| |

| |

| |

| Presented By Enbridge |

| |

| Axios Generate |

| By Ben Geman and Andrew Freedman · Nov 04, 2022 |

| 🍺 Happy Friday! Today's newsletter has a Smart Brevity count of 1,185 words, 4.5 minutes. 🛢️ Situational awareness: The U.S. and allies have reached a deal on which Russian oil sales will be subject to the planned "price cap," the WSJ reports. - Why it matters: The idea is to crimp Russian revenues while enabling continued supply to global markets.

🎸 Tomorrow marks the 1971 date when glam rockers T. Rex released this week's final intro tune... |

| |

| |

| 1 big thing: Egypt faces food insecurity as it hosts COP27 |

|

|

| Illustration: Sarah Grillo/Axios |

| |

| Egypt is experiencing a climate-fueled food crisis as it prepares to host this year's United Nations climate summit, Axios' Ayurella Horn-Muller reports. The big picture: Rising food insecurity is poised to be front and center at COP27 — further underscoring the water issues and agricultural declines in the country that's hosting it. What's happening: Unlike past climate summits, COP27 has lined up head-of-state-level food security sessions and expected announcements, along with an expected focus on climate damages for developing countries. - Going into COP27, Egypt's water scarcity issues in particular are a priority for government officials. The country is seeking loss and damage financing from developed countries contributing the most to global emissions to help fund an $8.3 billion climate adaptation plan, as reported by Quartz.

- On Monday, Bloomberg reported Egypt will get $2 billion in financing over the next eight years to help combat food insecurity, which will be targeted toward rural farmers, through the UN's International Fund for Agricultural Development and other organizations.

Context: Warming temperatures and prolonged droughts are compounding with rising food prices to exacerbate existing levels of food insecurity in Egypt. - About a third of people in Egypt live in poverty, according to the World Food Programme.

Yes, but: Climate isn't the only problem. Egypt's agriculture is impacted by pressure on water resources, including irrigation development around the Nile, according to Sonali McDermid, a professor at New York University who studies agriculture, food insecurity and climate change. - That development is threatened not only by rising sea levels or drought but also by intensifying conflict between the neighboring countries that depend on it, as tensions simmer over Ethiopia building a mega-dam.

What they're saying: Assem Mohamed, senior researcher at Egypt's Agricultural Research Centre, told Axios the impact of global warming on the country's agricultural systems is poised to be severe. - 85% of Egypt's share of the Nile, its key freshwater source, goes to agriculture. "Water is the source for agriculture in Egypt," said Mohamed. "And we don't have this much amount of water."

The bottom line: "What the water shortage in Egypt means, for farmers, [is] they suffer from decrease of water and from the drought," Mohamed told Axios. "This is a big disaster." Read the whole story. |

|

| |

| |

| 2. Exxon and the return of the "old economy" |

Data: Goldman Sachs; Chart: Thomas Oide/Axios Exxon's mammoth Q3 earnings were higher than Microsoft's for the first time since 2018 — and that illustrates a wider market shift, Goldman Sachs analysts say, Ben writes. What they're saying: Their note, called "Revenge of the Old Economy," describes the "rotation away from growth in big tech toward growing profits from energy and industrial firms." - "[R]ising prices are constraining consumer incomes and discretionary purchases, cannibalizing the source of big tech's earnings — advertising."

- They also note the "strength of the energy sector vs. disruptors such as Tesla after multiple years of underperformance."

The big picture: It's not just about fossil fuels vs. tech. Goldman analysts see the "old" economy outperforming the "new" one in several huge sectors in 2022 — the latest in decades worth of push and pull. That includes... - Traditional banks over crypto stocks.

- Large pharma players over biotech companies.

- Some retailers like Walmart over Amazon.

- Agribusiness giants like ADM over "perceived disruptors" like Beyond Meat.

|

|

| |

| |

| 3. Study sounds Arctic wildfire warnings |

|

|

| Firefighter stands in front of a wildfire in Yakutia, Sakha, Russia on Aug. 8, 2021. Photo: Ivan Nikiforov/Anadolu Agency via Getty Images. |

| |

| A new study sounds the alarm on the likelihood of increasing Arctic wildfires to unleash vast quantities of greenhouse gasses from continuously frozen soils and peatlands, Andrew writes. The big picture: The Arctic is warming at about four times the global average rate. - Early spring snowmelt and hotter summers are melting and drying out Arctic ecosystems.

- This makes the region more prone to wildfires, and recent Siberian wildfire seasons have set records.

Zoom in: The study, published in Science, uses satellite fire data along with temperature records to conclude that warming may soon cross a threshold where small additional Arctic warming results in a near-exponential expansion in the area burned. - The study shows that Siberian wildfires during 2019 and 2020 accounted for nearly half of the total burned area there in the past four decades.

- These two years were also the warmest in the study.

- Current projections of global warming don't account for a large feedback between Arctic warming and wildfire emissions, and may be underestimating future warming, the study finds.

What they're saying: "It's worrying because predictions essentially indicate that the fires of 2019, 2020 will become the norm by the end of the century," coauthor David L.A. Gaveau told the NYT. Yes, but: Some scientists who study Arctic fires are not yet convinced the region has slipped into a long-lasting, new fire regime. |

|

| |

| |

| A message from Enbridge |

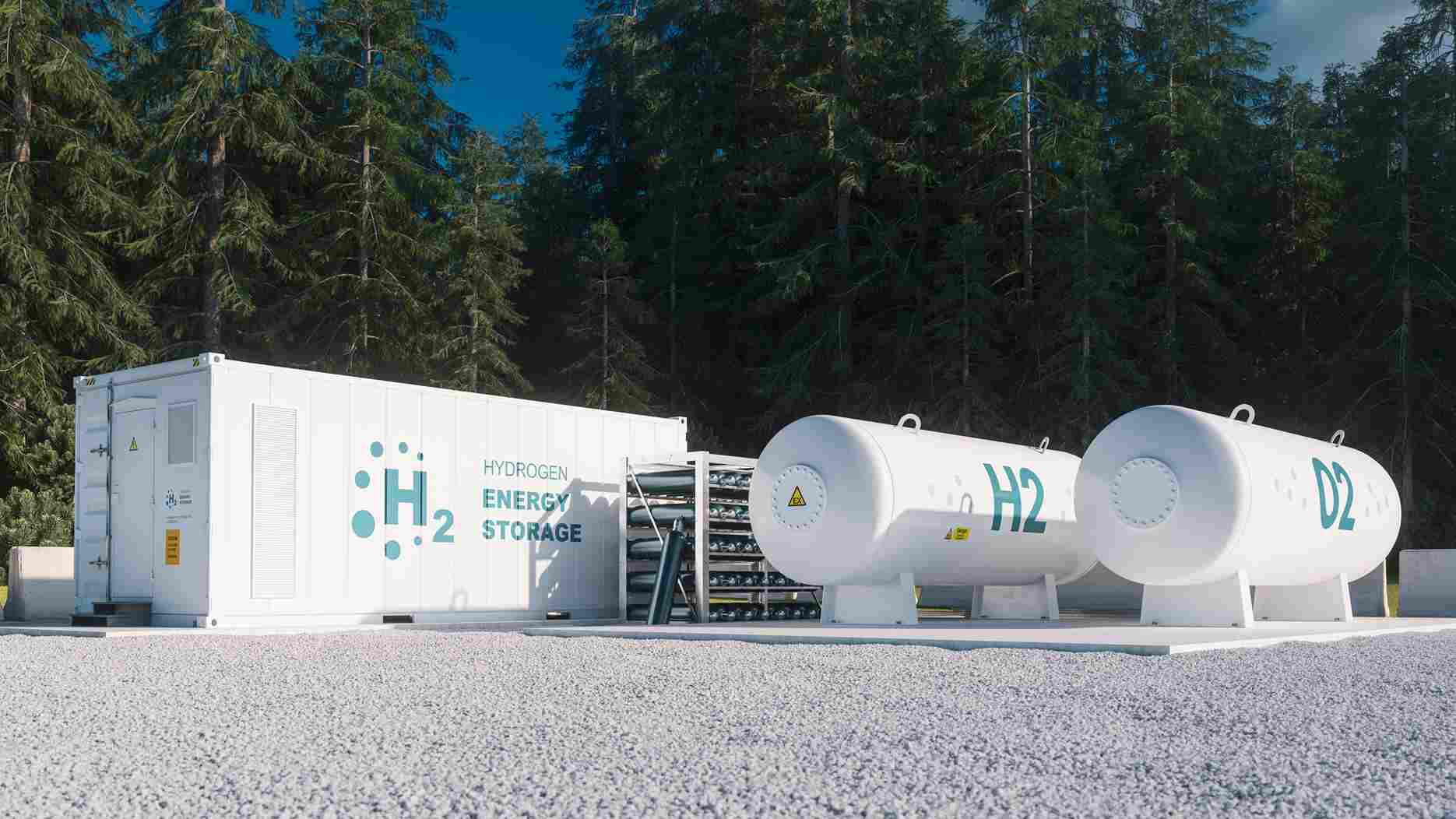

| Hydrogen, fuel of tomorrow — today |

| |

|

| |

| Enbridge is blending green hydrogen into natural gas to lower the carbon content and curb greenhouse gas emissions. What you need to know: Enbridge was the first to pilot blending in North America — just one of the investments it's making to green the natural gas grid. Here's how it works. |

| |

| |

| 4. 🏃🏽♀️Catch up fast on EVs: Foxconn and Ford |

| 🤝 Saudi Arabia's huge sovereign wealth fund is teaming up with Foxconn (best known for its iPhone manufacturing) to launch a joint venture for making electric vehicles, Ben writes. - Driving the news: The newly envisioned EV brand called Ceer will license BMW tech. The JV envisions an EV portfolio that "will lead in the areas of infotainment, connectivity and autonomous driving technologies," the Saudi announcement states.

- Why it matters: The Saudis called the new venture part of plans to diversify the kingdom's oil-dependent economy.

- What's next: The brand will target sales to consumers in Saudi Arabia and the wider Middle East-North Africa region, with the first vehicles launching in 2025. TechCrunch has more.

📝 "Ford Motor Co said on Thursday the U.S. Treasury Department should limit the definition of a 'foreign entity of concern' to ensure more electric vehicles can qualify for up to $7,500 in consumer tax credits." (Reuters) |

|

| |

| |

| 5. Europe's gas peril is nowhere near over |

|

|

| Illustration: Brendan Lynch/Axios |

| |

| It's looking like Europe will avoid catastrophic gas shortfalls this winter, but that's no reason for complacency, the International Energy Agency warned, Ben writes. Driving the news: "The cushion provided by the current mild temperatures, lower gas prices and high storage levels should not lead to overly optimistic predictions about the future," a new analysis states. Zoom in: Repeating this year's success at heading into winter with robust supplies (storage levels are at 95%) can't be taken for granted IEA says because... - Russian pipeline flows were somewhat normal for the first half of 2022 before dropping, and could cease completely.

- Next year should bring stronger competition from China for LNG cargoes as demand there rebounds from COVID.

- Overall growth in global LNG supplies next year probably won't fully make up for reduced Russian flows.

Threat level: Europe could face a significant shortfall next summer when it needs to be re-filling storage, IEA said. "More rapid deployment of energy efficiency measures, renewables and heat pumps is needed to reduce the risk of a worsening energy and gas crisis." |

|

| |

| |

| Bonus: Charting Europe's storage success |

Reproduced from IEA; Chart: Axios Visuals EU gas storage sites are 5 billion cubic meters (bcm) above their five-year average, per IEA. Yes, but: "This additional storage cushion could be quickly erased: 5 bcm is just two days of EU gas demand during a cold spell," it notes. |

|

| |

| |

| 6. 🧮 Number of the day: $1.5 billion |

| The White House this morning said it's steering $1.5 billion from the new climate law into bolstering the Energy Department's national labs network, Ben writes. Why it matters: The fiscal year 2022 money will help fund multiple initiatives, including R&D into climate-friendly technologies, the White House said. |

|

| |

| |

| A message from Enbridge |

| Building progress together |

| |

|

| |

| Enbridge has embarked on the largest energy-related Indigenous economic partnership transaction in North America. The story: 23 First Nation and Métis communities will acquire a 11.57% interest in 7 Enbridge-operated pipelines in northern Alberta for $1.12 billion. Read more. |

| |

| 📬 Did a friend send you this newsletter? Welcome, please sign up. 🙏Thanks to Mickey Meece and David Nather for edits to today's newsletter. Have a great weekend and we'll see you Monday! |

| | Why stop here? Let's go Pro. | | |

No comments:

Post a Comment