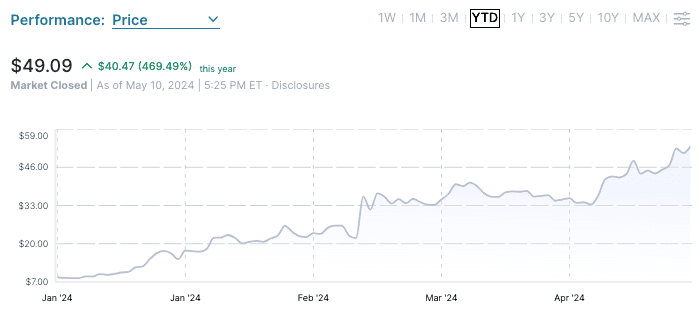

| We've found 5 tiny stocks CRUSHING big tech this year Amazon is up 25% year to date — second only behind Nvidia in the world of big-tech stocks (up almost 90%). Meanwhile, these five little-known stocks are up over 250% on average this year. That's roughly 10 times Amazon's year to date return. And despite returns of over 400% (this isn't even the top stock!)... ...they're still flying under Wall Street's radar right now. And they're not showing signs of slowing down. >> If you want to get in before they go mainstream, click here now.

P.s. According to Bank of America's fund managers survey, investors haven't been this bullish on small caps in almost three years!

|

| Information contained in this email and websites maintained by Magnifi Communities LLC (dba Investors Alley) are provided for educational purposes only and are neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Magnifi Communities and its affiliates may hold a position in any of the companies mentioned. Magnifi Communities is neither a registered investment adviser nor a broker-dealer and does not provide customized or personalized recommendations. Any one-on-one coaching or similar products or services offered by or through Magnifi Communities or Investors Alley does not provide or constitute personal advice, does not take into consideration and is not based on the unique or specific needs, objectives or financial circumstances of any person, and is intended for educational purposes only. Past performance is not necessarily indicative of future results. No trading strategy is risk free. Trading and investing involve substantial risk, and you may lose the entire amount of your principal investment or more. You should trade or invest only "risk capital" - money you can afford to lose. Trading and investing is not appropriate for everyone. We urge you to conduct your own research and due diligence and obtain professional advice from your personal financial adviser or investment broker before making any investment decision. Smaller capitalization securities involve greater issuer risk than larger capitalization securities, and the markets for such securities may be more volatile and less liquid. Specifically, small capitalization companies may be subject to more volatile market movements than securities of larger, more established companies, both because the securities typically are traded in lower volume and because the issuers typically are more subject to changes in earnings and prospects. Securities of small and medium-sized companies tend to be riskier than those of larger companies. Compared to large companies, small and medium-sized companies may face greater business risks because they lack the management depth or experience, financial resources, product diversification or competitive strengths of larger companies, and they may be more adversely affected by poor economic conditions. There may be less publicly available information about smaller companies than larger companies. In addition, these companies may have been recently organized and may have little or no track record of success. All information contained herein is copyright 2024, Magnifi Communities LLC. |

If you no longer wish to receive our emails, click the link below:

Unsubscribe

DailyMarketAlerts c/o CLM Media LLC 315 Ridgedale Avenue #556 East Hanover, New Jersey 07936 United States

No comments:

Post a Comment