Hello from FinBrain Technologies, here is the part-2 of our yearly backtest results for the S&P500 stocks.

Old-School, Technicals-Based, Non-Adaptive Strategies Are Losing Money

The widely used indicator-based strategies have lost their edge because of the fact that their parameters keep constant over time and the fall short in capturing the regime changes in the market. These widely-known technicals based investing strategies also cannot factor-in different types of inputs at once such as OHLCV values, News Sentiment, other technical indicators and custom built adaptive indicators. This is why traders who employ the old-school, technicals-based, non-adaptive methods are losing money over the long run, eventually quit trading and believe that making money in the markets is impossible.

FinBrain Technologies has developed Digital Signal Processing algorithms and Deep Neural Network models for trading. These algorithms combine an adaptive approach to data processing and a self-learning neural network structure to factor in asset financial data to predict the future outcomes.

FinBrain's DSP and DNN based approach captures the regime changes, trends and mean reversions better than any other static, technicals based strategy out there. Our algorithms give the traders the edge they were seeking and help them achieve consistent returns in the long run.

We would like to demonstrate how our algorithms performed for the stocks listed under S&P500 over the year of 2019.

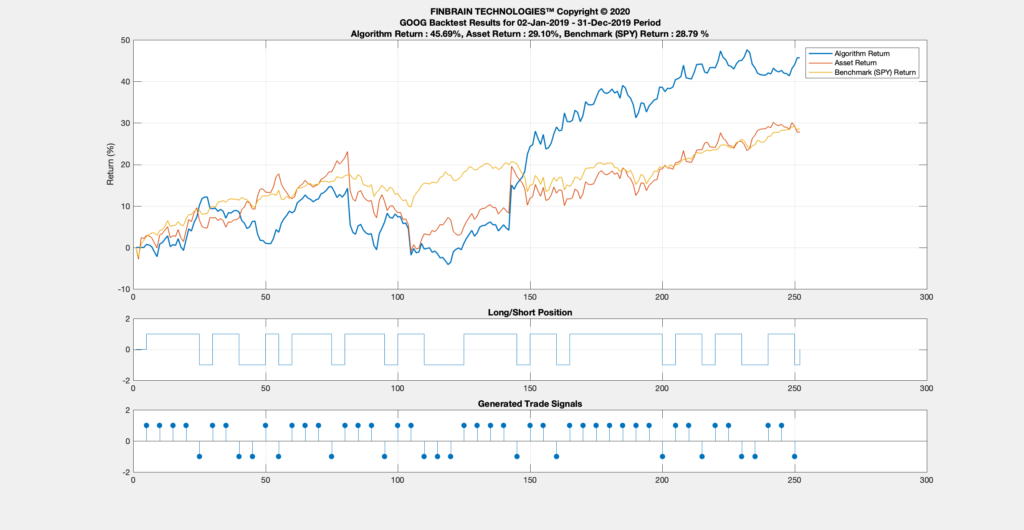

GOOG - Alphabet Inc. Class C

GOOG buy and hold strategy has returned 29.1% during the year of 2019. FinBrain's trading strategy which considers 5-day ahead predictions and interprets them as Buy or Sell signals, have returned 45.69% over the same period trading GOOG. The algorithms took 24 trades and 14 of them were profitable. One of the most important qualities required for trading is to accept that losing trades will occur. However, your strategy needs to have more winning trades than the losing ones over the long run and you shouldn't quit trading because you had a couple of losing trades. The maximum drawdown was 15.64% and Return-to-Drawdown ratio was 2.92.

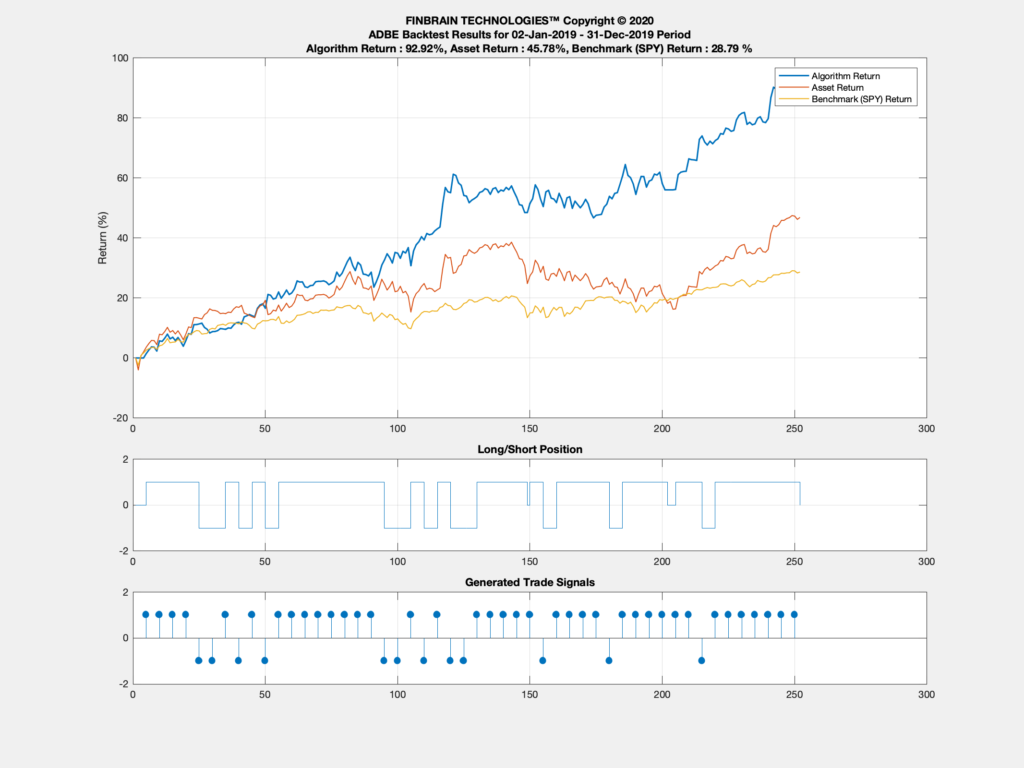

ADBE - Adobe Inc.

ADBE has gained 45.78% in value during 2019. The stock price has started to move south during the Q3 of the year and gave back almost half of its gains. The stock had a few upward and downward periods, however FinBrain's algorithms have spotted these regimes correctly and turned them into profitable periods. Our algorithms have returned twice the asset's yearly return, which equals to 92.92%. Maximum drawdown was 8.60% and Return-to-Drawdown ratio was 10.81. The return/equity curve exhibited by our strategy backtest is very close to the ideal curve with a low drawdown and high return.

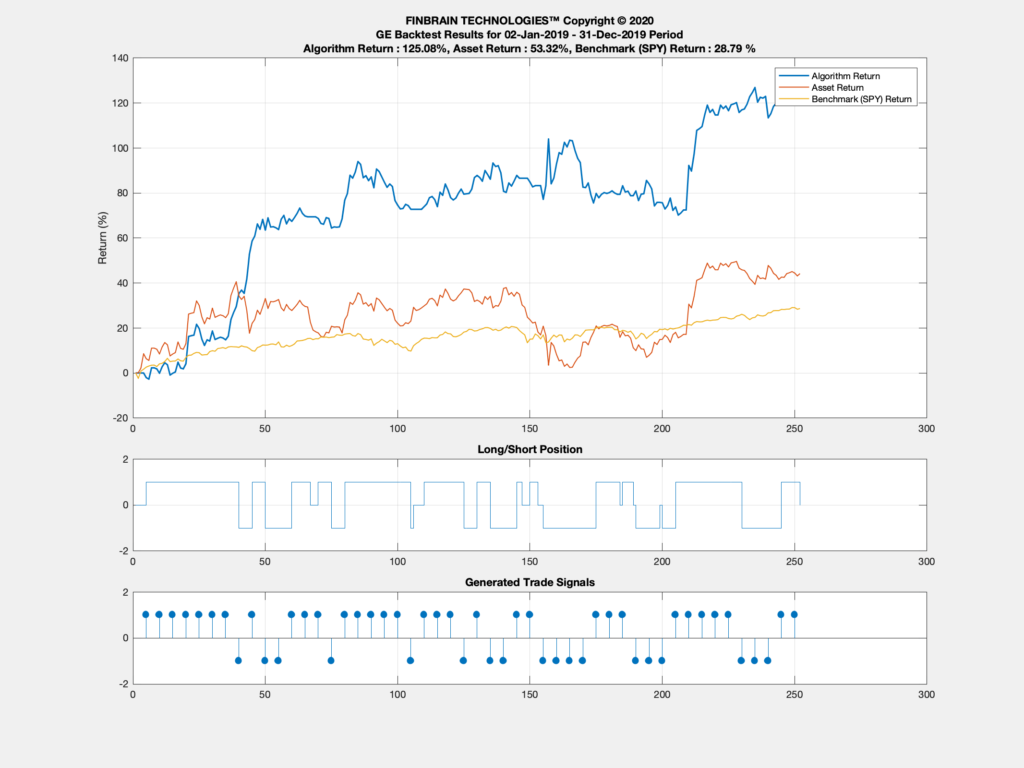

GE - General Electric Company

GE has gained almost 40% during the first half of 2019, then gave back almost all of its gains. The stock has again started to gain traction, and finished the year with a 53.32% increase. Despite all the ups and downs in the GE stock price, FinBrain's return curve for GE had strong upward moves and finished the year with a massive 125.08% gain. Our strategy has beaten both buy&hold strategy for GE and the Benchmark(SPY) returns. The maximum drawdown exhibited by our strategy was 15.79% and the Return-to-Drawdown ratio was 7.92.

Static and non-adaptive indicators based strategies have lost money during this period, as the underlying characteristics of the stock price do not stay the same over the time.

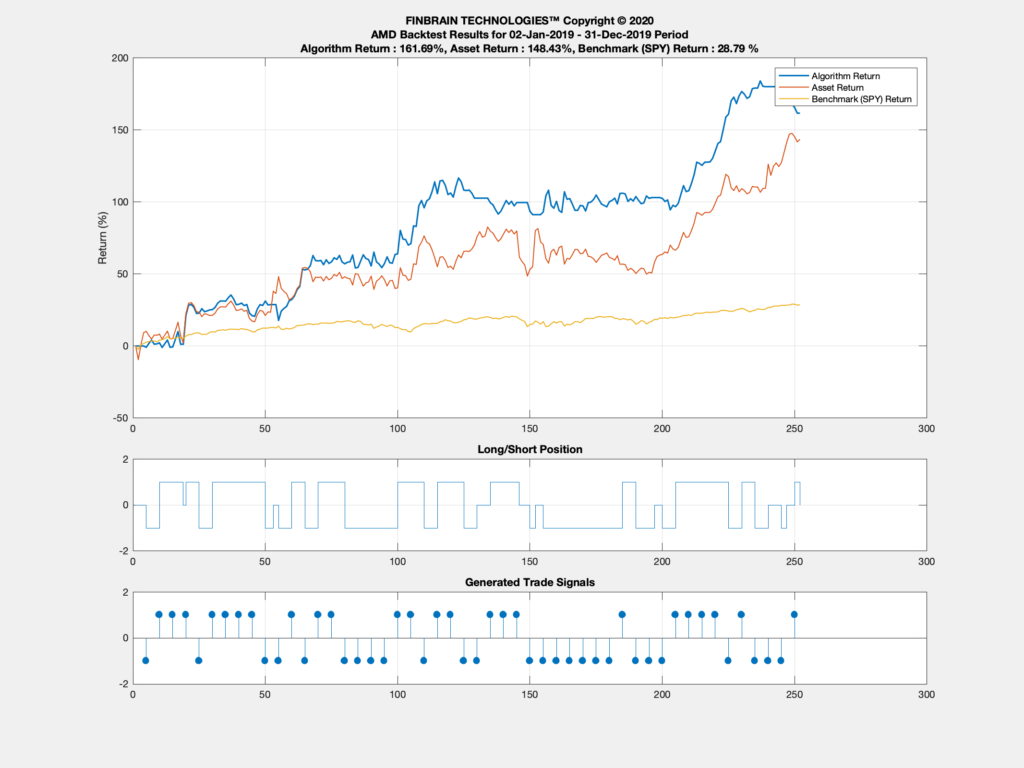

AMD - Advanced Micro Devices, Inc.

AMD is a quite popular semiconductor company that focuses on developing computer processors. The AMD stock took off like a rocket in 2019 and enjoyed its ride in 2020 as well. The stock has gained 148.43% in 2019 with a couple of strong pullbacks. FinBrain's algorithms trading AMD based on 5-day ahead predictions have returned 161.69% in a year's time. Maximum drawdown was 12.39% and Return-to-Drawdown ratio was 13.05. FinBrain's algorithms have captured the upward moves in the AMD stock price correctly and didn't get hit by the pullbacks during the mid-year. This indicates that the smart and adaptive Digital Signal processing techniques combined with Neural Networks exhibit a great performance in trading.

FinBrain Terminal and FinBrain API

Currently, traders from all over the world can reach out to FinBrain's AI enabled predictions for the next 10 days and 12 months, through FinBrain Terminal. However, if you would like to automate your trades or if you are already doing so, our brand new FinBrain API will help you on retrieving our AI enabled predictions for more than 10.000 assets. FinBrain API will help you on beating the markets, as seen on the backtests given above for some of the largest US companies' stocks. You'll also have the chance of removing the emotional bias from your trades, apply a proven cutting-edge strategy and become a consistent trader.

You'll be one of the select few, who employs Deep Learning technologies on their algorithmic trades by utilizing FinBrain API. We will release our API products in the coming weeks. FinBrain Terminal and FinBrain API will empower you on the way to become a consistently profitable trader, who beats the markets thanks to the cutting-edge AI and data analysis technologies.

Visit https://www.finbrain.tech now and start utilizing AI enabled predictions instantly!

FinBrain Technologies

99 Wall Street #2023

New York, NY 10005

Please email us back if you would like to unsubscribe from this mail list.

No comments:

Post a Comment