| | | | | | | Presented By The Ascent | | | | Axios Markets | | By Aja Whitaker-Moore ·Jun 10, 2021 | | Good morning! Today's newsletter is 1,131 words, 4 minutes. 🚨Situational awareness: For inflation watchers, April CPI data is scheduled to be released at 8:30am ET. Economists are expecting one of the largest year-over-year gains in a decade. Send tips, feedback and general niceties to aja.moore@axios.com or hit me up on Twitter @AjaWMoore. | | | | | | 1 big thing: A secretive corner of the equity market |  | | | Illustration: Aïda Amer/Axios | | | | Investors on the hunt for buying opportunities in equities probably haven't come across some of this year's notable success stories. That's because they are hiding in an illiquid, old-school market — and being traded by fixed-income desks, writes Axios' Kate Marino. Why it matters: After Chapter 11, many companies are left for dead by the broader investing community — keeping their comebacks under the radar due to the private market in which they trade. SPACs (special purpose acquisition vehicles) are increasingly starting to take notice as they search for targets to buy. Case in point: J.Crew. - As the U.S. comes out of the pandemic, J.Crew's shares have nearly doubled in value over the last three months, Axios has learned.

- J.Crew is now part of a shadowy group of retailers — including Neiman Marcus, JCPenney and Belk — that have gone through bankruptcy and now sit in a kind of ownership purgatory, with their equity held by a disparate group of former creditors.

By the numbers: J.Crew's shares traded at $9 around March, and have moved up to $17 as the company's earnings rebounded. - With approximately 100 million shares outstanding, the equity is now worth around $1.7 billion.

How it works: When companies file for bankruptcy, their creditors usually wind up with ownership. It's the same idea as a bank taking over a house after the owner stops paying the mortgage. - In the case of companies, the creditors forgive some or all of their debt claims, and in return are given new private shares, or "reorganized equity."

The players: The reorg equities trade by appointment only. Buyers are often existing investors or distressed funds already tapped into the network. Reality check: Some of the reorg equity holders never wanted to own it in the first place. Their ultimate goal is to sell the company outright or take it public. The big picture: The plumbing remains antiquated in this corner of the world. - "It's a very thin market. The stocks are not listed somewhere, and you can't electronically trade them. It's ripe for disintermediation, like through the use of blockchain," Sanjeev Khemlani, leader of FTI Consulting's senior lender advisory practice, tells Axios.

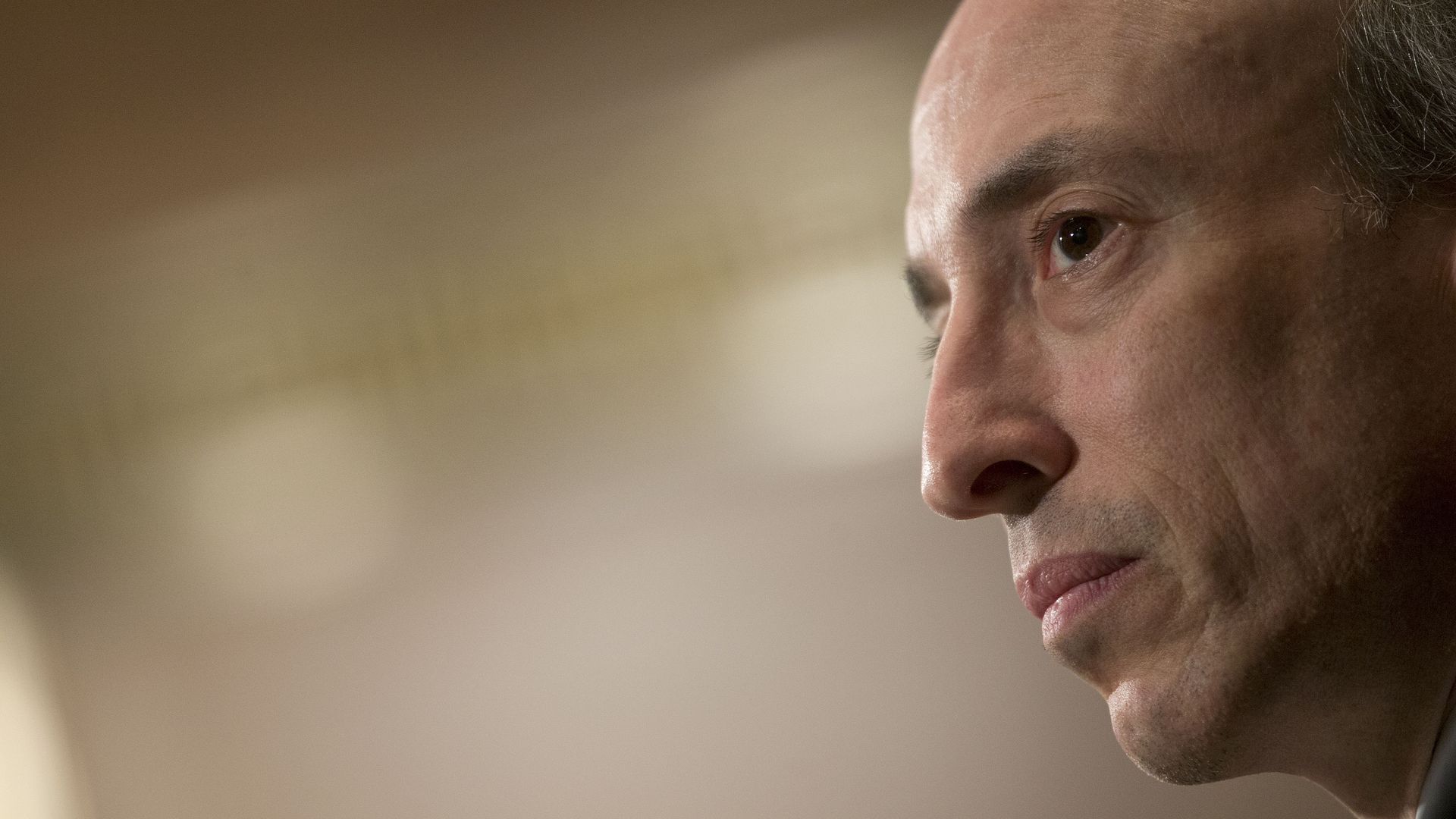

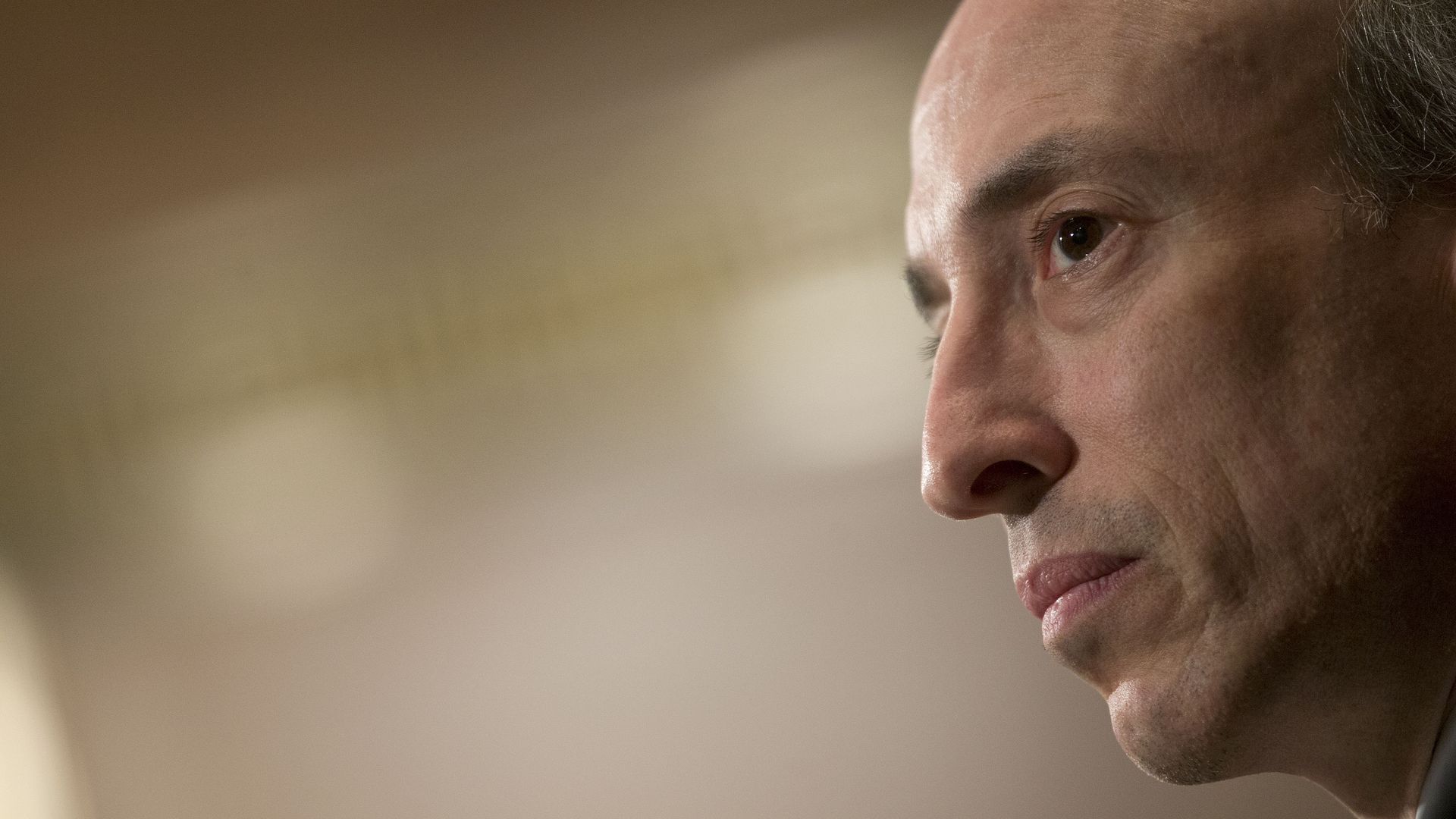

The bottom line: J.Crew and others aren't meme stocks or SPACs (yet) — but they are real companies with real market capitalizations. They left the public market arena but may very well be back soon. |     | | | | | | 2. Catch up quick | | The White House talked up the economic recovery and cited analysis that inflation will be transitory ahead of the CPI report. (Axios) Five former U.S. Treasury secretaries penned an editorial proposing strategies for recouping the hundreds of billions in legally owed but uncollected taxes. (NYT) Wall Street is selling green junk bonds in droves with a catch — the fine print doesn't always require borrowers to use the money to finance environmental projects. (WSJ) |     | | | | | | 3. Gensler's publicity tour 🎤 |  | | | Andrew Harrer/Getty Images | | | | In appearances this week, SEC chairman Gary Gensler laid the groundwork for his agency to play offense, Kate writes. Why it matters: Phenomenons like SPACs and an explosion of retail trading have taken off over the last year, presenting new market realities for regulators to consider. On Wednesday, Gensler outlined plans for a broad review of the equity market's structure — with a goal of modernizing the rules of the game. - "Rules mostly adopted 16 years ago do not fully reflect today's technology. I believe it's appropriate to look at ways to freshen up the SEC's rules," Gensler said in prepared remarks at the Global Exchange and FinTech Conference.

- The comments followed an appearance at Monday's Wall Street Journal CFO Network Summit, where Gensler said he wanted to address market manipulation that takes place on social media, as well as insider trading.

Of note: One of the original meme stocks, GameStop, said Wednesday that the SEC is investigating trading activity in its shares — and those of other companies. The big picture: Gensler had already indicated that he'd be a proactive chairman, as Axios' Kia Kokalitcheva reported. - But yesterday's comments suggest a more sweeping review of the equity markets than he has previously telegraphed.

- "This reflects the realities of market conditions ... and [Gensler's] agenda is very much investor protection, and broader market structure issues that could lead to victimization of investors," Ken Joseph, Duff & Phelps' head of Americas regulatory consulting, tells Axios.

The details: Gensler also doubled down on concerns he previously expressed about the gamification of trading, and payment for order flow at off-exchange wholesale market makers. - The shares of Virtu Financial, one of the wholesalers, fell 8% Wednesday.

As far as timing for actual rule-change proposals, he said "it should not be confused with something that is far off," the WSJ reports. What to watch: Gensler's next move on insider stock transactions. He said Monday he wants to revise the rules governing insider stock-buying arrangements, known as 10b5-1 plans. - "Assuming new rules pass, it will significantly alter the landscape for corporate insiders to defend themselves against charges of insider trading," Joseph says.

|     | | | | | | A message from The Ascent | | The high cash back card that smart spenders dream about | | |  | | | One of the highest cash back cards available now has 0% APR into 2022. Cardholders also enjoy: - No annual fee and up to 5% cash back on everyday purchases.

- An opportunity to secure $1,148 of value from the card.

See why The Ascent says this is their "number one pick for a one card wallet." | | | | | | 4. Report: The need for paid leave |  | | | Illustration: Eniola Odetunde/Axios | | | | About two-thirds of service sector workers said they could not take leave, or took less leave than they wanted, when they experienced a major life event, according to a Harvard and UC San Francisco study released today, Axios' Hope King writes. Within this group, 71% said the reason was they couldn't afford to. Why it matters: Part of President Biden's American Families Plan provides 12 weeks of guaranteed paid family and sick leave to workers, marking the first time that a U.S. president has introduced a national-level paid leave program. By the numbers: The study, which Axios is first to report, shows exactly how difficult it was for low-income workers to think about taking time off in the fall of 2020 — whether for a personal medical need, caregiving, new child or a combination of qualifying events. - Men (38%) were more likely than women (28%) to say they didn't take leave or as much as they would have liked to out of fear that they would lose their jobs.

- Hispanic workers (53%) and Black workers (49%) were the most likely to say they felt pressure to avoid taking time off or fear job loss compared with white workers (39%).

- The survey covered 8,500 of those who worked for 85 of the largest companies across retail, grocery, delivery and fulfillment and food service, including Walmart, Target and Starbucks.

- The median wage of workers surveyed was $12.75 per hour.

What they're saying: The study is among the first to document the extent to which paid leave is inaccessible among front-line low-wage workers, researchers Elaine Zundl, Julia Goodman and Daniel Schneider tell Axios. The bottom line: Making the case for paid leave, financially fragile workers "are serving food and going hungry," Schneider says. |     | | | | | | 5. Main Street retail fears grow |  | | | Illustration: Aïda Amer/Axios | | | | Owners of independent brick-and-mortar businesses have a bleak outlook of the competitive threat posed by online shopping, Hope writes. A new survey of local U.S. retailers published by Shopify today shows that 82% of respondents agree that major online marketplaces are making it more difficult to operate. Why it matters: The pandemic accelerated the decline of retail stores and this latest study adds to the expectation that more than 150,000 stores may close in the next five years. - About 89% of local retailers surveyed say they are in competition with online retailers.

- And of those, 59% say they may be forced to close their business within the next 24 months.

State of play: In some cases, businesses are using their stores as last-mile delivery solutions to complement their e-commerce strategy — fulfilling online orders while providing a local presence. |     | | | | | | A message from The Ascent | | The high cash back card that smart spenders dream about | | |  | | | One of the highest cash back cards available now has 0% APR into 2022. Cardholders also enjoy: - No annual fee and up to 5% cash back on everyday purchases.

- An opportunity to secure $1,148 of value from the card.

See why The Ascent says this is their "number one pick for a one card wallet." | | |  | | The tool and templates you need for more engaging team updates. | | | | | | Axios thanks our partners for supporting our newsletters. If you're interested in advertising, learn more here.

Sponsorship has no influence on editorial content. Axios, 3100 Clarendon Blvd, Suite 1300, Arlington VA 22201 | | | You received this email because you signed up for newsletters from Axios.

Change your preferences or unsubscribe here. | | | Was this email forwarded to you?

Sign up now to get Axios in your inbox. | | | | Follow Axios on social media:    | | | | | |

No comments:

Post a Comment