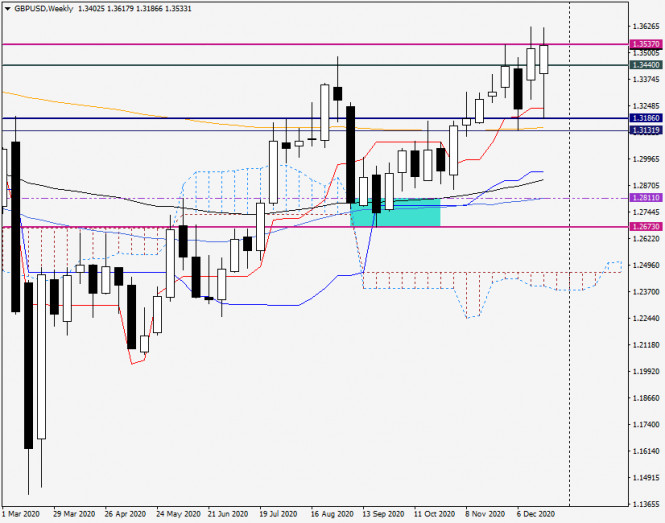

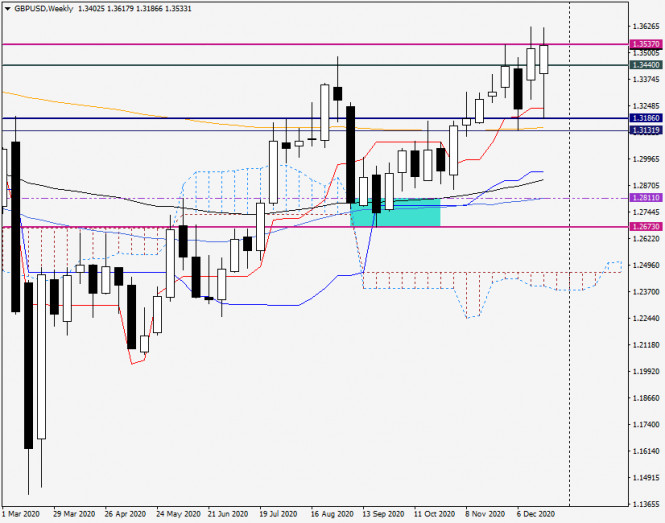

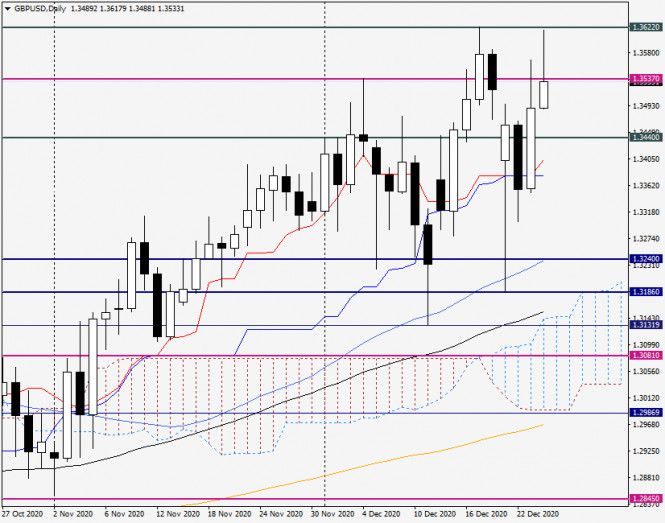

| Overview of the GBP/USD currency pair from December 25, 2020 2020-12-25 Yesterday in the afternoon, Michel Barnier proudly said: "We did it!". We are talking about signing a document on trade relations between the UK and the European Union after Brexit. This is a real Christmas gift, however, the European Parliament and the House of Commons of the British Parliament must vote "for" this document now. European lawmakers will begin to verify the agreement reached next Monday, the House of Commons of the UK Parliament will try to ratify the deal on December 30, right on New Year's eve. And here some difficulties may arise, primarily related to the current problem of fishing in British territorial waters. Also, we should not forget that Scotland is opposed to the UK's withdrawal from the EU and even threatened to hold its referendum on this issue. In general, a lot will depend on the political will of British lawmakers. As for investors, they are encouraged by the agreement reached and the British pound sterling ended the last five days of trading with a strong growth against the US dollar. Weekly

Unlike the single European currency, the "Briton" ended the week's trading with a confident and fairly strong growth against the US currency. The weekly chart shows how volatile and nervous trading was. After falling to 1.3186, the GBP/USD pair turned on the rise and ended the week at 1.3533. However, there are two important points here. First, the bulls on the pound could not break through the strong resistance of sellers at 1.3537. Secondly, the highs of the last candle were lower than the maximum values of the previous candle. A lot will depend on how Monday's trading opens. And the most important day will be December 30, when the House of Commons will vote on the agreement reached between the parting parties. In principle, British Prime Minister Boris Johnson has every opportunity to extend the deal, since he can enlist the support of at least 80 parliamentarians. If everything goes well and the document is accepted, the pound will fly up and break not only the resistance of 1.3537 but also the strong price zone of 1.3600-1.3620. Daily

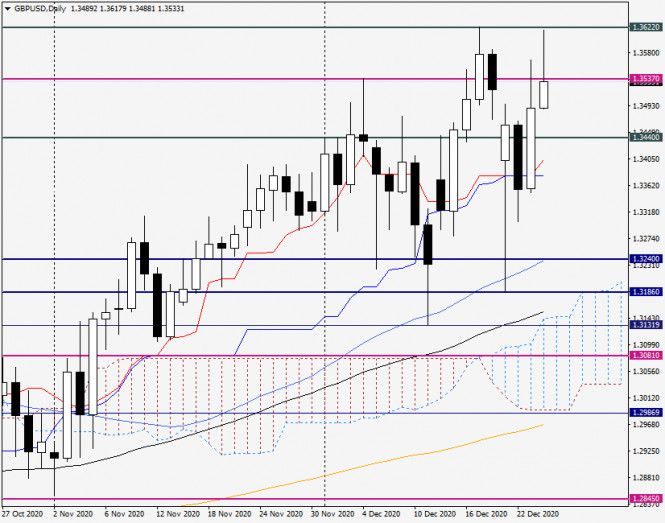

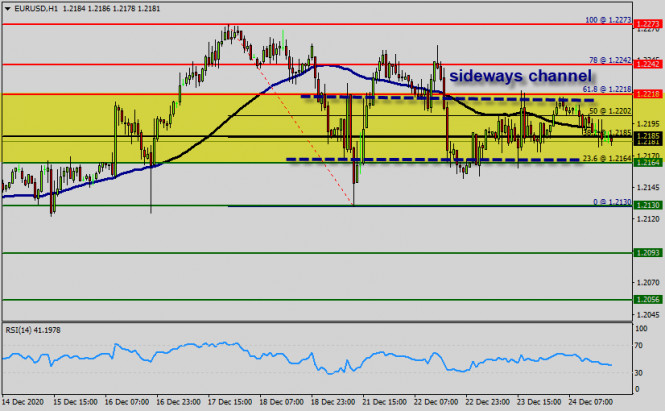

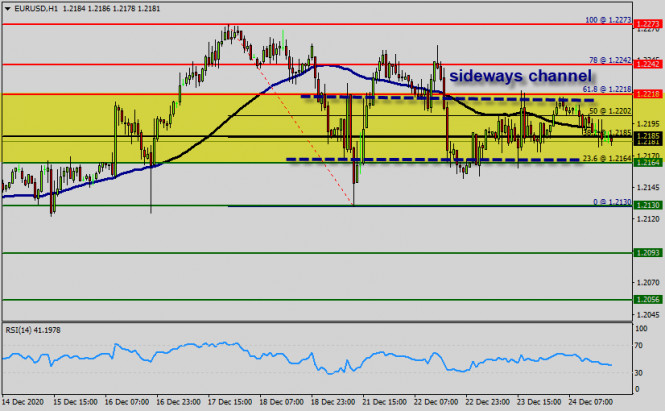

However, on the daily chart, the last candle with a sufficiently long upper shadow does not exclude a decline in the exchange rate. When the upper shadow is larger than the bullish body itself, very often this leads to a decrease in the quote. However, the current situation is not quite typical, so we can expect any development of the situation. We just have to wait for the opening of trading on the night from Sunday to Monday and only then build our trading plans. Technical analysis of EUR/USD for December 25, 2020 2020-12-25  Overview : The EUR/USD pair is neutral-to-bearish in the near-term and could move alongside the EUR/USD during the upcoming thinned sessions. The one-hour chart shows that it's trading around a moderate bearish 100 SMA. The RSI indicators are directionless just below their midlines. The EUR/USD pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability (but we guess a bearish market in coming hours). Amid the previous events, the price is still moving between the levels of 1.2218 and 1.2164. The daily resistance and support are seen at the levels of 1.2218 and 1.2164 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. On the H1 chart, the price spot of 1.2218 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move to the downside and the fall structure does not look corrective. Resistance is seen at the level of 1.2218 today. So, sell below 1.2218 with the first target at 1.2164. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.2218. Furthermore, if the EUR/USD pair is able to break out the first support at 1.2164, the market will decline further to 1.2130 to test yesterday's bottom. However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 1.2218. Analysis of Gold for December 25,.2020 - First upside target at the price of $1.884 has been reached. Second target set at $1.906 2020-12-25 Further Development

Analyzing the current trading chart of Gold, I found that there is the rejection of the rising trendline and that buyers can continue with more upside. Key Lvels: Resistance: $1,906 Support level: $1,855 EUR/USD analysis for December 25 2020 - gtrendline and potential for the rally towards 1.2215 2020-12-25 Further Development

Analyzing the current trading chart of EUR/USD, I found that there is rising trend line and support on the test. Stochastic oscillator is is bearish but waiting for the fresh bull cross signal can be good strategy. Key Levels: Resistance: 1,1215 Support level: 1,2175

Author's today's articles: Ivan Aleksandrov  Ivan Aleksandrov Ivan Aleksandrov Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy. Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Ivan Aleksandrov

Ivan Aleksandrov  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment