| Two foundations just unveiled a $1 billion initiative to help deliver clean energy to huge numbers of people worldwide who lack electricity access — and they hope it catalyzes vastly more outside capital, Ben writes. Driving the news: The Rockefeller and Ikea foundations said the new program "aims to reduce 1 billion tons of greenhouse gas emissions and to empower 1 billion people with distributed renewable energy." - The new platform will be housed in the RF Catalytic Capital division that Rockefeller launched last year, which it calls a way for "impact investors, and governments to combine their resources and expand their global philanthropic reach."

- The goal is to unlock finance for areas like micro-grids and off-grid renewable power.

Why it matters: While the initial $1 billion on its own is nowhere near the scale needed to sustainably expand global access, the Financial Times reports that the effort is aimed at mobilizing much more money. - "[T]hey hope to attract $10bn of additional funds this year from international development agencies, before opening up to institutional investors in a bid to expand renewables investment in countries such as India, Nigeria, and Ethiopia," the FT reports.

- It quotes Rockefeller President Rajiv J. Shah expressing hope that the effort could eventually reach $100 billion or even $1 trillion by using "philanthropic capital as a lever to get commercial capital."

- This morning's announcement says the foundations see the new platform as a way to identify "viable, investment-ready projects."

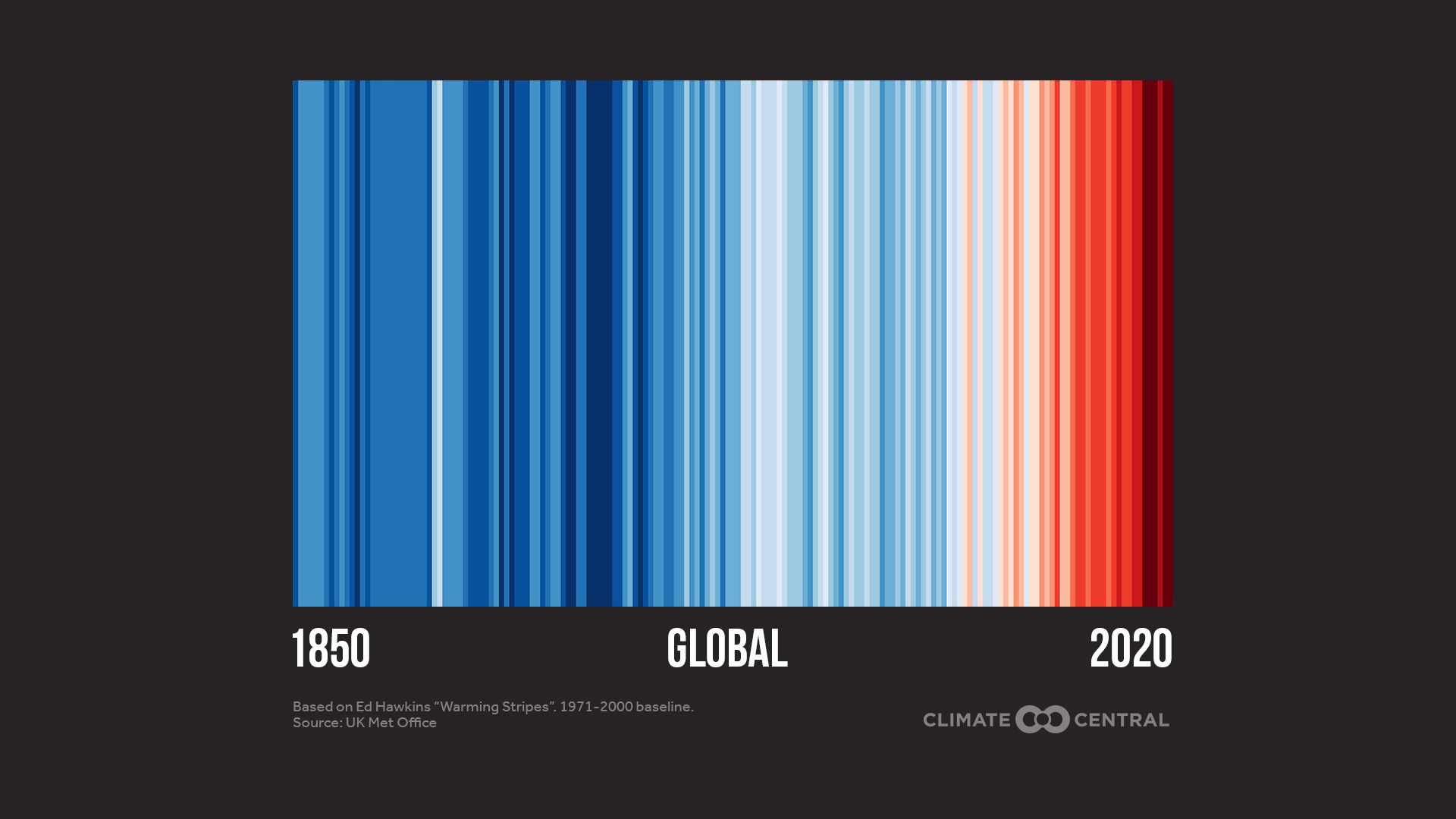

The big picture: Meeting rising global energy demand in developing countries without a corresponding increase in emissions is a key global challenge — especially as scientists say steep emissions cuts are needed to contain global warming. By the numbers: An estimated 759 million people worldwide lacked electricity as of 2019, per joint analysis from the World Bank and other agencies. And the two foundations' announcement this morning notes that access is unreliable for another 2.8 billion people. What they're saying: An International Energy Agency report this month looked more broadly at the need to scale up finance for climate-friendly energy in emerging and developing economies worldwide. They estimate that by the end of this decade, "annual capital spending on clean energy in these economies needs to expand by more than seven times, to above USD 1 trillion, in order to put the world on track to reach net-zero emissions by 2050." |

No comments:

Post a Comment