| Forex forecast 12/18/2020 on Bitcoin, SP500, Dow Jones and USD/JPY from Sebastian Seliga 2020-12-18 Let's take a look at the USD/JPY, SP500, Dow Jones and Bitcoin at the last trading day of the week. Trading recommendations for starters on GBP/USD and EUR/USD for December 18, 2020 2020-12-18

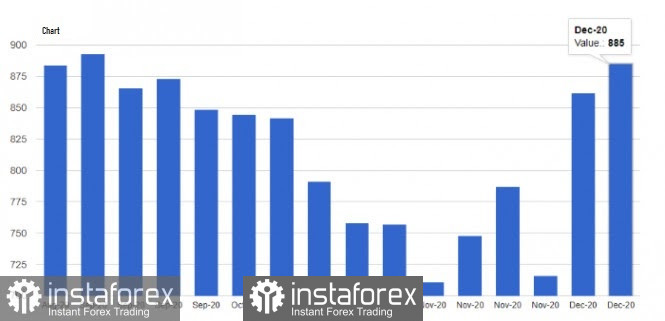

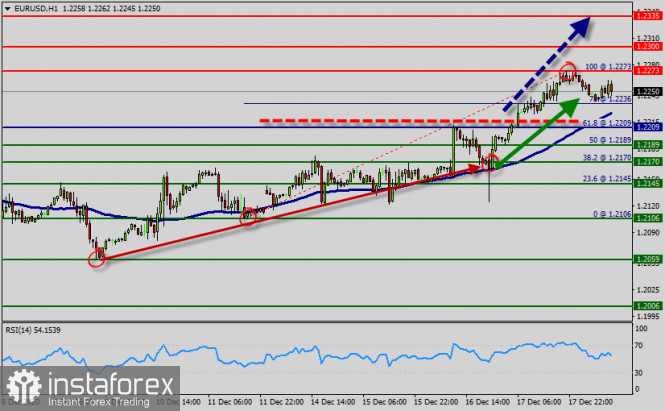

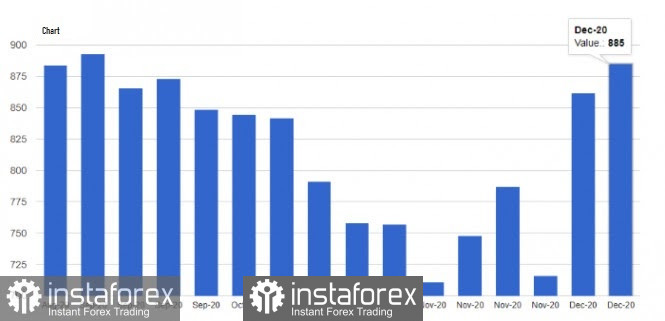

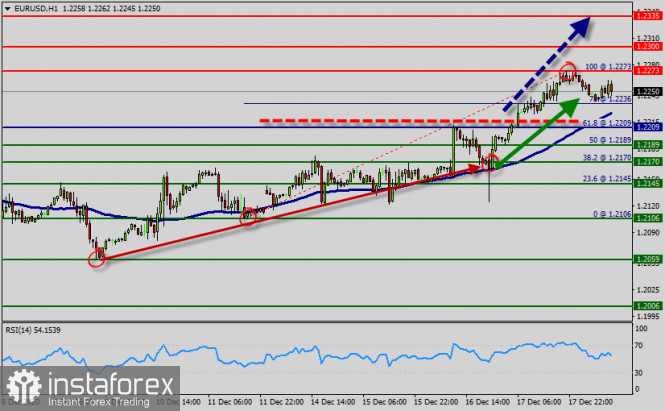

EUR/USD: Previous day's review The Euro continued to strengthen its positions at the levels of 2018 yesterday. As a result, its rate grew by + 0.60% against the US dollar. Important economic events in the calendar: The final inflation data were published in Europe. So, the consumer price index in November fell from 0.2% to -0.3% month-on-month, and remained at -0.3% year-on-year. The forecast in both cases coincided with analysts' expectations. Market participants expected such inflation rates, so the euro did not make any reaction. The weekly data on the number of unemployment claims in the US was published in the afternoon, where they expected an increase in their volume. But the result of the data turned out to be better than forecast. The volume of repeated applications declined by 273 thousand – from 5,781 thousand to 5,508 thousand, instead of growth. Meanwhile, primary applications expectedly rose by 23 thousand – from 862 thousand to 885 thousand. At the time of the publication of US statistics, the euro temporarily slowed down its growth. What happened on the trading chart? Buyers prevailed in the market by the time the daily candle opened at 00:00 Universal Time. There were some minor stops, but the Eurocurrency adhered to the upward mood. As a result, it managed to reach the level of 1.2272. If you move on the growth, it could very well let you gain 50-70 points of profit. GBP/USD: Previous day's review On December 17, the pound updated the local high of 2020 and due to which, the quote reached the level of 1.3623. Important economic events in the calendar: Yesterday's main event was the Bank of England meeting, where the regulator left the monetary policy unchanged. The base interest rate was kept at the level of 0.1% per annum, and the limit on funds for the purchase of assets remained in the amount of 895 billion pounds. At the same time, the regulator noted that its further actions will depend on the results of negotiations between the UK and the EU's trade agreement. Such dovish rhetoric from the BoE is already expected, so the quote did not react to the results of the December meeting. What happened on the trading chart? The pound sterling updated its local high and headed towards the level of 1.2623, where market participants reduced the volume of buy positions and formed a stagnation followed by a pullback. The decline in the volume of buy positions is due to the uncertainty in the Brexit trade negotiations. Trading recommendation for EUR/USD on December 18 Today, important statistics from Europe and the United States is not expected to be published. Therefore, we should pay special attention to the Brexit information flow, as well as technical analysis. Analyzing the current trading chart, it can be seen that there was a pullback stage from the high of 1.2272 towards 1.2258 during the Asian session. But considering euro's overbought stage, the pullback is insignificant. Now, it is necessary to keep the quote below 1.2250, which will open the way towards the level of 1.2200, in order to continue the downward movement. An upward development is considered in case of a characteristic speculative hype in the market, for example, in the information flow on Brexit trade negotiations. A price consolidation above the level of 1.2272 will lead to further growth towards 1.2300.

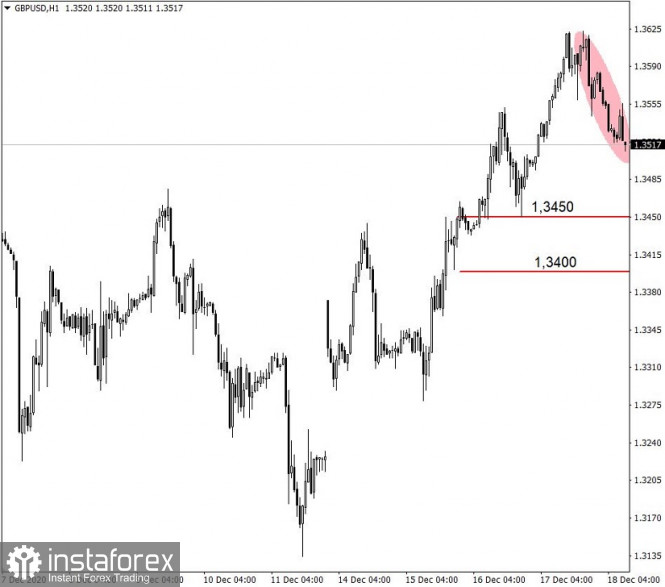

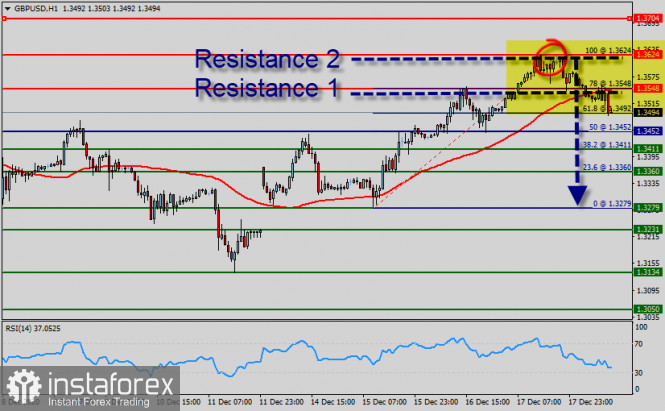

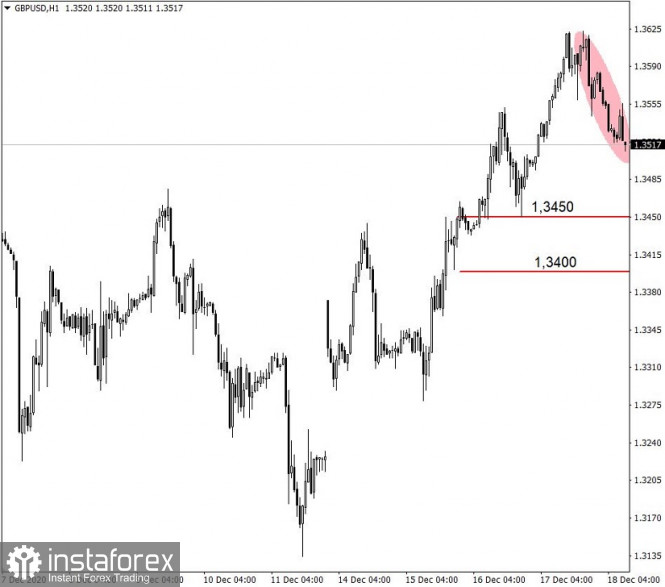

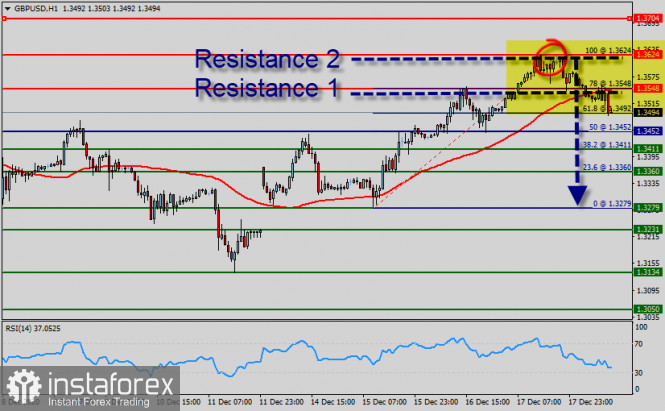

Trading recommendation for GBP/USD on December 18 UK data on the volume of retail sales were published, where they recorded a decline of -3.8% in November. This is a lot, although they expected a decline even more to -4.2%. In annual terms, retail sales are reduced from 5.8% to 2.4%, against the forecasted decline of 2.8%. After the publication of UK statistics, the value of the pound slightly weakened. Brexit trade negotiations remain to be the main factor that affects the price of the pound sterling. The moving tactics with the information flow stays the same: Good news about Brexit may lead to the pound's strengthening. Bad news about Brexit may lead to the pound's weakening. If a correctional movement occurs in the market, the pound's decline towards the level of 1.3450-1.3400 is possible.

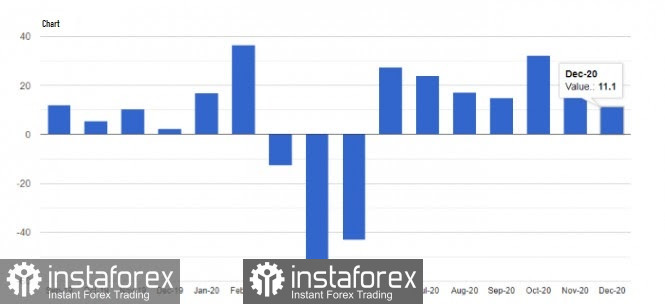

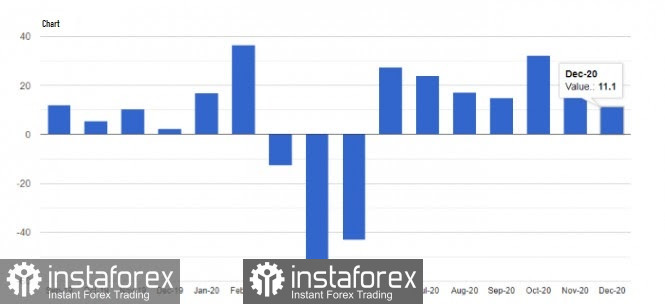

GBP/USD and EUR/USD: Pound plummets after some details of the Brexit negotiations were revealed. Meanwhile, the state of the US labor market is deteriorating, which creates problems to the US economy. 2020-12-18 GBP: Some details of the Brexit negotiations were revealed. They disappointed traders who were hoping for a deal to be signed this week, as they clearly suggest that such will not happen. And because of this, demand for the pound plummeted sharply, therefore, it would be risky to open long positions at the current highs. It is more rational to proceed from the technical correction, as such may intensify today.  Nonetheless, at the moment, the target of pound bulls is to return the quote to 1.3560. Then, good data on UK retail sales will pull it up even higher to 1.3620, a break of which will make it easier for the pound to reach the 37th figure, in particular, the level of 1.3760. But if the pressure on GBP / USD persists, the quote will drop to 1.3360. Going back to the negotiations, UK Prime Minister Boris Johnson said it may fail if the EU does not soften its position on fisheries. He called the EU's demands unreasonable. As for European Commission President Ursula von der Leyen, she said it will be quite difficult to overcome the existing differences on the issue. But despite this pessimistic rhetoric, officials in Brussels have expressed confidence that a deal could be closed before next week. They said that behind the scenes, the negotiations are moving in the right direction, and emerging negative statements from both the EU and the UK are common negotiation tactics to exert pressure. The remaining issue that hinders the concussion of a deal is the access of European fishing vessels to UK waters. The problem has minimal economic impact - the industry accounts for only 0.12% of the UK's GDP - but has a lot of political implications. This industry employs only 24,000 workers, which, for the EU economy, is practically "nothing". However, the EU wishes to have access to the UK's rich fishing waters in the future, as more than half of the fish and shellfish caught in UK waters come from EU countries. The UK wants to regain control of its economic zone (which is about 200 nautical miles under international law) and withdraw from the EU fisheries agreement, which sets quotas on how much and what kind of fish EU countries can catch.  Political analysts said that if both parties failed to sign a deal just because of this issue, it likely means that one of them is not ready to enter an agreement from the very beginning. In another note, the pound's growth earlier this week was driven by the rumors that a compromise has been found on the problem of equal competitive conditions for business. Then, yesterday, the European Parliament increased pressure on negotiators by setting the deadline on Sunday. Therefore, by that time, the UK and the EU must ratify an agreement. USD: The US dollar collapsed after data emerged that US jobless claims rose amid the second COVID-19 outbreak. The report published by the Department of Labor said initial jobless claims jumped 885,000 between December 6 and 12, while economists expected a drop in the figure. Secondary applications also rose to 812,500, which suggests that it is high time to start worrying about the state of employment again, because conditions will only worsen amid the continuous spread of the coronavirus. The results of the vaccination will be seen next year, but for now, restrictive measures and pressure on the service sector will force business owners to fire people to minimize costs. Current government aid programs are inadequate, and the supposed $ 900 billion new US package is once again suspended. This weak data on jobless claims is likely to have a negative impact on the overall nonfarm payrolls report due in early January 2021.  On a positive note, housing starts in the US increased in November, as apparently, demand rose amid very low interest rates. The report published by the US Department of Commerce said they increased by 1.2% to the previous month, and compared to 1.547 million units per year. The Economists had expected the figure to drop by 0.7% and amount to only 1.52 million units per year. As for economic activity, Kansas City Fed said the composite index jumped to 14 points in December, while economists had expected it to be 10.0 points only. Strong growth in manufacturing activity is a sign of a healthy sector, even as the coronavirus spreads. Meanwhile, the report from the Philadelphia Fed was not that good, as according to the data they released, business activity in the area fell to 11.1 points this December, while economists had expected it to be 20.0 points. But this slowdown in activity is not a serious problem yet, since the growth of the production sector in the region continues, albeit at a slower pace.  With regards to the EUR / USD pair, the bulls are currently trying to break the quote above 1.2271, as going beyond which will form a new and strong upward trend. If they succeed, the euro could reach the levels 1.2305 and 1.2340. But if there is no activity on the part of buyers near the yearly highs, EUR / USD may decline to 1.2225, and then to 1.2180. Trading plan for the EUR/USD pair on December 18. COVID-19 vaccinations will begin in Europe soon. 2020-12-18

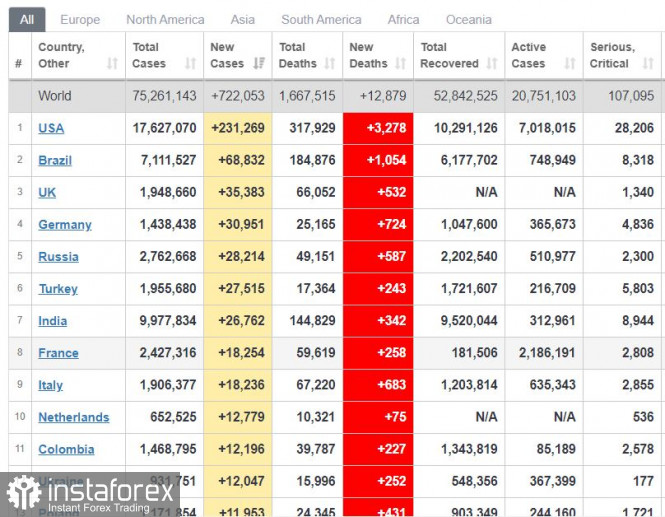

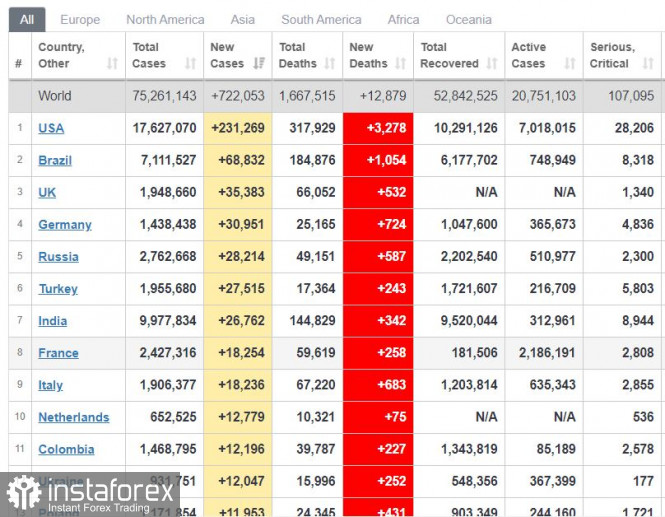

A new peak was reached again in terms of global COVID-19 incidence, as new cases totaled 722,000 yesterday. In the United States, the number of new infections reached 231,000. On a positive note, vaccinations continue in the UK and the US. Soon, it would also start in Europe - by December 27-29.

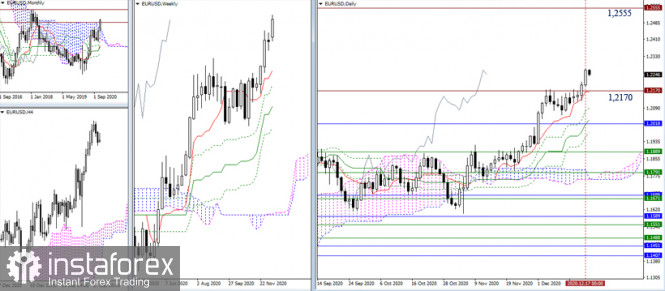

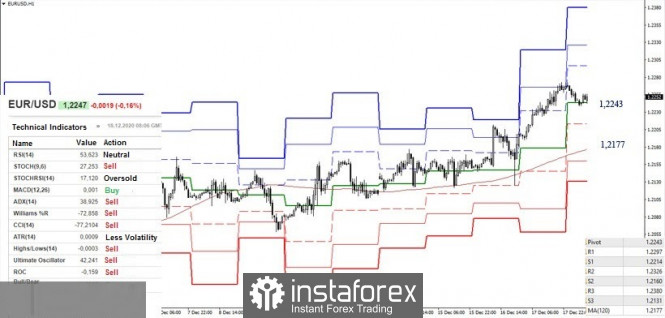

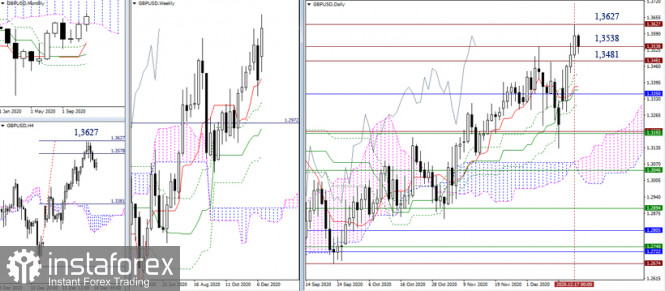

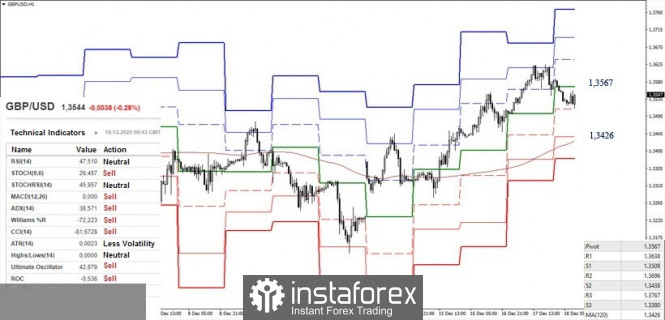

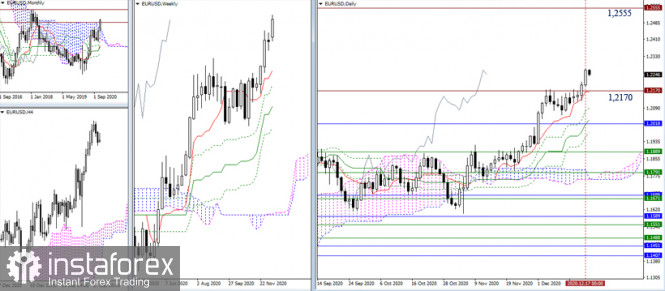

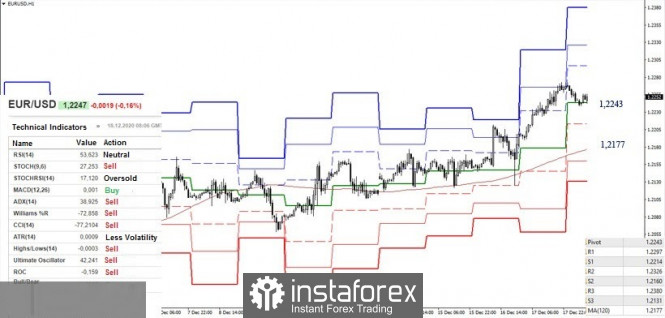

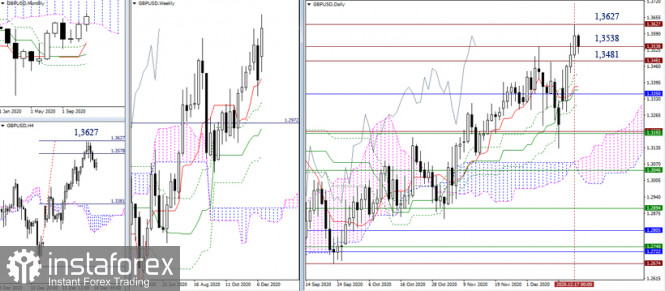

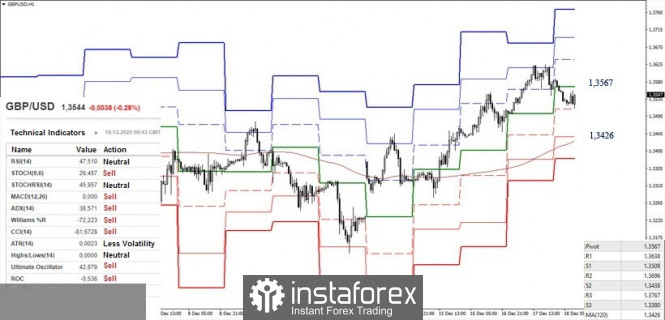

EUR/USD - euro bulls are trying to keep the upward trend. Set long positions at 1.2215. Set short positions at 1.2124. Technical analysis of EUR/USD for December 18, 2020 2020-12-18  Overview : As expected, the EUR/USD pair is still moving in a strong bullish channel (upwards) from the level of 1.2209. Yesterday, the pair rose from he level of 1.2209 (Pivot, support, 61.8% of Fibonacci retracement, last bearish wave) to the top point around 1.2273. Today, the first resistance level is seen at 1.2273 followed by 1.2300 and 1.2335, while daily support 1 is seen at 1.2209. But the pair has rebounded from the top of 1.2273 to close at 1.2250. Furthermore, the price has set above the strong support at the level of 1.2209, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected several times confirming the veracity of an uptrend. Additionally, the RSI starts signaling an upward trend. According to the previous events, the EUR/USD pair is still moving between the levels of 1.2209 and 1.2335; for that we expect a range of 126 pips (1.2335 - 1.2209). If the EUR/USD pair fails to break through the resistance level of 1.2209, the market will rise further to 1.2273 again. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to climb higher towards at least 1.2300 with a view to test the first daily resistance. Consequently, the market is likely to show signs of a bullish trend. So, it will be good to buy above the level of 1.2273 with a target at 0.6551 1.2300 and further to 1.2335. On the contrary, if a breakout takes place at the resistance level of 1.2209 (pivot), then this scenario may become invalidated. Conclusion : Accordingly, the EUR/USD pair is showing signs of strength following a breakout of a high at 1.2209. Hence, buy above the level of 1.2209 with the first target at 1.2273 in order to test the daily resistance 1 and move further to 1.2300. Also, the level of 1.2335 is a good place to take profit because it will form a new bearish wave. Amid the previous events, the pair is still in an uptrend; for that we expect the EUR/USD pair to climb from 1.2209 to 1.2335 today. At the same time, in case a reversal takes place and the EUR/USD pair breaks through the support level of 1.2209, a further decline to 1.2106 can occur, which would indicate a bearish market next week. Technical analysis of GBP/USD for December 18, 2020 2020-12-18  Overview : The GBP/USD pair faced a strong resistance at the level of 1.3624, while minor resistance is seen at 1.3548. Support is found at the levels of 1.3452, 1.3411 and 1.3360. This week, the GBP/USD pair continued to move upwards from the level of 1.3452. The pair rose from the level of 1.3452 to the top around 1.3624. In consequence, the GBP/USD pair broke resistance, which turned strong support at the level of 1.3452. However, the price spot of 1.3624 - 1.3548 remains a significant resistance zone. Thus, the trend will probably be rebounded again from the double top as long as the level of 1.3624 is not breached. Today, the level of 1.3624 is expected to act as major resistance. Hence, we expect the GBP/USD pair to continue moving in the bearish trend from the resistance levels of 1.3624 and 1.3548 towards the target level of 1.3435 so as to test pivot point. If the pair succeeds in passing through the level of 1.3435, the market will indicate the bearish opportunity below the level of 1.3435 in order to reach the second target at 1.3411. Next objective 1.3360 In other words, sell orders are recommended below the zone of 1.3548 with the first target at the level of 1.3452; and continue towards the tragets of 1.3411 and 1.3360. According to the previous events, we expect the GBP/USD pair to trade between 1.3548 and 1.3360. Note, the bottom stands at 1.3279, while daily resistance is found at 1.3548. On the contrary, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.3624, then a stop loss should be placed at 1.3650. Technical recommendations for EUR/USD and GBP/USD on 12/18/20 2020-12-18 EUR/USD  Bullish traders continue to rise. If the current week's closing is positive, it will confirm the implementation of the trend continuation signal. A reliable consolidation and retention of positions above the historical level of 1.2170 will allow us to consider new prospects. In the higher time frame, the nearest highest extremum of the month, which is the level of 1.2555, will be considered as an upward pivot point.  The pair in the smaller time frame is currently in the correction zone. The development of a downward correction is already ready to support technical indicators, but the bulls' interests in the current conditions continue to defend the key supports, which are now located at 1.2243 (central pivot level of the day) and 1.2177 (weekly long-term trend). The nearest support is located at 1.2214 (S1). Now, the higher time frame strengthened the support for the weekly long-term trend, so a consolidation below will change the current balance of power not only on the hourly time frame. On the other hand, exiting from the correction zone and continuing the upward movement will open the way to the resistances of the classic pivot levels 1.2297 (R1) - 1.2326 (R2) - 1.2380 (R3). GBP/USD  The bulls developed the target for the breakdown of the four-hour cloud (1.3627), then took a break. This week's result of closing will be important. Here, too long shadow of the weekly candle can be a signal of a long stop and the beginning of a new huge correctional decline. In the current conditions, it is important for bulls to maintain their position above 1.3481 - 1.3538. In this case, they will have a better chance of closing December in the monthly cloud with a recovered upward trend.  The support of the central pivot level (1.3567) was lost and the technical indicators are set to strengthen bearish mood, with the development of the correction in the hourly time frame. The nearest support is currently located at 1.3509 (S1), so the bears' interest will be directed to the weekly long-term trend (1.3426). Their main task will be to restore the trend (1.3624) in case that the level of 1.3567 returns to the bulls' side. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120) Analysis of Gold for December 18,.2020 - Broken bullish flag pattern and upside continuation towards $1.895 2020-12-18 UK PM Johnson: Our position is we want to keep talking if there is a chance of a Brexit deal Our door is open - Things are looking difficult

- Hopes that EU will see sense, they must come to the table with something

- If they don't, we will trade on WTO terms

- WTO terms may be difficult at first, but we will prosper

If both sides are still unwilling to move, I just don't see how there will be any conclusion in talks from this weekend either. The transition period deadline is 31 December, so perhaps we may see some political will to work out a compromise by then. However, knowing both sides and how this saga has dragged on, it may not come until the very last minute - quite literally.

Further Development

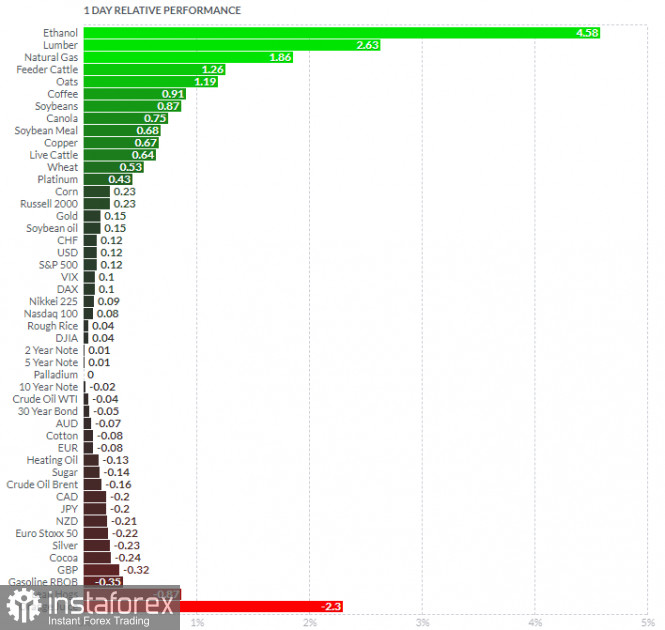

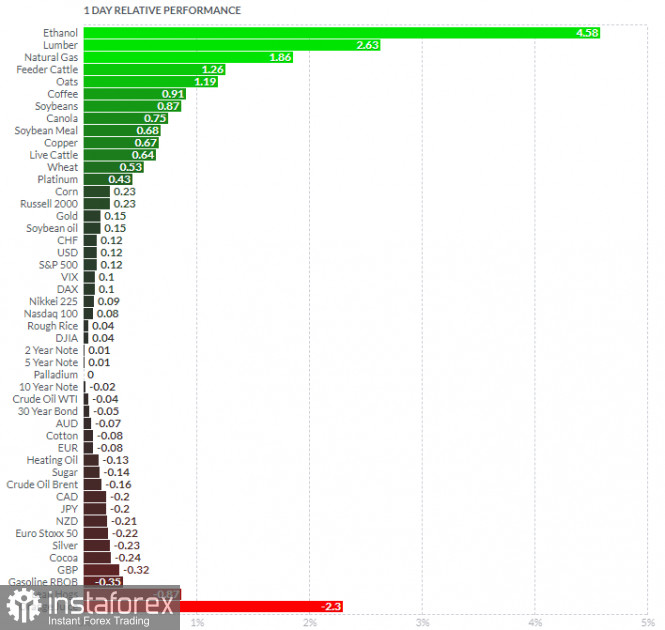

Analyzing the current trading chart of Gold, I found that there is completed bull flag pattern and potential for the upside continuation. Imy advice is to watch for buying opportunities on the dips with the upside targets at $1,895 and $1,930. Additionally, there is the rejection of the middle Bollinger band, which is further sign of continuation. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lumber today and on the bottom Lean Hogs and Orange Juice. Key Lvels: Resistance: $1,895 Support level: $1,877 EUR/USD analysis for December 18 2020 - Broken bull flag pattern and possible test of 1.2275 and 1.2350 2020-12-18 UK December CBI trends total orders -25 vs -40 expected Prior -40 - Trends selling prices 0

- Prior -8

UK factory orders balance rises to a ten-month high in December and though that might be related to some Brexit stockpiling, it is still at a relatively subdued level overall. The CBI readings are a survey on manufacturers to rate the level of volume for orders expected during the next 3 months. Further Development

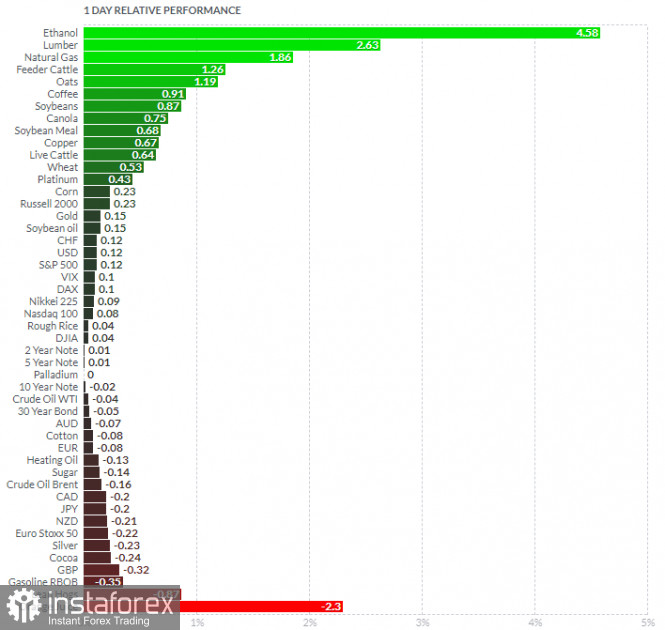

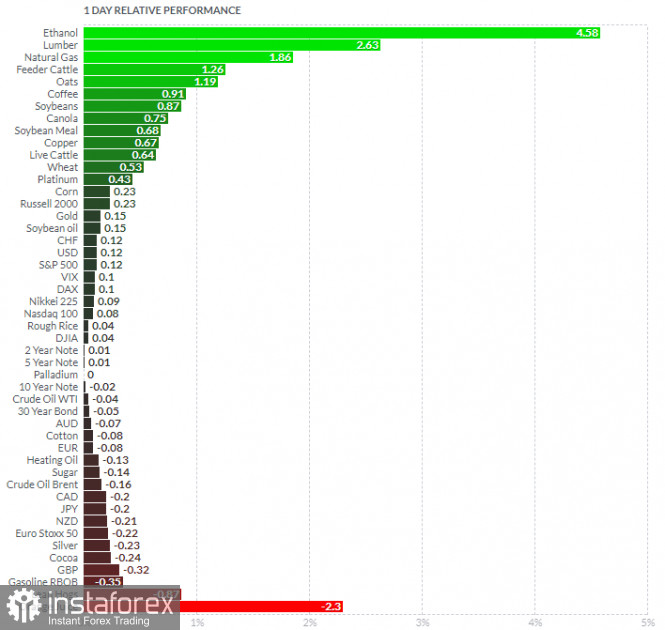

Analyzing the current trading chart of EUR/USD, I found that there is completed bull flag pattern and potential for the upside continuation. My advice is to watch for buying opportunities on the dips with the upside targets at 1,2275 and 1,2350/80. Additionally, Stochastic oscillator is showing the new leg upside and fresh bull cross, which is sign that there is the upside continuation on the way. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lumber today and on the bottom Lean Hogs and Orange Juice. Key Levels: Resistance: 1,2275 and 1,2350/80. Support level: 1,2240

Author's today's articles: Sebastian Seliga  Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Pavel Vlasov  No data No data Mihail Makarov  - - Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Zhizhko Nadezhda  Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu

Sebastian Seliga was born on 13th Oсtober 1978 in Poland. He graduated in 2005 with MA in Social Psychology. He has worked for leading financial companies in Poland where he actively traded on NYSE, AMEX and NASDAQ exchanges. Sebastian started Forex trading in 2009 and mastered Elliott Wave Principle approach to the markets by developing and implementing his own trading strategies of Forex analysis. Since 2012, he has been writing analitical reviews based on EWP for blogs and for Forex websites and forums. He has developed several on-line projects devoted to Forex trading and investments. He is interested in slow cooking, stand-up comedy, guitar playing, reading and swimming. "Every battle is won before it is ever fought", Sun Tzu  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  No data

No data  -

-  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn

Graduated from Irkutsk State University. Having acquainted with Forex market in 2008, followed the courses in the International Academy of Stock Exchange Trading. The agenda was so exiting that she moved to St. Petersburg in order to get professional education. Obtained a diploma of the retraining course on the discipline Exchange market and stock market issues, defended the graduation paper with distinction on the subject "Modern technical indicators as the basis of the trading system". At the moment obtains a master degree in International Banking Institute on specialty Financial markets and investments. Apart from trading is occupied with development of trading systems and formalization of the working strategies using Ichimoku indicator. At the moment is working on the book dedicated to the peculiarities of Ichimoku indicator and its operating methods. Interests: yoga, literature, travelling and photograph. "You can only get smarter by playing a smarter opponent" Basics of Chess play, 1883 "Successful people change by themselves, the others are changed by life" Jim Rohn  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment