| Trading plan for the EUR/USD pair on December 25. 2020-12-25

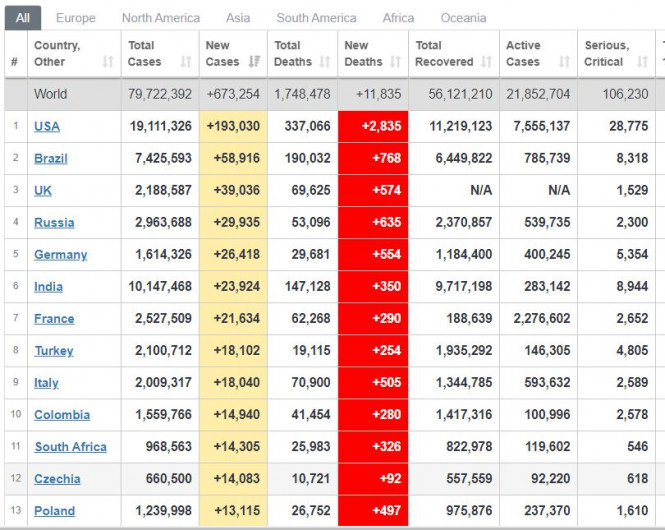

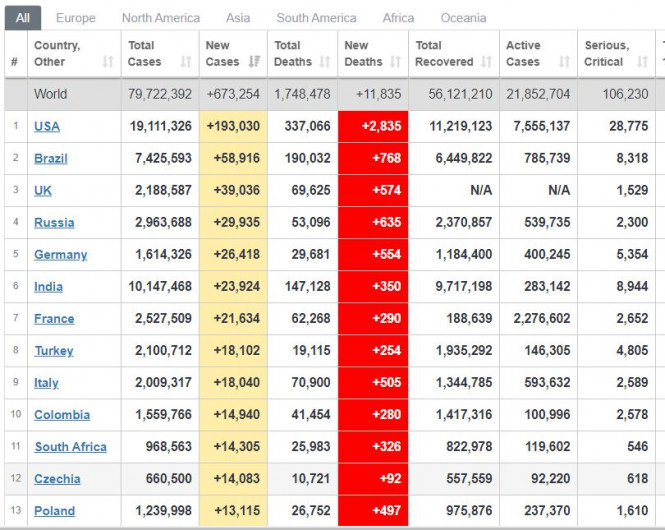

COVID-19 is on the rise again. A global incidence of about 673,000 was recorded yesterday. In the United States, new cases have decreased to below 200,000, while in Brazil, a sharp jump to 58,000 was observed. Growth was seen in Europe as well, as the UK listed 39,000 new cases and Germany recorded 26,000 new infections. As a result, Europe imposed strict quarantine restrictions, especially for the holidays. On the positive side: a) Vaccination is active both in the US and the UK, while Europe will begin on December 27 Vaccinations will also start in South America after Christmas. b) The Brexit crisis is over. Finally, the EU and the UK has concluded a trade deal, so now, parliaments must ratify the agreement on December 30.

S&P 500 - the US market grew sharply, reaching record highs before the holidays. A new and small growth is expected, followed by a strong correction.

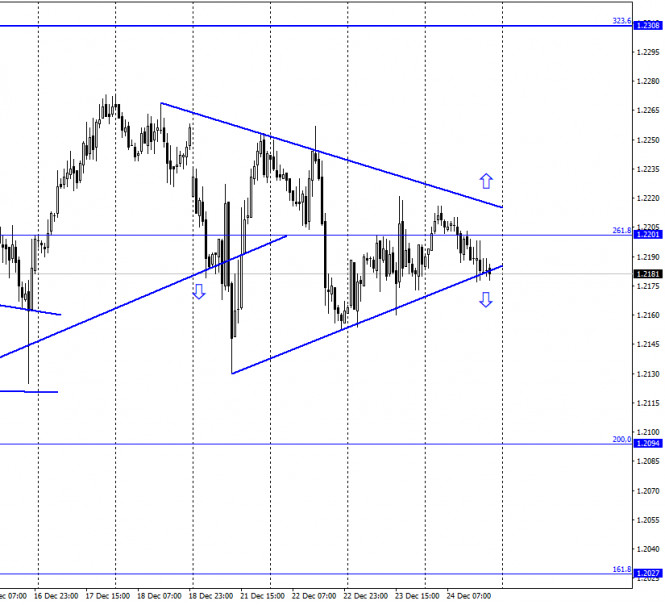

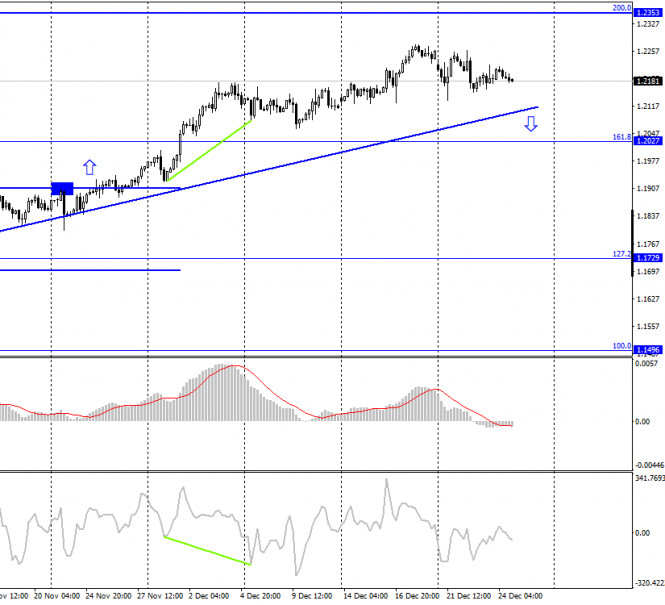

EUR/USD: Expect a sharp growth after the weekend. Open long positions from 1.2190. Open short positions from 1.2130. Simplified wave analysis and forecast for EUR/USD and AUD/USD on December 25 2020-12-25 EUR/USD Analysis: The chart of the major European currency continues to be dominated by an upward trend. After the correction wave that ended on December 21, a reversal pattern is developing on the chart. It will be followed by a breakthrough on the main course. Forecast: In the coming day, a general sideways movement is expected. The probable limits of the daily price corridor limit the counter zones. In the first half of the day, you can expect a downward movement vector. Potential reversal zones Resistance: - 1.2200/1.2230 Support: - 1.2120/1.2090 Recommendations: The downward trend contradicts the main trend of the euro, thus, sales can be unprofitable. It is recommended to skip this section of the movement and track the buy signals at the end of it.

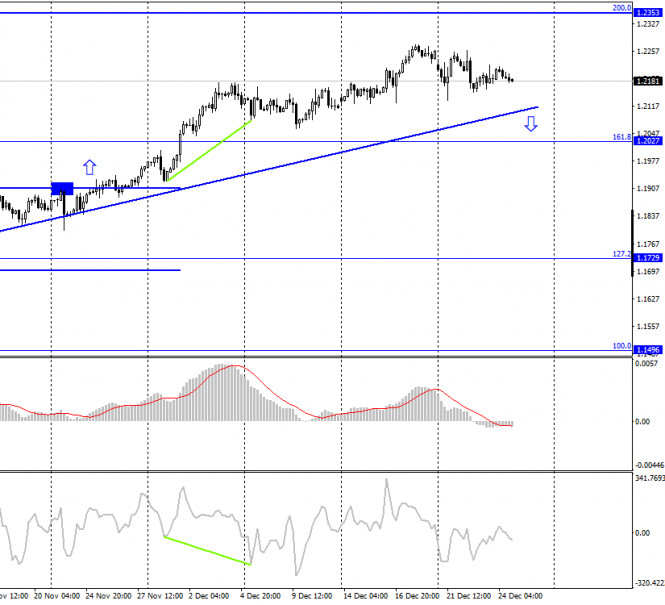

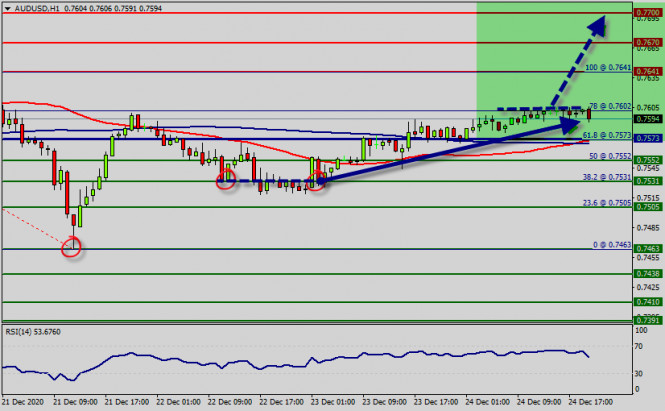

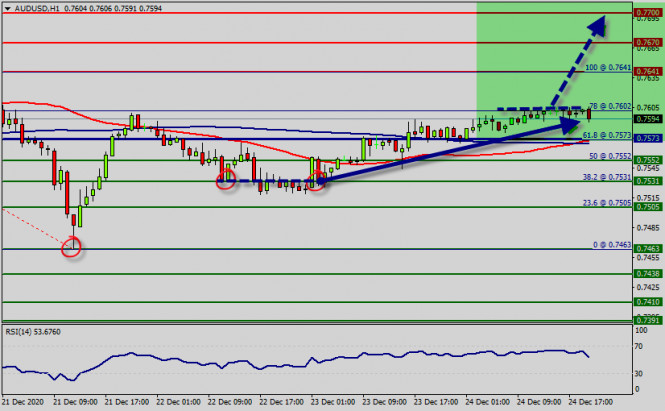

AUD/USD Analysis: The upward trend of the Australian dollar that began in March continues. In the last unfinished section of November 2, a hidden correction was completed last week. A new section was launched on December 21. Before further breakout of the price up, the price needs to form an intermediate correction. Forecast: Today, there is a high probability of price movement in the lateral plane. A short-term decline in the exchange rate is possible, not further than support. The beginning of price growth is expected at the end of the day or next week. Potential reversal zones Resistance: - 0.7610/0.7640 Support: - 0.7550/0.7520 Recommendations: There are no conditions for selling the pair today. It is recommended to skip the correction and look for long position entry signals at its end.

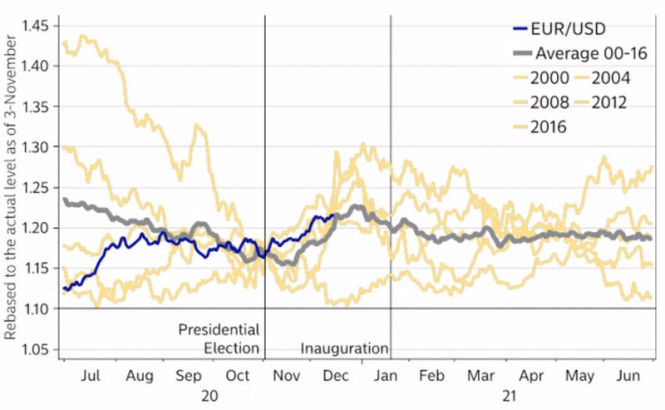

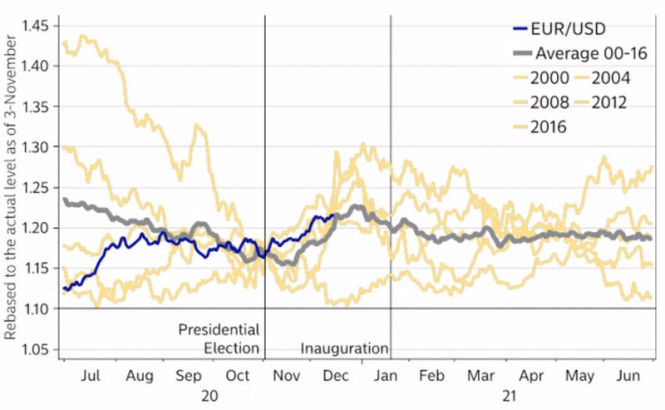

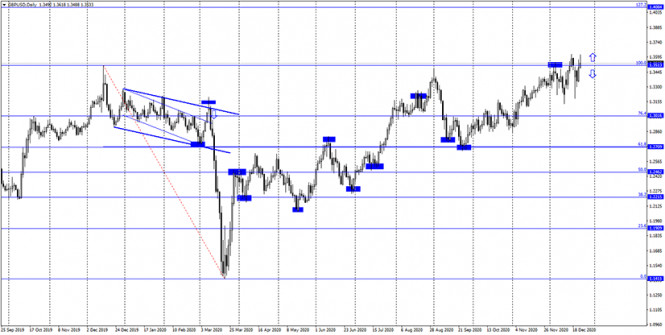

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements. Attention: The wave algorithm does not take into account the duration of the instrument's movements in time! How will EUR/USD behave in 2021? 2020-12-25 For the past 4 years, Bloomberg experts have made a mistake when giving forecasts for the EUR / USD pair. At the end of 2016, they said the euro will decline, but thanks to the rapid growth of the eurozone's GDP, EUR / USD jumped 14%. In 2018-2019, estimates were also incorrect, and this is because of the trade wars that happened. Now, in 2020, the euro rose instead of the expected decline, although those who bet on its strengthening from the very beginning of the year found themselves in a deep minus. For 2021, forecasts say EUR / USD will reach 1.25. However, it is very doubtful whether this will come true or if it will become a mistake once again. Aside from that, next year, there is a high chance that the US dollar will grow, especially because of these factors: increased uncertainty and a divergence in economic growth (of the US and the Euro area). Meanwhile, an ineffective vaccination, the emergence of new strains of COVID-19 that do not respond to vaccinations, the political crisis in the US in the form of Joe Biden's clashes with Republicans in Congress, and a new round of trade and diplomatic conflict between US and China seem unlikely events. As for the dynamics of the US GDP, judging by the financial conditions and business activity, it will be a bit mediocre, at least in the first quarter. Dynamics of financial conditions and business activity:

At the moment, tough restrictions have been implemented in many countries, but as the third quarter report shows, economic recovery has grown faster. Defeating COVID-19 will revive international trade and support the currencies of export-oriented countries and regions, in particular, the euro area and the euro. Therefore, EUR / USD will see drivers for growth, at least for the first half of 2021. Then, most likely, the bullish trend of the euro will change if the Fed adjusts its outlook, which will only happen if inflation accelerates. Currently, the FOMC does not plan to raise interest rates before 2024, but who knows for sure that this stance will remain until the end of 2021. As long as the Fed is "dovish" and does not think about normalizing monetary policy, the US dollar will be sold, which will accordingly lead to the rise of the euro. However, there is also a chance that EUR / USD will repeat what happened during the US presidential elections, when it peaked and then fell sharply right after. EUR / USD's reaction to the US presidential election

In my opinion, the euro is capable of reaching $ 1.25-1.27. However, this may be the limit of its capabilities. Nonetheless, on the EUR/USD daily chart, several bars have formed, and the exit from short-term consolidation will provide a hint about the further dynamics of the pair. In any case, long positions should be placed from 1.204-1.208, or on the breakout of 1.2245 and 1.2265. EUR/USD daily chart:

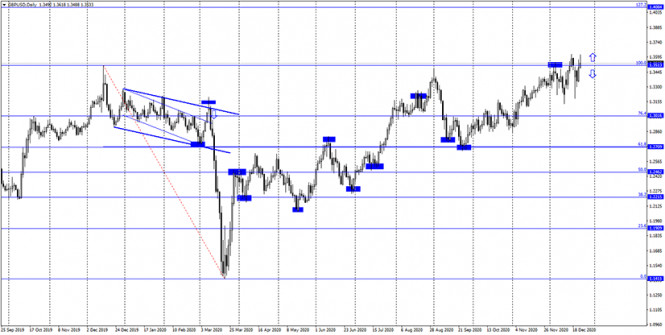

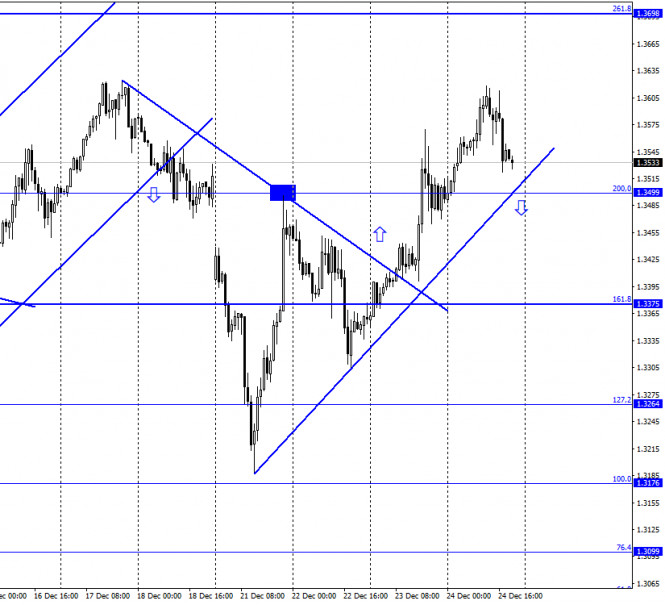

GBP/USD. December 25. COT report. The deal has been agreed and submitted to the parliaments for consideration 2020-12-25 GBP/USD – 1H.

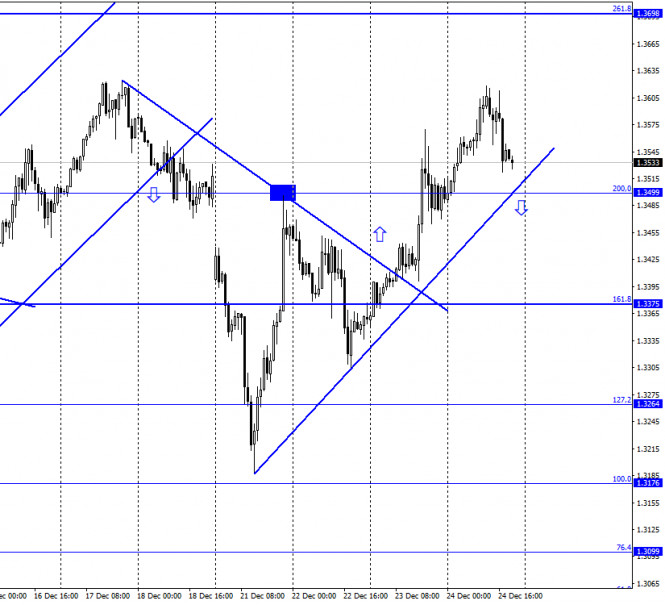

According to the hourly chart, the quotes of the GBP/USD pair continued for some time on December 24, the process of growth over the ascending trend line, which still characterizes the current mood of traders as "bullish". In the afternoon, a reversal was made in favor of the US currency, and the process of falling in the direction of the upward trend line began. The rebound of quotes from this line will work in favor of the British and the resumption of growth in the direction of the corrective level of 261.8% (1.3698). Fixing under it will increase the chances of a further fall in the direction of the Fibo level of 161.8% (1.3375). "The deal is done," Boris Johnson said. The trade deal between the UK and the European Union is fully agreed upon, although few people believed it. Nevertheless, London and Brussels still managed to settle all the disputed issues. Now the case remains small: the agreement must be approved by the parliaments of the UK and the EU. I believe that there will be no special problems with this, even though the time remains until the end of Brexit is catastrophically short. It is already known that if the parliaments do not have time to ratify, the European Council will recognize the agreement as valid, using the corresponding article in EU legislation. This will make it possible to continue trading with Britain without duties and commission from January 1, and parliaments will be able to vote on this agreement later. Today, the foreign exchange market is closed and trading will resume on Monday. GBP/USD – 4H.

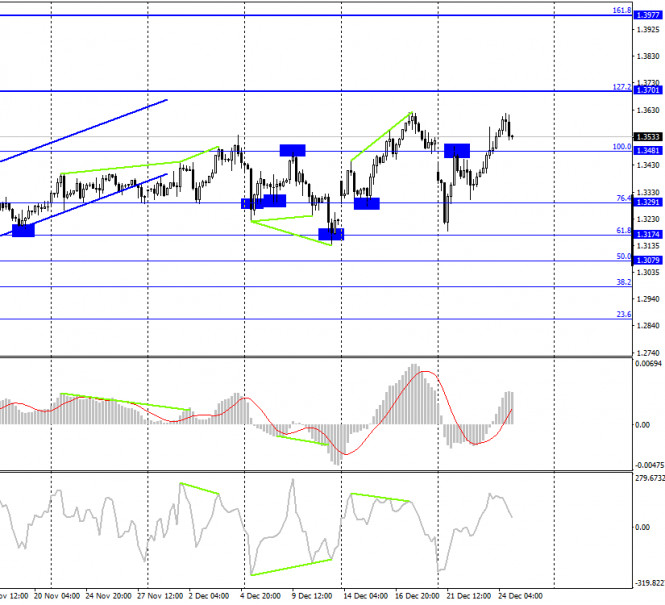

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and also began the process of falling in the direction of the corrective level of 100.0% (1.3481). The rebound of quotes from this level will work in favor of resuming the growth process, and fixing under it will increase the probability of continuing the fall. GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). A new rebound from this level will again work in favor of the US dollar and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016). GBP/USD – Weekly.

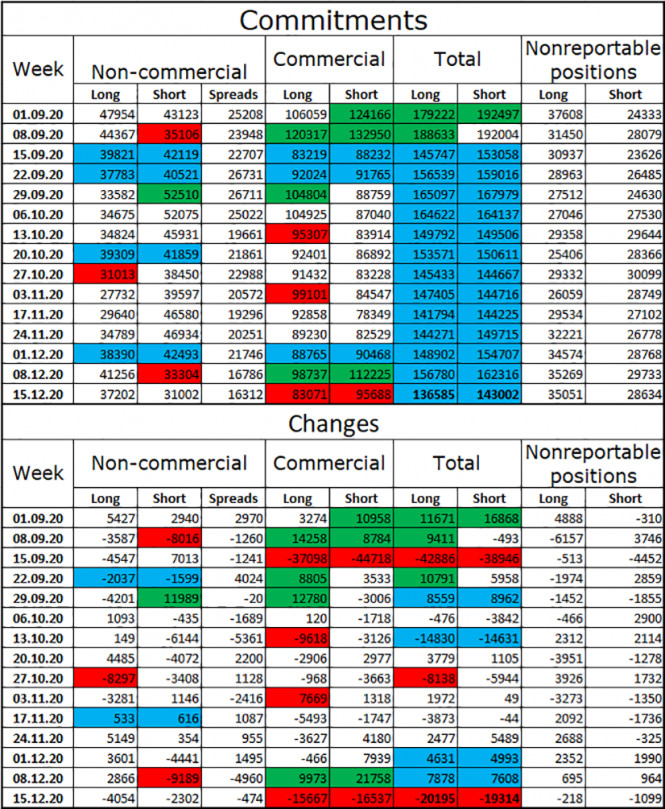

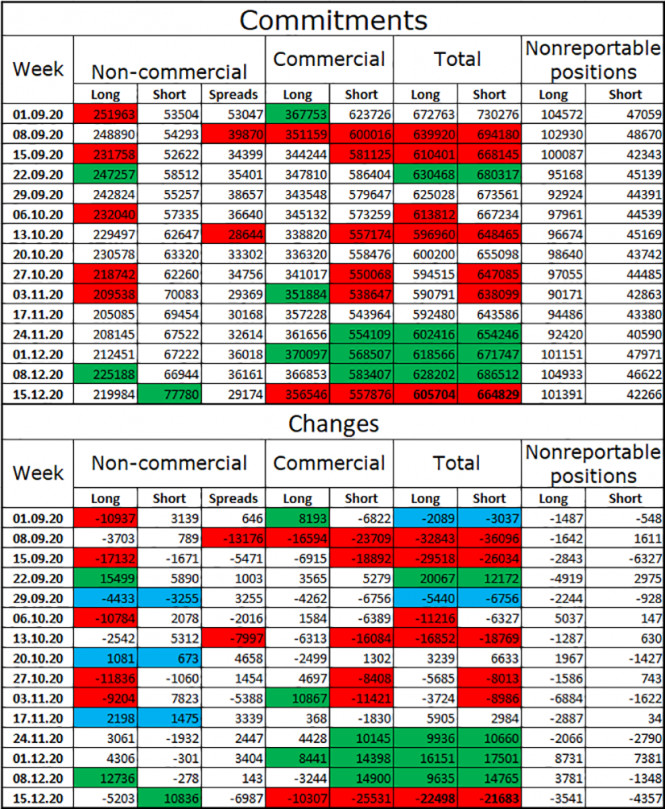

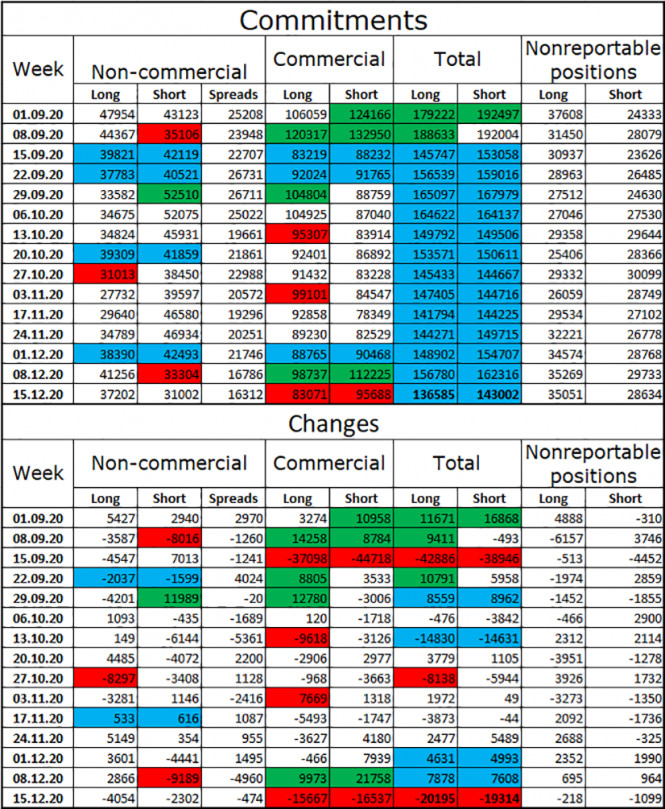

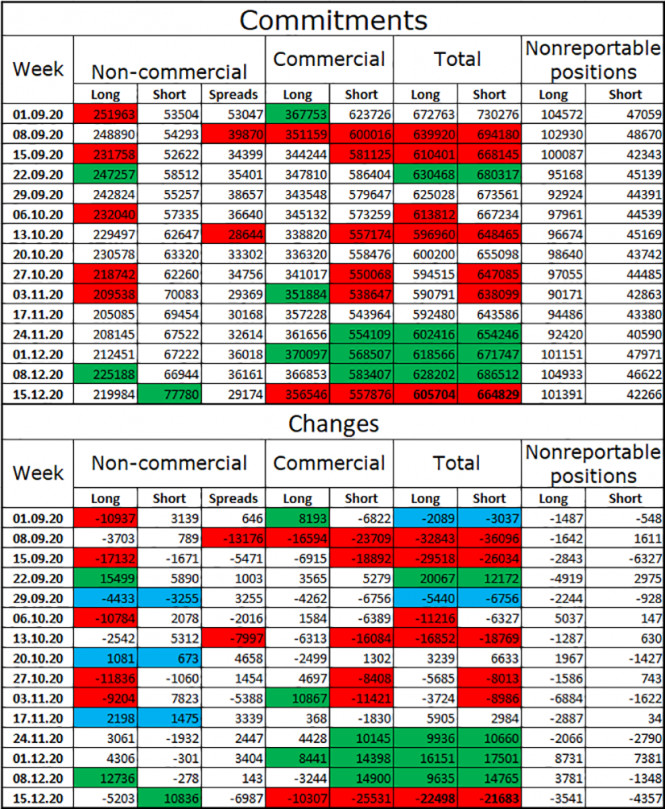

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes. Overview of fundamentals: On Thursday, there were no economic reports in the UK, however, the British pound was still trading quite actively. The economic calendar for the US and the UK: On December 25, the calendar of economic events in the UK and the US is empty. Markets are closed today. COT (Commitments of Traders) report:

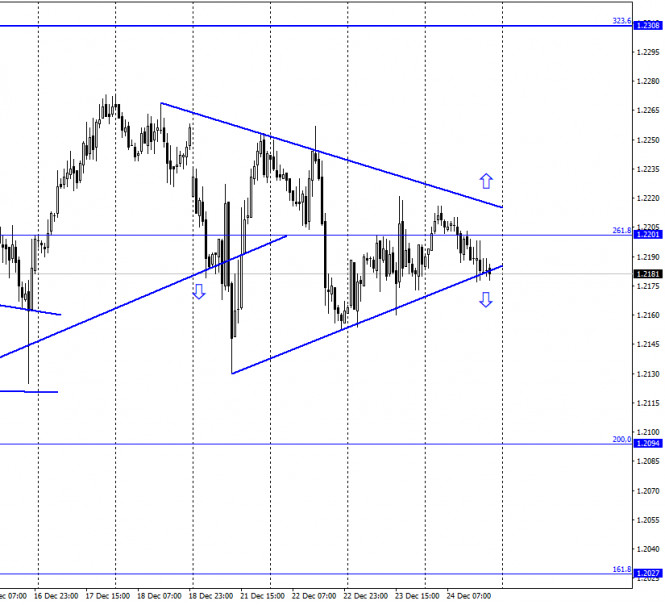

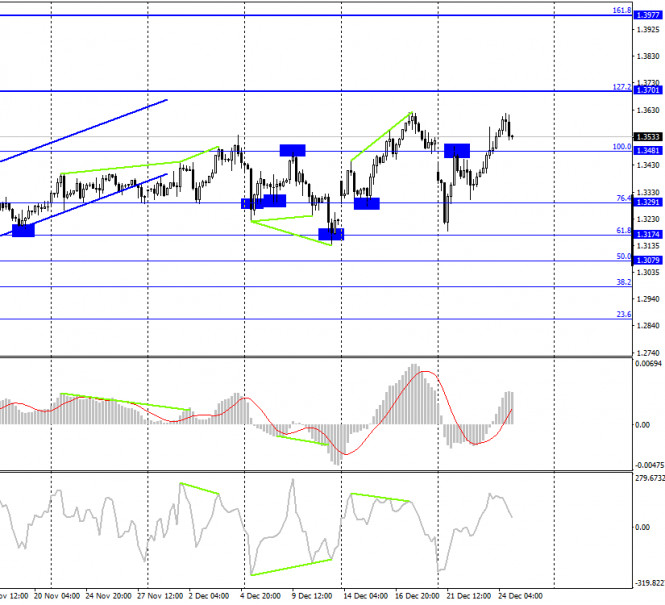

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling. GBP/USD forecast and recommendations for traders: It is recommended to open new purchases of the British dollar on Monday in case of a rebound from the ascending trend line on the hourly chart with the target level of 261.8% (1.3698). I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. EUR/USD. December 25. COT report. The European currency went on Christmas holidays 2020-12-25 EUR/USD – 1H.

On December 24, the EUR/USD pair performed a reversal in favor of the US currency and returned to the upward trend line. The rebound of quotes from this line will allow traders to count on a reversal in favor of the EU and the resumption of growth in the direction of the downward trend line. However, traders should wait for the exit from the "narrowing triangle" now. It is unclear whether it will take place during the new year's week. After all, we are interested in the signals that will be generated in this case. But it may well end with the usual movement in the side corridor and a little activity. Thus, next week, you need to remember that there are little news and reports now, as well as the desire of traders to trade. Already this week, it was clear that traders are celebrating Christmas in their minds. There was some news, however, the number of traders working on it was getting smaller and smaller every day. In fairness, it should be noted that there were practically no really important messages. Donald Trump's actions did not surprise anyone, thus, his blocking of the aid package for American citizens and the country's economy did not worry traders. The same goes for the defense budget. And nothing else interesting happened in America. In the European Union, all the attention of absolutely everyone was turned to the trade deal with the UK, which was reached only yesterday. However, this deal is much more important for Britain than for the EU, so the euro currency reacted to any news about Brexit 10 times weaker than the pound. EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a reversal in favor of the US dollar and began a very calm decline in the direction of the ascending trend line, which continues to characterize the current mood of traders as "bullish". The rebound of quotes from this trend line will work in favor of the euro and the resumption of growth in the direction of the corrective level of 200.0% (1.2353). Anchoring below the trend line will increase the likelihood of further falls. EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair continue the process of growth in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair makes a consolidation under the level of 323.6%, there are still high chances of growth. EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term. Overview of fundamentals: On December 24, there was not a single important news or report in the United States and the European Union. There was no information background. News calendar for the United States and the European Union: On December 25, there will again be no reports and news in America and the European Union. The foreign exchange market is closed today and trading will resume on Monday. COT (Commitments of Traders) report:

For four weeks in a row, the mood of the "Non-commercial" category of traders became more "bullish". This was indicated by COT reports and it coincided with what was happening on the euro/dollar pair. However, in the reporting week, speculators opened as many as 11 thousand new short-contracts, and also closed 5,200 long-contracts. Thus, they significantly weakened their bullish mood. And despite this, the euro continues to show growth. However, a sharp change in the mood of the "Non-commercial" category of traders does not mean that the euro currency should immediately fall. The latest COT report shows that speculators are once again preparing for a fall in the euro currency or at least for the end of its growth. EUR/USD forecast and recommendations for traders: On Monday, I recommend selling the euro currency in case the price is fixed under the lower trend line on the hourly chart with the target level of 200.0% (1.2094). New purchases of the pair can be opened with a target of 1.2308 when the quotes are fixed above the descending trend line on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. Technical analysis of AUD/USD for December 25, 2020 2020-12-25  Overview : The AUD/USD pair is forming another ascending wave from the area of 0.7550 - 0.7580 in the H1 chart. The AUD/USD pair currency exchange rate is likely to edge higher during this trading session (25/12/2020). In the fact, the AUD/USD pair rallied a bit yesterday heading into the holidays. The market looks likely to continue going higher into the new year. Reaching towards the 0.7602 handle. Today, the AUD/USD pair continues to move upwards from the level of 0.7573. The first support level is currently seen at 0.7573, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 0.7573, which coincides with the 61.8% Fibonacci retracement level. Moreover, the RSI starts signaling an upward trend, and the trend is still showing strength above the moving average (100). Hence, the market is indicating a bullish opportunity above the area of 0.7573. So, the market is likely to show signs of a bullish trend around 0.7573 - 0.7602. This zone of 0.7573 - 0.7602 has rejected several times confirming the veracity of an uptrend today. According to the previous events, we expect the AUD/USD pair to trade between 0.7573 and 0.7641. The market is likely to show signs of a bullish trend around the spot of 0.7573. In other words, buy orders are recommended above the region of 0.7573/0.7602 with the first target at the level of 0.7641; and continue towards 0.7670 (R2) - major resistance stands at 0.7700 (R3). If we were to break down below the 100 day SMA which sits just below the 0.7552 handle we could see a bit further downside. Longer-term trades do lead that we probably go higher based upon motivation and general against US dollar trading. Forecast : According to the previous events the price is expected to remain between 0.7573 and 0.7700 levels in long term. Buy-deals are recommended above 0.7573 with the first target seen at 0.7641. The movement is likely to resume to the point 0.7670 and further to the point 0.7700.

Author's today's articles: Mihail Makarov  - - Vyacheslav Ognev  Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle Igor Kovalyov  Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014. Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014. Grigory Sokolov  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker Mourad El Keddani  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Languages: Arabic, English, French and Dutch.

Interests: Algorithm, Graphics, Social work, Psychology and Philosophy.

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

-

-  Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle

Vyacheslav was born on August 24, 1971. In 1993, he graduated from Urals State University of Economics in the Russian city of Ekaterinburg holding a degree in Commerce and Economics of Trade. In 2007, he started concentrating on the Russian stock market, trading stocks on the RTS Stock Exchange and futures contracts on FORTS. Since 2008 he has been engaged in analyzing Forex market and trading currencies. He is an author of a simplified wave analysis method. He has also developed a trading strategy. At present, Vyacheslav is a co-author of training materials on two web portals dedicated to Forex trading education. Interests: fitness, F1 "Experience is the best of schoolmasters, only the school fees are heavy." - Thomas Carlyle  Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014.

Igor Kovalyov was born on September 24, 1985. Igor graduated from Krasnoyarsk State University with a degree in Philology and Journalism. He has a wide experience as a newspaper and information agency correspondent. He got interested in financial markets in 2001. He also graduated from Moscow State University of Economics, Statistics, and Informatics (MESI) with a degree in Global Economics and then served as an analyst in an investment company. He has been working at InstaForex since 2014.  Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker

Born 1 January, 1986. In 2008 graduated from Kiev Institute of Business and Technology with "Finance and Credit" as a major. Since 2008 has studied the behavior of various currency pairs and their correlation on Forex. In his works and trading practice he uses candlestick analysis and Fibonacci technique. Since 2009 has written analytical reviews and articles which are published on popular Internet resources. Interests: music, computers and cookery. "Out of five deadly sins of business and as a rule, the most widespread, excessive striving to get profit is the worst". P. Drucker  Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development).

No comments:

Post a Comment