| Here's a list of the largest "days to cover" readings - meaning these are the biggest short squeeze candidates in all of Wall Street. - PMV Pharmaceuticals (PMVP): 15 days to cover

- Tattooed Chef (TTCF): 17 days to cover

- Erasca (ERAS): 17 days to cover

- Sana Biotechnology (SANA): 20 days to cover

- MicroVision (MVIS): 23 days to cover

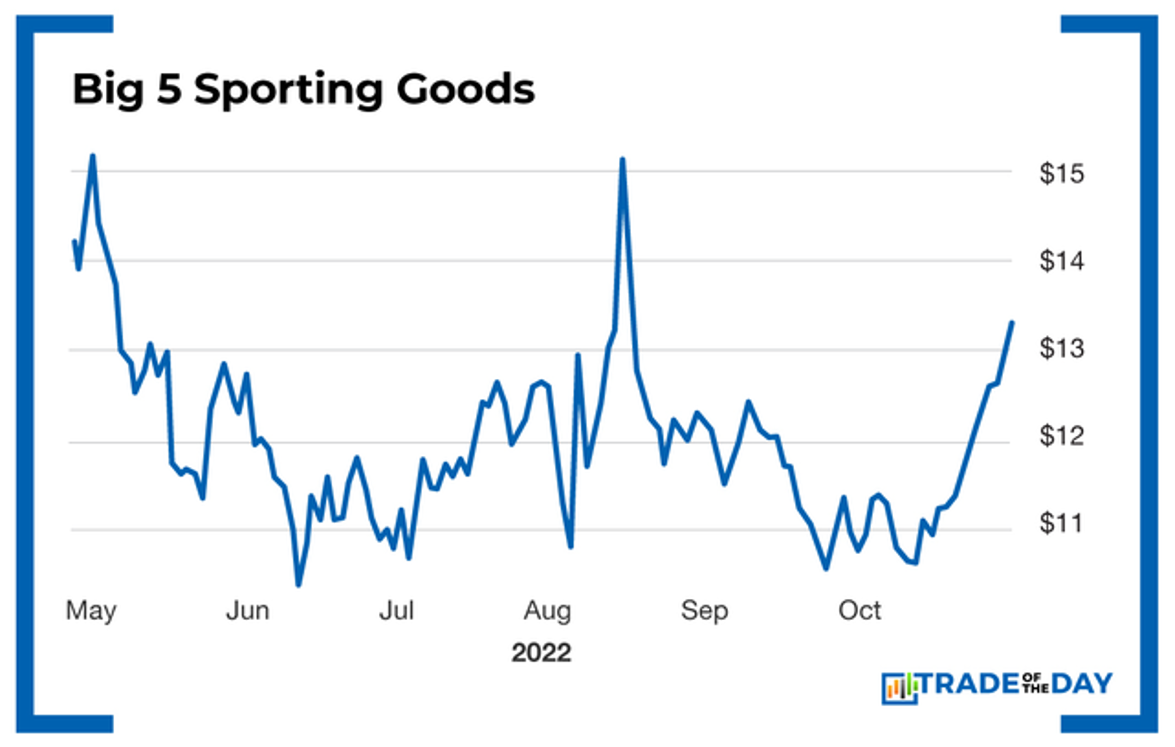

- Big 5 Sporting Goods (BGFV): 22 days to cover

- Stoke Therapeutics (STOK): 24 days to cover

As you can see, Big 5 Sporting Goods (BGFV) is on this list - with a whopping 22 days to cover their entire short position. In other words... Given their current short position - and average daily volume - it would take nearly a full calendar month to clear out every single short on BGFV. Why is this important? YOUR ACTION PLAN BGFV reports earnings after the close of trading tomorrow. If the earnings are strong, the stock could pop - which could ignite one of the biggest short squeeze situations in all of Wall Street. To see how we're playing short squeeze situations like this, you're invited to join our trading community inside The War Room. Right now we're guaranteeing members will receive 252 winning trades in their first 12 months of membership. Click here to join The War Room. |

.gif)

No comments:

Post a Comment