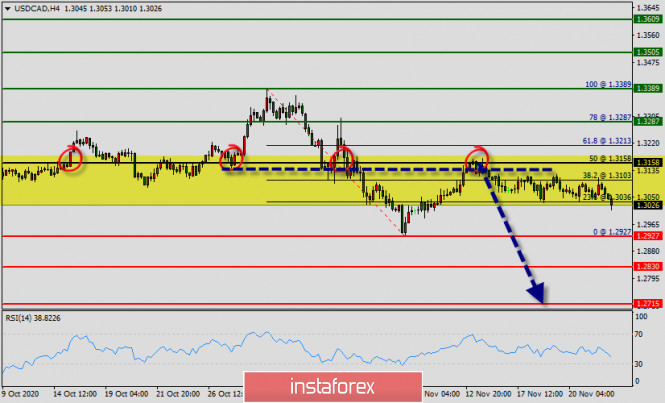

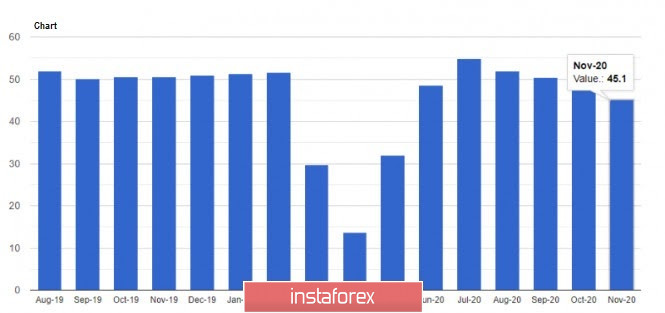

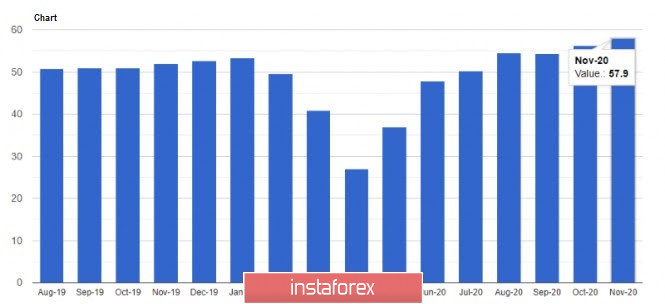

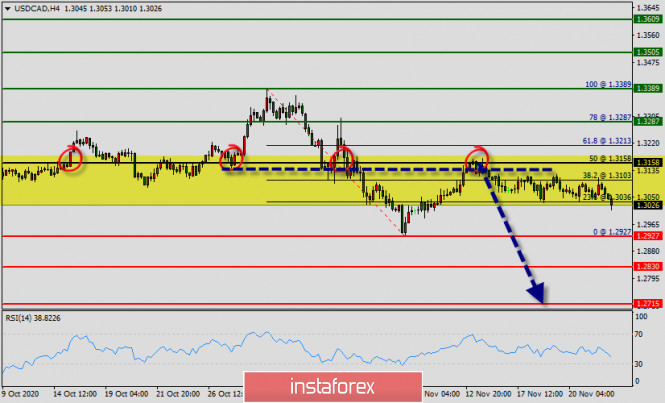

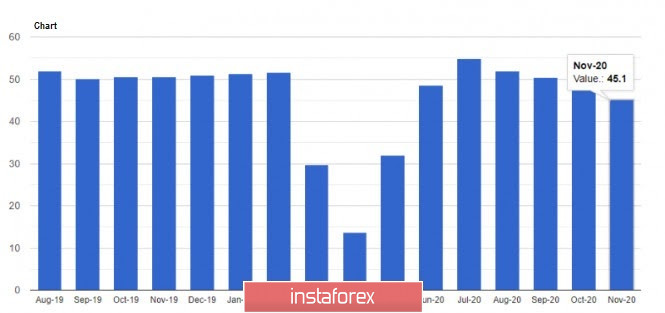

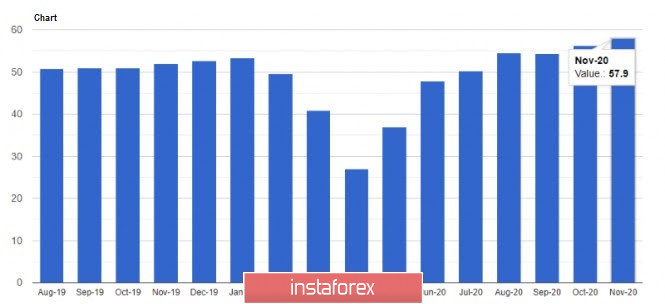

| Technical analysis of USD/CAD for November 24, 2020 2020-11-24  Overview : The USD/CAD pair is still staying in long term falling channel that started back in 1.3389. Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 1.2927 low. The USD/CAD pair dropped sharply from the level of 1.3389 towards 1.2927. Now, the price is set at 1.3031. The resistance of USD/CAD pair is seen at the level of 1.3287 and 1.3389. It should be noted that volatility is very high for that the USD/CAD pair is still moving between 1.3389 and 1.2927 in coming hours. Moreover, the price spot of 1.3158/1.3287 remains a significant resistance zone. Therefore, there is a possibility that the USD/CAD pair will move downside and the structure of a fall does not look corrective. In order to indicate the bearish opportunity below 1.3158/1.3287. Sell below 1.3158 with the first target at 1.2927 so as to test yesterday's bottom. Additionally, if the USD/CAD pair is able to break out the bottom at 1.2927, the market will decline further to 1.2830 to test the weekly support 2. Also, it should be noticed that support 1 is seen at the level of 1.3158 which coincides the daily pivot point. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an descending movement to the point of 1.2830 and further to the level of 1.2715. Amid the previous events, the price is still moving between the levels of 1.3389 and 1.2927. We still prefer the bearish scenario as long as the price is below the level of 1.3389. On the upside, break of 1.3389 resistance is needed to be the first signal of medium term reversal. Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 1.3389. Otherwise, outlook will remain bearish. EUR/USD and GBP/USD: The dollar gained strength amid record growth in the US economy. UK to lift nearly all COVID-19 restrictions on December 2. 2020-11-24 It seems that incumbent US President, Donald Trump, is trying every way to retain his seat. Yesterday, he announced that he has sufficient evidence to prove that votes were rigged at the 2020 US elections, especially in the 4 states where, in his opinion, he should have won. He also asked why Joe Biden is in a hurry to form his cabinet when the people investigating the elections found so many fraudulent votes. And although his latest lawsuit was dismissed, Trump called on the courts to ensure the integrity of not only the country's election procedures, but also the integrity of the United States itself.  As for Europe, things are not going well, especially since the latest economic reports say the bloc's GDP will again decline due to lockdowns. Such limits the upward potential of risky assets, the growth of which could be observed in the morning. From a technical point of view, nothing has changed in the EUR / USD pair. However, many are convinced that very few people are willing to buy the currency above the base of the 19th figure. Only a real consolidation at the level of 1.1900 will push the pair to the highs of 1.1960 and 1.2010, but if the quotes return to the level of 1.1800, the pair will quickly fall to the lows 1.1750 and 1.1710. As noted above, this despondent outlook is mainly because of the projected contraction of the EU economy against the background of lockdowns that now persist in many European countries due to the second wave of the coronavirus. Business and service sectors are currently in a downturn, which greatly affects the state of the EU economy. But good news is that the manufacturing sector remains afloat, and economists expect that it will pull the EU economy at the end of this year. However, much will depend on whether the partial lockdown continues or not. Meanwhile, in the UK, the government has decided to lift all restrictions on December 2. Prime Minister Boris Johnson confirmed yesterday that the national lockdown will end next week, and it will be replaced by a tougher three-tier system of regional restrictions, which will last until early next year. The essence of this new method is that areas with highest incident rates will undergo regular checks, and people who have been in contact with carriers of COVID-19 will be able to avoid quarantine, but they will have to be tested every day for seven days in a row. The program will be tested first in Liverpool, and its effectiveness will determine the further steps of the UK government in the fight against coronavirus. As per the new rules, from December 2, shops, hairdressers and gyms will start functioning as usual. In regions where infections are high, bars and restaurants will only sell takeaway food.  On the topic of statistics, the IHS Markit reported yesterday that composite PMI in the euro area, which includes the services and manufacturing sectors, have declined, falling from 50.0 points to 45.1 points in November. An index value above 50.0 indicates an increase in activity, thus, in this regard, it is expected that the eurozone's GDP in the 4th quarter may contract immediately by 3%. The only thing that the EU can count on is the coronavirus vaccine, which may become available early next year. As for the composite PMI of the US, a sharp increase was observed, even though COVID-19 incidence in the country has jumped to a fairly high level. The index came out at 57.9 points in November, from 56.3 points in October. Even more surprising was the fact that not only the manufacturing sector was growing, but also the service sector, which is most at risk of contraction amid the coronavirus pandemic. This strong rise in performance reflects further strengthening in demand, which in turn is prompting companies to hire workers. According to the report, preliminary service PMI rose to 57.7 points in November, while economists had expected the index to be 55.0 points. The manufacturing PMI, on the other hand, rose immediately to 56.7 points, much higher than the expected 53.0 points. It seems that the recent good news about the COVID-19 vaccine gave a positive impact on sentiment, leading to increased optimism.  Economic activity in the Chicago Fed also grew positively as expected. The latest report said the index of national activity came out 0.83 points against 0.32 points in September, while economists had expected it to only reach 0.23 points. GBP/USD Recent data suggests that the UK economy will contract less larger than expected in the 4th quarter, mainly due to the UK being able to handle the current lockdown better than expected. The report published by the IHS Markit said the composite PMI of the country this November was much better than forecasted, coming out at 47.4 points against 52.1 points in October. In this regard, the UK GDP is projected to contract by only about 2% in November, against the latest forecast of 8%. With regards to the technical picture of the GBP/USD pair, the bulls are still aiming at the resistance level of 1.3390, as a breakout of which will bring the quote towards the highs 1.3470 and 1.3530. But if the pressure on the pound returns, the quote is expected to decline below the support level of 1.3250, and such which will quickly push the GBP/USD pair to the lows 1.3170 and 1.3100. Trading idea for the EUR/USD pair 2020-11-24  Last week, we gave a trading recommendation to set up long positions in the EUR / USD pair.  The plan was to complete the wave pattern that started on November 19, however, the target was reached only yesterday, ahead of the publication of PMI statistics from Market Economist. The quote successfully managed to climb past the target area, which is the round level of 1.19. Development:  The upward movement amounted to more than 400 pips. Notably, after the quote climbed past the target, the EUR/USD pair turned around due to strong PMI data for the United States. Regardless, congratulations to those who followed last week's strategy! (Price Action and Stop Hunting were used for the approach) Trading idea for gold 2020-11-24  Last week, we gave a trading recommendation to set up short positions in gold in order to decrease its rate in the market.  Yesterday, amid a fairly strong volatility in the market, the quotes finally managed to break the target level, collapsing by almost 4,000 pips. Development:  Gold was able to break the level of 1850 amid the unexpectedly strong news on US PMI:  Such gave rather good profit to gold bears, so, a huge congratulations to those who followed this simple trading strategy! (Price Action and Stop Hunting were used for the approach) EUR/USD analysis for November 24 2020 - Potential for another strong donside wave towards 1.1800 2020-11-24 Germany November Ifo business climate index 90.7 vs 90.2 expected Prior 92.7; revised to 92.5 - Expectations 91.5 vs 93.5 expected

- Prior 95.0; revised to 94.7

- Current assessment 90.0 vs 87.5 expected

- Prior 90.3; revised to 90.4

Slight delay in the release by the source. The headline may be slightly better than estimates but business morale still reflects a drop with the expectations component also highlighting a more pessimistic outlook towards the economy as we head towards the year-end. This just about sums up economic sentiment in the euro area at the moment, though Germany is still arguably faring better than others considering that its manufacturing sector is seen holding up despite tighter restrictions being introduced. Further Development

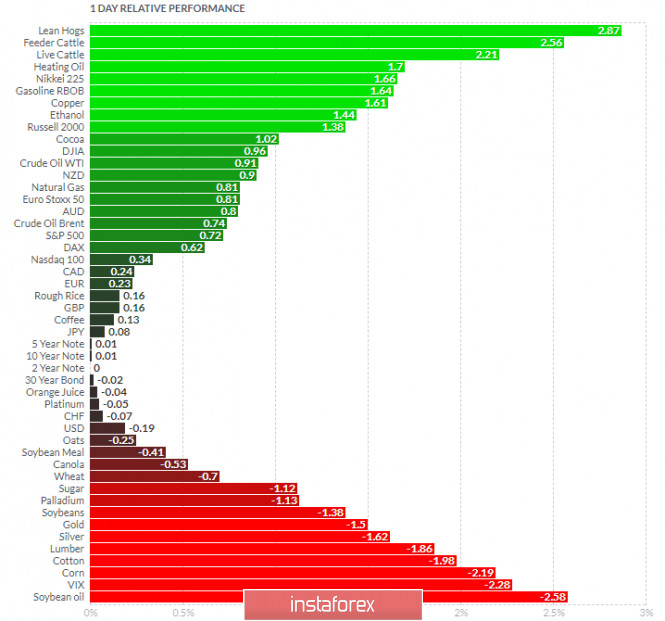

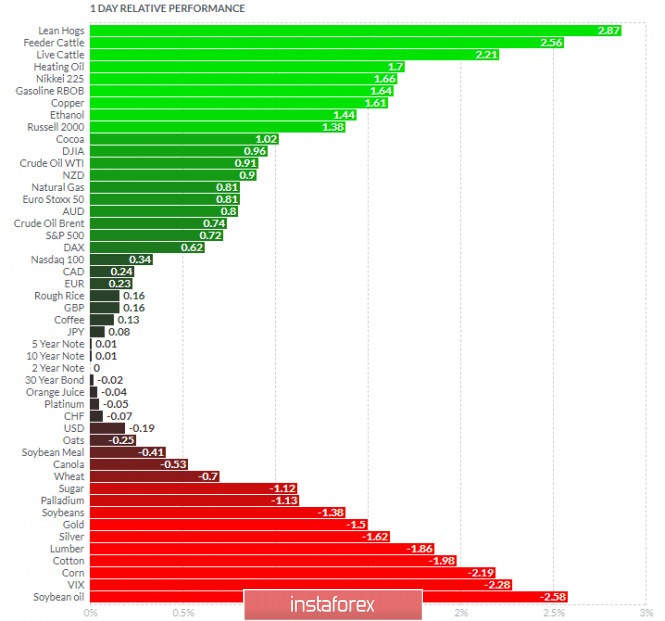

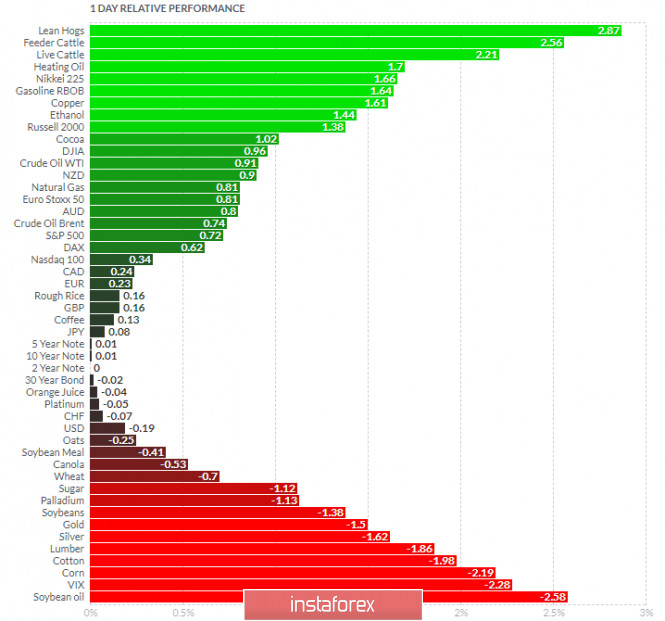

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted on the upside correction and that another downside swing is possible to happen. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and Feeder Cattle today and on the bottom Soybean Oil and VIX. Key Levels: Resistance: 1,1900 Support level: 1,1800 November 24, 2020 : EUR/USD daily technical review and trade recommendations. 2020-11-24

In October, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. All target levels were achieved. However, after such downside movement, evident signs of bullish reversal were demonstrated around the depicted price levels of 1.1600. Shortly after, the EUR/USD pair has demonstrated a significant BUYING Pattern after the recent upside breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1920 which exerted considerable bearish pressure bringing the pair back towards 1.1800 which constituted a prominent KEY-Zone for the EUR/USD pair. Recently, the price zone around 1.1840 was mentioned as a prominent KeyZone to be watched for Price Action. Since, then, the EURUSDpair has been failing to maintain movement below it. That's why, another upside movement is being expressed towards 1.1900-1.1920 where price action should be watched for possible bearish rejection. Moreover, Bearish closure below the mentioned price zone of 1.1840 is needed to enhance a quick bearish decline towards 1.1750. Trade Recommendations :- Currently, the price zone around 1.1880-1.1920 ( backside of the broken trendline ) stand as significant Resistance-Zone to offer a valid SELL Entry. Exit level should be placed above 1.1940. Analysis of Gold for November 24,.2020 - First downside target at $1.850 has been reached and Gold is heading towards next target at $1.790 2020-11-24 BOJ's Kuroda: Central bank measures have helped with global pickup Comments by BOJ governor, Haruhiko Kuroda - Coordination of monetary, fiscal policies were more prompt and comprehensive this time than during the global financial crisis

- Swift, abundant liquidity provision from central banks prevented negative feedback loop between economic and financial activities

There is certainly little doubt that central banks intervened in a more timely manner this time around but there will still be questions on what that has done to the "economic fundamentals" of the market. But to central banksters, this is the only pickup that matters:

Further Development

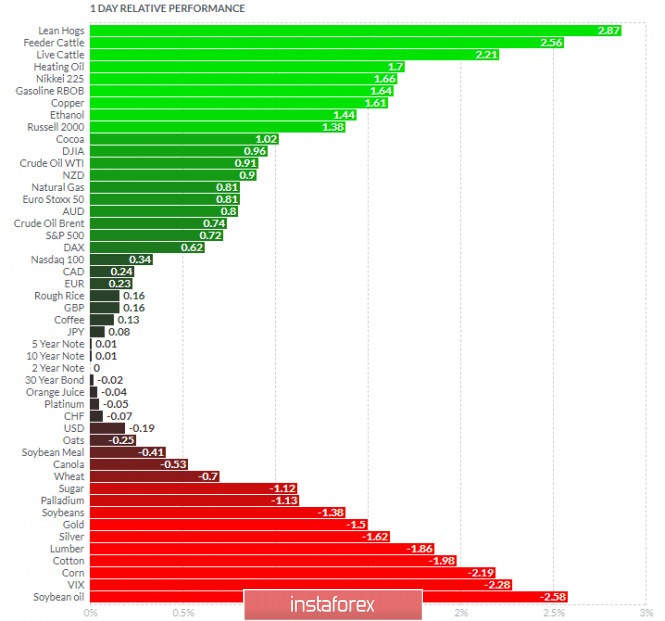

Analyzing the current trading chart of Gold, I found that the Gold reached my yesterday's target at $1,850 and is heading towards the next target at $1,792. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and Feeder Cattle today and on the bottom Soybean Oil and VIX. Resistance: $1,821 Support level: $1,792 and $1,760. November 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations. 2020-11-24

Intraday traders should have noticed the recent bearish closure below 1.1700. This indicated bearish domination for the market on the short-term. However, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponded to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal. All bearish targets were already reached at 1.1700 and 1.1630 where the current bullish recovery was initiated. The current bullish pullback towards the price zone of 1.1870-1.1900 is supposed to be considered for signs of bearish rejection and another valid SELL Entry. S/L should be placed just above 1.1950. Bearish closure and persistence below 1.1777 (61.8% Fibonacci Level) is needed to enhance further bearish decline at least towards 1.1630. Otherwise, one mor bullish pullback towards 1.1870-1.1900 should be considered for another valid SELL Entry. November 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations. 2020-11-24

In July, the GBP/USD pair has expressed an Ascending Flag Pattern above the price level of 1.2780. Shortly after, bullish persistence above the price zone of 1.3300 was achieved. This was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested pattern. However, the GBP/USD pair failed to do so. Instead, another bearish movement was targeting the price level of 1.2840 and 1.2780 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000 which failed to maintain sufficient bearish momentum. That's why, the recent bullish breakout above 1.3000 has enabled further bullish advancement towards 1.3250-1.3270 where the upper limit of the new movement channel came to meet the GBP/USD pair. Further bullish advancement is being expressed towards 1.3380-1.3400 where the pair looks overbought after failure of the previous price zone to offer sufficient bearish pressure on the pair. Upon the current bullish pullback, price action should be watched around the price levels of (1.3380-1.3400) for signs of bearish pressure as a valid SELL Entry can be offered. Initial bearish target would be located at 1.3300 and 1.3250. While S/L should be placed above 1.3450.

Author's today's articles: Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Pavel Vlasov  No data No data Andrey Shevchenko  Andrey Shevchenko Andrey Shevchenko Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Mohamed Samy  Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). No data

No data  Andrey Shevchenko

Andrey Shevchenko  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"  Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies

Born November 18, 1966, in Egypt. In 1990 graduated from the Faculty Of Engineering, Alexandria University. In 2000 started to follow financial markets. Took a higher diploma in investing and finance in 2008 and also CMT in 2009. Started at the Financial World as an analyst, then worked as a technical analysis consultant at Misr Financial Investments Co. Since 2005 has been working on the Stock Exchange. Has been familiar with Forex since December 2005. Being a member of the Egyptian Society of Technical Analysis, attends seminars and conferences dedicated to financial markets. Is a member of the American Market Technicians Association. Interests: football, reading, volleyball, swimming, movies

No comments:

Post a Comment