| GBP/USD: It is time to buy the pair 2020-10-13 The pound showed a downward trend this morning, being under the aggression of fundamental problems. In view of an informational background regarding the prospects for Brexit negotiations, GBP/USD traders drew attention to key data on the growth of the UK labor market, as well as to the "dovish" intentions of the English regulator.  As a result, the buyers of the pair were forced to leave the conquered highs (that is, from the level of 1.3060) and settle at the base of the 30th figure. In my opinion, this price downturn can be used as an excuse to open long positions, since the outlined progress in trade negotiations neutralizes any negative from macroeconomic reports. As for the intentions of the Bank of England, everything is not so simple here. Rumors about negative rates have been circulating since the beginning of the year, but not all members of the Central Bank agree to implement this scenario. Even the chairman of the Central Bank, Andrew Bailey, changed his mind on this issue several times. Now, let's start with the macroeconomic reports. It is worth noting here that today's release is not clearly pessimistic. Traders drew attention to the rise in the unemployment rate, which soared to 4.5%, instead of the expected 4.2%, while ignoring the good "salary" figures. The indicator of average earnings left the negative zone, being at zero level for the first time since April this year. On the one hand, this is a doubtful achievement, but, on the other hand, experts expected a further decline in the indicator - to -0.6%. Excluding premiums, the indicator showed stronger dynamics, rising to 0.8%. In addition, the growth rate in the number of applications for unemployment benefits also came into the positive zone. Considering the tightening of quarantine measures in September, experts expected a sharp surge by almost 80 thousand, but the real situation turned out to be not disappointing – the indicator grew by only 28 thousand. Moreover, this indicator has been showing a decline for two months. In other words, the UK labor market, on the one hand, is undoubtedly experiencing the consequences of the second wave of the COVID-19, but on the other hand, its effect was not as strong as analysts expected. On another note, the BoE said a few words about its intentions to reduce the interest rate to the negative area. The head of the regulator has repeatedly said that the Central Bank economists are studying this issue and modeling the possible consequences, weighing all the pros and cons. At the same time, many members of the Central Bank expressed opposite opinions on this issue. Just yesterday, Jonathan Haskel announced that he is ready to consider using negative rates. He stated that such a step could harm the profits of banks, but its effect wo;; be offset by a positive contribution to the economy. On the same day, the head of the Bank of England, Andrew Bailey, announced that the Committee members are only thinking about how reasonable it is to have negative rates in the set of instruments. But according to him, the answer to this question will depend on the reaction of banks to relevant requests from the Bank of England. By the way, the slowdown in the growth of the GBP/USD pair is also due to the fact that the British regulator turned to British financial institutions in order to assess their readiness for negative interest rates. Although the official comments of the Central Bank on this step indicate that the very fact of this appeal "does not mean that the Bank will switch to a policy of negative interest rates." To simply put, there are currently no grounds for a large-scale devaluation of the British currency, although, at first glance, the information background for this pair looks extremely negative (i.e unemployment is growing, the Bank of England is considering a negative rate option, quarantine restrictions are tightening, etc.) But a closer look at the above factors reveals that the problems are "inflated". The UK labor market data are quite contradictory, and the option of reducing the rate to zero is only at the stage of preliminary discussion (and not all members of the Central Bank agree with such an initiative).  All this suggests that the current reaction of GBP/USD was primarily due to the information background regarding the prospects of Brexit. As soon as the first rumors about the possible outcome of the EU summit (which will be held on October 15-16) appear, the market will completely switch to this topic. And if you put together the disparate "information puzzles", you can come to the conclusion that the results of the above summit will be in favor of the British currency. The concessions from Michel Barnier (at least on the issue of fishing), the "conciliatory" rhetoric of Angela Merkel, the optimistic attitude of Boris Johnson – all these factors suggest that the October meeting of EU leaders may end in a victory for London. Thus, long positions are still a priority for the pair. For reliability, you can wait until the pair breaks through the resistance level of 1.3070 (the middle line of the Bollinger Bands on the daily chart). If buyers sharply consolidate above it, then we can consider long positions to the next resistance level, which is located much higher, at around 1.3220 – this is the upper limit of the Kumo cloud on the same time frame. EUR/USD: Will the euro win over the US dollar? 2020-10-13

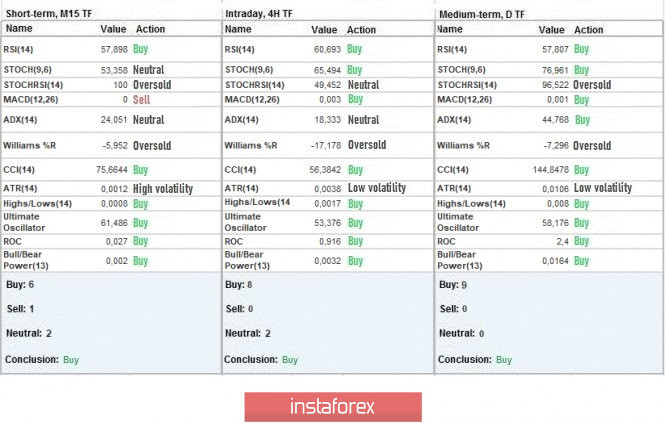

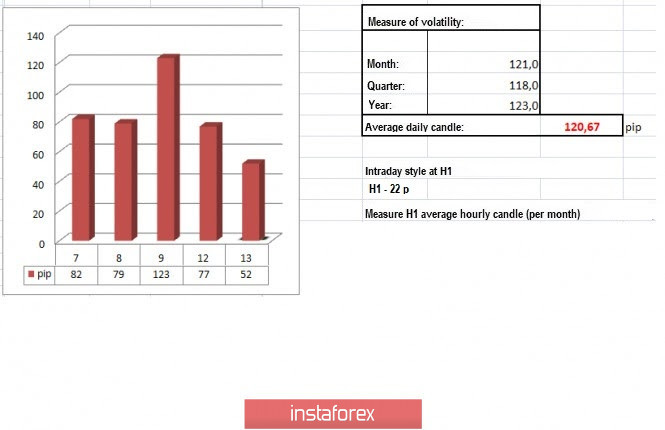

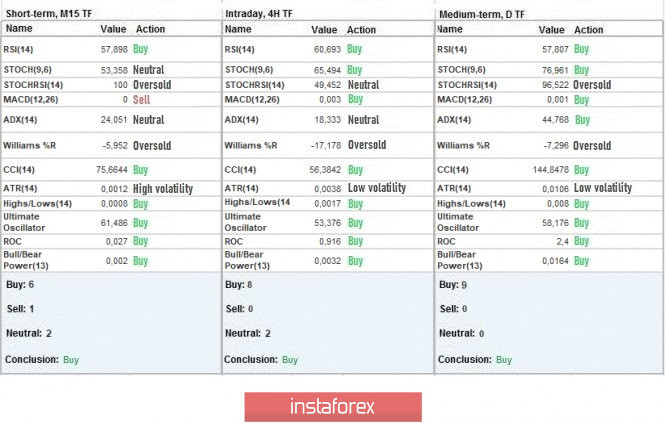

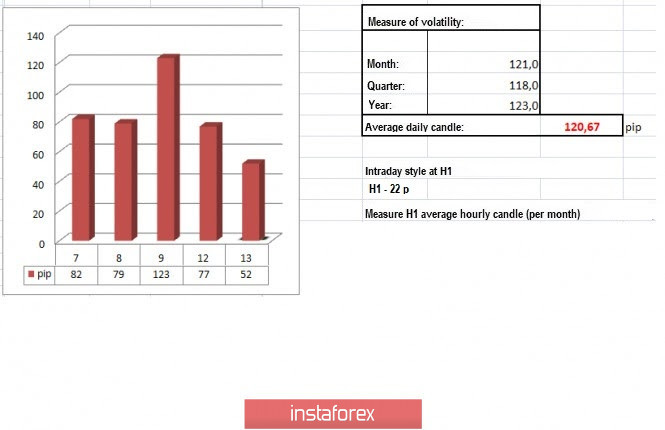

Many experts are sure that the Euro will bypass the US dollar in the long run. At the moment, the euro is winning, although it sometimes yields to the dollar in the battle on the global financial field. Several economists say that the inflation rate significantly affects euro's further dynamics. This problem was mentioned earlier by the ECB Council. European monetary authorities were alarmed by the inflationary pressure on the EUR exchange rate, as well as the reverse process. Experts emphasize the relationship between the dynamics of the Euro and the inflation level, believing that its growth carries risks for itself and for subsequent economic rise in the Euro area. Some analysts also believe that the current economic problems develop from low inflation. In August 2020, this indicator went into a negative area, amounting to -0.2%. Experts do not exclude that the current inflation level will be in the "red" zone until the end of the year. Meanwhile, euro's growth suppresses inflation expectations, so experts warn that it can provoke deflation. To stabilize the situation, the ECB is ready to apply any necessary measures, including large-scale monetary stimulus, as well as adjust its strategy considering the existing problems. The regulator does not rule out revaluation of existing economic instruments necessary to accelerate inflation and restore the economy as soon as possible. Unlike the euro, the USD is not active. Moreover, it was slightly depressed, ending the past week on a minor note. It fell below key support levels amid improving risk sentiment. This was supported by expectations about the adoption of large-scale stimulus measures and the possible victory of Joe Biden in the upcoming US presidential election. If Joe Biden wins, the market expects an impressive cash inflow, but leaves out such important points as increasing business taxes and high personal incomes. The current situation negatively affects the dynamics of the US currency, pushing it from its previous peaks and forcing it to give way to the Euro. Yesterday, the EUR/USD pair rose above 1.1800. Its current state is influenced by the possibility of introducing stimulus measures in the US and similar expectations from the ECB. Today, this classic pair was trading near the range of 1.1785-1.1786, while experts still consider increased pressure from the "bears" on the dollar, regardless of the results of US presidential elections. After recovering its position and breaking the level of 1.1800, the euro is confidently gaining impulse and it is not going to stop, as it receives support from the growing probability of monetary stimulus to the economy. Major currency strategists, including those at Danske Bank, expect it to continue to grow to 1.2000 over the next six months. They believe that the economic recovery in the USA and Europe will continue next year. Due to this, financial flows to the assets of the "safe haven", including in USD, will decline. Against this background, analysts conclude that the dollar may fall again, while the euro may get a chance for an upward trend. Trading recommendations for the GBP/USD pair on October 13 2020-10-13 Yesterday, the GBP / USD pair managed to renew the local high of October, but the buyers' joy was short-lived as right after, the quote returned within the deviation of the psychological level of 1.3000. In fact, the movement was triggered by the local bursts of activity, which arose amid speculative excitement. It led to trading forces concentrating around 1.2950 / 1.3050, indicating a reversal in the market. So, if we look at the M15 chart and analyze the trades set up yesterday, we will see that long positions surged around 12: 00-16: 15, during which the pound reached a new local high, which is 1.3081. Afterwards, a fluctuation occurred at a range of 1.3056 / 1.3070. Now, there is an assumption that the psychological level of 1.3000 will keep the quote in a sideways channel until a strong information background appears, for example, on Brexit or on COVID-19. In terms of daily dynamics for October 12, an abnormally low figure of 77 points is recorded, which is 36% below the average level. The last time the market observed such a figure was 40 trading days ago, which signals an upcoming acceleration. Low activity was also noticed in the dynamics of the EUR / USD currency pair, where volatility was recorded at only 37 points. A notable point was the fact that both trading instruments are within important price levels, which affects activity. With regards to the daily chart, we can see that the correction, which started at local low 1.2674, ended at the level of 1.3081, reflecting a 50% retracement relative to the downward tact that occurred in September. As for the news, although it lacked significant statistics for Britain and the United States, it was full in terms of information background. On Monday, UK Prime Minister Boris Johnson announced new local restrictions regarding the coronavirus. He introduced a three-stage system of restrictions - medium, high and very high - where, depending on the stage, their own control measures will be implemented. "The new measures are additional restrictions that will affect catering, entertainment and recreation, as well as hairdressing and beauty salons. Retail outlets, schools and universities, meanwhile, will remain open," Johnson said Aside from promising that the government will provide financial assistance to businesses and people temporarily unemployed due to the new measures, Johnson also noted that the authorities do not plan to introduce a nationwide quarantine. Casinos, slot machine halls, gyms, bars and pubs will be closed in Liverpool and Merseyside from October 14. New restrictive measures were also announced in Europe, thus, news on the coronavirus is everywhere in the media, which can affect speculative positions.  Today, a rather weak data on the UK labor market was published, revealing a rise in the unemployment rate from 4.1% to 4.5%. At the same time, employment, which should have been reduced by 30 thousand, suddenly decreased by as much as 153 thousand. Such is already its fourth decline in a row, which clearly does not add optimism. Further development As we can see on the trading chart, market participants are still concentrating at the psychological level of 1.3000, where an assumed flat was formed within the boundaries of 1.3000 / 1.3080. The slowdown yesterday can be the catalyst for trading activity, which will lead to a breakdown of the set boundaries. In that regard, here is one trading strategy for the GBP / USD pair: - Open long positions from 1.3085, and then take profit around the levels 1.3120-1.3165. - Open short positions from 1.3000, and then take profit at the level of 1.2950.  Indicator analysis All time frames (TF) are emitting a BUY signal, and this is due to the price fluctuations above the psychological level of 1.3000.  Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Volatility is currently at 52 points, which is 36% below the average level. It is assumed that due to speculative excitement, the market will continue to show activity in the form of increased volatility.  Key levels Resistance zones: 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.3000 ***; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411). * Periodic level ** Range level *** Psychological level Analysis of Gold for October 13,.2020 - Completed downside correction (bull flag pattern) and potential for rise towards $1.931 2020-10-13 He reinforces that there is 'strong' EU unity ahead of the European Council meeting later this week and that they will continue to work for a fair Brexit deal in the coming 'days and weeks'. I think the mention of 'weeks' says a lot about what they are expecting.

Further Development

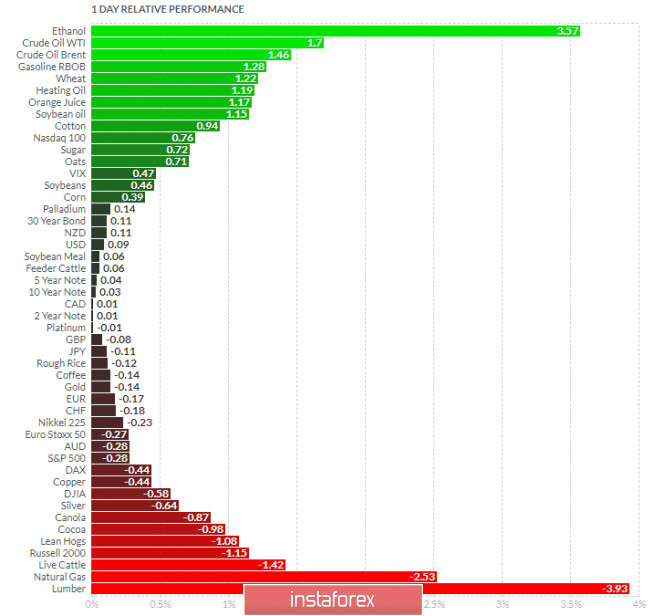

Analyzing the current trading chart of Gold, I found that there is completion of the downward correction (bull flag pattern), which is good indication for the further rise on the Gold. 1-Day relative strength performance Finviz

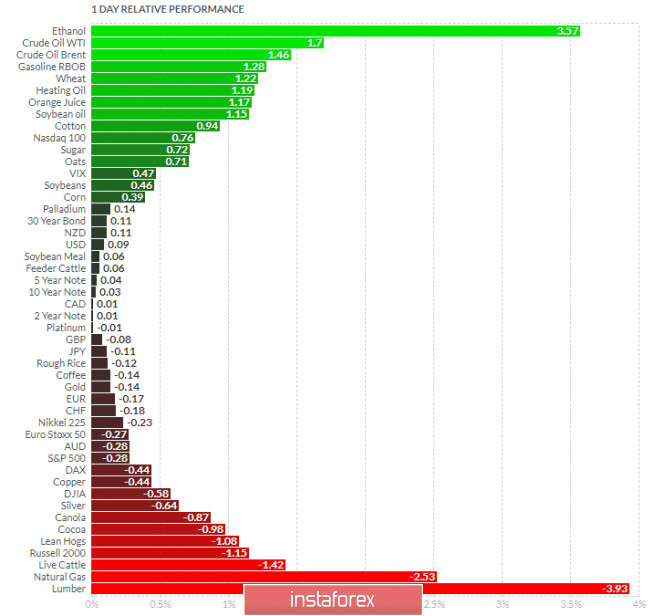

Based on the graph above I found that on the top of the list we got Ethanol and Crude Oil today and on the bottom Lumber and Natural Gas. Key Levels: Resistance levels: $1,931 and $1,954 Support level: $1,910 EUR/USD analysis for October 13 2020 - Completion of the bull flag pattern and potential for new wave to the upside towards 1.1870 2020-10-13 - Too early to say if ECB emergency support measures need to be extended

Knot may be a perennial hawk on the ECB board but the comments above pretty much reflects the wait-and-see approach the central bank is largely adopting currently. Further Development

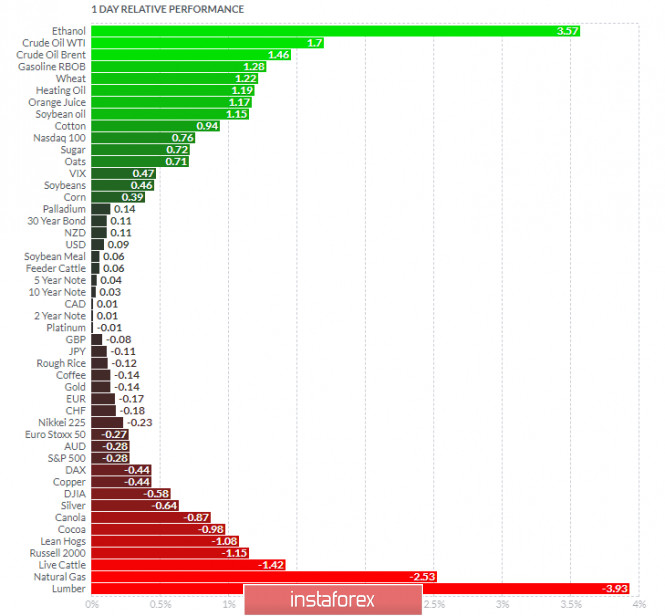

Analyzing the current trading chart of EUR. I found that there is completion of the downward correction (bull flag pattern), which is good indication for the further rise on the Gold. Additionally, there is the test-reject of the middle Bollinger band, which is another confirmation for further rise.... My advice is to watch for buying opportunities with the targets at 1,1830 and 1,1875. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Crude Oil today and on the bottom Lumber and Natural Gas. EUR is slightly negative on the the list but with no evidence of any strong downside momentum. Key Levels: Resistance levels: 1,1830 and 1,1873 Support level: 1,1780

Author's today's articles: Irina Manzenko  Irina Manzenko Irina Manzenko l Kolesnikova  text text Vladislav Tukhmenev  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up." Petar Jacimovic  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work" Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

A Zotova, Aleksey Almazov, Alexander Dneprovskiy, Alexandr Davidov, Alexandros Yfantis, Andrey Shevchenko, Arief Makmur, Dean Leo, Evgeny Klimov, Fedor Pavlov, Grigory Sokolov, I Belozerov, Igor Kovalyov, Irina Manzenko, Ivan Aleksandrov, l Kolesnikova, Maxim Magdalinin, Mihail Makarov, Mohamed Samy, Mourad El Keddani, Oleg Khmelevskiy, Oscar Ton, Pavel Vlasov, Petar Jacimovic, R Agafonov, S Doronina, Sebastian Seliga, Sergey Belyaev, Sergey Mityukov, Stanislav Polyanskiy, T Strelkova, Torben Melsted, V Isakov, Viktor Vasilevsky, Vladislav Tukhmenev, Vyacheslav Ognev, Yuriy Zaycev, Zhizhko Nadezhda

Edit data of subscription settings

Unsubscribe from the mailing list Sincerely,

Analysts Service | If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|  |  InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. |

Irina Manzenko

Irina Manzenko  text

text  Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."

Vladislav graduated from Moscow State University of Technologiy and Management. He entered the forex market in early 2008. Vladislav is a professional trader, analyst, and manager. He applies a whole gamut of analysis – technical, graphical, mathematical, fundamental, and candlestick analysis. Moreover, he forecasts the market movements using his own methods based on the chaos theory. Vladimir took part in development of trading systems devoted to fractal analysis. In his free time, Vladimir blogs about exchange markets. Hobbies: active leisure, sporting shooting, cars, design, and marketing. "I do not dream only of becoming the best in my field. I also dream about those who I will take with me along the way up."  Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

No comments:

Post a Comment