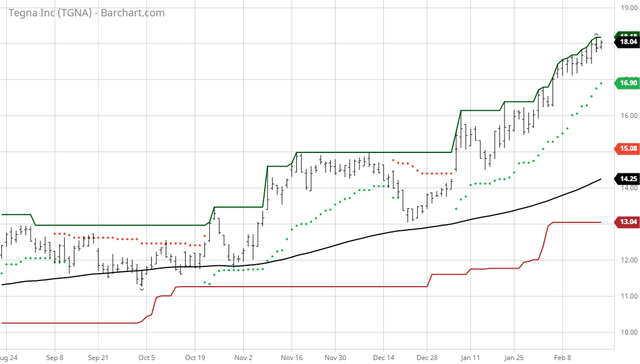

The Barchart Chart of the Day belongs to the TV media company TENGA (NYSE:TGNA). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 1/7 the stock gained 15.35%. TEGNA is a media company which consists of 47 television stations operating in 39 markets offering high-quality television programming and digital content. The primary sources of their revenues are: 1) advertising & marketing services revenues, which include local and national non-political advertising, digital marketing services (including Premion), and advertising on the stations' websites and tablet and mobile products; 2) political advertising revenues, which are driven by even year election cycles at the local and national level and particularly in the second half of those years; 3) subscription revenues, reflecting fees paid by satellite, cable, OTT (companies that deliver video content to consumers over the Internet) and telecommunications providers to carry their television signals on their systems; and 4) other services, such as production of programming from third parties and production of advertising material.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. Barchart technical indicators: - 100% technical buy signals

- 158.75+ Weighted Alpha

- 142.35% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 14.92% in the last month

- Relative Strength Index 74.09%

- Technical support level at 17.89

- Recently traded at 18.04 with a 50 day moving average of 15.43

Fundamental factors: - Market Cap $3.92 billion

- P/E 11.17

- Dividend yield 1.56%

- Revenue expected to grow 27.30% this year

- Earnings estimated to increase 62.30% this year and continue to compound at an annual rate of 10.00% for the next 5 years

- Wall Street analysts issued 3 strong buy, 3 buy, 6 hold and 1 under perform recommendations on the stock

- The individual investors following the stock on Motley Fool voted 306 to 105 that the stock will beat the market

- 3,311 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis. |

No comments:

Post a Comment