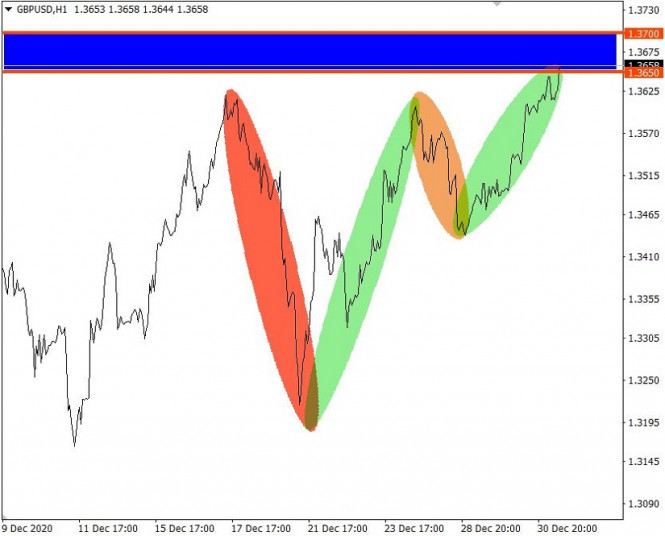

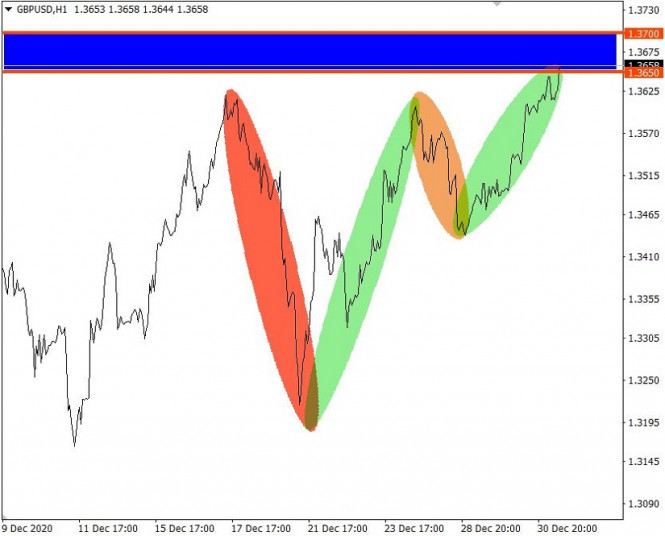

| Trading idea for gold 2020-12-31  The sharp decline of the US dollar today has affected all trading instruments, including gold. Now, since most sell stops are placed at 1900, gold bulls can build up long positions in the market, in order to raise the price of gold.  In particular, since the quotes have already formed three wave patterns (ABC), where wave "A" is the upward movement observed yesterday, traders could set up buy positions from the 50% retracement level, and then take profit as soon as the quote breaks out of 1900. The risk for this transaction is the low reached yesterday. Of course, traders have to monitor and control the risks to avoid losing money. Trading is very precarious, but also very profitable as long as you use the right approach. Price Action and Stop Hunting were used for this strategy. Good luck and Happy New Year! Trading recommendations for starters on GBP/USD and EUR/USD for December 31, 2020 2020-12-31 November's pending sales in the US real estate market was the only released data yesterday, where they forecasted a growth of 0.2%, but a decline of -2.6% was recorded instead. Moreover, there was a decline from 20.2% to 16.4% in annual terms. It is possible that the statistics affected the US dollar rate, but there is an assumption that the main driver for the weak dollar was speculation on it. Also yesterday, there was outrage about the health system of the United States, where intriguing headlines in the media said that the national vaccination program completely failed, despite the catastrophic situation with coronavirus. Such headlines provoke speculators to sell the dollar. What happened on the trading charts? The pound updated the local high on the wave of the upward movement. This turns out to be at the level of 1.3650, without reducing buyers' interest. Such a high degree of overbought does not stop speculators, but it is worth considering that the area of 1.1650/1.1700 has served as a resistance throughout history, which may well affect the volume of long positions (buy positions). In turn, the Euro did not lag behind its counterpart in the market, which also updated the local high of the medium-term upward trend. Considering the latest movement, the quote reached the level of 1.2309, and this already reflects the lower limit of the 2018 side channel – 1.2300/1.2500.

Trading recommendation for GBP/USD on December 31 US unemployment benefits are expected to be released for today's economic calendar. However, everything about it is not pleasant. Initial applications are predicted to rise from 803 thousand to 815 thousand, which is quite reasonable. Repeated applications for benefits can please traders with a decline from 5,337 thousand to 5,290 thousand. It is noteworthy that there is a shorter working day today at all major stock exchanges. Thus, trading volumes may be reduced, which will affect the volatility in the market. As for price movements, it was previously mentioned that the quote reached the resistance area of 1.3650/1.3700, which can negatively affect the volume of long positions. In connection with the early closing, it is not excluded that the quotes will slow down, expressed in amplitude along the resistance area. Traders will consider a following upward movement if the price is maintained above the level of 1.3700 in a four hour time frame.

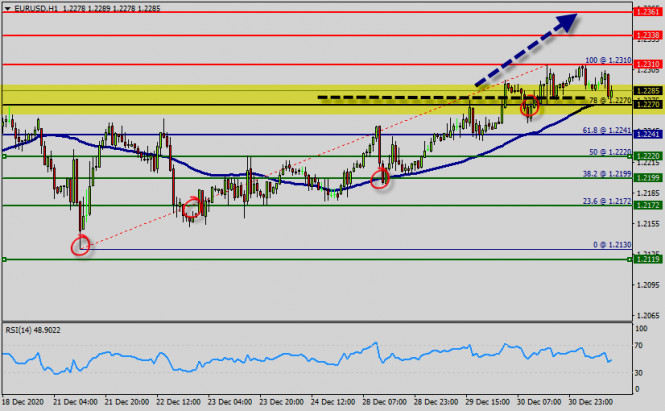

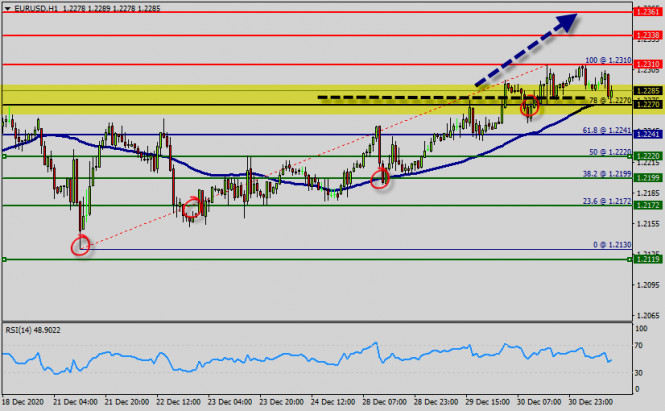

Trading recommendation for EUR/USD on December 31 Statistical data is not expected to be published in Europe and Britain today. The impulse represented by Germany will also not also work today, since it is New Year's Eve. In this case, trading volumes will be reduced and trading can be boring. Analyzing the current trading chart, it can be seen that the quote moves within the local high of the medium-term upward trend, where market participants feel pressured due to the high degree of overbought of the single currency. We can assume that the 2018 flat range of 1.2300/1.2500 will eventually affect the volume of long positions and a massive correction for the euro will occur in the market.

Trading idea for the USD/JPY pair 2020-12-31  Yesterday, the USD / JPY pair faced a very interesting situation, which, in our opinion, is caused by the closure of short positions in the market. In that regard, traders can use this as a pivot, in order to take over the sell stops at 103.9.  In fact, since the quotes have formed three wave patterns (ABC), where wave "A" is the upward movement observed yesterday, the bulls can open long positions from 103.30-103.50, the target of which is a 50% retracement in the market. The risk for this transaction is 102.950, which is the low reached yesterday. The main target is a breakout from 103.9, but if the quote reaches 103.350, take profit. Price Action and Stop Hunting were used for this trading strategy. Good luck and Happy New Year! EUR/USD: US dollar still thinks about a rebound, although the euro ends the year positively 2020-12-31

The US currency temporarily rose in March amid the coronavirus outbreak, however, it lost more than 13% of its value. The USD index reached its lowest point since April 2018, dropping below 90 points. Nevertheless, experts from Commonwealth Bank of Australia said that the launch of COVID-19 immunization campaigns in several countries, as well as additional fiscal support in the United States, reduced the risk of deterioration in the global economy and served as a good tool for improving market sentiment. This continues to be the main obstacle for the US dollar. Many market participants believe that a weak dollar will contribute to the global economic growth and ensure a rally in risky assets next year. However, the future fate of the US currency largely depends on how quickly the economies of Europe and Asia will recover from the coronavirus crisis compared to the United States. Eurozone's preliminary PMI data released earlier in December showed that activity in the currency bloc's manufacturing sector grew faster than expected, while the services sector contracted less than expected. These reports added to optimism that the region's economy is beginning to stabilize, which in turn was a key factor contributing to the recent growth of the single European currency. Meanwhile, IMF experts warn that the economic recovery in the eurozone in 2021 may not meet expectations amid a new wave of coronavirus in the region. They said that if the dynamics of COVID-19 cases does not change significantly in the coming months, then economic activity in the eurozone will recover more slowly than we expected. Slower economic growth is likely to leave deep scars that will negatively affect the economy of the currency bloc in the future.

Amid the US dollar's weakening almost across the entire spectrum of the market, the main currency pair updated the 32-month highs, breaking the level of 1.2300. US stock indices also end the year near their peak levels. According to Sam Stovall of CFRA research, the market is now on autopilot at the end of the year. However, we will be vulnerable in the short term due to the second round of US Senate elections in Georgia. If it turns out that we have two Democrats, that will be enough to force investors to rethink how optimistic they want to be. The fact is that the upcoming January 5 re-election to the US Senate may transfer control of the Upper House of Congress to the Democrats. The latter will promote some of the initiatives by the recently elected, US President Joe Biden, which investors consider as unfriendly to the market, including raising the level of taxation for corporations. In addition, a lot of different statistics for December will be released during the first week of new year. The releases across the US and Europe are likely to be weak, since restrictions were imposed again during the second wave of COVID-19. This could put an end to the prolonged vaccine optimism in the market and provide a fairly oversold dollar with a chance to rebound. Bloomberg analyst, Garfield Reynolds, believes that the breakthrough in the Brexit negotiations, which became a negative factor for the US currency, is now left behind, while the ongoing deterioration of the global epidemiological situation creates prerequisites for the strengthening of the USD. However, he warns that although a noticeable decline in the US currency is expected in the long term, it can suddenly rise in the short term which can surprise the market. If this scenario works out, then we will be able to see the EUR/USD pair decline in January, that is, from its current levels to the level of 1.1800. Technical analysis of EUR/USD for December 31, 2020 2020-12-31  Overview : The EUR/USD pair continued to move upwards from the level of 1.2241. Since yesterday, the pair has risen from the level of 1.2241 (the level of 1.2241 coincides with the ratio of 61.8% Fibonacci) to the top around 1.2310 - closed at 1.2280, current price sets at 1.2284. In consequence, the EUR/USD pair broke resistance at 0.9887, which turned into strong support at the level of 1.2241. In the H1 time frame, the level of 1.2241 is expected to act as major support today. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish market. The price is still above the moving average (100). From this point, we expect the EUR/USD pair to continue moving in the bullish trend from the support level of 1.2241 towards the target level of 1.2310 (to test it again. If the pair succeeds in passing through the level of 1.2310, the market will indicate the bullish opportunity above the level of 1.2310 so as to reach the second target at 1.2338. We guess that the EUR/USD pair won't pass the spot of 1.2360 - 1.2400 in 2020. At the same time, if the EUR/USD pair is able to break out the level of 1.2241, the market will decline further to 1.2130 (last bearish wave). Trading plan for EUR/USD on December 31 2020-12-31

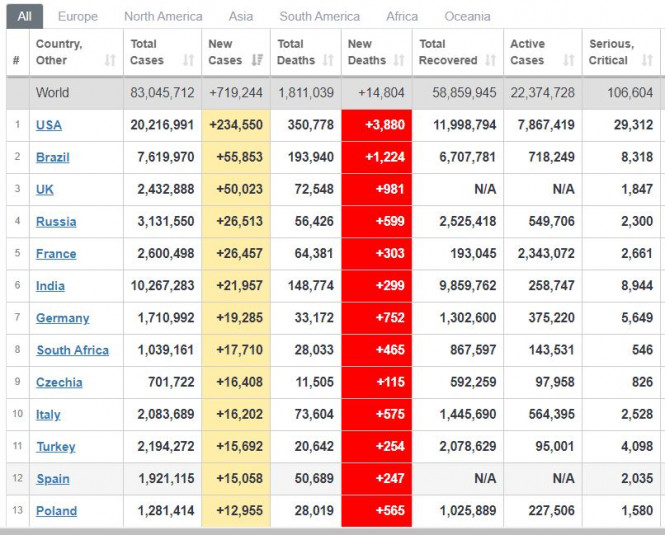

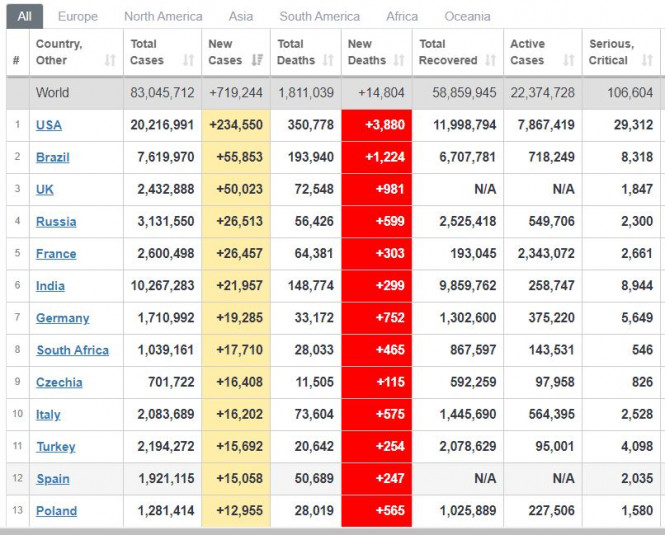

Latest data shows that COVID-19 incidence grew again around the world, recording a total of 719,000 new cases yesterday. In the United States, new infections reached 234,000, while in the UK it was at 50,000. But on the bright side, vaccinations are now active, especially in the US, UK and the EU. In Israel, almost 800,000 have already been vaccinated. The effects of vaccinations should begin to appear as early as mid-January.

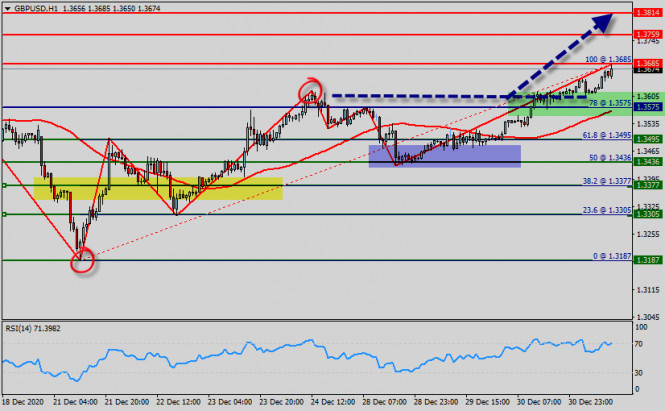

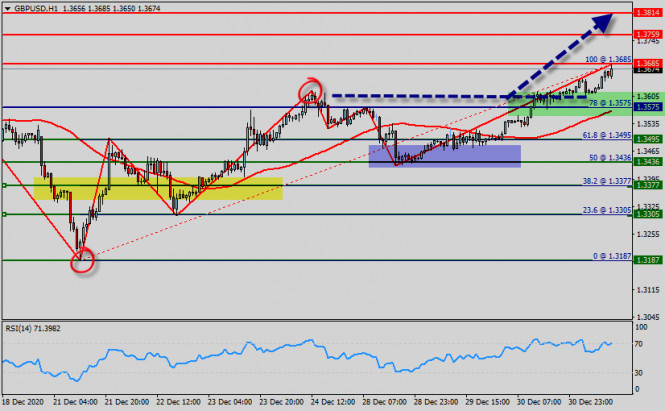

EUR/USD - euro continues to climb up in the markets. Open long positions from 1.2190. Open short positions from 1.2180. Technical analysis of GBP/USD for December 31, 2020 2020-12-31  Overview : The GBP/USD pair broke resistance, which turned into strong support at 1.3575. Right now, the pair is trading above this level. It is likely to trade in a higher range as long as it remains above the support (1.3575), which is expected to act as a major support today. Therefore, there is a possibility that the GBP/USD pair will move upwards and the structure does not look corrective. The trend is still below the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. From this point of view, the first resistance level is seen at 1.3759 followed by 1.3814, while daily support 1 is seen at 1.3575 (78% Fibonacci retracement). According to the previous events, the GBP/USD pair is still moving between the levels of 1.3575 and 1.3759; so we expect a range of 184 pips from the end of 2020 to the first week of 2021. Consequently, buy above the level of 1.3575 with the first target at 1.3759 so as to test the daily resistance 1 and further to 1.3814. Besides, the level of 1.3814 is a good place to take profit because it will form a new double top in 2021. On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.3575, a further decline to 1.3436 can occur, which would indicate a bearish market. Overall, we still prefer the bullish scenario, which suggests that the pair will stay above the zone of 1.3575. Analysis of Gold for December 31,.2020 - First upside target at $1.895 hs been reached. Second target at $1.906 2020-12-31 ECB's Weidmann says do not expect central banks to keep interest rates low forever Bundesbank President and hence ECB board member Jens Weidmann in an interview with a German newspaper. - We expect Germany's debt burden during the pandemic to be smaller than during the 2008 financial crisis

- says he doesn't expect second coronavirus wave to inflict more economic damage than first wave

- German government's emergency fiscal measures must be terminated once crisis unleashed by the pandemic is over

- says 2021 general election in Germany should play no role in the decision to end or extend economic rescue measures

- governments should not expect central banks to keep interest rates low forever

- if price outlook requires it, there must be a turning point in terms of interest rates in euro zone

- price pressures in euro zone are expected to remain subdued in coming years

- a shift in interest rate policy can take some time

- governments should prepare for interest hikes and not pretend that their debt burden is easy to service

- ECB will not take into consideration public debt servicing costs if price stability requires higher interest rates

- economic outlook ultimately depends on how covid infections develop after lockdown

Further Development

Analyzing the current trading chart of Gold, I found that the price reached our first upward target from yesterday at the price of $1,895 and $1,905. Key Levels: Resistance: $1,905 Support levels: $1,885 and $1,905 EUR/USD analysis for December 31 2020 - Potential for the ABC completion and further rise towards 1.2300 2020-12-31 Manufacturing 51.9 - expected 52.0, prior 52.1

Non-manufacturing 55.7 - expected 56.3, prior 56.4

Composite 55.1 All three slipping back a little on the month and still expanding. Further Development

Analyzing the current trading chart of EURUSD, I found that there is sellers today on the market but that there is also potential for the abc downside correction completion, which is sign for the further rise. Key Levels: Resistance: 1,2285 and 1,2300 Support level: 1,2265

Author's today's articles: Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." V Isakov  text text Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Mihail Makarov  - - Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Andrey Shevchenko

Andrey Shevchenko  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  text

text  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). -

-  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment