| | Andy Snyder

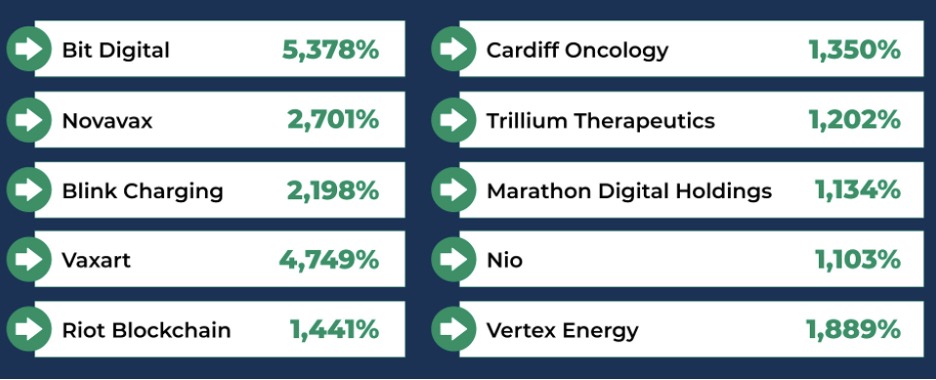

Founder | Those few Americans who still dare to use their brains will find it ironic that a nation founded on tax freedom... is working on legislation that provides for hiring 87,000 new IRS agents. Many of the hires, we've learned, will be armed. Our tea tastes bitter this cool summer morning. We're told Joe Sixpack doesn't have to worry about this new army. Its soldiers will go after only the elites... those scumbags who made more than they deserve and actually want to keep it. We'll remind readers now that there are a little more than 600 billionaires in the United States. That means these 87,000 newly deputized agents are going to be looking for something to shake up... and somebody to shake down. We've seen enhanced scrutiny recently in the crypto world. It's no surprise, though. We've expected it for a while. The SEC has cracked down on crypto projects that it deems securities. It's gone after Coinbase and Kraken - and others too. It says many of the coins they list on their exchanges are securities... and must be registered as such. This idea is not new. But its enforcement is. In just the last few weeks, nine tokens have found themselves in the SEC's crosshairs. You'd think a balding, free-market-loving, don't-tread-on-me fella like us wouldn't be so keen on the news. Let the market be the market, right? But no, we've been on top of this for months. We saw it coming. And we know where it's headed. Better yet... we know just how profitable it could all become. | SPONSORED | | What Do These Companies Have in Common? - 1,000% (or better) wins

- One year (or shorter) time frames

- Part of a class of stocks that Wall Street CAN'T touch.

Altogether, it means less competition - and bigger profit opportunities for YOU! Click for more details... and to get the free ticker of a little-known stock that could soon be on that list. | | | Rules Are Rules To our mind, the SEC has just kick-started the next BIG thing in the investing world. For crypto traders who truly believe in the technology and the ideas behind it (and aren't in it just for the gambler's high)... this is absolutely huge. It combines the technology and promise of crypto with the real-world need for a market that offers liquidity and access to capital. What the SEC is kick-starting (if entirely by accident) is a market that makes good on the promise of crypto... and finally brings it out of the shadows and the legal margins. Did you know, for example, that companies are already using new blockchain technology to raise capital in the open market? Did you know that with the same technology, it's now possible to buy a fraction of a valuable asset - like a real estate property or even a single business line? And did you know... it all has the blessing of our beloved keepers in Washington? It will not only eliminate much of the regulatory risk that has clouded the space for the last decade but also attract the sort of big money that can propel an industry from nascent to dominant. With all that's happening, it's no surprise that BlackRock (which until recently was anti-crypto) just teamed up with Coinbase. And it's no surprise that Intercontinental Exchange, the company behind the NYSE, also bought a stake in the technology. Very few folks are talking about this. The money media has absolutely let its followers down. The crypto space is a virtual ghost town these days. It's a crazy idea, especially when we consider that some of the biggest names on Wall Street are quietly moving in... and that many tokens have gone up 50%, 60% or even 100% over the last 45 days. This new market has only just passed the $1 billion mark. It's still quite tiny. But British bank HSBC quietly estimates it could be worth as much as $24 trillion in just five years. That would be 2.4 million percent growth. And virtually none of it would be possible without the SEC putting its foot down like it just did. This is it... the start of something new. Perhaps the IRS believes what we believe - that a lot of folks could get very rich from this trend. There are just 600 billionaires now. But with 2.4 million percent growth on the table... that could change quickly. We just sat down for one of our biggest interviews yet. It marks a huge move forward for Manward and its many, many readers. We describe what's happening - plus give away one of our favorite ways to play it all - right here in this brand-new interview. This is big. And it's moving fast. Watch the whole interview here. Be well, Andy P.S. If you think Bitcoin was big... wait until you see this. With the names we're seeing piling into this opportunity, it could be 10X bigger than Bitcoin. Full details here. Want more content like this? | | | | | Andy Snyder | Founder Andy Snyder is the founder of Manward Press, the nation's premier source of unfiltered, unorthodox views on money and what it means for a free society. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. He's been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms. | | | |

No comments:

Post a Comment