| | | | | | | Presented By The Ascent | | | | Axios Markets | | By Aja Whitaker-Moore ·Jun 07, 2021 | | Happy Monday. I promised you exciting news about the future when we returned, so here you go! 🚨Axios has hired the amazing and talented Sam Ro to lead this newsletter. He's been obsessively covering the most important stories in business and markets for the past 15 years, most recently co-authoring a daily newsletter and overseeing the newsroom at Yahoo Finance. - You'll start to see Sam's insightful coverage in your inbox after he joins officially on June 14. In the meantime, you can find him on Twitter @SamRo and say hello!

Now let's get to today's news in 1,200 words, 4.5 minutes. | | | | | | 1 big thing: AMC's wild week 🎢 |  | | | Illustration: Annelise Capossela | | | | AMC has learned its lesson from the meme winter, and is determined to use the meme summer to its advantage, writes Axios' chief financial correspondent Felix Salmon. Why it matters: AMC might not be able to make money by selling movie tickets, but it's proving itself a master of bringing in money by selling share certificates. How it works: The theater chain has steadily issued new stock, most recently on Thursday, when it sold more than 11 million shares, netting $587.4 million — more than the entire company's equity value at the beginning of the year. - The total number of AMC Class A shares outstanding has risen tenfold from 50 million this time last year, to 500 million today. As a result, the company's market capitalization has risen even faster than its stratospheric share price.

The big picture: When GameStop first started heading to the moon, the overwhelming consensus was that the stock had become a pure gambling vehicle that was inevitably going to crash, creating massive losses for people who bought into the hype. - Those losses didn't happen. GameStop stock continues to trade at extremely elevated levels, raising the prospect that meme stocks can actually be (very risky) investments, rather than just short-term trades.

- Once meme stocks become a potential investment, companies can take advantage of that fact by issuing new shares on the capital market — just as other risky companies like Tesla have done.

The difference is that AMC isn't a technology stock with the potential to dominate the world. It's just a struggling chain of movie theaters. - Short-sellers beware: The similarity between the two companies is that both have large and enthusiastic retail investor bases. AMC, just like Tesla before it, is proof that once retail investors dominate a stock, its trajectory is unlikely to behave in a familiar manner.

Reality check: Bank of America will stop covering GameStop, and plans to suspend its rating of fellow meme stock Bed Bath & Beyond, saying the shares no longer trade on fundamentals. The bottom line: Capital markets are playing by new rules, and regulators are understandably loath to get involved, even if there are risks to the public's broad faith in efficient markets. - Hertz stock, for instance, is now trading — on fundamentals! — at higher levels than it was last year while going through bankruptcy. The SEC prevented a stock sale back then, in a move that now looks as though it killed a trade that would have been beneficial for both the company and its investors.

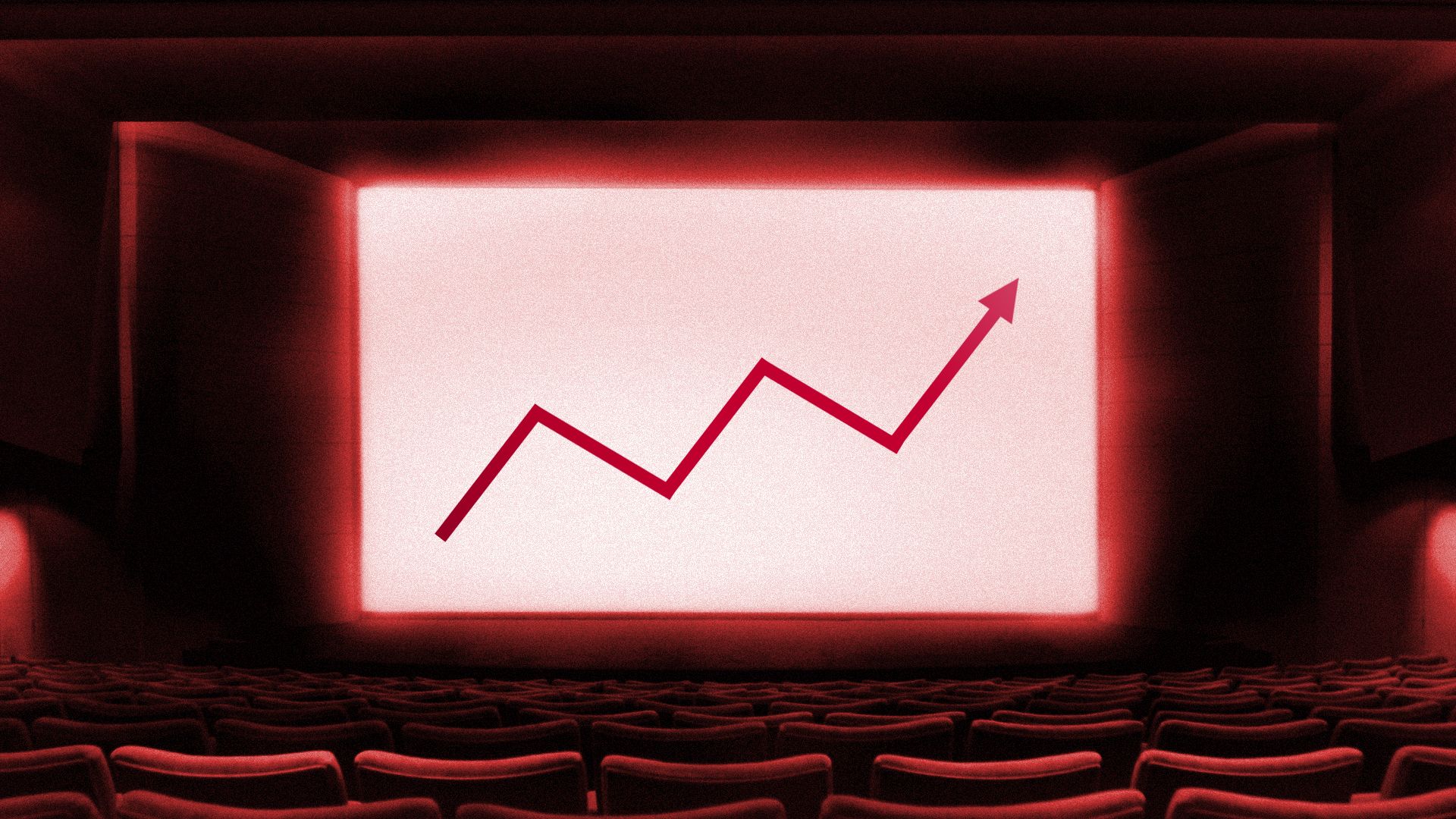

Go deeper. |     | | | | | | Bonus Chart: AMC's upward surge |  Data: YCharts; Chart: Axios Visuals |     | | | | | | 2. Catch up quick | | President Biden issued an executive order that expanded his predecessor's ban on American investment in Chinese companies with purported ties to China's military. (WSJ) Investors are souring on Turkey's markets, as President Erdoğan continues to push for interest rate cuts even as inflation hit 17% in May. (Bloomberg) Multinationals are reconsidering the need to be in Hong Kong, after the political upheaval of the last few years. Some are instead heading for Singapore, or even Shanghai to better profit from China's enormous economy. (WSJ) |     | | | | | | A message from The Ascent | | The high cash back card that smart spenders dream about | | |  | | | One of the highest cash back cards available now has 0% APR into 2022. Cardholders also enjoy: - No annual fee and up to 5% cash back on everyday purchases.

- An opportunity to secure $1,148 of value from the card.

See why The Ascent says this is their "number one pick for a one card wallet." | | | | | | 3. The Goldilocks effect |  | | | Illustration: Sarah Grillo/Axios | | | | Last week's economic data dump was nothing if not consistent, Axios' Kate Marino writes. Spanning the May jobs report, the Federal Reserve's Beige Book and business activity indicators, the picture that emerged was one of an economy in recovery — albeit slower than some expected, and jammed with labor and supply shortages. Why it matters: Taken together, the data gives the Fed cover from making any big monetary decisions or changing its course over the next few months. Catch up quick: Friday brought a "Goldilocks jobs report," in that it was "not too hot, and not too cold," Kristina Hooper, Invesco's chief investment strategist, tells Axios. - "From a markets perspective, this is the best possible scenario. We saw enough job creation, but not too much," Hooper says.

- There were 559,000 jobs created in May — which is still 7.6 million below pre-pandemic levels.

- The market generally expected the Fed to begin telegraphing plans for tapering by late summer or fall. After last week's reports, that hasn't changed.

Meanwhile: The Fed governors in Wednesday's Beige Book highlighted increased growth compared with earlier in the year. Yes, but: They also noted labor shortages and increasing input costs for businesses. - "It's unusual to see continued slack in the economy, together with labor shortages which are very clearly being signaled by employers," says Sonal Desai, fixed income CIO at Franklin Templeton.

- And it's not just low-skilled jobs. "There appears to be a genuine difficulty in finding both unskilled and skilled workers," she notes.

What to watch: Whether the June and July jobs and price data show the bottlenecks working themselves out as the pandemic recovery progresses. What else to watch: The mismatch of available jobs to available labor could ultimately become part of the conversation on immigration reform. Go Deeper with Axios Re:Cap🎙 to unpack the jobs report. |     | | | | | | 4. Wage pickup ⬆️ |  | | | Illustration: Aïda Amer/Axios | | | | Speaking of employment ... The May jobs report provided an injection of optimism, but it's too early to feel confident about the wage growth picture, Axios' Hope King writes. Why it matters: Employers have had to raise wages to incentivize workers to come back or to stay. It's unclear how much higher they're willing to go. - Last month average hourly earnings rose half a percent, while weekly earnings ticked up just a quarter percent versus April.

- Average hourly earnings grew nearly 3% for leisure and hospitality roles — where job growth has been strongest — between March and May, notes Invesco's Hooper.

What to watch: In the fall, when schools reopen and supplemental unemployment benefits go away, the data will present a clearer picture of how willing employers are to continue raising wages. |     | | | | | | 5. Foreclosure crisis fears subside |  Credits: Data: Black Knight; Chart: Axios Visuals The federal government's foreclosure moratorium is ending later this month. But that doesn't mean foreclosures are about to come roaring back, Felix writes. Why it matters: The housing market is very tight, and people who lose their homes right now can find it very hard to find somewhere else to live. The good news, however, is that foreclosures are almost certain to remain extremely uncommon until 2022 at the earliest. Driving the news: As the White House's moratorium is ending, the Consumer Financial Protection Bureau is proposing a new rule, called Regulation X, that would effectively ban foreclosures until the end of 2021, while also making it easier to keep borrowers in their homes. The big picture: About 7.2 million homeowners entered pandemic-related forbearance plans, but most of them have already successfully left that purgatory. - According to data from Black Knight, 46% are now reperforming on their loans, and another 17% have paid off their mortgage entirely, either by refinancing or by selling their house into the strong housing market.

- About 2.1 million homeowners remain in forbearance. Even if they're behind on both mortgage payments and property taxes, the overwhelming majority of those homeowners still have substantial positive equity in their homes, says Black Knight economist Andy Walden.

What they're saying: "It's almost the exact opposite of what we saw during the last financial crisis," Walden tells Axios. - Back then, millions of homeowners were underwater on their mortgages, "which really limited the options and created a snowball of distress."

- Now, by contrast, rising prices create a lot more space for servicers to work out deals that keep borrowers in their homes.

The bottom line: There's a good possibility that foreclosures will rise above their pre-pandemic levels in 2023, once all other options have been tried and once the current backlog of court cases has begun to clear. For the time being, however, foreclosure is one thing that most homeowners don't need to worry about. Go deeper. |     | | | | | | A message from The Ascent | | The high cash back card that smart spenders dream about | | |  | | | One of the highest cash back cards available now has 0% APR into 2022. Cardholders also enjoy: - No annual fee and up to 5% cash back on everyday purchases.

- An opportunity to secure $1,148 of value from the card.

See why The Ascent says this is their "number one pick for a one card wallet." | | |  | | The tool and templates you need for more engaging team updates. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment