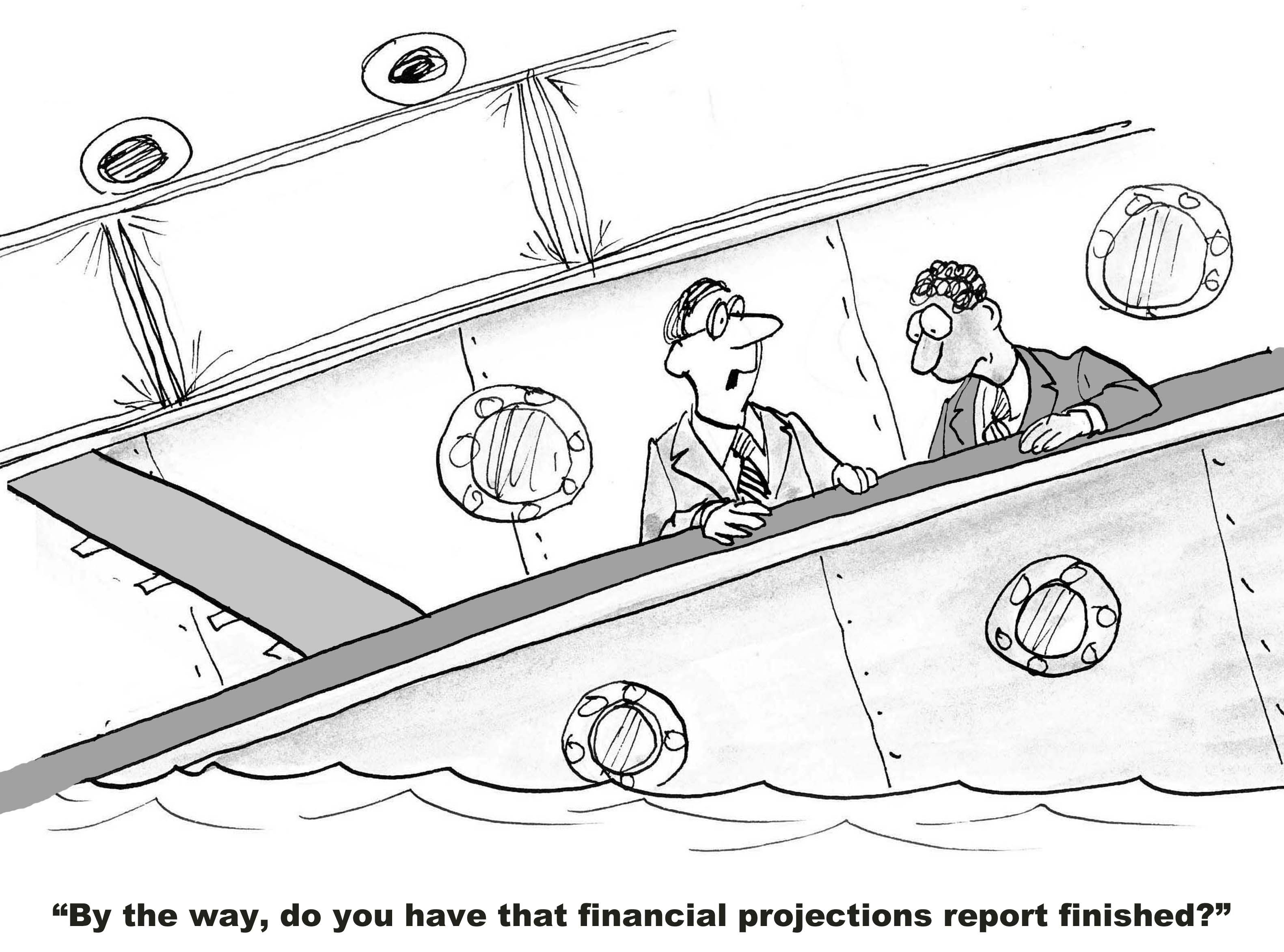

|  | |  Good morning. The past decade has seen a rather unusual trading strategy emerge. It's one that's gotten noticed and has become more popular than ever. It's a simple strategy too. All you have to do is identify the most-shorted stocks on the market, wait for the market to have one of its periodic pullbacks, and go long on those companies. Good morning. The past decade has seen a rather unusual trading strategy emerge. It's one that's gotten noticed and has become more popular than ever. It's a simple strategy too. All you have to do is identify the most-shorted stocks on the market, wait for the market to have one of its periodic pullbacks, and go long on those companies.

For whatever reason, those stocks have tended to have the strongest rebounds. That's likely because with so much short interest, it doesn't take a lot of volume to cause a big move higher. Typically, going long the most-shorted names has been great at the start of an uptrend, but the move fades fast.

Now, we're seeing retail investors drive these stocks higher, in a development likely to cause hedge funds to either rethink their strategies of shorting a company into bankruptcy, or investing in better lobbyists. Until then, it's a strategy worth considering.

Now here's the rest of the news:

| |  | |  |  |

|  |  |  | DOW 34,577.04 | -0.07% |  | |  | S&P 4,192.84 | -0.36% |  | |  | NASDAQ 13,614.51 | -0.09% |  | |  | | *As of market close |  | | • | Stocks traded down on Thursday, with tech seeing the biggest drop lower. |  | | • | Oil traded flat, with a barrel of crude last going for $68.85. |  | | • | Gold declined 1.9 percent, hitting $1,873 per ounce. |  | | • | Cryptocurrencies moved higher, with Bitcoin last at $38,621. |  |  | |  | | | |

|  | | There's More to this Meme Stock Than Meets the Eye |  |  |  | Retail investors are coming back to some of the top performing stocks of January and February with a vengeance. One such company that's starting a new massive rally? BlackBerry (BB).

Shares saw a move higher at the start of the year that nearly quadrupled shares. But that peak was undone was brokerage firms shut down the ability of traders to add to positions, only liquidate existing ones. Nevertheless, shares are moving higher again.

» FULL STORY |  | | |  |

|  | Insider Trading Report: US Silica Holdings (SLCA) |  |  |  | William Kacel, a director at US Silica Holdings (SLCA), recently bought 15,000 additional shares. The buy increased his stake by nearly 8 percent, and came to a total purchase price of just over $154,000.

The buy comes a few weeks after the company CEO made a 2,000 share purchase, shelling out just over $18,000. Over the past few years, company insiders have been active, with buyers far exceeding that of sellers.

» FULL STORY |  | | |  |

|  | Unusual Options Activity: Baker Hughes (BKR) |  |  |  | Shares of oil and gas equipment and services company Baker Hughes (BKR) have surged 30 percent higher in the past month. One trader sees that trend continuing over the summer.

That's based on the October $29 calls. With 133 days until expiration, over 6,180 contracts traded against a prior open interest of 104, for a 59-fold jump in volume. The buyer of the calls paid about $1.45 to make the trade.

» FULL STORY |  | | |  |

|  | • | Man Who Picked GOOGL, AMZN, and CSCO Issues Major "BUY Alert"

The man who became a millionaire on Wall Street by the age of 25 gives his #1 buy alert.

Get it now. (Clicking above will opt you in to receive emails from True Market Insiders - Privacy Policy.)

|  |  |  | • | Traders Brace for May Jobs Numbers

After weaker than expected jobs numbers for April, traders are looking for a surprise with the May numbers, potentially in either direction. Weekly jobs data indicates that there's still an ongoing recovery for the jobs market, but that gains are likely to continue to show a slowing trend. |  |  |  | • | The Current Economic Recovery Is Unlike Any Other

Many recessions and recoveries have some similar trends to them. This one is different. Households managed to increase their savings overall thanks to pandemic closures and stimulus checks. Banks held up well and housing is booming on strong demand. But supply chain shortages are being felt, as is a shortage of workers in many industries and areas. |  |  |  | • | Fed Look to Unwind Bond Program

The Federal Reserve has announced plans to wind down its bond buying facility. The program purchased tens of billions of dollars in corporate assets during the pandemic, a move the bank saw as key to keeping businesses from going bankrupt. The central bank is still likely to continue to keep interest rates at zero percent for some time. |  |  |  | • | Biden, GOP to Meet on Infrastructure Plan

President Biden is planning on meeting with GOP Senator Shelley Moore Capito on Friday, in the hopes that a deal can be reached on an infrastructure plan and how to pay for it. While Democrats hold a razor-thin majority in the Senate, and could push a bill through, both sides are looking for a compromise deal. |  |  |  | • | Confluent Files IPO Paperwork

Streaming data platform Confluent has filed paperwork to go public via an IPO. Founded in 2014, the company has raised $455 million from private investors and is currently valued at $4.5 billion. The company is a spinoff from an internal project started at LinkedIn in 2011. |  |  |

|  |  | | TOP |  | | F | 7.244% |  |  | | GM | 6.387% |  |  | | NRG | 3.846% |  |  | | HSIC | 3.368% |  |  | | LUMN | 3.024% |  |  | | BOTTOM |  | | ETSY | 5.367% |  |  | | TSLA | 5.335% |  |  | | LUV | 4.288% |  |  | | UAL | 4.246% |  |  | | WYNN | 4.137% |  |  | |  |

|  |  |  | | We think in the next three years we could see $100 barrels again, and we stand by that. That would be a 2022, 2023 story. Part of it is the fact we have OPEC kind of holding all the cards, and the market is not particularly price responsive on the supply side and there is a lot of pent-up demand ... We also have a lot of inflation everywhere. Oil has been lagging the rise in prices across the economy. |  | - Francisco Blanch, global commodities and derivatives strategist at Bank of America, on why oil has been a relative laggard among commodities lately, and why rising demand and higher inflation could take oil back to over $100 per barrel.  |  |

|

No comments:

Post a Comment