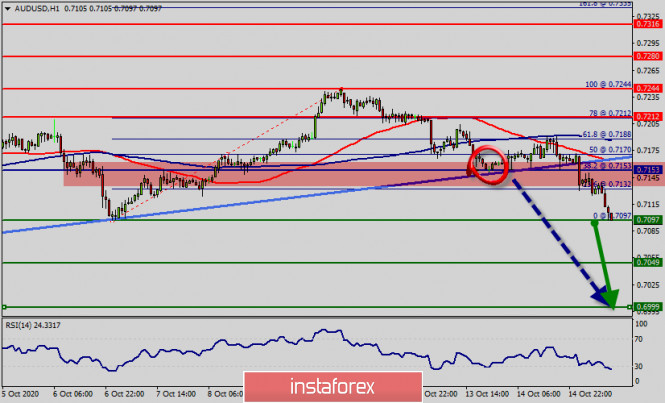

Analytics and trading signals for beginners. How to trade EUR/USD on October 15? Plan for opening and closing trades on Thursday 2020-10-15 Hourly chart of the EUR/USD pair  The EUR/USD pair tried to start a new downward movement last Wednesday night, which we are waiting for, but the sell signal that the MACD provided turned out to be false, and trading over the past 12 hours has been extremely weak. A sell signal from MACD appeared around midnight, but the majority of traders are already asleep at this time. However, if there were those who opened sell positions on the pair, then the current loss on this deal is only 5 points and it can be closed, since the MACD indicator has already moved up again. Therefore, we can expect another round of upward corrective movement and again we have to wait until the MACD indicator turns tp to the downside. Recall that there are more chances for the downward movement to continue after quotes of the euro/dollar pair have gone beyond the ascending channel. At least the price should fall to the 1.1696 level. We have also formed a new downward trend line, which currently has four points of contact with the price. This line also supports the option of moving downward, however, if the price settles above it, this will mean that traders are preparing new buy positions. In general, we can't call this line strong, since it was formed in two days. The fundamental background for the EUR/USD pair remains unchanged. Nothing new in America, which has been the main factor in changes in the exchange rate in recent years. The election topics are smoothly approaching their finale, and the topic of negotiations between Democrats and Republicans has stalled again, but the differences in views on the size of the aid package for the American economy are not as big as before, so there is hope that the two opposing parties can still agree. But there is no news on this right now. A report on US unemployment benefits will be released today. An interesting report in our opinion, but not interesting from the markets' perspective. They probably won't react to it. European Central Bank President Christine Lagarde will deliver another speech in the evening, which she has done almost every day now and this significantly reduces the importance of her speeches. As before, everything will depend on what exactly Lagarde says, and whether she touches on the topic of monetary policy at all. Thus, we advise beginners to pay more attention to technical factors and watch news feeds for unplanned news and events. Possible scenarios for October 15: 1) Buy positions on the EUR/USD pair have ceased to be relevant at the moment, since the pair left the ascending channel. However, if the price settles above the new trend line today, then novice traders can try to open long positions with targets at the resistance levels of 1.1771 and 1.1796. However, we recommend that you be as careful with these positions since the trend line is not strong. 2) Sell positions are still relevant at the moment. However, there is still a lack of a sell signal from MACD. If it forms in the next few hours, and the price remains below or near the trend line (a delicate moment), then novice traders will have the right to open new sell orders with targets at 1.1720 and 1.1696. You can sell the pair even if the price breaks the trend line, but be careful, since the trend line is weak. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. AUD/USD. Disastrous labor market data and RBA chief's "dovish message" 2020-10-15 The Australian dollar was not supported by macroeconomic reports. Data on the Australian labor market, although slightly better than expected, still reflected a slowdown in the recovery process in the country. The "test shot" for the Aussie was a speech by RBA Governor Philip Lowe, which took place against the backdrop of the Chinese indicators' disappointing release. Such fundamentals have reignited speculation that the Reserve Bank of Australia may cut interest rates at the next meeting. In the Australian statistics, the preliminary forecasts did not bode well. According to most experts, the unemployment rate was expected to rise to 7.2%, and the growth rate of the number of employed was expected to decrease by almost 40 thousand. The figures were slightly better in reality than the forecast: unemployment rose to 6.9%, but the number of employed people decreased by 29 thousand. However, we should not pay any heed to the fact that the announcement was released in the "green zone." As a matter of fact, this situation is clearly negative and there is no reason for optimism here.

The unemployment rate is gradually rising again, despite the fact that a decline was recorded in August after a four-month marathon. For comparison: in the "pre-crisis" times, this indicator fluctuated in the range of 5.0%-5.3% for many months. Starting in April, unemployment starts to rise and reaches its peak (7.5%) in July. In August, there was a fairly sharp decline (6.8%), after which there were hopes for a relatively rapid recovery in the Australian labor market. However, the September data showed that it is too early to talk about the recovery of key indicators. The employment growth rate also reflected worrying trends. First, this indicator declined for the first time since May of this year (when the country was just coming out of full lockdown mode). Second, this decrease was mainly due to a reduction in the full employment component. If the indicator of partial employment growth decreased by 9 thousand, the indicator of full employment went into negative territory by 20 thousand. Recall that the RBA reports have repeatedly indicated that full-time positions tend to offer a higher level of salary and a higher level of social security, compared to temporary part-time jobs, resulting in the decline in consumer activity of Australians and weak inflation growth. Therefore, the current dynamics are doubtful to please the members of the Australian regulator. The published Chinese data during the Asian session on Thursday exerted additional pressure on the Aussie. Despite the difficult political relations between Canberra and Beijing, China is still Australia's largest trading partner. Thus, the slowdown in the Chinese economy is also reflected in the Australian's well-being. According to published data, the consumer price index in China (in annual terms) in September increased by only 1.7%. This is the weakest growth rate since March last year. At the same time, this indicator increased by 2.4% in the previous month. The producer price index, which is an early signal of changes in inflationary trends, was also disappointing. This indicator, firstly, remained in the negative area, and secondly, was in the "red zone," falling short of the weak forecast values (-2.1% instead of -1.9%). It is not surprising that the Australian dollar weakened throughout the market against the backdrop of such a fundamental picture. In early October, there were rumors on the market that the Australian central bank will soon reduce the interest rate. This scenario was warned by currency strategists at the country's largest financial conglomerate Westpac, whose position was also supported by AMP Capital, HSBC, and UBS. Economists at these banks predicted a rate cut before the end of this year as "one of the most likely options." However, at the October meeting, RBA members restricted themselves to saying that the regulator "continues to consider how additional monetary easing can support the growth of the labor market as the economy continues to recover." In other words, the Australian regulator did not rule out the option of easing monetary policy, but it did so in a rather veiled way, ergo the Aussie ignored this message at the end of the October meeting.

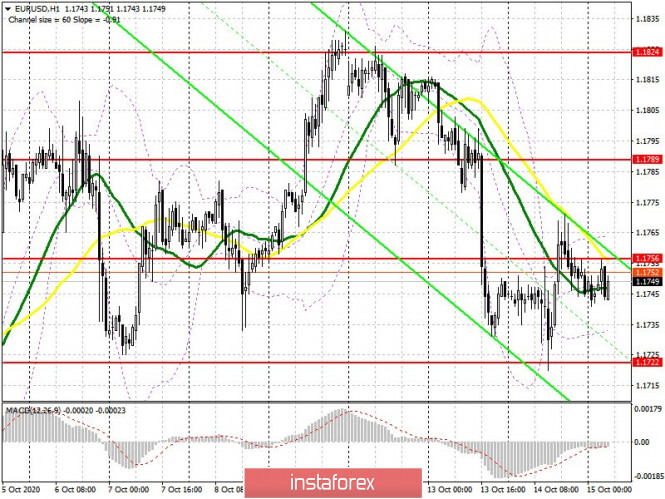

But this signal from the RBA today played with new colors. A few hours before today's release, the head of the Australian Central Bank, Philip Lowe, said that he does not exclude a further reduction in the interest rate to 0.1% (that is, by 15 basis points). However, he ruled out raising the rate for "at least three years." Given these messages, we can conclude that the regulator will still consider easing monetary policy at the November meeting (November 3). Therefore, the dovish rhetoric of the RBA head, the failed data on the labor market, the latest restrictions from China (a ban on the import of Australian coal), and the decline in Chinese inflation suggest that the Australian dollar will soon be under significant pressure. The AUD/USD pair is currently testing the support level of 0.7130 – this is the lower limit of the Kumo cloud on the daily chart. With a high degree of probability, we can assume that the bears will push through this level and go to the main price citadel – to the "round" mark of 0.7000. Given the fundamental background that has developed for the Australian dollar, short positions to the base of the 70th figure are in priority for the pair. EUR/USD: plan for the European session on October 15. COT reports. Bears are pulling the market over to their side. Aim for support at 1.1737 2020-10-15 To open long positions on EUR/USD, you need: Yesterday, buyers of the euro tried to retrieve resistance at 1.1756 and even formed a signal from it to buy the euro, but, unfortunately, a strong upward movement did not take place. If you look at the 5-minute chart, you will see how the bulls managed to settle above 1.1756 and defended this level by testing it from top to bottom, trying to build a new wave of growth. Sellers regained control towards the end of the US session, forming a signal to sell the euro by testing it from the bottom up at the 1.1756 level, but so far this setup has not led to a good downward movement.  Nothing has changed from a technical point of view. Buyers are still focused on resistance at 1.1756, and settling above this level forms a good entry point into long positions while counting on the euro's succeeding growth and also an update of a high at 1.1789. The 1.1824 level will be a distant target, where I recommend taking profits. If the pair is under pressure in the first half of the day since we don't have important fundamental statistics, there is no need to rush to open long positions. Forming a false breakout at the 1.1722 level will be a signal to buy EUR/USD. If bulls are not active at this level, then I recommend postponing long positions until we have updated the low of 1.1688, counting on a correction of 20-30 points within the day. The Commitment of Traders (COT) report for October 6 showed a reduction in long positions and an increase in short positions, which led to an even greater decrease in the delta. Buyers of risky assets believe in sustaining the bull market, but prefer to proceed with caution, as there is no good news about the eurozone and the pace of economic recovery so far. Thus, long non-commercial positions decreased from 241,967 to 231,369, while short non-commercial positions increased from 53,851 to 57,061. The total non-commercial net position decreased to 174,308, against 188,116 a week earlier. which indicates a wait-and-see attitude of new players. However, bullish sentiments for the euro remain rather high in the medium term. To open short positions on EUR/USD, you need:  The bears managed to defend resistance at 1.1756 yesterday afternoon, however the downward movement has occurred. Sellers will have the advantage as long as trading is below this range. Forming the next false breakout at the 1.1756 level will be a signal to open short positions in EUR with the goal of returning to the support area of 1.1722. However, a much more important task is to break out and settle below this range, testing it from the bottom up forms just an excellent entry point for short positions with the goal of pulling down the euro to a low of 1.1688, where I recommend taking profits. In case bears are not active at 1.1756, it is best to postpone sell positions until a larger resistance at 1.1789 has been tested, from where you can open short positions immediately on a rebound, counting on a correction of 20-30 points within the day. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which again indicates a confusion between buyers and sellers. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the lower border of the indicator around 1.1730 will increase pressure on the euro and lead to a larger downward movement for the pair. A breakout of the upper border of the indicator in the 1.1765 area will lead to an increase in EUR/USD. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

EUR/USD: plan for the European session on October 15. COT reports. Bears are pulling the market over to their side. Aim for support at 1.1737 2020-10-15 To open long positions on EUR/USD, you need: Yesterday, buyers of the euro tried to retrieve resistance at 1.1756 and even formed a signal from it to buy the euro, but, unfortunately, a strong upward movement did not take place. If you look at the 5-minute chart, you will see how the bulls managed to settle above 1.1756 and defended this level by testing it from top to bottom, trying to build a new wave of growth. Sellers regained control towards the end of the US session, forming a signal to sell the euro by testing it from the bottom up at the 1.1756 level, but so far this setup has not led to a good downward movement.  Nothing has changed from a technical point of view. Buyers are still focused on resistance at 1.1756, and settling above this level forms a good entry point into long positions while counting on the euro's succeeding growth and also an update of a high at 1.1789. The 1.1824 level will be a distant target, where I recommend taking profits. If the pair is under pressure in the first half of the day since we don't have important fundamental statistics, there is no need to rush to open long positions. Forming a false breakout at the 1.1722 level will be a signal to buy EUR/USD. If bulls are not active at this level, then I recommend postponing long positions until we have updated the low of 1.1688, counting on a correction of 20-30 points within the day. The Commitment of Traders (COT) report for October 6 showed a reduction in long positions and an increase in short positions, which led to an even greater decrease in the delta. Buyers of risky assets believe in sustaining the bull market, but prefer to proceed with caution, as there is no good news about the eurozone and the pace of economic recovery so far. Thus, long non-commercial positions decreased from 241,967 to 231,369, while short non-commercial positions increased from 53,851 to 57,061. The total non-commercial net position decreased to 174,308, against 188,116 a week earlier. which indicates a wait-and-see attitude of new players. However, bullish sentiments for the euro remain rather high in the medium term. To open short positions on EUR/USD, you need:  The bears managed to defend resistance at 1.1756 yesterday afternoon, however the downward movement has occurred. Sellers will have the advantage as long as trading is below this range. Forming the next false breakout at the 1.1756 level will be a signal to open short positions in EUR with the goal of returning to the support area of 1.1722. However, a much more important task is to break out and settle below this range, testing it from the bottom up forms just an excellent entry point for short positions with the goal of pulling down the euro to a low of 1.1688, where I recommend taking profits. In case bears are not active at 1.1756, it is best to postpone sell positions until a larger resistance at 1.1789 has been tested, from where you can open short positions immediately on a rebound, counting on a correction of 20-30 points within the day. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 moving averages, which again indicates a confusion between buyers and sellers. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the lower border of the indicator around 1.1730 will increase pressure on the euro and lead to a larger downward movement for the pair. A breakout of the upper border of the indicator in the 1.1765 area will lead to an increase in EUR/USD. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

GBP/USD: plan for the European session on October 15. COT reports. Pound buyers believe in conclusion of trade deal on Brexit 2020-10-15 To open long positions on GBP/USD, you need: There was an excellent entry point to sell the pound from the 1.3065 level yesterday afternoon, because after the first breakout of resistance at 1.3009, it was not possible to wait for it to be tested from the reverse side. Let's take a look at the 5-minute chart. The bulls began to take profits after testing resistance at 1.3065, which caused the pound to immediately fall to the support area of 1.3009, where it was then possible and necessary to open long positions in anticipation of another wave of the pound's growth. However, there was no major upward movement.  The technical picture has slightly changed at the moment. Buyers will focus on resistance at 1.3059 in the first half of the day, getting the pair to settle in this area will open the possibility for a new wave of growth for GBP/USD in the area of a high of 1.3154. Good news on Brexit will provide support to the pound, which will lead to a test of resistance at 1.3234, where I recommend taking profits. An equally important task is to protect support at 1.2988, just below which the moving averages pass. Forming a false breakout at this level will be a signal to open new long positions, counting on an upward trend. In case bulls are not active in this range, it is better not to rush to buy, but to wait for news on Brexit. In this case, the nearest major support levels will be seen in the area of 1.2923 and 1.2865, from where you can consider buy positions for a rebound upon reaching it, counting on a correction of 20-30 points within the day. The Commitment of Traders (COT) report for October 6 showed a minimal increase in short non-commercial positions from 51,961 to 51,996. Long non-commercial positions slightly rose from 39,216 to 40,698. As a result, non-commercial net position remained negative and reached -11,298 against -12,745, which indicates that sellers of the pound retain control and also shows their slight advantage in the current situation. The higher the pair grows, the more attractive it is to sell. To open short positions on GBP/USD, you need: Sellers need to defend resistance at 1.3059, but a lot will depend on news on the trade deal and on the decisions taken at the Eurogroup meeting. Forming a false breakout at 1.3059 generates a signal to sell the pound, but bad news on Brexit is necessary to exert pressure on the pair. After consolidating below support at 1.2988, we can finally expect the pair to fall and return to the 1.2923 area. I recommend taking profit in the 1.2865 area, since large buyers are most likely present in that area. In the absence of activity in the resistance area of 1.3059, it is best to postpone short positions until the resistance at 1.3154 has been tested, and you can also sell immediately on a rebound from the high of 1.3234. At least you can expect the bull market to stop at these levels.  Indicator signals: Moving averages Trading is carried out above 30 and 50 moving averages, which indicates another attempt by the bulls to take control of the market. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of classic daily moving averages on the D1 daily chart. Bollinger Bands A breakout of the upper border of the indicator around 1.3059 will lead to a large wave of growth in the pound. A breakout of the lower border of the indicator in the 1.2965 area will increase the pressure on the pair. Description of indicators - Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

Elliott wave analysis of EUR/JPY for October 15, 2020 2020-10-15

EUR/JPY dipped to the 61.8% corrective target of wave i at 123.41, which also where the support line from the 114.40 low was seen. This solid support is expected to protect the downside for a break above minor resistance at 123.99 to confirm wave ii has completed and wave iii towards 128.02 is unfolding. R3: 124.18 R2: 123.94 R1: 123.76 Pivot: 123.80 S1: 123.38 S2: 123.19 S3: 123.00 Trading recommendation: We are long EUR from 123.48 with our stop placed at 123.00. Upon a break above 123.99 our stop will be raised to 123.30 Elliott wave analysis of GBP/JPY for October 15, 2020 2020-10-15

GBP/JPY dipped just below our target zone between 135.78 - 136.04 (the low was seen at 135.66) before GBP/JPY rallied strongly through minor resistance at 136.54 to confirm the completion of red wave ii and the onset of red wave iii towards 143.93. Short-term, we could see a re-test of the former resistance at 136.54 now acting as support before the next push higher towards 137.87 and 138.31 as the next minor hurdles to overcome. R3: 137.77 R2: 137.38 R1: 137.15 Pivot: 136.89 S1: 136.76 S2: 136.54 S3: 136.35 Trading recommendation: We are long GBP from 135.71 and we will move our stop up from 135.00 to 135.60. Indicator Analysis. EUR/USD daily review for October 15, 2020 2020-10-15 The pair moved in a side channel yesterday. Moving down, the price tested the pullback level of 50% - 1.1723 (blue dotted line), and then the market went up testing the upper pullback level of 38.2% - 1.1766 (red dotted line). Today, the economic calendar news is expected at 16.00 UCT (Euro), 12.30 and 15.00 UCT (dollar). It is possible to continue working down. Trend analysis (Fig. 1). Today, the market from the level of - 1.1748 (closing yesterday's daily candle) can continue to move down with the goal of 1.1723 - a pullback level of 50.0% (blue dotted line). When testing this level, the price will further work down with the goal of 1.1697 - a pullback level of 61.8% (blue dotted line).  Figure 1 (daily chart). Complex Analysis: - Indicator Analysis – down

- Technical Analysis – down

General conclusion: Today, the market from the level of 1.1748 (closing yesterday's daily candle) can continue to move down with the goal of 1.1723 - a pullback level of 50.0% (blue dotted line). When testing this level, the price will further work down with the goal of 1.1697 - a rollback level of 61.8% (blue dotted line). Alternative scenario: from the level of 1.1748 (closing of yesterday's daily candle), the price may continue to move down with the goal of 1.1723 - a pullback level of 50.0% (blue dotted line). When testing this level, the price will further work down with the goal of 1.1766 - a pullback level of 38.2% (red dotted line). Trading plan for the EUR/USD pair on October 15. Second pandemic wave in Europe and news on the United States 2020-10-15

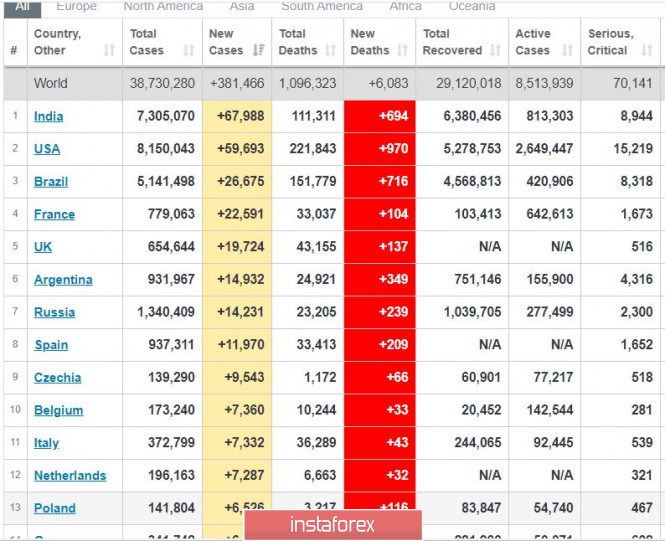

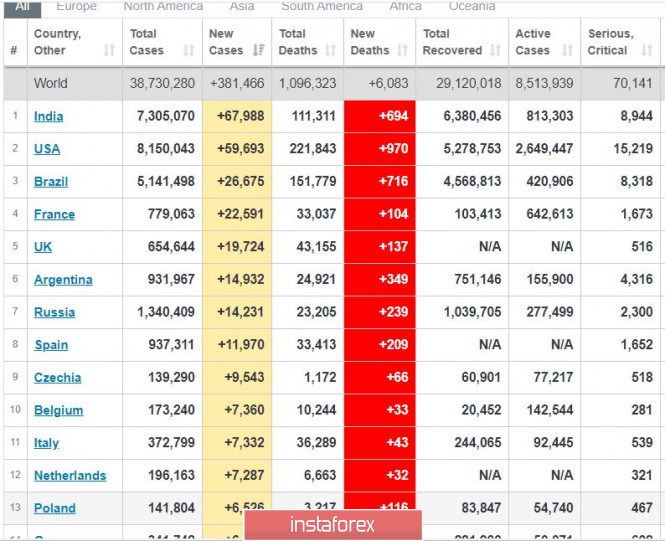

The situation continues to worsen in Europe, as many states again recorded high levels of incidence rate. The leading country is France, which recorded more than 22 thousand new cases, followed by the UK, which listed around 20 thousand. Spain, meanwhile, noted 12 thousand, while the Czech Republic counted more than 9 thousand. Belgium and the others had more than 7 thousand new infections.

The United States will publish its latest employment report today, which will influence the position of the dollar against other currencies in the market. Meanwhile, the euro traded in a narrow sideways channel yesterday, and still does not have a definite direction as of the moment. EUR / USD: Open long positions from 1.1775. Open short positions from 1.1715. Brief trading recommendations for EUR/USD on 10/15/20 2020-10-15

The EUR/USD pair failed to break through the variable support yesterday before the local lows from October 7 and 8 (1.1725 and 1.1732). As a result, there was a rebound with price consolidation above 1.1750. In this case, we should pay attention to the two factors that helped the euro to reverse its rate: 1. A technical rebound from the area of interaction of trade forces, which occurred at local lows on October 7 and 8. To simply put, the natural basis of a rebound. 2. A correlation between EUR/USD and GBP/USD pairs. Let's start with the fact that correlation in trading is the relationship of trading instruments (currency pairs), where if one currency rises/falls, then the other can repeat its dynamics, given that there is a connection between them – correlation. Yesterday, the price of the pound actively rose, against the background of Brexit information. Due to the positive correlation, the Euro turned its direction. As a result, we could observe its intensive strengthening by 10:00-12:00 UTC+00. Regarding the quote's current location, you can see that it has returned to the range of 1.1750 once again, where it formed stagnation at 1.1740/1.1760. In our case, the most important coordinates are the level of 1.1725 (low on October 7) and 1.1770 (yesterday's high). Now, a price consolidation beyond these values may indicate a subsequent move in the market. Based on the location of the quote and control levels, you can make a trading forecast from a number of possible market scenarios. First, an upward movement. An upward movement may develop if the price consolidates above yesterday's high of 1.1770, which will provoke buyers to increase trading volumes. In this case, the price movement in the direction of 1.1800 is not excluded. Second, a downward movement. Market participants are trying to restore the downward trend and face indecision, which leads to the formation of a side range of 1.1725/1.1760. Moreover, there will be a main flow of sellers after the price consolidates below 1.1725 in the four-hour (H4) time frame.

Trading plan for EUR/USD and GBP/USD for 10/15/20 2020-10-15 Ideally, the US dollar was expected to continue strengthening yesterday after taking a break before the US session started. After rising inflation, the rise in producer prices should have supported the US currency. However, everything went wrong due to one problem – Brexit. Apparently, Boris Johnson made a statement that once again contradicts everything that he not only said, but also did before, realizing that the EU leaders will blame him for the lack of progress in the negotiations on a trade deal during today's EU summit. He said London is not ready to leave the European Union without a trade agreement. If it is true, then why did he initiate a Law on the Protection of the Internal Market of Great Britain? Is it just a blackmail? Nevertheless, his statement gives the pound hope that there will be no unregulated Brexit. That is, some kind of agreement will still be signed. Another thing is that the methods of achieving the desired look somewhat suspicious. However, this was enough for the pound to show good growth, which is based solely on emotions. Indeed, nothing significant has happened, as Boris Johnson has previously made conflicting statements regarding Brexit.

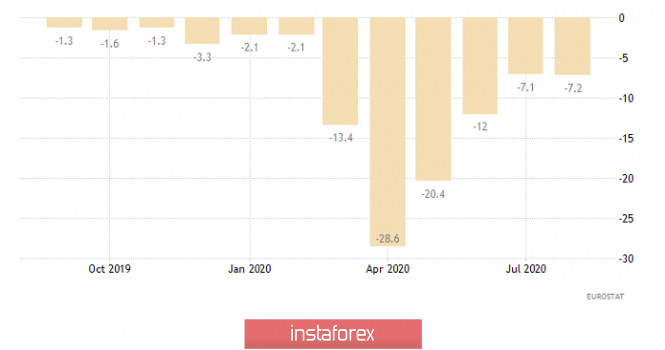

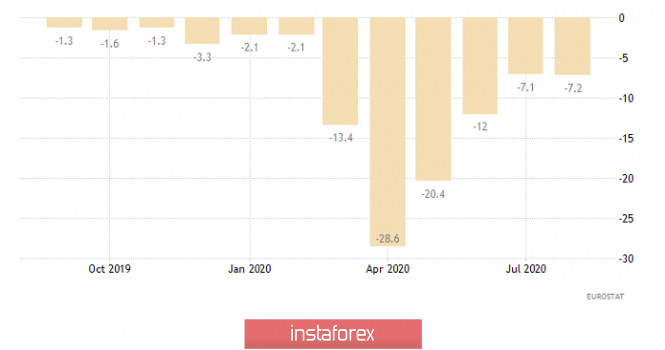

Boris Johnson's statement yesterday really surprised investors. This coincided with today's EU summit, during which the progress of the negotiation process should be discussed. As a result, investors have simply ignored Europe's data on industry. The decline rate in industrial production rose from -7.1% to -7.2%, although it was only due to the revised previous data. However, this does not change the fact that industrial production in Europe has been declining for almost a year in a row. Thus, the state of affairs in the European economy is clearly far from ideal, since it all began long before the COVID-19, which everyone is blaming now. If you carefully read the ECB's minutes, you get the impression that all the problems are connected precisely with the pandemic as if there is no trace of stagnation that lasts for a long time. This only means that no one intends to solve real problems or it is possible that the ECB have no idea how to deal with them. Industrial production (Europe):

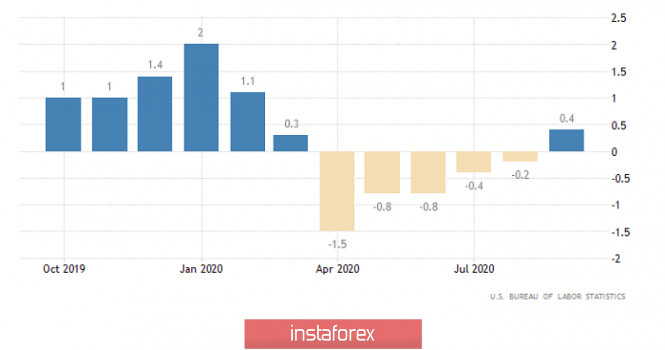

At the same time, many were so confused by Boris Johnson's statement that they did not notice the US producer prices, which should have become the starting point for the dollar's further strengthening. After all, the decline in producer prices, the rate of which was -0.2%, gave way to growth. Now, their growth rate is 0.4%. This indicates that US inflation will continue to rise. Therefore, there is clearly a reason for the dollar to be positive. Producer prices (United States):

Today's main event will be the EU summit, which will discuss the course of Brexit negotiations. Most likely, all participants will express their desire for an early, successful resolution of this problem and their desire to achieve a mutually beneficial trade agreement. But they will blame the UK along the way for the lack of progress, which is expected. The key issue will be the timing of this very agreement. Recently, Boris Johnson has gotten to everyone's nerves, particularly the UK Home Market Protection Act. So the EU leaders can announce that they intend to make a final decision on the trade agreement on November 15. Let me remind you that the deadline was just October 15, but Boris Johnson agreed to extend the negotiations for another month. In other words, everything remains as it is. In view of this, the emotions should somewhat calm down, but then everyone will again realize again that something is wrong which is not very good for the pound. However, there is a chance that European Union leaders may be willing to give London even more time. But in this case, the pound may soar even higher. Therefore, the market will be waiting for at least some statements and details. Against this background, there are few people who are interested in any applications for US unemployment benefits. So what if the number of initial applications should grow from 840 thousand to 845 thousand? And what difference does it make if the number of repeated applications declines from 10,976 thousand to 10,650 thousand? Will the US labor market continue to recover and will it pull the entire economy along with it? Here are the global issues that should be addressed. Repetitive Unemployment Insurance Claims (United States):

The EUR/USD pair found support in the area of the local low on October 7 - 1.1725, which resulted in a slowdown and a variable flat 1.1725/1.1765. We can assume that the movement along the course of the side channel still persists for some time in the market, where the work is based on the method of breaking a particular range limit.

The GBP/USD pair showed a very high activity. As a result, the quote returned to the area of the high of the recent correction of 1.3060/1.3080, where there was a stop, followed by a pullback. We can assume if the price is kept below the 1.3000 level, a recovery process may occur in the direction of the level of 1.2950. Alternatively, there will be another scenario if another information noise flow will occur, which will provoke speculators to make price surges.

GBP/USD: There are three conditions under which the Bank of England will go for negative interest rates 2020-10-15

Yesterday, UK Prime Minister Boris Johnson expressed his disappointment that earlier trade talks did not lead to more progress over the post-Brexit deal. Nonetheless, he said that the current results could help the European Council make the right decision. Today though, negotiations over Brexit will resume, and it is set to last for two days. The leaders will work to find a common ground to be able to build a trade agreement. However, if the EU fails again to make concessions, the UK will be forced to implement a "tough scenario" on future trade relations between the parties. In fact, this issue is viewed by economists as one of the factors for further developments. If a deal is not made, the Bank of England will most likely go to extremes, implementing additional stimulus measures, one of which is the introduction of negative interest rates. Many analysts also expect the central bank to increase its asset purchase program to £ 845 billion soon, a decision likely to be made during the November meeting. With regards to the negative rate specifically, it is necessary to highlight three main conditions, subject to which the Bank of England can take such extreme measures. The first condition is the need for monetary incentives, which is already evident due to the slowing economic recovery. The second one, meanwhile, is that the positive impact of negative rates must outweigh their negative impact, which the central bank is already working to answer now by approaching other banks and asking them to prepare specific answers about its impact on their activities. For example, in Europe, such measures led to a sharp drop in bank profits. Lastly, implementing this measure must be a last resort, so it is necessary to understand whether such is really needed or that other instruments could still be used. As for the technical picture of the GBP/USD pair, it is very difficult to predict its further movement, especially in light of recent events. Regardless, it is obvious that for the bull market to resume, the quote must break out from the local weekly high (1.3065), as without it, the pair will have a hard time rising up towards 1.3160 and 1.3240. If Brexit negotiations fail again, pressure on the pound will return, and this case, it is possible that the pair will decline towards 1.2920, or even lower at 1.2850. Technical analysis of AUD/USD for October 15, 2020 2020-10-15  Overview : The AUD/USD pair has dropped sharply from the 0.7153 level towards 0.7097. The level of 0.7153 acts as a daily pivot point. The pair is trading below its pivot point. It is likely to trade in a lower range as long as it remains below the pivot point. Short positions are recommended with the first target at 0.7097. A break of that target will move the pair further downwards to 0.7049. The pivot point stands at 0.7153. It should be noted that the volatility is very high for that the price of the AUD/USD pair is still moving between 0.7153 and 0.6999 in the coming hours. Furthermore, the price has set below the strong resistance at the levels of 0.7153 and 0.7188 which coincide with the 38.2% and 61.8% Fibonacci retracement levels respectively. Additionally, currently the price is in a bearish channel. According to the previous events, the pair is still in a downtrend. From this point, the AUD/USD pair is continuing in a bearish trend from the new resistance of 0.7153. Thereupon, the price spot of 0.7153 and 0.7188 remains a significant resistance zone. Therefore, the possibility that the Aussie will have a downside momentum is rather convincing and the structure of the fall does not look corrective. In order to indicate a bearish opportunity below 0.7097, it will be a good signal to sell below 0.7097 with the first target of 0.7040. It is equally important that it will call for downtrend in order to continue bearish trend towards 0.6999. On the contrary, stop loss should be placed at the price of 0.7212 (above the daily resistance). The bullish outlook remains the same as long as the RSI indicator is pointing to the upside on the one-hour chart. Hence, the stop loss should be located above the level of 0.7212. Technical analysis of EUR/USD for October 15, 2020 2020-10-15  Overview : The EUR/USD pair dropped perfectly, remain bearish for a further drop today. After a breakout at the price of 1.1746 this morning, support now becomes resistance at the level of 1.1746. The EUR/USD pair broke resistance which turned to strong resistance at the level of 1.1746. The level of 1.1746 coincides with 38.2% of Fibonacci, which is expected to act as major resistance today. Since the trend is above the 38.2% Fibonacci level, it means the market is still in a downtrend. From this point, the EUR/USD pair is continuing in a bullish trend from the new support of 1.1746. Currently, the price is in a bearish channel. According to the previous events, we expect the EUR/USD pair to move between 1.1746 and 1.1612. On the H1 chart, resistance is seen at the levels of 1.1746 and 1.1778. A bearish outlook remains the same, as long as the 100 EMA is pointing to the downside. RSI (14) sees major descending resistance line acting as resistance to push price down from the spot of 1.1746 - 1.1762 . We still expect the bearish trend for the upcoming sessions as long as the price is below 1.1746 level. Also, it should be noticed that, the level of 1.1746 represents the daily pivot point. The bias remains bearish in nearest term testing 1.1696 – 1.1612. Immediate resistance is seen around 1.1746. Therefore, strong resistance will be formed at the level of 1.1746 providing a clear signal for sell deals with the targets seen at 1.1696. If the trend breaks the support at 1.1696, the pair will move upwards continuing the development of the bearish trend to the level 1.1665 in order to test the daily support 2. Next objectives 1.1640 and 1.1612. Alternative scenario : The breakdown of 1.1778 will allow the pair to go further up to the levels of 1.1800 and 1.1830. Otherwise, the breakdown of 1.1778 will allow the pair to go further up to the levels of 1.1800 and 1.1830. Besides, is should be noted that all positions must be closed before the closing bell in New York session to day. But overall I still prefer a bearish scenario at this phase. Moreover, any downside pullback from the price of 1.3823 now is normal, because on the whole we remain bearish at present. Forecast : It will be good deal to sell at 1.1746 with the first target of 1.1696. It will also call for a downtrend in order to continue towards 1.1665 and 1.1640. The weekly strong support is seen at 1.1612. On the contrary, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.1778 (R1).

Author's today's articles: Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Stanislav Polyanskiy  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine. Irina Manzenko  Irina Manzenko Irina Manzenko Maxim Magdalinin  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006. Torben Melsted  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets. Sergey Belyaev  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis. Mihail Makarov  - - Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Alexandr Davidov  No data No data Pavel Vlasov  No data No data Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.

Graduated from Odessa State Economic University. On Forex since 2006. Writes analytical reviews about international financial markets for more than 3 years. Worked as a currency analyst in different finance companies for a long time including the biggest companies of Russia and Ukraine.  Irina Manzenko

Irina Manzenko  In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.

In 2005 graduated from the Academy of the Ministry of Internal Affairs of the Republic of Belarus, law faculty. Worked as a lawyer for three years in one of the biggest country's company. Besides the trading, he develops trading systems, writes articles and analytical reviews. Works at stock and commodity markets explorations. On Forex since 2006.  Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.  Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.

Born December 1, 1955. In 1993 graduated from Air Force Engineering Academy. In September 1999 started to study Forex markets. Since 2002 has been reading lectures on the technical analysis . Is fond of research work. Created a personal trading system based on the indicator analysis. Authored the book on technical analysis "Calculation of the next candlestick". At present the next book is being prepared for publishing "Indicator Analysis of Forex Market. Trading System Encyclopedia". Has created eleven courses on indicator analysis. Uses classical indicators. Works as a public lecturer. Held numerous seminars and workshops presented at international exhibitions of financial markets industry. Is known as one of the best specialists in the Russian Federation researching indicator analysis.  -

-  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  No data

No data  No data

No data  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

No comments:

Post a Comment